What to Watch in Walmart’s Quarterly Earnings Results

Operating margins are expected to see pressure, but the retailer’s status as a low-cost brand may help hold the line.

After a rough start to 2022, Walmart WMT, America’s largest retailer by sales, found its footing. As it reports results for the final quarter of last year, the question for investors is whether Walmart can sustain its solid performance in the face of ongoing cost pressures and worries about a slowing economy.

Walmart is slated to report its latest quarterly earnings Tuesday morning before the start of trading.

Thanks largely to Walmart’s position as a low-cost retailer at a time when consumers are looking for savings, the company’s sales have held up over the past year despite worries about decreased consumer discretionary spending.

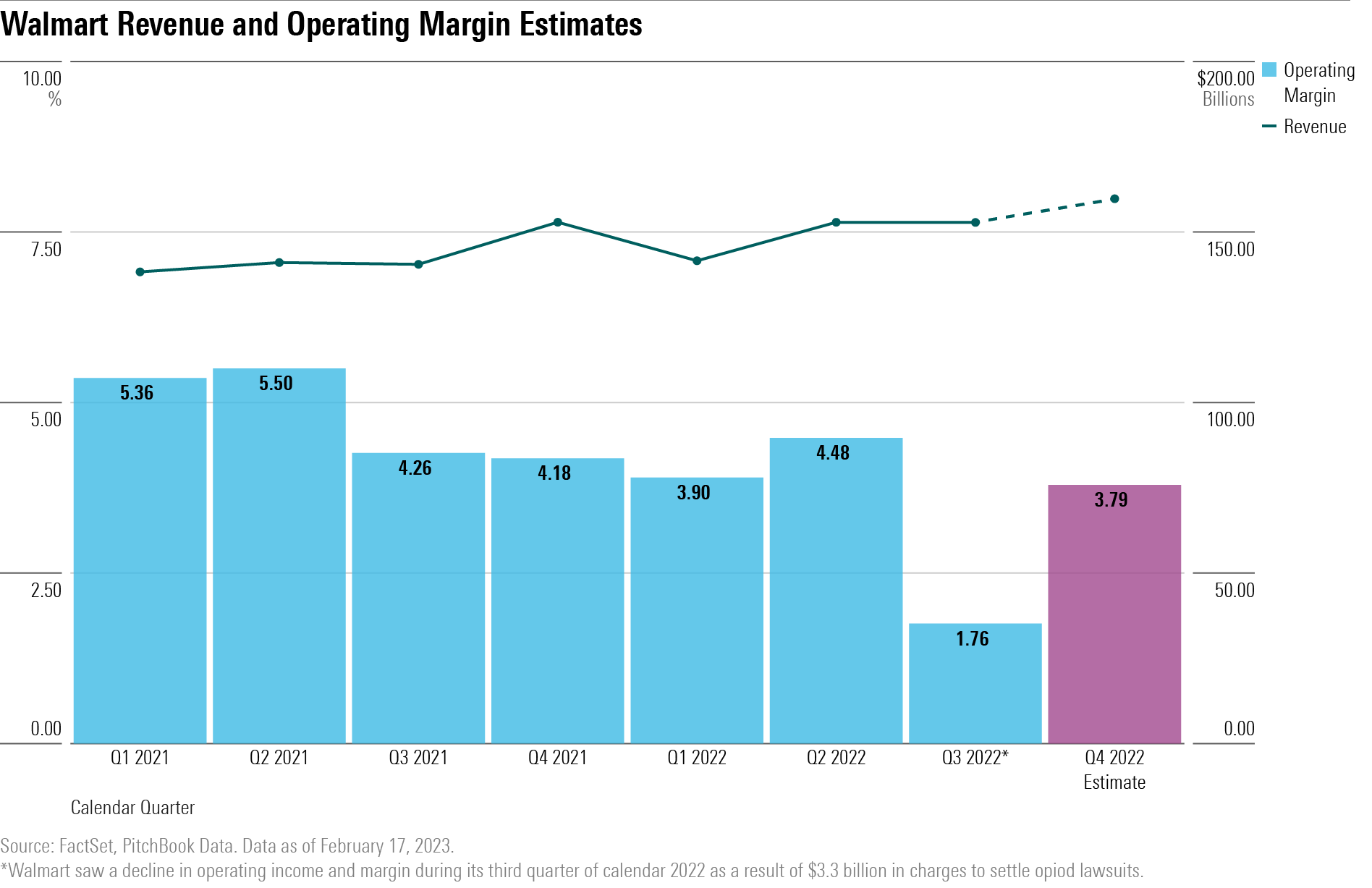

While the retailer faced pressures at the start of last year after having to heavily discount merchandise in order to reduce high inventory levels, the second and third quarters showed a rebound in sales. Analysts are expecting that recovery to continue with the latest quarter’s results.

A Bounce for Walmart Stock

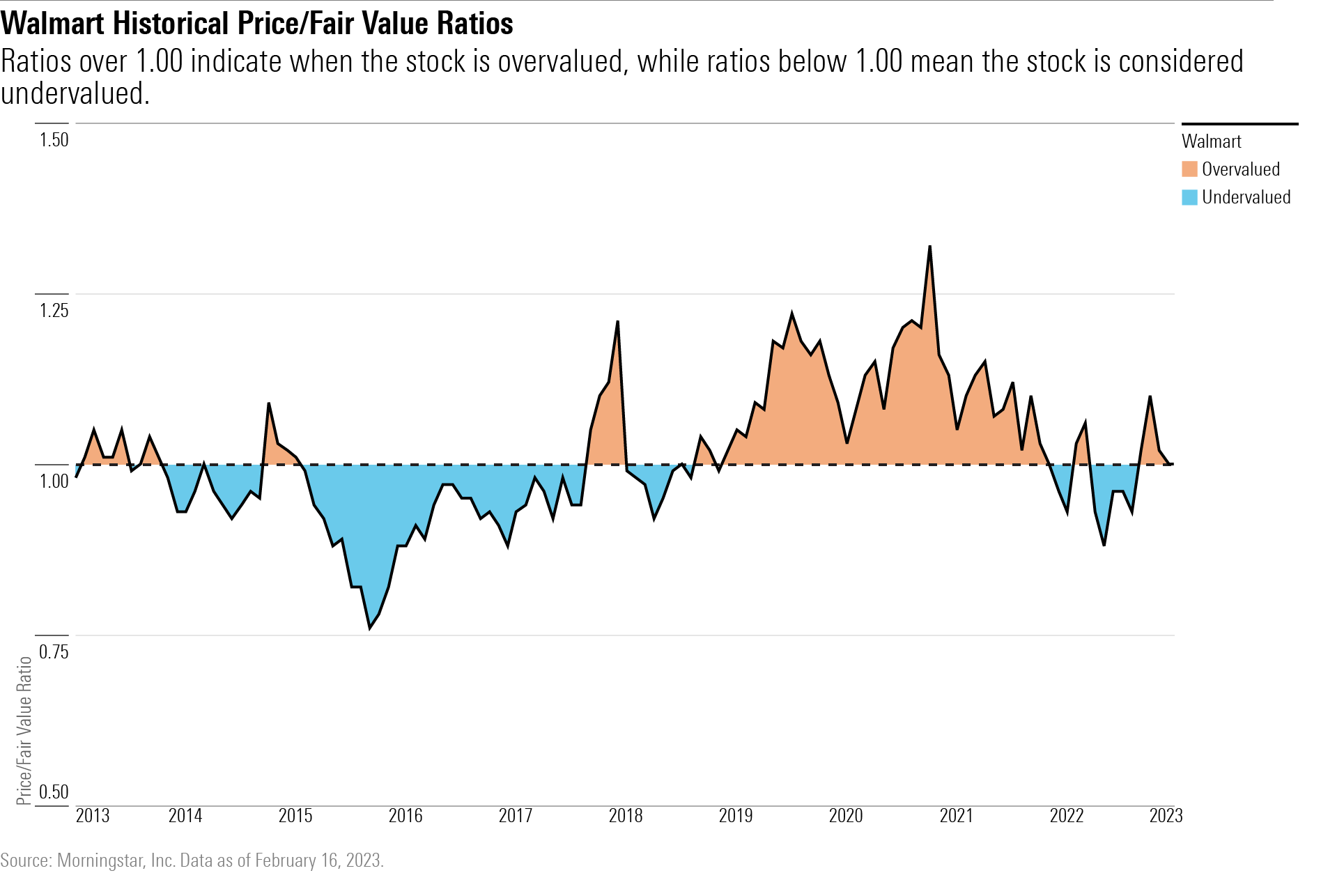

Walmart stock had a volatile 2022, falling nearly 18% in the first half of the year. However, Walmart stock recovered nearly all its losses and ended the year down only 0.47%, well ahead of the 20.7% decline in the Morningstar US Market Index. Walmart shares have inched up 1.8% in 2023.

Walmart Q4 Earnings Estimates

- Revenue: Up 4.5% year over year to $159.76 billion, according to FactSet.

- Net Income: Up 15% year over year to $4.10 billion, according to FactSet.

- Earnings Per Share: $1.52, according to FactSet.

- Same-Store Sales: 8.2% year-over-year growth for Walmart U.S. Stores, according to FactSet.

Data from FactSet show analysts expect sales growth of about 4.5% for its fourth-quarter 2022 results compared with the same period a year earlier, with revenue expected to hit $159.76 billion. Should Walmart meet those expectations, the firm will have reported full-year revenue of about $607 billion, or a roughly 6% increase from 2021.

Analyst estimates are reaching ahead of the company’s guidance ranges, which peg revenue to be about $156.07 billion and EPS to be between $1.43 and $1.46.

“We believe the fourth quarter could be better than expected, considering that Walmart has addressed many of the inventory challenges that led to above-normal discounting earlier in the year. We also suspect Walmart’s omnichannel capabilities will draw more shoppers looking for value and convenience, as it has invested to improve its standard of service,” Zain Akbari, Morningstar equity analyst, wrote in an analyst note.

Also critical to watch in Walmart’s results will be operating margins, which have been trending lower. Operating income is expected to be $6.07 billion, which would be about a 3% increase from Walmart’s operating income of $5.89 billion a year prior, according to FactSet. However, operating margins would still slightly decline to about 3.79% from 3.85%.

Walmart Stock Key Takeaways:

- Fair value estimate: $144

- Morningstar Rating: 3 Stars

- Economic Moat: Wide

- Moat Trend: Stable

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/4QBQ2NBJMFG5HGQTDEYCXY5OOI.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/2RGHQJTF4ZEURNSAGBY7CSHCUQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EAAEIIRVVNE7HNVXBSGTD3WPSI.jpg)