Morningstar's View: The Impact of Coronavirus on the Economy

The hit to 2020 should be significant, but we see minimal long-term economic impact, and the treatment pipeline is progressing.

Editor’s note: Read the latest on how the coronavirus is rattling the markets and what investors can do to navigate it.

COVID-19, the disease caused by the SARS-CoV-2 coronavirus, is spreading across the globe, leading to sharp market corrections and fears of triggering a global recession. Risks relating to the fallout from the spread of coronavirus pushed the Federal Reserve to cut the federal-funds target rate by 50 basis points on March 3, to 1%-1.25%, and President Donald Trump signed an $8.3 billion spending bill to fight the coronavirus on March 6. The virus emerged in China, where the government quickly weighed the economic and human costs of the rapidly transmitting new coronavirus and in January decided to focus on stopping the spread of the disease, regardless of the short-term economic hit. While responses beyond China are likely to be more measured, we expect to see school closures and recommended telecommuting as precautionary measures in the United States, given the recent rapid spread of the disease.

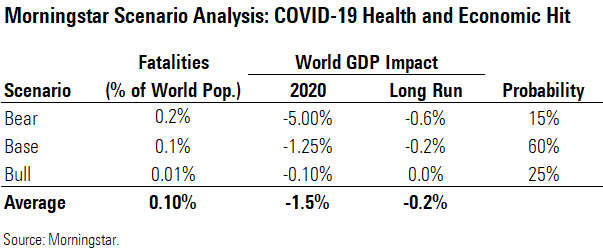

- Overall, we see a weighted average hit of 1.5% to 2020 global GDP and 0.2% to long-run global GDP. We forecast a muted long-term impact because damage to productive capacity will be small, plus economic confidence should quickly return once the virus subsides.

- Our long-term China GDP forecast is unchanged. We have lowered our 2020 China GDP forecast by 250 basis points, but we expect catch-up growth in following years.

- We assume a global fatality rate in our base case of 0.5% among those infected, higher than seasonal flu and recent pandemics like the 2009 swine flu, but much lower than levels reported to date as diagnosis improves. We expect even lower fatality rates for developed countries and the working-age population.

- We see reason for optimism surrounding vaccines and treatments. We should see initial data from Gilead's GILD remdesivir by April; this drug could be a strong defense for patients with severe disease. Among vaccines, Moderna's MRNA is the most advanced, but we don't expect use until 2021.

Morningstar's Coronavirus Analysis: Epidemiology and Society's Response A pandemic is defined as a disease that can infect and sicken humans, can transmit easily from one human to another, and has spread worldwide. Pandemics occur when a new form of virus emerges (either a mutated version or a combination with another variation) and is capable of transmitting from person to person. While the World Health Organization has not officially deemed this coronavirus a pandemic, it is likely moving in that direction.

What makes pandemics particularly dangerous is that the population generally does not have immunity to the disease, and this can cause outbreaks beyond the traditional winter flu season. Flu pandemics have decreased in severity with time, perhaps partly due to viral preference for diseases that are very transmissible but not lethal. Despite some similarities between seasonal and pandemic flu, there are also key differences. While seasonal flu is every year, pandemics can have multiple waves; Spanish flu came in three waves, and the 2009 swine flu had two waves.

Past pandemics have varied substantially in their lethality. For example, the 1957 Asian flu, considered a moderate pandemic, emerged in China in February 1957, reached the U.S. by June, and spread very rapidly in the fall in the U.S. and Europe, with the return to school seen as a significant driver for starting new community epidemics during that pandemic. With mitigation efforts focused on a vaccine (which was developed too late and was not more than 60% effective), most schools remained open and no travel restrictions or restrictions on social gatherings were undertaken, and 25% of the U.S. population was infected. The 1968 Hong Kong flu was milder but more widespread (estimated at almost 40% of the U.S. population infected). The death rate may have been significantly lower than Asian flu because patients had some pre-existing immunity.

Coronavirus 101: A New Virus Related to SARS and MERS On Jan. 7, a new coronavirus was identified as the cause of several cases of pneumonia in Wuhan, China. COVID-19 is the disease caused by SARS-CoV-2, one of a family of coronaviruses, with this particular strain new to humans. Most coronaviruses spread between animals, although the common cold is often caused by a coronavirus. Like more serious coronaviruses SARS and MERS, SARS-CoV-2 is believed to have jumped to humans by first moving from one species known to carry these diseases to another species capable of transmitting the disease to humans. Like SARS-CoV and MERS, it is believed to be mostly spread through respiratory droplets, often from a patient's cough.

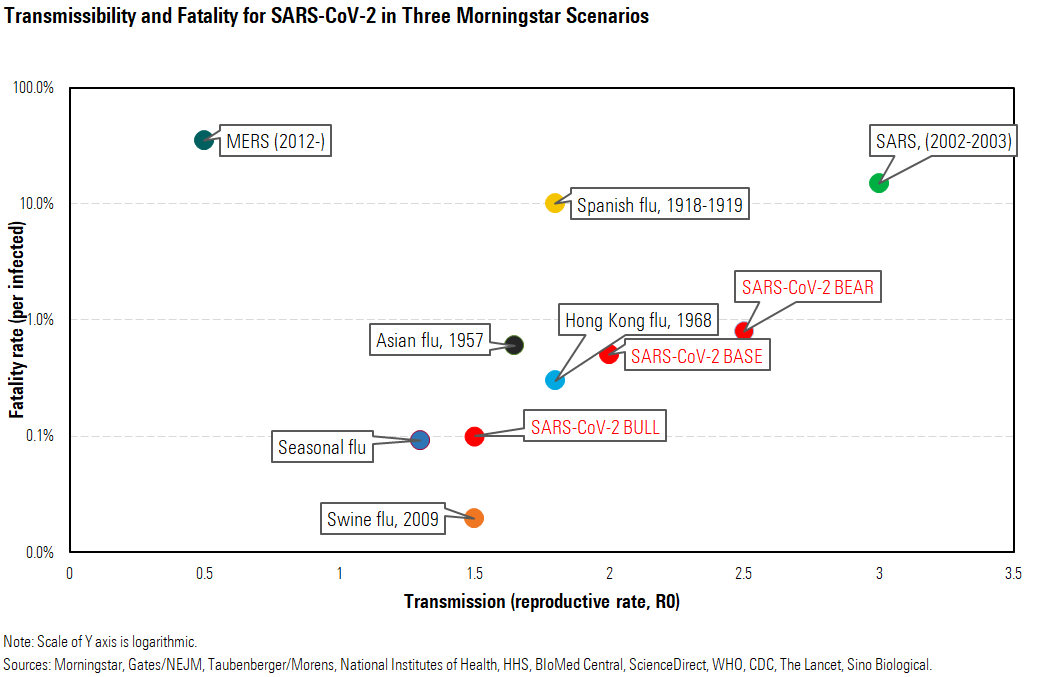

A comparison with other outbreaks is one of the easiest ways to think about the potential spread of coronavirus, although every disease has slightly different characteristics that limit the accuracy of this analysis. The intersection of the fatality rate (the percentage of infected patients who succumb to the disease) and how contagious it is, if left unchecked, is a simple way to begin to outline the potential impact versus past pandemics. Epidemiologists measure how contagious a disease is using a reproduction number, termed R0, reflecting how many people an infected person can typically infect. Generally speaking, an R0 of greater than 1 is a threshold for a disease being able to expand into an epidemic, and a virus with an R0 above 1.9 is considered highly transmissible. In addition, a higher R0 means a sharper rise and fall of infection rates with a shorter duration of the outbreak. An R0 of 1.9 could imply an outbreak of months, with a two-month peak in infections, as seen with the 1957 and 1968 pandemics.

Diseases are generally the most dangerous if they are both very deadly and very contagious (high R0), but most diseases tend to be more one than the other, as the self-interest of viruses would favor evolution toward diseases that don’t kill their victims. For example, Ebola and rabies have very high fatality rates but are tougher to transmit. At the opposite end of the spectrum is the common cold, which is fairly easy to transmit but almost never fatal. Smallpox was one of the most destructive diseases, as it was both very contagious and very deadly. Also, the Spanish flu of 1918-19 caused more than 50 million deaths worldwide and killed nearly 3% of the population. However, the spread of a disease is more than these numbers--significant efforts to contain SARS have eradicated the disease, even though it is more easily transmissible than the standard flu (which is very widespread every year).

Even though death rates have been falling gradually for flu pandemics since the 1918 pandemic, coronavirus pandemics are a newer phenomenon and don’t have an established trend. Fatality rates are already being estimated, but this is very difficult to do accurately at the start of any pandemic. As of March 7 data from Johns Hopkins, 105,820 people have been infected by the coronavirus, with a death rate of 3.4% (likely skewed high due to nonreporting of mild cases, particularly at the start of a new pandemic). A comprehensive analysis of more than 70,000 cases using data released by China’s Center for Disease Control and Prevention puts the fatality rate at 2.3%, but 8% for patients in their 70s and almost 15% for patients older than 80. While roughly 80% of the confirmed 44,672 cases were mild (either no or mild pneumonia), 5% of cases were critical, with half of these critical patients dying.

Researchers have also cited a range of lower fatality rates from as high as 2% (deaths with pneumonia diagnosis) to 1.4% (among 1,099 lab-confirmed cases in China, with a range of severity) to potentially less than 1% assuming a high proportion of asymptomatic cases. A fatality rate of 0.1%-0.8% would put the coronavirus in a position of being more severe than a typical flu (which has a 0.1% fatality rate, on average) but less severe than the Spanish flu (statistics put this closer to a 10% fatality rate). This is the range we use in our scenario analysis.

We think the bull case is slightly more likely than the bear case, as fatality rates outside Hubei province (the site of the initial outbreak) have been lower, and the 2009 pandemic was estimated to have fatality rates of 10%-20% initially before these rates faded dramatically, well below 0.1% using U.S. infection data. This can happen because only the sickest patients are diagnosed early in an outbreak, distorting the initial data.

Transmissibility is also difficult to estimate during a pandemic, but Bill Gates noted that this virus has already infected 10 times the number of total SARS cases, and in only one fourth of the time, indicating it is much more transmissible than SARS, with a likely R0 for COVID-19 between 2 and 3. Fauci and colleagues cited an R0 of 2.2 for the coronavirus, with containment efforts needed to get this below 1 to begin to contain the virus. Also, the high level of viral shedding early in the disease and among patients who have very mild disease (in contrast with SARS, which was more contagious among symptomatic patients) is concerning and could hamper efforts to lower this rate significantly. We assume a range from 1.5 (similar to the typical flu) in our bull case to 2.5 in our bear case.

While higher fatality rates and higher transmissibility are generally indicators of how severe a pandemic could be, SARS (what has been eradicated) is the highest on both measures among the outbreaks we used in our scenarios. Containment efforts were solid for SARS, and patients were most contagious when they were highly ill. In addition, Chinese citizens traveled within China much less extensively in 2003, limiting the spread, while today, 3,500 fly out of Wuhan each day, and the Belt and Road Initiative has led to a high number of domestic and international migrant workers. For COVID-19, viral shedding is more like the flu, with higher loads seen soon after symptoms and also in asymptomatic patients.

Coronavirus Likely to Be Mild Pandemic With Minimal Long-Term Economic Effect In a severe pandemic, infrastructure can be disrupted at a national level, such as healthcare, transportation, commerce, and utilities. This is due partly to risk mitigation measures but also potentially higher rates of patients on sick leave, employees taking care of children or other family members, or general population anxiety about gathering in public places.

The direct and indirect U.S. healthcare costs of a moderate pandemic, like those in the 1950s and 1960s, were estimated at roughly $180 billion in 2005 by the U.S. Department of Health and Human Services, assuming no intervention, but this does not include potential for commerce disruption. According to the Congressional Budget Office, a pandemic could cost the U.S. more than 4% of GDP in a severe situation (similar to the Spanish flu of 1918) or 1% of GDP (if the pandemic is more mild, similar to 1957 and 1968 pandemics).

Overall, we think the costs of coronavirus will mirror those of a milder pandemic. As we assume a lower death rate that primarily focuses on patients over the age of 65, we think there could be a significant short-term hit (1.5% of 2020 GDP) but minimal hits beyond, as the economy should be in position to rebound quickly.

Government Response to Pandemic Involves Multiple Stages Initially, efforts to contain a virus include isolation of suspected or confirmed infected patients, once an accurate diagnostic is developed, and quarantine for two weeks of those who were exposed to these patients. However, at a certain point these efforts are less effective due to the wide spread of the disease, at which time mitigation measures like social distancing become the main way to slow transmission, buying time that alleviates some pressure on hospitals and allows for potential development of best treatment practices. Mitigation measures are key to reducing transmission and impact on global health and economy. Social distancing takes many forms, like school closures, canceling large gatherings, telecommuting when possible, and travel restrictions. Layering of these efforts is even more effective. However, the negative effects of these efforts on the economy have to be considered, so deciding on the timing of implementation is tricky.

We think that most economic commentary on coronavirus has focused on the concern that we will have a strong government response with a disease that winds up being less dangerous than we thought, which creates unnecessary harm to the economy. However, we argue that such a scenario would have only a short-term impact on the economy, and that the most concerning scenario is one in which not enough of a government response is seen and the disease spreads widely.

Mitigation can significantly reduce the spread of a disease, although the percentage of a population infected is still closely tied to the R0 number (how contagious the disease actually is), which is very difficult to isolate after an outbreak, let alone during an evolving one.

While the situation is changing daily, we have seen mitigation efforts already emerging in various countries beyond China, although responses are generally more measured. Japan, Iran, Italy, and New Delhi have already closed all schools. We’re seeing fewer large gatherings (events canceled in France, Switzerland, the U.S., and other countries), and recommendations for flexible workers to telecommute, but businesses and transportation remaining open. School closures in a Seattle suburb are so far the most extensive in the U.S. The U.S. Centers for Disease Control and Prevention is recommending against cruise ship travel for all Americans, but particularly for those at elevated risk, and it also recommends that those at highest risk avoid crowds and nonessential travel. However, Italy has put its entire population on lockdown, a more extreme measure akin to that in China, and some argue for this sort of extreme measure in other developed nations like the U.S. We think the U.S. would be unlikely to go that direction unless this were a much more severe pandemic, with death rates closer to SARS or MERS.

China's Rapid and Aggressive Efforts Look Successful for Now As no drugs or vaccines are available for this novel coronavirus, China's rapid and aggressive response to the spread of a novel virus focused on basic mitigation measures, with successful outcomes so far, despite criticism for initial missteps and secrecy. China's first cases of COVID-19 probably began by early December, although no cases were officially diagnosed until January. Within a week of identifying the new virus on Jan. 7, China had released the virus genetic sequences publicly (allowing researchers across the globe to study and target the virus) and created a diagnostic test kit.

On Jan. 20, COVID-19 became a Class B notifiable disease, triggering a more comprehensive approach to containing the virus including quarantines and temperature checks. On Jan. 23-24, Wuhan and 15 other cities were effectively shut down. With the Lunar New Year holiday directly following this, and a mandatory nationwide extended holiday beginning directly after the holiday, China has made incredible strides in containing a very contagious new virus, likely buying the rest of the world a few weeks before spreading significantly beyond China, according to WHO. However, it is still unclear if it has contained or simply suppressed the virus, as Wuhan remains under lockdown, and businesses outside Hubei have lower alert levels, but workers and students are still in the process of returning to work and school, meaning there could be a resurgence.

Significant social distancing, quarantines, and travel restrictions were put in place in China, to the consternation of infectious disease experts, who see these more severe measures as potentially more destructive than helpful. But it now seems these efforts may have been successful; WHO sees the recent decline in cases as real, with any future resurgence potentially manageable. Offices began to reopen in early March after a monthlong break to slow the spread of the virus. In mid-February, at the height of the outbreak, more than half the population were under some form of lockdown in their homes, ranging from checkpoints to forbidding citizens to leave their homes.

Today, China is using smartphone software to determine whether citizens should self-quarantine or not, using an unknown method to determine their contagion risk. This can result in a range of actions from unrestricted to a mandatory two-week quarantine.

With the SARS outbreak in 2002, China and Hong Kong constituted the vast majority of cases (7,000 out of roughly 8,000 globally), and the disease was identified in November and officially eradicated by July 2003, with no recurrences. The COVID-19 outbreak has already spread much more widely than SARS, perhaps because patients are contagious when they are experiencing few symptoms. Given the widespread nature of COVID-19 at this point, we think eradication looks unlikely.

U.S. Mitigation Measures Hampered by Diagnostic Delays While the U.S. benefits from China's aggressive efforts to contain COVID-19, its initial response has been slow and disorganized. Trump held a press conference on the coronavirus on Feb. 26, appointing Vice President Mike Pence to lead the national effort to defend against the virus. However, the next day, the first case of possible community spread (infection from an unknown source) was identified in California, followed by several cases on Feb. 28, indicating that the virus had likely already been in the U.S. for weeks. While China has multiple commercial tests on the market and can test up to 1.6 million patients a week, the U.S. declined access to the WHO diagnostic, and diagnostics advancements in the U.S. have lagged other countries. The CDC had tested only 459 patients as of Feb. 28, using a test approved by the Food and Drug Administration in early February, for SARS-CoV-2. Testing is still ramping up as the disease spreads to many states, with more cases in Washington and California.

In 2007, the U.S. CDC introduced a pandemic severity index to help determine the measures to take and the length of time they should be implemented, with the goal of mitigating the impact of the disease on overall health and the economy. The system assumed that pandemics could affect 30% of the population and used case fatality ratios (percentage of infected patients who die) as a measure of the severity of a potential pandemic, with CFRs greater than 1% putting a pandemic into a category of 4 or 5 and leading to a number of recommended mitigation steps or nonpharmaceutical interventions, from more basic measures (voluntary quarantine of sick patients and their families) to social distancing measures (school/daycare closings up to 12 weeks, encouraging teleconferences and working from home, and canceling public gatherings). The goal is to delay the growth curve and buy time for vaccines and treatments.

An updated document from 2017 replaced this plan with a pandemic severity assessment framework that doesn’t just rely on CFR for disease severity (as this can be distorted by testing levels, particularly early in a pandemic), but also hospitalization/death ratios, and transmissibility is defined by attack rates in different community settings. The CDC will make a recommendation for action when a pandemic begins, which could take weeks to refine, and the effectiveness can be improved by layering several of these mitigation strategies together.

Therefore, the U.S. healthcare system has made significant effort to prepare for pandemics, and these plans were activated as recently as 2009 with the swine flu pandemic, meaning that hospitals should be prepared for current COVID-19 planning, with efforts focused on isolating suspected patients and protecting workers.

That said, diagnostics efforts, which should lead our response in a pandemic threat, have been disappointing. Distribution of tests to state and local labs was hampered by test inaccuracies. In addition, criteria for testing for the virus have been strict, delaying earlier diagnoses. We do expect rapid improvement on these fronts, as restrictions on testing were lifted as of March 3, and CLIA-certified labs (large labs such as those in medical centers) are now allowed to create and run their own tests. Commercial diagnostic makers are also working to get FDA approval for their tests, and while this is technically required before running tests in a public health emergency, the FDA is letting Quest DGX and LabCorp LH launch tests ahead of approval, given the strong need. In addition, Bill Gates has funded an effort that should result in at-home testing kits becoming available in Seattle; these tests can be sent for analysis with results in one to two days, although ultimate supply and processing is still uncertain. While a million tests could now be conducted each week, according to FDA head Stephen Hahn, this could overwhelm processing capabilities initially.

U.S. Measures Unlikely to Mirror China's, Making Containment More Difficult In the U.S., restrictions and quarantines were among the first steps to slow the spread of the virus. For example, the U.S. halted flights between the U.S. and China in early February (barring foreign nationals who had been to China from entering the U.S.) and is now screening all travelers on flights from Iran, Italy, and South Korea. School closures aren't yet widespread. While ideally we could learn more about the fatality rate (which is lower outside of Hubei province, where the disease started, and which provided the data for China to make its initial decisions) and weigh this against the potential economic hit from long-term closures of schools, public transportation, and office buildings, the disease is spreading rapidly and doesn't allow time for lengthy analysis. We expect to see school closures and recommended telecommuting in the U.S. as the next precautionary measures, as other than household transmission, schools and workplaces are the likeliest places for transmission. That said, we are unlikely to lock down the hardest-hit cities or prevent Americans from leaving their homes, as our culture and government would only bear these sorts of restricted freedoms in a far worse pandemic, in our opinion. In addition, certain factors make us more exposed than China, including the high number of workers who have limited sick leave and can't afford to stay home sick, or who lack health insurance and wouldn't seek care, as well as and the much higher percentage of our population that is urban (where diseases spread more rapidly). On the other hand, we are likely much more prepared for the taxing of our hospital system, as we appear to have a massive lead over other developed nations in the number of intensive care unit beds per citizen.

Base Case: 60% Probability We assume a global fatality rate of 0.5% of those infected in our base case, much lower than levels reported to date, with even lower rates for developed countries and the working-age population. We expect newer cases to become easier to diagnose and hospitals to learn how to best treat. Current numbers show a 4.4% death rate in Hubei province, which includes Wuhan, versus a 1%-2% death rate outside Wuhan, with most of these numbers still reflective of China's fatality rates. This should further lower the economic impact, even if global death rates are much higher than recent pandemics. This distinguishes coronavirus from influenza pandemics, which often target younger patients as well.

This 0.5% global fatality rate is still well ahead of death rates from the flu, which is around 0.1%. Given the high transmissibility, we also expect 20% of the global population to be infected, or roughly 1.5 billion people, which is above the high end of the typical range for seasonal flu of 3%-11% but consistent with the U.S. Department of Health and Human Services’ moderate to very severe pandemic projections of 20%-30% infection rates as well as infection rates for prior pandemic flu (20%-40% of the U.S. population was infected by Spanish flu, Asian flu, and Hong Kong flu). This could result in nearly 8 million deaths globally, or more than 200,000 deaths in the U.S., well ahead of the typical U.S. deaths from seasonal flu (12,000-61,000, according to the CDC).

Given the potential for a second wave, we think the impact on the economy could be felt for the remainder of 2020, and we assume this could cost the U.S. 1.5% of 2020 GDP, consistent with Congressional Budget Office estimates of the impact of a more mild pandemic similar to the 1957 or 1968 pandemics.

We assume that progress with a coronavirus vaccine will take time, with the first vaccines potentially ready for patients in the 2021-22 flu season if this turns into a recurrent virus like seasonal flu. However, we assume we could see the first treatments become available to patients with severe illness by May, if data in April supports the efficacy of Gilead’s remdesivir.

Other drugs are also in development or entering development. This could reduce the need for expensive and supply-constrained treatment including ventilators. We expect that the initial supply of Gilead’s drug could come before approval and may not benefit Gilead’s cash flows, but that the drug would be approved for a potential second wave in the fall and for future stockpiling for seasonal recurrence or future coronavirus pandemics (as the drug did show preliminary efficacy in other coronaviruses as well).

In the U.S., we assume slightly lower death rates (0.3% of infected) due to better care than other developed markets and developing markets. We assume, consistent with CDC expectations, that there will be significant community spread in the U.S. and significant impact on daily life. We expect an outbreak could last for two to three months, with potential for a second wave hitting in the fall. There are likely to be measures taken to achieve social distancing (school closures and working-from-home recommendations for up to three months).

In this scenario, we assume that hospitals will be stretched to care for severely ill patients, as they are during a typical severe flu season, with ventilators used at capacity. If all of the patients we assume will reach the ICU need a ventilator, this would be almost 600,000 patients in the U.S. in this base-case scenario. With the number of ventilators in the U.S. likely approaching 100,000 and a disease spread across months, we think this could be manageable, assuming the seasonal flu season begins to ramp down as anticipated. However, this depends on the speed of increase in cases and whether treatments (like remdesivir) become available.

Bear Case: 15% Probability In a bear case, we assume a potential pandemic cost of 5% of 2020 GDP, similar to the 1918 Spanish flu, consistent with past pandemic analysis from the CBO. This would be the result of extended (potentially six months) school closures, employees working from home, and significant impact on retail and service industries, as well as the higher pressure from employees caring for sick family members. However, we do not assume widespread use of extreme measures such as walling off cities or entirely stopping transport (even though the U.S. government has the authority to limit civil liberties to protect public health). Even if the virus fades by the end of 2020, we would expect recurrence of the disease as well as significantly more time for the economy to ramp back to its normal more functional level, although long-term impact is still relatively low.

We assume less significant improvement from ex-Hubei fatality rates, with a roughly 0.8% fatality rate for the remainder of the pandemic. This is similar to the U.K. action plan from March 2020, which discloses a worst-case scenario where 1% of infected patients die. In such a scenario, we assume 30% of the global population could be infected, consistent with HHS’ moderate to very severe pandemic projections, but a smaller number than worst-case scenarios put forward by Harvard’s Marc Lipsitch (40%-70%) and Australia’s government (25%-70%, with 50% in a severe scenario). Our assumptions imply more than 18 million deaths globally and nearly 700,000 in the U.S.

We don’t assume as high a percentage of the world’s population to succumb to the coronavirus in this scenario as in the Spanish flu (even in this bearish analysis, we assume 0.24% of the population could die). There were more than 50 million deaths from Spanish flu, at a time when the world’s population was just under 2 billion, implying that more than 2% of the population died from the disease (roughly one third were infected). We assume mitigation measures are much improved from a century ago and would be applied more consistently. This benefit, however, is partly countered by greater international travel in modern society. Perhaps even more important, patients frequently died within hours of developing symptoms of Spanish flu, limiting the ability for diagnosis and treatment to improve outcomes. Coronavirus is extremely different in that sense, with the average time between developing symptoms and hospitalization (in severe cases) of at least nine days. We think this buys time for patients to get diagnosed and get treatment, whether that is targeted treatment from novel medicines or simply the standard of care in hospitals.

Bull Case: 25% Probability We see limited economic impact in a bull-case scenario, where COVID-19 essentially slightly extends the typical flu season (which was already severe). In this scenario, we assume that fatality rates begin to fade rapidly, as they already have beyond Hubei province, settling closer to 0.1%, consistent with a typical flu. Given the high transmissibility, we still have a pandemic to be declared in this scenario. We model 10% of the global population infected, or roughly 770 million people, which is at the high end of the typical range for seasonal flu of 3%-11% but would generally be seen as successful mitigation of a pandemic. This results in less than 800,000 deaths globally this year (around 30,000 in the U.S.). We assume coronavirus does not recur and does not experience a second wave, mostly limiting the economic impact to the first quarter of 2020, with China remaining the most heavily exposed by far.

Pharmaceutical Innovation and Pandemics: Moderna and Gilead Lead Pipeline Two key ways of slowing or potentially stopping the coronavirus--treatments and vaccines--are quickly making their way into clinical trials. While the fastest timeline for vaccines to reach patients, even Moderna's mRNA vaccine, which was developed in record time, is 12-18 months, we think treatments stand a chance at becoming available this year. China has already recommended several drugs approved for other purposes in the treatment of coronavirus, including HIV combination Kaletra, flu antiviral Arbidol (approved in China and Russia), and Roche's RHHBY Actemra (which is used to treat immune overreaction that can cause lung damage and does not slow the virus itself). Gilead's remdesivir stands out for its potential to treat coronavirus, as the drug rapidly moved to phase 3 studies, with data expected by April.

The FDA has a Medical Countermeasures Initiative that could allow authorization of a COVID-19 treatment for emergency use, and COVID-19 developers could also use the standard accelerated approval pathway at the FDA. The structural similarities between SARS and SARS-CoV-2 could allow drug developers to dust off old SARS drugs from their libraries; if these prove effective, it could shave months off development times, particularly if safety was established during the initial SARS outbreak. Remdesivir, which has a huge lead in development among unapproved drugs, was on the shelf after being initially developed for Ebola, which allowed Gilead to quickly move into studies when it saw signs of efficacy in coronaviruses.

As this coronavirus is structurally related to the virus causing SARS (2002-03 outbreak) and also follows the outbreak of another coronavirus disease, MERS (since 2012), we think there will be an increasing prioritization of coronavirus vaccine development and future pandemic preparedness, regardless of whether coronavirus becomes a widespread pandemic. It took 20 months for a SARS vaccine to reach human testing and years to do the same for MERS, but this timeline is improving dramatically. It took only six months to move to testing for Zika virus, and Moderna entered coronavirus testing in two months.

The Coalition for Epidemic Preparedness Innovations, created in 2017 following Ebola and Zika outbreaks, is tasked with coordinating global responses to new outbreaks and serves as a public/private funding engine that is supporting development at firms like Moderna and Inovio INO through the COVID-19 outbreak. Moderna’s peers focusing on mRNA technology, CureVac and BioNTech BNTX, are also moving forward preclinically. Larger vaccine makers are entering the coronavirus space more slowly, perhaps because they focus on older technologies, or perhaps because past diseases that faded before a treatment could be approved.

Adding Remdesivir to Our Gilead Model WHO official Bruce Aylward cited remdesivir as "the one drug right now that we think may have efficacy" while in Beijing in late February. While the drug did not perform as well as Regeneron's REGN REGN-EB3 in an Ebola trial, it has shown preclinical efficacy in both SARS and MERS, and we have seen one impressive recovery of the first U.S. coronavirus patient reported on Jan. 31 in the New England Journal of Medicine.

Remdesivir is a nucleotide analog with broad activity across RNA viruses. Gilead rapidly collaborated with universities in China to begin testing remdesivir in sick patients in February, with data expected in April. Additional studies, including two phase 3 studies run by Gilead, have also been initiated. We expect data from these trials would be sufficient for breakthrough status and priority review at unprecedented speeds.

We haven’t included remdesivir in our Gilead model to this point, given scarce evidence of efficacy, several other generics in testing, and uncertainty around the global spread of the disease. Initially, with most cases in China, we assumed that there could be generic options that serve the market as well, limiting Gilead’s penetration in that market regardless of the drug’s efficacy. In addition, the first wave of cases is likely to rise and fall before Gilead will be able to garner approval, even at a very accelerated pace.

However, as our base case now includes the spread of the disease to 20% of the population, we now assume a 70% chance that Gilead will be able to sell remdesivir for future waves of coronavirus (beginning as early as the summer of 2020) and a 40% chance that it will be stockpiled for future years. We assume initial supply in the spring of 2020 will be largely provided before approval in severely ill patients. We assume a price around $500 per patient, which is above the roughly $150 price for Tamiflu, but we also assume that use could be reserved for more severe cases, at least initially while Gilead ramps up manufacturing.

We assume a much lower stockpiling price in the U.S. of $50 per person and assume the U.S. could gradually build enough supply to serve one fourth of the population. Overall, this leads to peak global sales of $1.4 billion in 2021, as Gilead could see both seasonal and stockpiling sales. Tamiflu pandemic stockpile sales peaked at CHF 2.1 billion in 2006 for avian flu and hit CHF 1.9 billion in 2009 for swine flu. We do not model sales beyond 2023, as uncertainty regarding commercial potential grows as the likelihood of effective vaccines rises. This has a modest impact on our Gilead valuation, which we have raised to $85 per share from $84. However, if other treatments fail, vaccine development stalls, and coronavirus does make annual recurrences, we could be begin to see remdesivir used for both treatment and antiviral prophylaxis, and sustained use would have a significant impact on our fair value estimate (carrying $1 billion in annual sales beyond 2023 could raise our fair value estimate closer to $90 per share).

Moderna's mRNA-1273 Most Advanced Among Vaccines Among vaccine makers, Moderna has the lead. It has created a nucleic acid-based vaccine, basically providing the body with the blueprint to manufacture certain proteins that are present on the virus. The body then mounts an immune response to the protein, but also to any virus with that protein on display. There are suggestions that there could be durability issues with responses based on this technology. Regardless, it will take at least one year to adequately test any new vaccine in sufficient numbers of patients for it to be safe for widespread use.

That said, Moderna’s mRNA technology has allowed it to bring a vaccine candidate into testing just two months after receiving the genetic sequence of SARS-CoV-2, which demonstrates significant progress with innovative new technologies that could become nimble enough, with time, to rapidly serve a new outbreak.

With a safety study in progress and efficacy studies to be conducted this summer, we would expect potential approval in early 2021, putting the firm in good position to supply the vaccine, should this become a recurring virus like influenza. While Moderna does not have any marketed products based on its mRNA technology, it does have several products in testing for a range of diseases, and we think stands a decent chance at becoming a diversified biotech in the long run. Moderna’s CEO has said he wouldn’t price higher than other respiratory virus vaccines, putting a high end at $800 per year (the cost of four shots of pneumonia vaccine Prevnar-13).

Beyond Moderna and Gilead, dozens of other firms are vying to enter the market. AbbVie’s ABBV HIV combination pill Kaletra, generic malaria medicine chloroquine, and antiviral flu medicines represent approved Western medicines that could prove effective for this novel coronavirus. Many traditional Chinese medicines are currently in trials in China as well, by one count constituting 80 of 139 interventional coronavirus clinical trials there. The pipeline also contains several novel vaccines and treatments that are still at the preclinical stage.

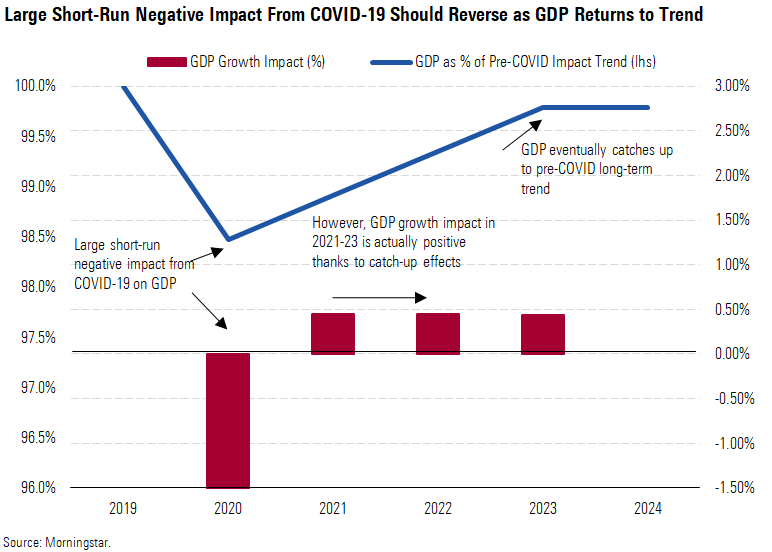

Economic Impact: We Forecast Minimal Long-Term Effect on GDP From Coronavirus Although we project a grim set of scenarios in terms of fatalities in our analysis, our view on the economic impact is much more sanguine. Weighting our scenarios by probability, we forecast an average negative 0.2% long-term impact on world GDP due to the COVID-19 pandemic. To be sure, we expect a much larger impact in the short run, with an average negative 1.5% impact on 2020 world GDP across our scenarios. However, equity valuations on average should be unscathed if our long-term projections on GDP are correct. Therefore, we think a 10%-plus fall in global equities since the outbreak began is a gross overreaction.

In the short run, there are many channels through which a pandemic could negatively affect GDP. Supply-side factors include those which affect the productive capacity of the economy. Demand-side factors are those that affect actual GDP without affecting the productive capacity of the economy.

Key Supply-Side Factors

- Labor supply would be curtailed by death, illness, quarantining, and preventative furloughs. This could come either from government restrictions or from voluntary worker decision to avoid risk of infection.

- Businesses could close in at-risk industries to mitigate infection risk for employees and customers alike. Tourism, transportation, retail, and restaurants are possible examples.

- Regions or countries not directly affected by the pandemic could see supply chain impact via trading partners hit with the virus.

Key Demand-Side Factors

- "Confidence" is the key demand side channel. Confidence is an elusive concept to quantify or model in a precise way, but it undoubtedly is a major demand-side driver of economic activity.

- Falling consumer confidence could cause lower household consumption.

- Falling business confidence could cause lower investment.

- Laid-off or temporarily furloughed workers in affected sectors will probably reduce their short-term consumption, even if they expect to regain employment in the near future.

While all of the factors listed above are serious potential drivers of short-run GDP impact, most of them should abate once the pandemic is over, and therefore they aren’t logical contributors to long-term GDP impact.

On the supply side, for example, laid-off or furloughed workers will be able to return to work when the outbreak subsides (with the exception of fatalities). On the demand side, confidence should return quickly, and consumers and businesses will be eager to make up for postponed expenditures.

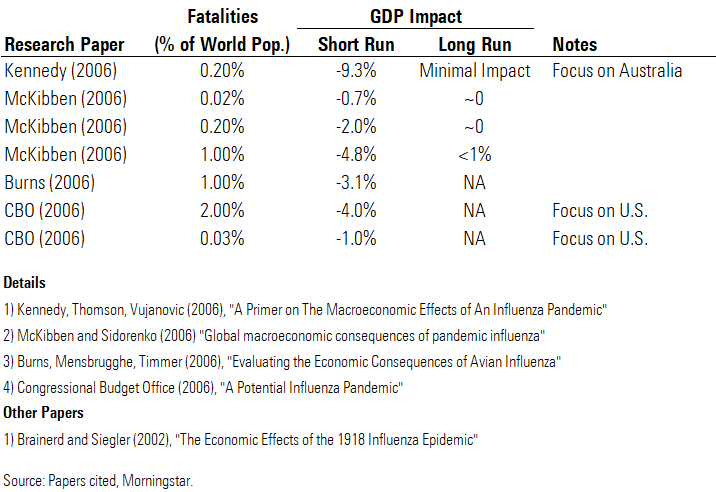

Short-Run Impact Could Be Large, but Long-Run Impact Should Be Minimal In the research papers we've studied that have done formal modeling of pandemic scenarios, many find a large short-run GDP impact, but none find a significant long-run impact (even in a very severe scenario). Some of the papers include an explicit long-term model. McKibben finds that the impact of the pandemic shock on GDP fades to virtually zero about four years after the pandemic occurs.

Within range of the 0.2% population fatality rate projected in our bear-case scenario, the papers project a short-run GDP decrease of 9.3% (Kennedy), 2% (McKibben), and 1% (CBO). The Kennedy paper is the clear outlier; this is chiefly because it is the only one to incorporate confidence effects in the authors’ economic model (accounting for 550 basis points of the total projected impact). We agree with the inclusion of confidence effects, though we think the arbitrary magnitudes chosen in the Kennedy paper (including a 10% hit to household consumption in the first quarter of the pandemic) are too high.

Central banks have some room to counteract the short-term GDP impact from COVID-19, and other countercyclical policies such as fiscal policy may have a role to play. However, countercyclical policies work via the demand side of the economy. These policies can compensate for a fall in confidence, for example (as the Fed already attempted to do with its March 3 rate cut). However, countercyclical policies have only limited ability to mitigate supply side impacts; for example, they cannot make up for the absent workers dragging on the economy’s productive capacity.

We Don't Think Recession Will Translate Into Long-Term GDP Loss Economic theory suggests that many short-run factors aren't consequential for long-term GDP, including in the pandemic-specific models we studied. However, the recent empirical record of recessions gives us some pause in assigning zero long-term import to short-run factors. Many recent recessions have not seen a return to the prerecession trend in GDP growth. The post-2008 Great Recession in the U.S. is the most illustrative case. Not only did the Great Recession cause U.S. real GDP to fall 4% immediately, but by 2013, it had fallen 10% below the precrisis (2007) estimate of potential GDP. Therefore, seemingly the recession had hurt the country's productive capacity, in addition to causing a shortfall in demand.

However, we think several characteristics make a potential pandemic-generated economic slowdown different from usual recessions (particularly the Great Recession).

First, recent recessions have been accompanied by large-scale reallocation of labor and other resources across sectors. For example, the U.S. housing bust required massive reallocation of labor away from construction and real estate into other sectors. Unemployed workers in these sectors took many years to regain employment. Likewise, while the post-2000 tech bust was less consequential for labor markets, it still required a large redirection of business investment away from IT equipment and software. By contrast, workers unemployed or put on furlough because of coronavirus are likely to resume their former positions. Overall, the former pattern of economic activity can be resumed, whereas usual recessions and their aftermath involve a reconfiguration of economic activity.

Second, recession duration is driven in part by lack of recovery in confidence. Confidence is impossible to measure with any degree of concreteness. Yet, it seems logical that economic confidence would quickly rebound once the epidemic receded. In contrast, confidence did not recover quickly after the 2008 global financial crisis, with households and businesses remaining much more conservative in their expenditure and other behavior.

We Forecast Negligible Long-Term GDP Impact From COVID-19 (Though 2020 Looks Bad) We forecast an average negative 0.2% long-term impact on global GDP due to COVID-19, which is quite small compared with the market reaction thus far (on average, the fair value of equities should vary in line with GDP). Even in our bear case, we forecast just a 0.6% long-term decrease in GDP.

In each scenario, we start by forecasting the short-run (2020) impact. These impacts are informed largely by the research papers we cited earlier. In the bear-case scenario, our forecast 5% world GDP impact is somewhat closer to the Kennedy paper’s projection of greater impact because of its inclusion of confidence effects.

The main driver of our forecast long-run GDP impact is the fatality rate as percentage of population, as fatalities permanently reduce the economy’s productive capacity via the labor force (with an assumption that the working-age fatality rate is just 60% of the overall fatality rate). We also include an incremental reduction equal to 10% of the 2020 GDP impact, in order to incorporate potential long-run effects of short-run decreases in output.

While the short-run GDP hit of 1.5% in our average scenario (and especially 5% in the bear case) looks daunting, it’s important to reiterate that this is a temporary shock to the economy. Many investors intuitively think of shocks to growth as being permanent, as many financial series are well modeled as (geometric) random walks.

Lowering Our 2020 China GDP Forecast, but Long Term Largely Unaffected We're lowering our 2020 China real GDP growth forecast by 250 basis points to 2.2%, from 4.7% in our prior forecast. According to official numbers, this would be China's slowest growth since 1976. China is the epicenter of the outbreak, and the intensive countermeasures taken by the government have hit economic activity hard in the first quarter. By the same token, we think China has contained its risk to the extent that we don't expect any greater long-run impact for China than for the world average (which is minimal). As such, we expect strong catch-up growth in the years after 2020.

Our long-term China GDP forecasts were already bearish relative to consensus before the COVID-19 outbreak. In a disaggregation of GDP forecasts for China (using our pre-COVID-19 impact numbers), we forecast about a 3.25% average real GDP growth rate over the next 10 years. This is meaningfully below consensus, exemplified by the International Monetary Fund’s forecast (pre-COVID) for almost 6% growth over the next five years.

First, we think growth in capital stock will slow, as China’s investment share of GDP (currently in the mid-40s) falls to a more normal level. China needs to restrain its investment spending, which has been fueled heavily by debt, for financial stability purposes. Its debt/GDP ratio has soared in recent years to about 260% at year-end 2019.

Next, we also think productivity growth will slow. The typical country that’s followed China’s pattern of fast growth historically has experienced a subsequent productivity slowdown. For China, key factors enabling productivity growth in the past (such as urbanization and catch-up to the world technology frontier) are running out of room.

/s3.amazonaws.com/arc-authors/morningstar/558ccc7b-2d37-4a8c-babf-feca8e10da32.jpg)

/s3.amazonaws.com/arc-authors/morningstar/010b102c-b598-40b8-9642-c4f9552b403a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/737HCNGRFLOAN3I7RKGB7VPEKQ.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZU2N7Y2TDFFL3EAFRGYANDSBJY.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/FNDLNORUIBFD5KKEXASUD67L6Q.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/558ccc7b-2d37-4a8c-babf-feca8e10da32.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/010b102c-b598-40b8-9642-c4f9552b403a.jpg)