Lingering COVID Concerns Slow Airline Recovery Takeoff

Continued pandemic fears have mispriced the risk in Delta and Southwest.

The airlines have been one of the industries most negatively affected by the COVID-19 pandemic, as people and businesses canceled air travel plans to protect themselves and others from the virus. A year and a half after the pandemic began wreaking havoc on the industry, we think the world is starting to slowly return to normal. We see the pandemic as an extended one-time event for the airlines, not the beginning of a new norm. We expect domestic leisure travel to recover to 2019 levels in 2022, business travel to reach 80%-90% of 2019 levels in 2023-24, and international leisure travel to hit 2019 levels in 2024. We think the longest-lasting effect of the pandemic on the airlines will be the efficiency measures those companies took to conserve cash, which we expect will lead to margin expansion as demand normalizes.

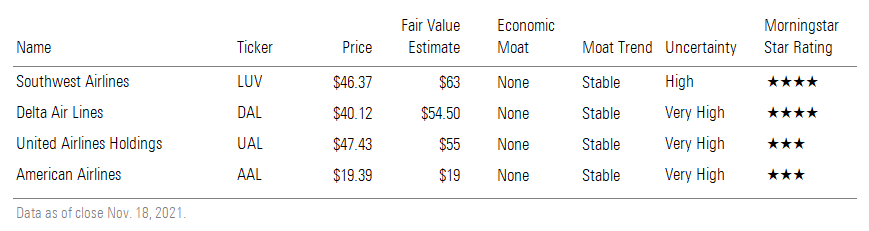

Our favorite carriers are Delta Air Lines DAL and Southwest Airlines LUV. We think the market underappreciates Delta’s frequent flier program, which gives the airline a sustainable revenue premium over peers that will allow it to earn the best margin of the network carriers. Southwest is our favorite airline independent of valuation because of its focus on domestic leisure travel; its business model has the least risk associated with business travel’s recovery, and we expect its bottom line will recover first among the airlines.

Pandemic Caused the Worst Aerospace Recession Ever

The pandemic halted airline passenger demand in April 2020, and revenue passenger miles--a measure of miles traveled by paying customers--subsequently remained at 25%-35% of prepandemic levels over the next several months. From the peak in July 2019, U.S. revenue passenger miles declined 97.1% to the trough in April 2020. This compares with peak-to-trough declines of about 43.5% after 9/11 and 34.3% after the great financial crisis. Seasonality plays a role in this rudimentary analysis, but the point remains: The COVID-19 pandemic has been the worst aerospace recession ever. COVID is the most important story for airlines right now in terms of operations, and the market recognizes this.

We think justified airline valuations depend on:

- The progression of the virus and vaccinations in the United States and in major international travel destinations for U.S. passengers, as we think this directly influences leisure and business travelers' willingness to travel. The major international markets for U.S. airlines are trans-Atlantic routes to Europe, trans-Pacific routes to Asia, and intra-North American routes.

- Airlines' ability to convert additional demand for air travel into operating income. The airlines completed significant restructurings in the early days of the pandemic, so we think much of the change in operating margin from the pandemic will be from changes in labor expense.

We think the right way to value a U.S. airline stock is to have a view on the progression of the recovery and an opinion on a midcycle profitability assumption. In our models for most airlines, near-term losses and low levels of profitability in 2022 and 2023 mean that our explicit five-year forecast for free cash flow is not as significant a contributor to enterprise value as we might typically expect for a no-moat business.

Our timeline for a return to normal is based on domestic and international vaccine progression research from Morningstar’s healthcare team. We believe fear of becoming infected with the virus and COVID-related travel restrictions are the primary barriers to travel. However, we expect domestic leisure travel will return to 2019 levels in 2022 and business travel and long-haul travel to return in 2023-24.

We believe that at midcycle, airlines will be slightly more profitable than their average over 2015-19. We think this assumption is reasonable because we believe that airlines have structurally taken costs out of their business model from pandemic restructuring and have developed sufficient pricing discipline to avoid returning all efficiency gains to the customer through lower prices due to increased consolidation in the post-financial-crisis air travel market.

Vaccinations Should Allow Nearly Normal Lifestyles by Year-End

Morningstar's view on vaccinations and the progression of the virus is that herd immunity in the U.S. is likely not possible due to the increased transmissibility of the delta variant and vaccine hesitancy. We believe that people in the U.S. can return to a nearly normal lifestyle by late 2021 as society refocuses on preventing severe disease and hospitalization through vaccination instead of eradicating the virus and as treatments for infection become more widely available. We broadly expect that developed markets in Europe, Japan, and Australia can outpace the U.S. in vaccinations because of political actions closer to vaccine mandates than what is possible in the U.S. We expect that the rest of the world will be vaccinated more slowly and that vaccinations in other nations will ramp up significantly in 2022.

We translate this vaccination forecast into an air miles and revenue yield forecast by considering the sources of travel, why particular sources of travel are not currently traveling, and the reactivity of that source of travel to increased vaccinations and lower travel restrictions. We think the most relevant restrictions are mandatory quarantines upon arrival to a destination for leisure and business travel as well as office closings for business travel. Recent evidence suggests leisure travel reacts more quickly to reopenings than business travel.

We don’t think there is much opportunity for Zoom or other technological solutions to provide a substitute for leisure travel. Most restrictions on domestic U.S. travel have been lifted, so we do not see a material barrier at this time. We anticipate that domestic leisure travel will recover in 2022 with the return of nearly normal lifestyles in the U.S.

We Think Business Travel Will Return With Office Reopenings

The progression of business travel is a major debate for airline investors. Skeptics believe that telecommunications platforms like Zoom will replace large swaths of business travel; these platforms allow people to communicate easily, companies would reap cost savings on last-minute flights, and workers appreciate the improved flexibility and time spent at home. We think these arguments have some merit, but we are more swayed by the argument that business travel will still serve the valuable function of showing a client or a stakeholder that the company sponsoring the travel cares enough to put in the time and expense to make a personal connection. Ultimately, we think that large sales demand face time and that business travelers will return to the skies once their companies begin losing sales due to a lack of it.

Our read of industry data suggests that before the pandemic, roughly 30% of business travel was for client support, 25% was for sales or securing clients, 20% was for trade shows and conferences, 20% was for internal meetings and training, and 5% was for commuting. We assume that the vast majority of client-facing and networking travel will functionally recover to well over 90% of 2019 levels, while travel related to internal meetings and training is more likely to be replaced by videoconferencing.

Mathematically, assuming our expectations of client-facing travel prove correct, business travel for internal meetings can decline about 50%, which we think is unlikely, and our forecast of an 80%-90% recovery would still work out. We think that meeting attendance will probably be threatened for lower-priority meetings, but higher-up executives attending higher-priority meetings will still likely travel. Given that there have been methods of business communication that are substantially more cost-efficient than business travel for quite some time, including email, telephone, and WebEx, we think it is likely that much of the easily cut business travel has already been cut.

We believe closed offices are a major barrier to business travel, but we don’t think the near-term timing of reopenings is a material concern for investors. We think the more important question is whether offices will reopen, and we think the evidence suggests that businesses generally prefer to have office availability. Major technology companies like Google, Meta, and Amazon, which one might expect to be at the forefront of telecommuting, have signed leases in New York City since the pandemic began. We think that even in a scenario in which flexible work arrangements dominate the business world, business travel would likely not be meaningfully affected, as workers would come to the office to take a meeting.

Broadly, we expect that as offices reopen, domestic business travel will begin to recover, but the whiplash in demand that we saw in leisure travel will occur much more slowly for business travel. We think it will be slower because planning for conferences and client meetings takes longer and goes through more layers of approval than a vacationer’s travel plans. We expect business travel to begin recovering in 2022 and reach roughly 80%-90% of 2019 levels in 2023. Critically, we expect it to grow at the rate of GDP thereafter.

We think current regulatory complexities regarding international travel are the primary reason that international leisure travel remains well below 2019 levels. The State Department’s travel advisories suggest that U.S. citizens should practice normal precautions for only 11 countries, while the department recommends reconsidering travel or not traveling at all to more than 180 nations.

The U.S. is also a major tourist destination. The United Nations World Tourism Barometer reports that the U.S. was the third most popular destination for international tourists, and we think that the relaxing of travel restrictions on foreign nationals is a major improvement for international travel. In general, we expect international travel to begin recovering in 2022 but not fully recover to 2019 levels until 2023 or 2024 because of vaccine distribution occurring more slowly in other nations than in the U.S. and regulatory inertia for travel restrictions in non-U.S. nations.

We Expect More Efficiency After Pandemic-Related Restructurings

Overall, we think the biggest efficiency gain that airlines will get out of restructuring during the pandemic is from wages. Airlines reduced employment materially during the pandemic and indicated that many older workers in unionized functions, such as pilots, took advantage of voluntary separation plans. This is important because unionized workers are typically paid by seniority. Peak airline employment occurred in 2001, and airlines were able to increase capacity (12-month rolling average) by about 28% from the pre-2001 peak to the prepandemic 2020 peak, so they have been able to increase supply without increasing employment in previous cycles.

We see additional evidence that airlines can return to growth on a more efficient cost base from our analysis of low-cost carrier Southwest, the most domestic leisure-focused airline we cover. Direct comparisons of individual expense line items for Southwest and the network carriers are not meaningful because of the differences in stage length between low-cost carriers and network carriers and differences in the definition of expenses. However, we can analyze the progression of employment at Southwest, as leisure travel has recovered much more than business travel, to show the ability of airlines to increase capacity with a smaller employment base.

Southwest was able to bring back capacity essentially to 2019 levels with employment levels reasonably below 2019 levels. We also believe Southwest was one of the more efficient airlines before the pandemic, as it has primarily grown organically throughout its history. We support our assessment that Southwest was more efficient than the network carriers quantitatively by using the overall cost per available seat mile (excluding fuel costs), or CASM-ex, which avoids the problem with line item comparison because it is all-encompassing but still has issues due to differences in stage length and the fact that Southwest is a low-cost carrier. That noted, Southwest’s shorter stage length leads to higher costs per mile, so the biases in this rudimentary analysis do not entirely work in Southwest’s favor.

Southwest’s CASM-ex averaged $0.0894 per seat mile during 2015-19, while United UAL, American AAL, and Delta averaged $0.1037, $0.1099, and $0.1108 over the same period. Southwest’s total nonfuel costs were about 20% lower than peers’ per every mile flown.

The network carriers were much more affected by COVID-19 because they rely more on business and international travel than the low-cost carriers do. We believe increased overhead from mergers completed during the financial crisis at least partially explains why network carriers were less efficient than Southwest before the pandemic.

Network carriers have not recovered as much as Southwest, but Delta and United have made significantly larger cuts to employment than Southwest has. Delta and United are hovering at around 80% of 2019 employment, while American and Southwest are at nearly 90% of 2019 employment. Although total employment is not a perfect metric because it does not consider the wage savings from early retirements or wage differentials across job functions, we think it’s instructive, considering the relative lack of information and the high degree of uncertainty.

Southwest is currently hiring aggressively as it has needed workers to cover shifts, but we think it’s more likely than not that the company is not going to increase workers by the 11% necessary to get back to previous peak employment. While American and Southwest have more domestically focused networks than United and Delta, American still has material international exposure at about 26% of prepandemic passenger revenue. American’s international business outside Latin America has not recovered, while Southwest is almost a pure-play domestic carrier, and domestic capacity has recovered significantly.

We expect that Southwest would need to bring back or hire proportionally more people than American because of this dynamic, as we don’t think American would need to bring back as many employees for its trans-Atlantic or trans-Pacific exposure as Southwest would need to for its domestic exposure. For this reason, we’re less confident that American can exit the pandemic as a more efficient airline than it was when it entered.

Ultimately, we think Southwest’s ability to deliver supply comparable with 2019 with below-2019 employment indicates that airlines can become more efficient from restructuring during the pandemic. We expect material margin expansion over the next five years, as we think that increased consolidation in the airline business gives incumbents more pricing power. As evidence, we look at the industrywide break-even load factor, which is the quotient of the costs per available seat mile and the total revenue yield (or cents earned per occupied seat mile) an airline generates.

Airlines were able to materially decrease their break-even load factor in the most recent cyclical upswing during 2015-19 as fuel costs remained low, but they did not reduce pricing as much as fuel costs decreased. This is in stark contrast to previous economic cycles, in which break-even load factor and load factors achieved moved relatively in tandem, which implies a highly competitive market in which prices are lowered with reductions in cost per available seat mile.

We think that if airlines were able to maintain disciplined pricing and avoid giving cost savings back to the customer in the previous economic cycle, they more likely than not are going to be able to continue demonstrating this pricing power in the travel recovery, though we’re less confident that airlines will be able to maintain that over the long run.

Southwest Airlines, Delta Air Lines, United Airlines Holdings, and American Airlines data

/s3.amazonaws.com/arc-authors/morningstar/c32e19fc-79e3-48d7-b503-8c516793755e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RNODFET5RVBMBKRZTQFUBVXUEU.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LJHOT24AYJCHBNGUQ67KUYGHEE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/V33GR4AWKNF5XACS3HZ356QWCM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/c32e19fc-79e3-48d7-b503-8c516793755e.jpg)