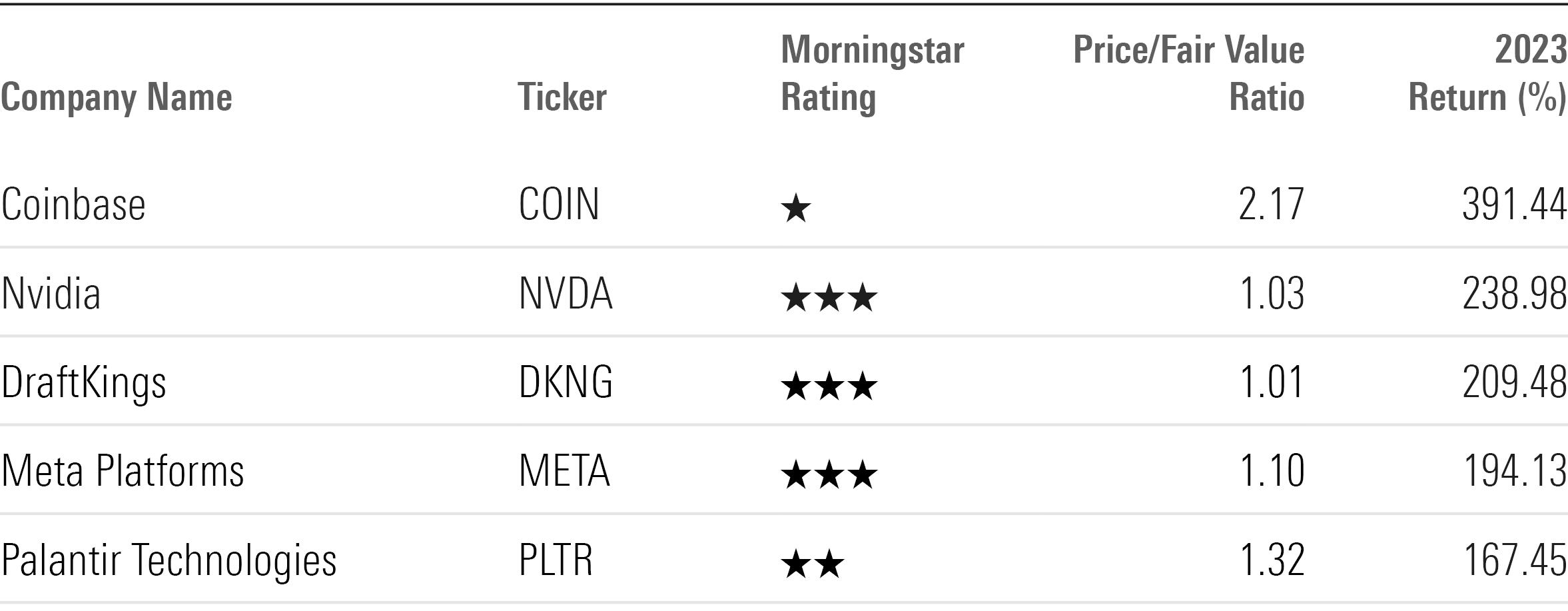

Top-Performing Stocks of 2023

Coinbase, Nvidia, Palantir, and other tech names dominate the list of the year’s best stocks.

Amid a strong stock market rally in 2023, Coinbase COIN performed best among U.S.-listed stocks covered by Morningstar analysts, as the cryptocurrency exchange platform rebounded from a steep downturn in 2022. Its 391.4% surge came as the price of Bitcoin rose 154.8% in 2023. The stock gained nearly 40% in December alone.

Not far behind was the 239% jump seen by Nvidia NVDA, which came thanks to booming demand for its semiconductor chips, driven by artificial intelligence technologies.

Top-Performing Stocks of 2023

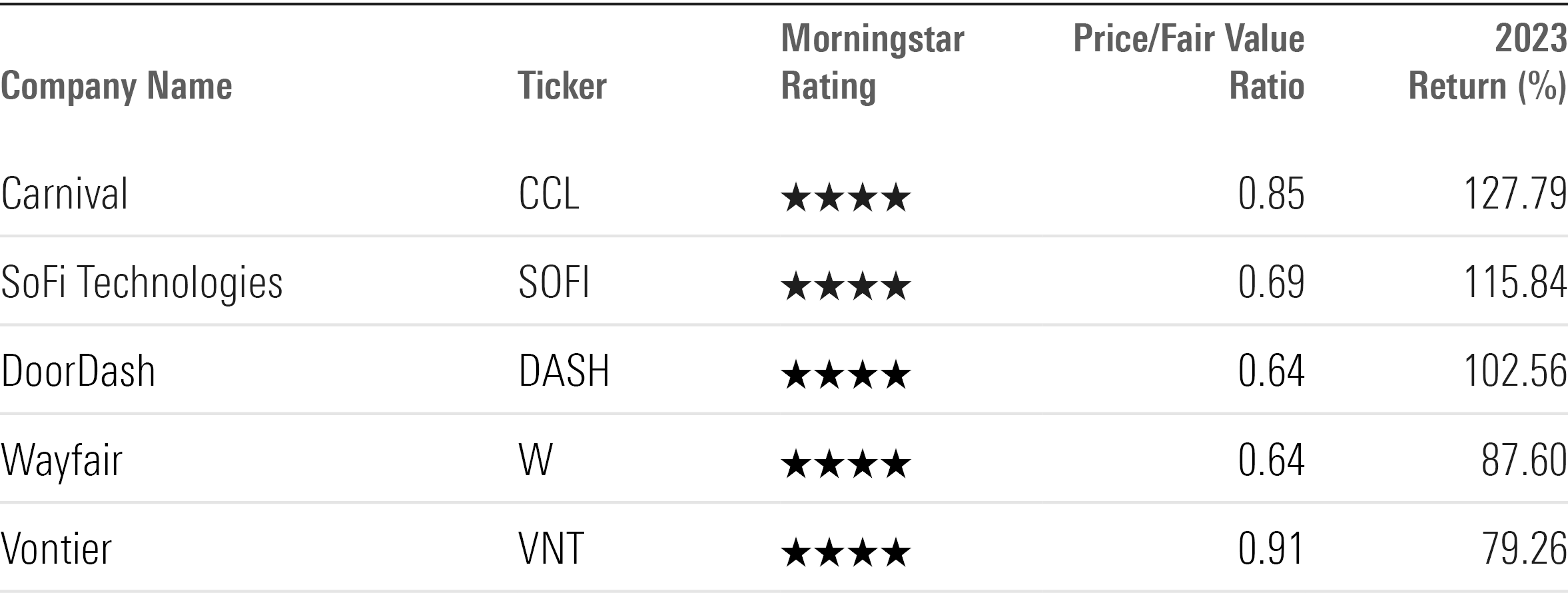

Among stocks considered undervalued by Morningstar analysts, Carnival CCL (which carries a Morningstar rating of 4 stars) performed best in 2023. The cruise ship company climbed 130% during the year as post-pandemic travel demand remained strong. SoFi Technologies SOFI followed close behind with a 115.8% jump.

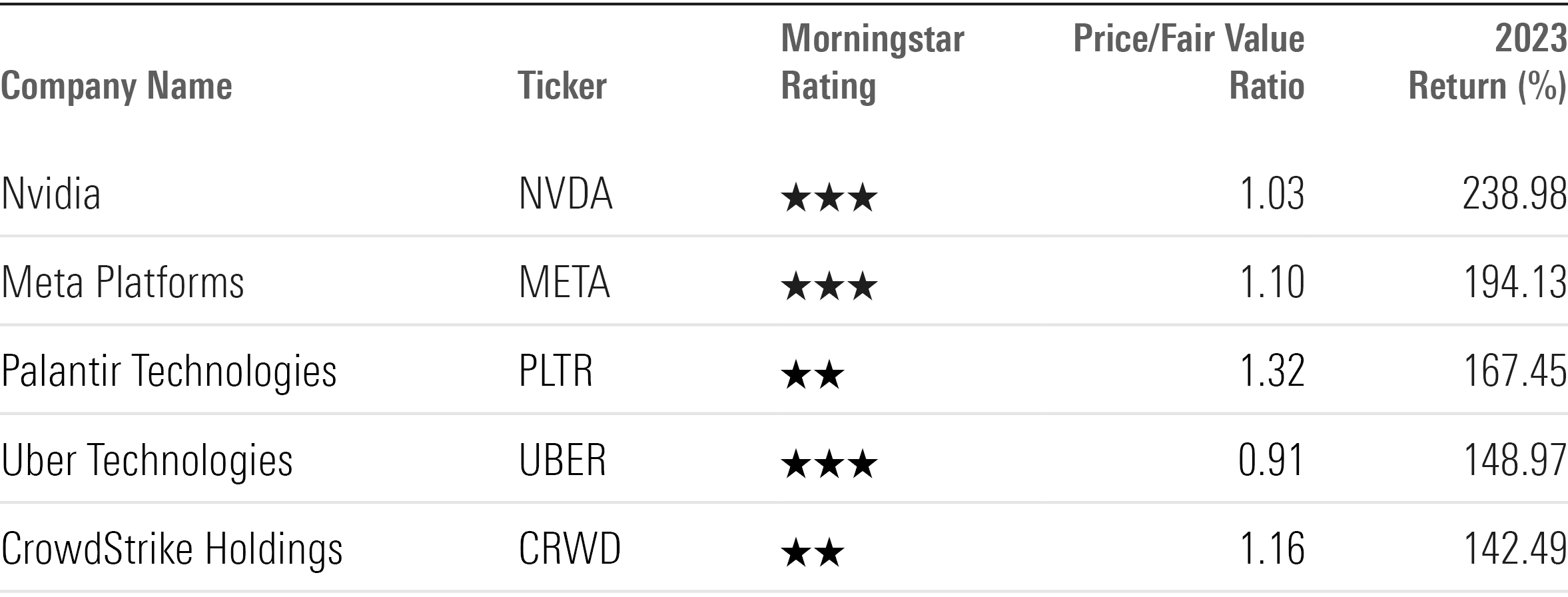

Within the group of stocks that Morningstar analysts classify as having an economic moat (meaning those companies have durable competitive advantages), the best-performing name by far was Nvidia. It was followed by social network giant Meta, which gained 194.1%.

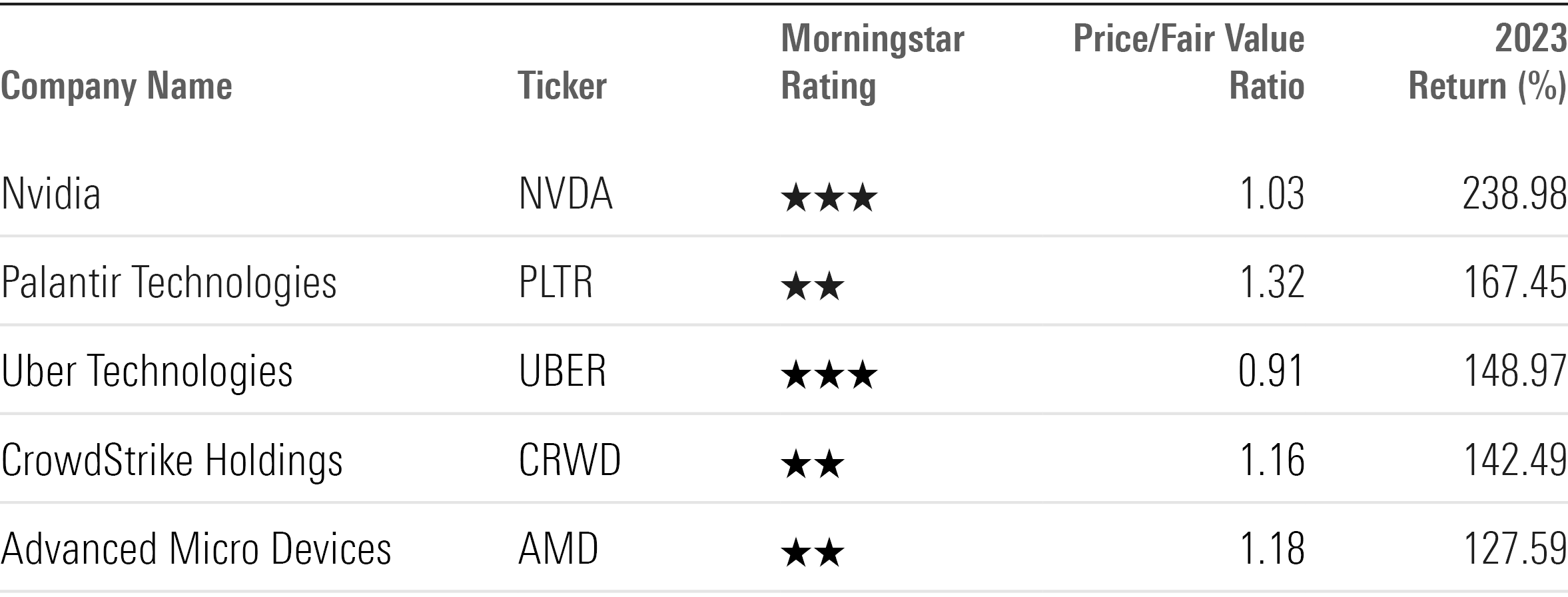

Technology stocks rallied to have the best performance among all sectors in 2023, with a 59.1% gain. Riding the momentum from AI, the best performers include Nvidia and Palantir, which gained 167.5% despite a 14% slide in December.

Here are the highlights of 2023′s top-performing stocks, along with their key Morningstar metrics.

2023 Top-Performing Stocks

Coinbase

- Fair Value Estimate: $80.00

- Morningstar Rating: 1 star

- Morningstar Economic Moat Rating: None

“As the leading U.S.-based cryptocurrency exchange, Coinbase has positioned itself as the reliable on-ramp to the space for new and experienced cryptocurrency traders alike. The company’s reputation, regulatory compliance, and record as a custodian have allowed it to maintain transaction fees above many of its peers despite operating in a crowded field with hundreds of competing firms. Unlike traditional exchanges in the United States, Coinbase fulfills multiple roles in the trading ecosystem by acting as an exchange, asset custodian, and broker. It has continued to branch off into adjacent businesses offering the stablecoin USDC through its partnership with Circle, a crypto debit card, blockchain infrastructure, and data analytics services.”

—Michael Miller, equity analyst

Nvidia

- Fair Value Estimate: $480.00

- Morningstar Rating: 3 stars

- Morningstar Economic Moat Rating: Wide

“We think Nvidia’s prospects will be tied to the AI market, for better or worse, for quite some time. We expect leading cloud vendors to continue to invest in in-house semis (with Alphabet GOOGL and Amazon.com AMZN leading the way), while CPU titans Advanced Micro Devices AMD and Intel INTC are working on GPUs and AI accelerators for the data center. However, we view Nvidia’s GPUs and Cuda as the industry leaders, and the firm’s massive valuation will hinge on whether (and for how long) it can stay ahead of the rest of the pack.”

—Brian Colello, strategist

DraftKings

- Fair Value Estimate: $35.00

- Morningstar Rating: 3 stars

- Morningstar Economic Moat Rating: None

“DraftKings has extended its leading daily fantasy sports position, first established in 2012, into one of the top positions in the North American sports betting and iGaming market. The company, FanDuel, and MGM hold a combined 70%-80% revenue share. Sports betting is currently legal in 38 states and iGaming is legal in seven, and we expect a handful of states to be added to each market over the next few years as governments look to capitalize on the tax revenue generated from the growing activity, which is benefiting from an improved product (parlay and in-play wagering) and technology (customized content) offering across the industry. As a result, we estimate the North American sports betting and iGaming market to reach $40 billion-$50 billion in revenue in the early part of the next decade, from over $13 billion in 2022.”

—Dan Wasiolek, senior equity analyst

Meta Platforms

- Fair Value Estimate: $322.00

- Morningstar Rating: 3 stars

- Morningstar Economic Moat Rating: Wide

“Facebook is the largest social network in the world, with nearly 3 billion monthly active users. The growth in users and user engagement, along with the valuable data that they generate, makes Meta attractive to advertisers. The combination of these valuable assets and our expectation that advertisers will continue to shift their spending online bodes well for the firm’s top-line growth and cash flow.”

—Ali Mogharabi, senior equity analyst

Palantir Technologies

- Fair Value Estimate: $13.00

- Morningstar Rating: 2 stars

- Morningstar Economic Moat Rating: Narrow

“We believe Palantir is well-placed for long-term financial success as a leader in the artificial intelligence/machine learning platforms space. Palantir’s two main platforms, Gotham and Foundry, are well-suited to help governments and commercial clients harness the power of data. Palantir’s platforms stand to materially benefit as organizations seek to expand their use of data to inform business decisions. We expect this secular tailwind to allow Palantir to land more clients while expanding revenue from existing ones.”

—Malik Ahmed Khan, equity analyst

Undervalued Top-Performing Stocks

Undervalued Top-Performing Stocks

Carnival

- Fair Value Estimate: $24.00

- Morningstar Rating: 4 stars

- Morningstar Economic Moat Rating: None

“Carnival remains the largest company in the cruise industry, with nine global brands and 92 ships at the end of fiscal 2023. The global cruise market has historically been underpenetrated, offering these companies a long-term demand opportunity. Additionally, the repositioning and deployment of ships to faster-growing and underrepresented regions like Asia-Pacific helped balance the supply in high-capacity regions like the Caribbean and Mediterranean prior to the pandemic—a factor that the firm can again utilize to help optimize forward pricing. Since the European demand profile has recently normalized, we believe there is plenty of support for improving economic performance at Carnival.”

—Jaime M. Katz, senior equity analyst

SoFi Technologies

- Fair Value Estimate: $14.50

- Morningstar Rating: 4 stars

- Morningstar Economic Moat Rating: None

“SoFi Technologies targets young, high-income individuals who may be underserved by traditional full-service banks. The company is purely digital and engages with its clients exclusively through its mobile app and website. Unlike existing digital banks, which generally have limited product offerings, SoFi offers a full suite of financial services and products including everything from student loans to estate planning. The intent is that this will allow customers to structure the entirety of their finances around SoFi. By acting as a one-stop shop for its customers’ finances, SoFi intends to create powerful cross-selling advantages that will reduce its cost of acquisition.”

DoorDash

- Fair Value Estimate: $155.00

- Morningstar Rating: 4 stars

- Morningstar Economic Moat Rating: Narrow

“DoorDash DASH is the top online food order aggregator in the U.S., ahead of Uber Technologies’ UBER Uber Eats and Grubhub. The firm is in the early stages of trying to attract a larger piece of what we estimate could be $1 trillion worth of goods and services by 2025. DoorDash benefits from the network effects between merchants, deliverers (or ‘dashers’), and consumers, plus intangible assets in the form of data, which we believe together warrant our narrow moat rating.”

Wayfair

- Fair Value Estimate: $97.00

- Morningstar Rating: 4 stars

- Morningstar Economic Moat Rating: None

“Wayfair W plays in the fragmented home goods market across North America and Western Europe (an $800 billion-plus global opportunity), offering more than 40 million products from more than 20,000 suppliers. We think its differentiation comes by way of product breadth and its logistics network, which permits faster delivery with fewer touch points and less product damage than its peers. However, we believe Wayfair lacks brand strength, evidenced by its elevated advertising spending relative to peers and customer acquisition costs. Moreover, we think peers will continue to attempt faster delivery, spurring rising competition. Targeting a wide consumer base of customers 25-54 years old with an average household income of $80,000 also means Wayfair is competing with mass-market retailers, specialty retail, and low-cost providers, making it harder to stay top of mind.”

Vontier

- Fair Value Estimate: $38.00

- Morningstar Rating: 4 stars

- Morningstar Economic Moat Rating: Narrow

“Vontier’s VNT business model is an iteration of the Danaher Business System playbook, which the firm inherited from its former parent companies Danaher and Fortive. The Vontier Business System focuses on acquiring moat-worthy companies, boosting their operating margins through continuous improvement, and reinvesting cash flows in further M&A deals.”

—Krzysztof Smalec, equity analyst

Top-Performing Moat Stocks

Top-Performing Moat Stocks

Uber Technologies

- Fair Value Estimate: $68.00

- Morningstar Rating: 3 stars

- Morningstar Economic Moat Rating: Narrow

“Uber has become the largest on-demand ride-sharing provider in the world (outside of China). It has matched riders with drivers completing trips over billions of miles and, at the end of 2022, had 131 million customers using its ride-sharing or food delivery services at least once a month. In light of Uber’s network effect between riders and drivers, as well as its accumulation of valuable user data, we believe the firm warrants a narrow moat rating.”

CrowdStrike Holdings

- Fair Value Estimate: $220.00

- Morningstar Rating: 2 stars

- Morningstar Economic Moat Rating: Narrow

“We view CrowdStrike CRWD as a leader in endpoint security, a prominent part of the cybersecurity stack that protects an enterprise’s endpoints from nefarious activity. As enterprises undergo digital transformations and cloud migrations, we foresee endpoint security further gaining wallet share of an enterprise’s security spend. Within this growing market, CrowdStrike has emerged as a leader, and we think the stickiness of its platform, Falcon, is clear in the firm’s impressive gross and net retention metrics. Beyond endpoint, CrowdStrike has been enhancing its security portfolio by adding cloud security, identity security, and security operations offerings to Falcon.”

Top-Performing Technology Stocks

Top-Performing Technology Stocks

Advanced Micro Devices

- Fair Value Estimate: $125.00

- Morningstar Rating: 2 stars

- Morningstar Economic Moat Rating: Narrow

“AMD has a wealth of digital semiconductor expertise and is well-positioned to prosper from favorable trends in data centers, artificial intelligence, and gaming. We think the firm benefits from intangible assets across a variety of products. Meanwhile, it’s one of two notable firms in graphics processing units, which are especially well-suited for AI. AMD may play second fiddle to Nvidia in AI GPUs, but its GPU expertise should become increasingly valuable (and lucrative) in the years ahead.”

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/11aca145-fc87-4ca5-9dbf-09f77ad3584c.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ECVXZPYGAJEWHOXQMUK6RKDJOM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KOTZFI3SBBGOVJJVPI7NWAPW4E.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/V33GR4AWKNF5XACS3HZ356QWCM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/11aca145-fc87-4ca5-9dbf-09f77ad3584c.png)