What to Watch for in Home Depot’s Q4 Earnings

A tough housing market, changing consumer spending could pressure results.

Home Depot HD investors may have to brace for some bad news from fourth-quarter earnings results as economic pressures in the housing market and changing consumer behavior dampen sales growth.

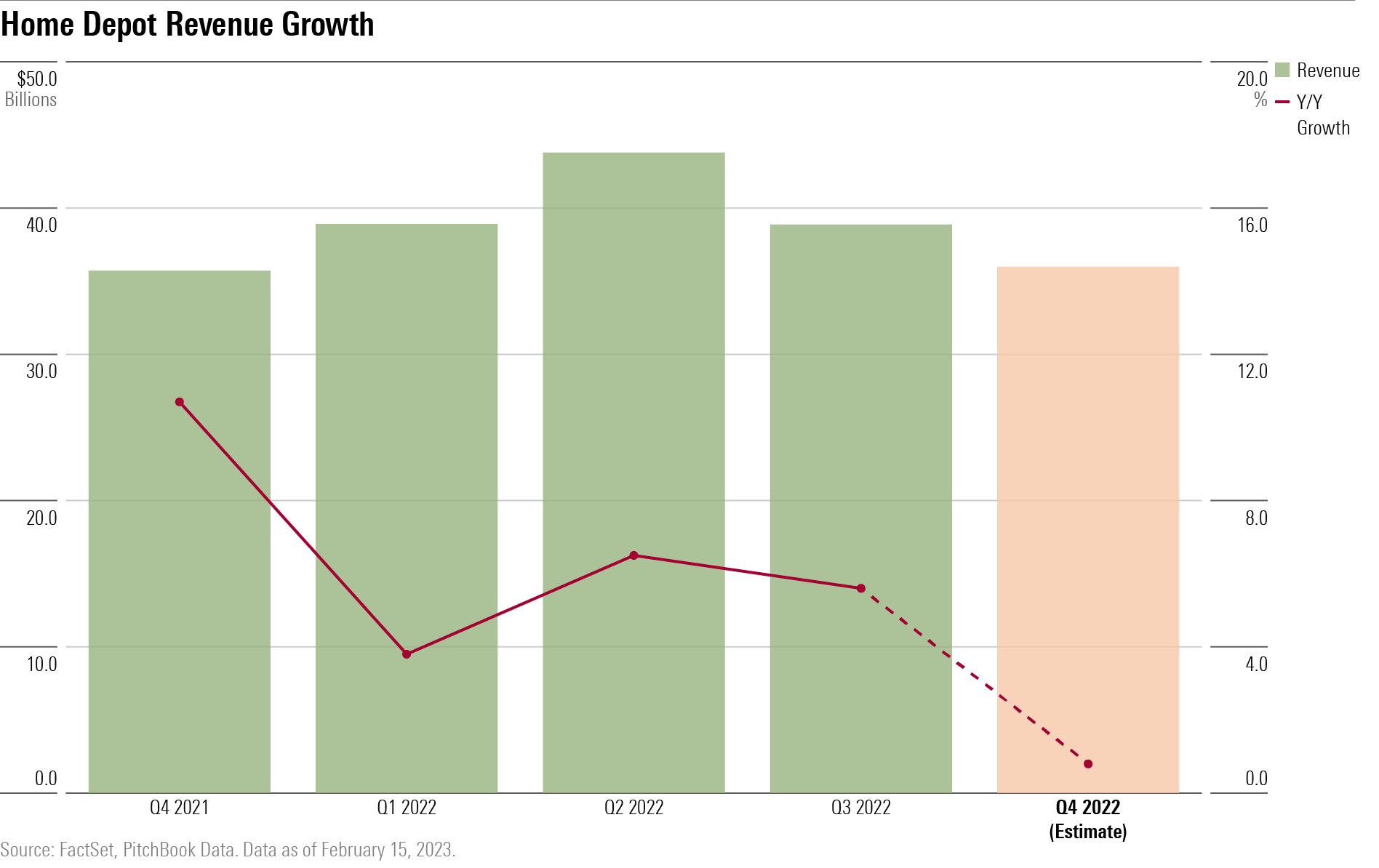

The home improvement specialty retailer is coming off explosive growth in 2020 and 2021 when revenue growth hit the mid- to high-teens percentages.

However, Home Depot is now facing headwinds in the form of rising interest rates, declining existing-home sales, and a shift in consumer spending.

Home Depot’s stock has lagged this year, rising just 1.6% as the Morningstar US Market Index has gained 8.8%. The stock also fared worse than the broader market in 2022, losing 22%, but that followed a 59.5% rally in 2021, the stock’s biggest annual return since 1999.

Morningstar senior equity analyst Jaime Katz says key items for investors to focus on heading into Home Depot’s earnings release will be the impact of higher interest rates on do-it-yourself home improvement sales, how the company plans to continue growth following its stellar 2020 and 2021, and what investments will be required to “elevate the brand” and improve operating margins.

Home Depot is expected to report fourth-quarter earnings results before the market open on Feb. 21.

Home Depot Q4 Earnings Estimates

- Revenue: Up 0.7% year over year to $35.96 billion, according to FactSet.

- Net income: Year-over-year decline of 0.5% to $3.34 billion, according to FactSet.

- Earnings per share: $3.28, according to FactSet.

- Same-store sales: 0.4% year-over-year growth, according to FactSet.

If Home Depot hits the fourth-quarter consensus revenue estimate of just shy of $36 billion, that would represent just 0.7% growth from the same period a year ago and have the retailer close 2022 with 4.2% growth in sales. It would be the second-slowest rate of sales growth for the home improvement company in the past 10 years, second only to 2019 when sales only grew 1.9%. By contrast, sales grew 14.4% in 2021 and 19.9% in 2020.

Same-store sales are expected to have increased only about 0.4% during the quarter from a year ago. This slowing would reflect a significant fall from the strong demand during 2020 and 2021, and changes in consumer behavior have shifted following higher interest rates and economic uncertainty.

“Consumers continue to spend more on services than goods, which would represent categories away from home improvement,” says Katz.

Weakening Home Sales Likely Hit Demand

Weaker existing-home sales are another concerning trend in recent months that pose a threat to Home Depot’s ability to maintain strong growth, says Katz. In December, home sales declined by about 34% from a year prior, according to data from the National Association of Realtors.

Home sales provide a measure of potential demand for products in Home Depot’s portfolio, raising concerns that there may be a greater impact on demand in the coming months.

Katz currently values Home Depot at $270 per share, leaving the stock trading at about a 19% premium to her fair value estimate as of Feb. 15.

Home Depot Stock Key Takeaways

- Fair value estimate: $270

- Star rating: 2 stars

- Economic moat: Wide

- Moat trend: Stable

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/4JOND5R2SBFPZE63XWPYQDG56A.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/K36BSDXY2RAXNMH6G5XT7YIXMU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/BG4IFJHA25B6RKD3XNUYKROBBM.jpg)