What Does Barbie’s Box Office Bonanza Mean for Mattel Stock?

After Mattel’s Q2 earnings and a 30% rally in its stock, here’s Morningstar’s take on the firm’s outlook.

Barbie, the live-action movie inspired by Mattel’s MAT flagship doll, grossed $1 billion in just three weeks in theaters. Enthusiasm for the film has spread to Mattel stock, which has rallied more than 30% from March, when the company’s shares hit their lowest point since the end of 2020.

But how much will Barbie’s success affect Mattel’s bottom line? The toymaker released its second-quarter earnings report on July 26, 2023. Here’s Morningstar’s take on Mattel’s outlook.

Key Morningstar Metrics for Mattel

- Fair Value Estimate: $25

- Morningstar Rating: 4 stars

- Morningstar Economic Moat Rating: Narrow

- Morningstar Uncertainty Rating: Medium

Mattel’s Post-Barbie Outlook

- While Mattel has done a tremendous job of raising the visibility of the Barbie brand, implying success in the firm’s plan to elevate its intellectual property, the other 14 films it has in production aren’t set for release soon, which could cause some buzz to fizzle.

- This could pose a problem in 2024, when Mattel is lapping elevated movie-related Barbie sales. Given Barbie’s importance in the total sales mix (at nearly 25% of gross sales in 2022), it could be hard to fill the gap even with other brands improving.

- Mattel hasn’t yet provided insight into how Barbie’s success is translating into sales.

What We Thought of Mattel’s Q2 Earnings

- In the second quarter, Mattel’s sales fell 12% (better than our projected 18% downtick), as sales in the infant, toddler, and preschool segment contracted 28% and challenger toys declined 39%. As a result, widespread expense deleverage took hold, leading to an adjusted operating margin of 6.9%, down 2.9 percentage points.

- We expect Mattel to produce further adjusted operating margin expansion ahead (after its rightsizing inventory at retail during the first half of 2023), benefiting from its $300 million cost-saving program. The shift to a capital-light strategy offers lower capital and operating expenditures than in the past (supporting profit growth while allowing for investment in product innovation), but profits could be hurt by tactical investments in capacity for dolls and vehicles, as well as logistics and input cost inflation.

- On the positive side, the back half of 2023 is set up for healthy top-line growth (a low double-digit rate), lapping a significant pull forward of sales in the first half of 2022 to account for supply chain concerns.

- We expect investments to focus on elevating core brands (Barbie, Hot Wheels, Fisher-Price), winning licenses, and decreasing time to market, which should support sales and market share growth at Mattel. A complementary digital plan should help brand visibility, potentially preventing share losses to other digital toy peers. Over time, stronger brands could lead to gross margin leverage stemming from a focus on higher-margin franchise brands and the optimization of retail inventory positions (shipments closely aligned with demand). We expect pricing gains to slow over the next few quarters, but also for inputs and logistics costs to moderate, protecting gross margin.

Fair Value Estimate for Mattel Stock

We are maintaining our $25 per share fair value estimate for Mattel stock. Its performance was set to surface in the second quarter, given ongoing inventory rightsizing at retailers after a weak holiday season.

Mattel’s full-year outlook calls for flat constant currency sales and earnings per share of just $1.10-$1.20, along with a 47% gross margin guidance (lower than both 2020 and 2021 levels). We foresee 2023 sales of $5.4 billion (flat) and earnings per share of $1.17.

We project 3%-4% sales growth over the long term.

Read more about Mattel’s fair value estimate.

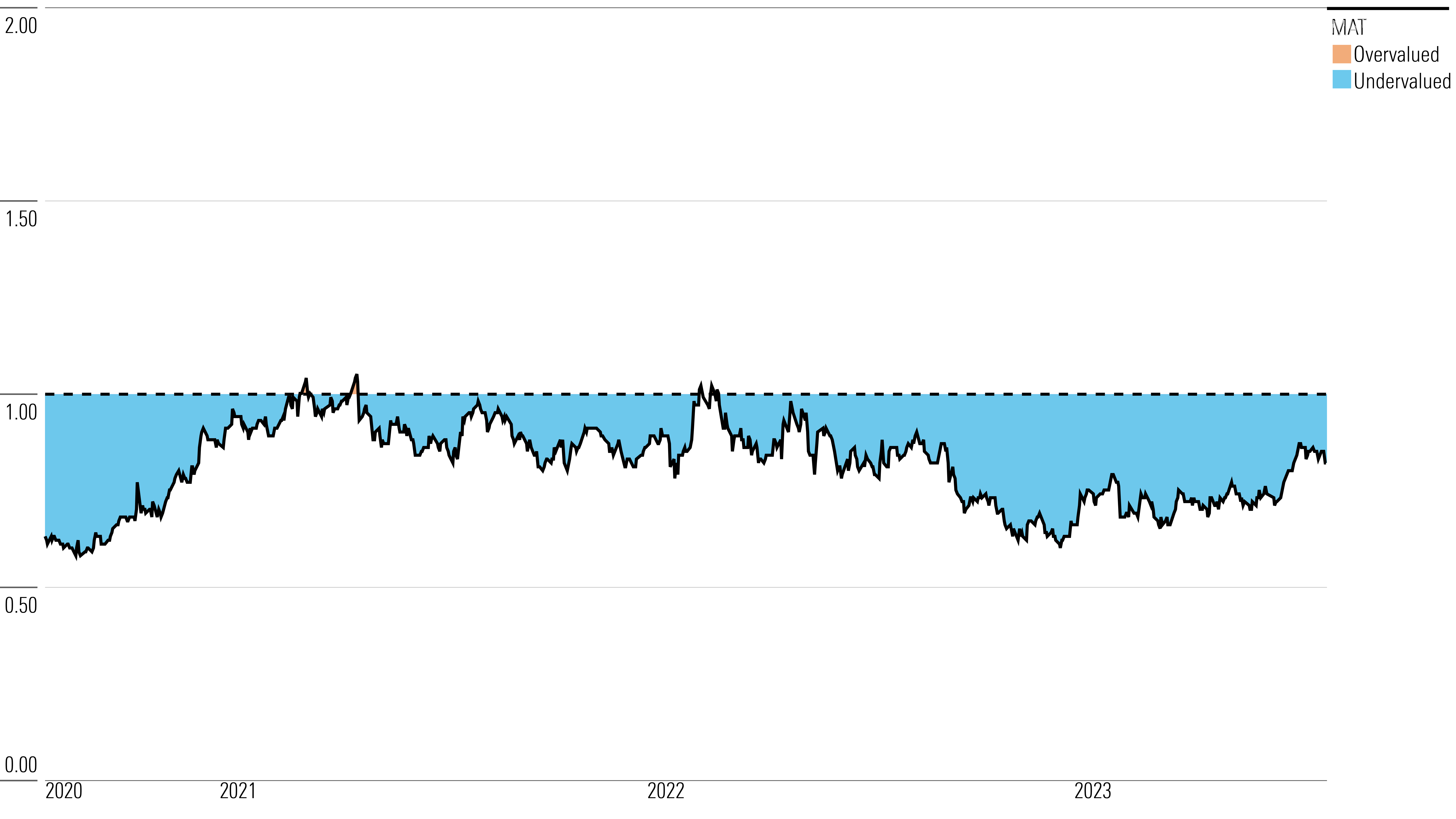

Mattel Historical Price/Fair Value Ratios

Economic Moat Rating

We assign a narrow economic moat to Mattel, which has historically captured a double-digit share of the North American toy industry (which declined to around 6% over 2019-22, according to the most recently reported year for Euromonitor).

Combined, four of the biggest constituents of the toy market—Mattel, Hasbro, Nintendo, and Activision—control 24% of the very fragmented North American toy space, which constitutes around 30% of the global market. The significant market share represented by these companies, along with the licensing and entertainment relationships already contracted by these industry incumbents, is enough to make most would-be competitors skeptical about entering the marketplace and directly competing for new licensing contracts, as these leaders have more advertising dollars to offer.

Mattel’s position as one of the largest toy companies allows it to capture these partnerships with relative ease, as the company is a top choice for any partner, having one of the widest reaches and the deepest marketing pockets across the space.

Read more about Mattel’s economic moat rating.

Risk and Uncertainty

Mattel faces a number of inherent risks that may affect its future enterprise value, supporting our Medium Uncertainty Rating.

First, significant customer concentration raises the risk that liquidity issues or changes to ordering patterns could affect the firm’s profitability. The top three channels for distribution (Walmart, Target, and Amazon) constituted 43% of total sales in 2022, and brick-and-mortar retailing has become more competitive.

Second, Mattel faces risk from litigation regarding product recalls or poor manufacturing.

Third, integration risk with acquisitions could disrupt management’s focus and profits.

Fourth, Mattel remains exposed to input cost inflation, which is difficult to predict and hard to hedge, and can also affect gross margin.

Read more about Mattel’s risk and uncertainty.

MAT Bulls Say

- Mattel’s size allows it to fund new products, expand into high-growth emerging markets, and make acquisitions, while its portfolio of brands lends itself to scalable expansion in new categories like digital and new franchises.

- As one of the largest players in the toy industry, Mattel is a preferred licensing partner for important tie-ins with entertainment companies.

- Mattel’s prior cost-saving and capital-light initiatives yielded $1 billion in run-rate savings. Efforts beyond the $300 million expected from its “Optimizing for Growth” initiative could further reduce expenses.

MAT Bears Say

- The target market for traditional toy manufacturers could continue to shrink as a percentage of total toy sales, hurt by digital content that becomes more pervasive in product selection.

- Supply chain congestion, geopolitical disruptions, and inflationary headwinds could prevent Mattel from reaching its prior 16% operating margins goal until the next decade.

- Mattel’s inability to capture entertainment and licensing contracts could lead peers to become more attractive. Prior losses of contracts like the license for DC Comics boys toys demonstrate difficulty with maintaining key agreements.

This article was compiled by Caryl Anne Francia.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/3559e02b-f74d-4a72-a821-b50f61ba05e9.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CWMPLAZER5HFBGFDFB45VCOUHI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VCYGUEZEV5DA3PVEIJNCMYA7AU.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/K36BSDXY2RAXNMH6G5XT7YIXMU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/3559e02b-f74d-4a72-a821-b50f61ba05e9.jpg)