Ultimate Stock-Pickers' Top 10 Buys and Sells

What top managers were doing in the months leading up to the global equity market downturn.

By Greggory Warren, CFA | Senior Stock Analyst

Had we known that talking about a correction would bring one about almost immediately, we would have adjusted our portfolios before publishing our last article. As you may recall, we noted that it had been more than three years since we had a genuine price correction of at least 10% in the U.S. markets (as represented by the S&P 500 Index), and while we didn't see a near-term catalyst for a meaningful correction in the markets we were not alone in believing that we were due for one. We went on to highlight that there have been a few periods when the markets have charged higher for a number of years without too many pullbacks in excess of 10%, generally during periods of much stronger economic expansion than we are seeing today. However, we noted that corrections are generally unpredictable, with the past two weeks being a prime example.

The last genuine correction we had before this one (in which the S&P 500 dropped from 2,102 on Aug. 18 to 1,868 on Aug. 25) was during April-June 2012, when the markets pulled back 10% in response to concerns about corporate earnings, the Federal Reserve's removal of its quantitative easing program, and an expanding European debt crisis. While neither correction has yet been as dire as the May-August 2011 market adjustment (when the markets dropped close to 20%) or the one in April-June 2010 (when the markets fell more than 15%), it was a reminder that the markets can go down for a short period and still continue to march upward. In fact, with the S&P 500 bouncing back more than 6% in the last three trading days of last week, the index has risen more than 190% since the markets bottomed in early March 2009, with just four corrections along the way.

The root causes of the most recent downturn are numerous, but at the end of the day we feel that investors have been looking for a reason to sell for quite some time, despite shrugging off the Greek debt crisis and concerns about a China slowdown for much of the last year (evident in the declining prices of commodities essential to fueling its boom). What it finally took, though, was a dramatic decline in the Chinese stock markets, and a devaluation of the yuan, to start a cascade in U.S. stocks. This created a decent buying opportunity for some investors, with wide-moat-rated

, being the first to hit the wires. In a late filing on Friday, Berkshire disclosed that Warren Buffett and his two lieutenants—Todd Combs and Ted Weschler—had added 3.2 million shares last week to the insurer's stake in

What Berkshire has that many of our other managers wish they had is a ton of capital to work with that does not run the risk of being redeemed away when the market takes a turn downward. As you may recall, when we relaunched the Ultimate Stock-Pickers concept in April 2009 we made a point of including a handful of insurance companies—Alleghany, Berkshire Hathaway, Fairfax Financial Holdings, and Markel—on our list of top managers because, unlike their peers in the mutual fund business, the portfolio managers at insurance companies are not affected by investor redemptions during poor market environments. With constant redemptions a reality for our top managers, the downturn in the global equity markets the last couple of weeks likely only exacerbated the problem.

As we noted last time, cash balances for our top managers crept lower during the second quarter, with the 22 fund managers we follow holding an average cash balance of 5% of their total assets (and a median cash balance of 4%) at the end of June compared with 6% (5%) at the end of the first quarter of 2015. Those whose cash balances are less constrained had an average balance of 8% (and a median cash balance of 7%), which is down from 9% (8%) at the end of the March quarter. While we do have a handful of managers who report their holdings monthly (providing us with a more or less real-time look at their trading activity), we're unlikely to get a full picture of the buying and selling of our top managers during the downturn until sometime in late October. What we have in the meantime is all of the holdings data for our Ultimate Stock-Pickers through the end of the second quarter (and end of July for those who report monthly), which highlights the buying and selling before the current period.

From the discussion we've already had on the high-conviction and new-money purchases that made up the bulk of our

, our top managers were able to put some money to work during the second quarter despite the market trading at close to all-time highs for much of the period. That said, the conviction buying that did take place was focused on high-quality names with defendable economic moats—exemplified by a greater number of wide- and narrow-moat names in our list of top 10 high-conviction purchases last time around. Not surprisingly, five of the high-conviction purchases we highlighted in that article—wide-moat

this time. The big difference between the two lists is that we roll up all of the buying activity of our top managers in this article as opposed to looking solely at their individual high-conviction and new-money purchases.

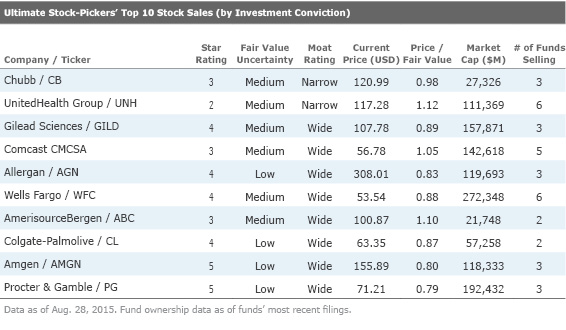

As for the top 10 stock sales this time, there continued to be a fair amount of outright selling, although most of it (along with the trimming of positions that took place during the period) seemed focused on positions that have reached a fair value benchmark for our Ultimate Stock-Pickers or were acquisition targets. Even with all of this buying and selling, as well as changes to the Investment Manager Roster during the first quarter of 2015, our top managers remained underweight in energy, utilities, communication services, and real estate relative to the weightings of those sectors in the S&P 500 at the end of June. They also continued to hold an overweight position in financial services and basic materials, having previously pulled back on their consumer defensive exposure, which remains modestly overweight relative to the market (much like their exposure to consumer cyclical, industrials, health-care and technology stocks).

Our Ultimate Stock-Pickers' buying and selling activity during the most recent period also affected the list of top 10 holdings of our top managers, with wide-moat

this time, with three of the 12 Ultimate Stock-Pickers that held the stock at the beginning of the first quarter selling it before the end of the June—with two of those sales being eliminations from these managers' portfolios. Of his sale of what had been a 2% holding in P&G in his fund at the end of the first quarter, Ronald Canakaris at

We initially trimmed the Fund's position in Procter & Gamble after the company reported fiscal third quarter results that exhibited lackluster organic revenue growth. Although the company benefitted from ongoing productivity initiatives, currency headwinds have masked the benefits to earnings. We subsequently eliminated the position given the limited prospects for a pickup in earnings momentum.

Canakaris also eliminated stakes in wide-moat

this time around. Canakaris had the following to say about some of this trading during the period:

[W]e sold the portfolio's positions in American Express and Schlumberger. We removed the small remaining position in Amex as earnings growth is likely to be subdued in 2015 while the company spends to retain cardholders due to the loss of its Costco partnership. We took advantage of a rebound in the Energy sector to exit Schlumberger, as the collapse in energy prices over the last nine months will likely lead to down earnings in 2015.We [also] reduced the size of positions in AmerisourceBergen and Monsanto following a rough quarter for each.

AmerisourceBergen was trading above our estimate of present value. The stock traded lower and detracted from results as investors focused on more difficult comparisons ahead and dilution from a warrant issuance related to its partnership with Walgreens Boots Alliance. We trimmed Monsanto, the Fund's only holding in the Materials sector, ahead of the company's earnings report given soft underlying industry fundamentals and confusion about the merit of its Syngenta acquisition. The crop chemicals/protection business is typically viewed as lower growth and with a lower multiple than that of the seed and biotech trait business. We further reduced the position following the earnings report, which confirmed the weak trends.

As for PepsiCo and J&J, which also made it onto our list of top 10 holdings this time, the former was also trimmed by Canakaris, which absent any meaningful additions by the nine other managers holding it at the start of the second quarter was enough to push it off of the list. With J&J, meaningful reductions by Nicholas Kaiser in both

As we noted above, five of the top 10 stock purchases we’re highlighting here—CVS Health, Walt Disney, Google, Dollar General, and Danaher—were represented on our list of top 10 high-conviction purchases in our

, where we had highlighted stock purchases above a certain threshold based on early data we were receiving for our Ultimate Stock-Pickers. Four of the top 10 stock purchases this time around—CVS Health, Dollar General,

It was no surprise to see wide-moat CVS Health top the list this time, as meaningful new-money purchases by Alleghany and Aston/Montag & Caldwell Growth, as well as additions by

The merger of CVS and Caremark into CVS Health added meaningful purchasing scale and allowed for the development of a suite of innovative products for the combined business. The firm stands to benefit from an aging population, the remaining wave of generic drugs, and a dramatically increasing skew toward specialty drugs in the pharmaceutical pipeline.

Despite being best known as a retail drugstore, CVS Health is well-positioned, with substantial market share in both the retail pharmacy and pharmacy benefit manager spaces, Morningstar analyst Vishnu Lekraj believes. He notes that the firm has been actively deemphasizing its retail sales operation in favor of its PBM segment. CVS Health has faced significant prescription reimbursement pressure, as well as heightened competition, in its retail segment. Lekraj believes that all retail pharmacy players will have to contend with tough long-term headwinds as payers are layering on material reimbursement pressure, and sees the expansion of pharmacy operations by many mass and regional retailer/grocer establishments as a meaningful competitive threat to stand-alone retail pharmacies. Lekraj believes that the ongoing mix shift toward specialty prescription claims eventually will lead to higher gross profits in the PBM segment, which will drive higher returns on invested capital than the firm is currently producing. Despite being well-positioned for growth, with pharmaceutical spending expected to grow robustly over the next several years, CVS Health is currently trading on par with Lekraj's $104 per share fair value estimate. He would like to see a decent margin of safety for investors before he would consider recommending the name.

Looking beyond health care, the industrials sector received the most attention during the period, with UPS, GE, and Danaher all being bought with conviction. Of their new-money purchase of UPS, Chuck Bath from

We initiated a position in airfreight and logistics company United Parcel Service, Inc. We believe UPS is well positioned to grow earnings over the next five years through the combination of top-line growth, margin improvement, and share repurchases. The stock price has declined 11% year-to-date, largely due to margin pressures that we view as transitory. This weakness in share price provided the opportunity to buy a high-quality franchise, which enjoys high returns on capital and generates substantial free cash flow at a reasonable valuation.

This echoes some of the thinking of Morningstar analyst Keith Schoonmaker, who notes that UPS is the giant among the global parcel shipment companies and considers its economic moat to be the widest among all of the freight transportation firms. He highlights the fact that UPS produces returns on invested capital about double its cost of capital and margins well above its competitors, crediting its leading package density and outstanding operational efficiency, which is enhanced by extensive and ongoing technology investments, for the gap between UPS and its peers. Schoonmaker believes that efforts to grow in the health-care markets in developed economies, as well as in developing nations overall, should add to revenue growth longer term. He also thinks that the firm's existing operations have revenue expansion potential via pricing, as UPS operates in a somewhat rational oligopoly in its largest market—U.S. high-service parcel delivery. As for share repurchases, Schoonmaker notes that UPS has consistently generated strong cash from its operations, and after investments in technology and capital assets, dedicates much of the rest to dividends and share repurchases. Despite all of these positives, the company's stock continues to trade just under his $101 per share fair value estimate. Schoonmaker would prefer to see a more adequate margin of safety before recommending the name.

As for General Electric, the firm was a top 10 new-money and high-conviction purchase in both the fourth quarter of 2014 and the first quarter of 2015 and made both lists again in the second quarter. This time, following in the footsteps of Bill Nygren and Kevin Grant at the Oakmark fund, it was Clyde McGregor at Oakmark Equity and Income doing the buying. He had the following to say about his purchase during the June quarter:

General Electric is a company with businesses we have always admired, but we have questioned the stock's valuation and management's focus on returns when making capital allocation decisions. However, the appointment of a new CFO in mid-2013 ushered in significant changes. Since then, GE has, in our view, acquired assets cheaply (Alstom) and sold assets at good prices (Synchrony and its appliances division). GE is also significantly reducing its financial services business to focus on those lending activities that are core to its industrial products. The company has totally revamped its variable compensation plan for thousands of employees, emphasizing factors that drive return on invested capital, which should boost future results. Some investors may have a stale opinion of GE after the past 15 years of persistent underperformance, but we believe the remaining businesses will grow in excess of global GDP with high returns on capital. At less than 14x our estimate of normalized EPS and with over a 3% dividend yield, we believe the current valuation is attractive for this good collection of businesses.

Morningstar analyst Barbara Noverini remains positive about GE's outlook, particularly as the firm has accelerated its efforts to sell the majority of GE Capital, keeping only the specialty finance businesses that directly support its wide-moat industrial businesses. She notes that the company just disposed of another $8.5 billion in health-care sector lending to narrow-moat-rated

With regards to Danaher, the name was a meaningful new-money purchase for the managers of

We added… Danaher, a holding company with an eclectic mix of subsidiaries ranging from sophisticated medical devices to a label printing business, [during the quarter]. What links all of these holdings is an outstanding culture anchored by a formalized system of continuous improvement called Danaher Business System (DBS).

Just after we starting buying Danaher's shares, management announced its intention to split the corporation into two separate holding companies. This transaction should be completed by the end of 2016. We think this restructuring is a good idea, because the resulting companies will have more focused strategies to grow organically and through acquisitions.

With Danaher's shares currently trading at 121% of our $73 per share fair value estimate, even after the downturn in the global equity markets, it is difficult for us to see a valuation rationale for buying the stock. Noverini notes that the shares have risen above her fair value estimate since Danaher announced it would be buying narrow-moat

As for the top sales, as we noted above there continued to be a fair amount of outright selling, with most of this activity (along with the trimming of positions that took place during the period) focused on positions that have with reached a fair value benchmark for our Ultimate Stock-Pickers or were acquisition targets. The sales of narrow-moat

Chubb shares rose following the company's announcement that it had agreed to be acquired by Ace Ltd., a large, globally diversified property and casualty insurer headquartered in Switzerland. The proposed stock and cash consideration was in line with our estimate of Chubb's intrinsic value. Since we initiated our position in 2007, Chubb's focused and long-term oriented management team has meaningfully grown shareholder value through strong operational execution and intelligent capital allocation. We believe that Chubb presented an attractive acquisition target given its strong market position, brand reputation, and well-capitalized balance sheet.

Most of the other sales looked to have been done because share prices had approached our top managers' estimates of their intrinsic value. We would also point to Canakaris' comments earlier in the article about the meaningful cut that he made to his fund's stake in AmerisourceBergen during the period, which along with sales of Allergan, Gilead Sciences, Amgen, Colgate-Palmolive, and Wells Fargo were enough to lift all of these names onto our list of top 10 stock sales this time.

If you're interested in receiving e-mail alerts about upcoming articles from The Ultimate Stock-Pickers Team, please sign up here.

Disclosure: Greggory Warren owns shares in the following securities mentioned above: Colgate-Palmolive and Synchrony Financial. It should also be noted that Morningstar's Institutional Equity Research Service offers research and analyst access to institutional asset managers. Through this service, Morningstar may have a business relationship with fund companies discussed in this report. Our business relationships in no way influence the funds or stocks discussed here.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/4QBQ2NBJMFG5HGQTDEYCXY5OOI.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/2RGHQJTF4ZEURNSAGBY7CSHCUQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EAAEIIRVVNE7HNVXBSGTD3WPSI.jpg)