Is the Worst Yet to Come for Utilities?

Inflation weighs on earnings, balance sheets, and real yields, but growth opportunities remain.

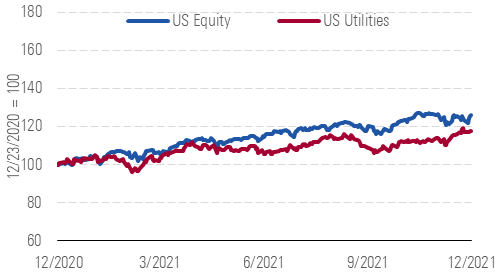

After climbing 10% during the fourth quarter of 2021, U.S. utilities head into 2022 with robust valuations that seem to ignore the sector’s worst enemy: persistent inflation. Either the worst is yet to come for utilities as inflation weighs on earnings, balance sheets, and real yields, or inflation will prove to be a fast-passing fad.

Utilities' Fourth-Quarter Rally Was Too Little, Too Late

Source: Morningstar analysts

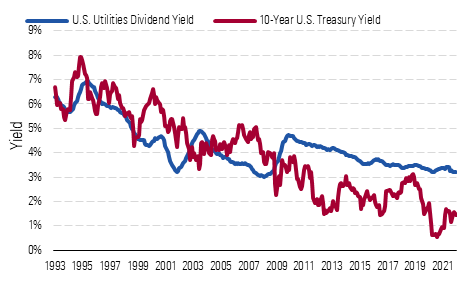

Even if the worst is yet to come, utilities enter 2022 in a strong position to minimize the harm inflation might cause. Lower-for-longer interest rate policy and benign inflation during the last decade has allowed utilities to strengthen their balance sheets, improve regulation, and set aggressive growth plans with minimal customer rate impact. In addition, utilities head into 2022 as one of the few attractive income options for investors. The sector's 3.3% average dividend yield is 180 basis points above the 10-year U.S. Treasury yield as of late December, an historically attractive premium. If higher interest rates ward off inflation, utilities should continue producing 7%-9% total returns for investors in 2022 and beyond.

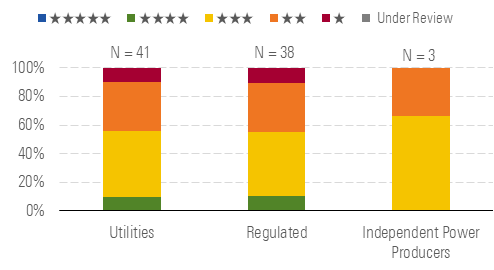

Cheap Utilities Are Scarce After Valuations Climbed in Late 2021

Source: Morningstar analysts

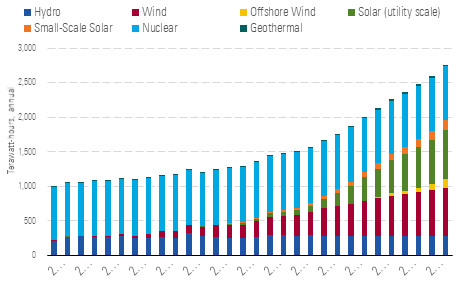

Utilities' growth opportunities also are a bulwark against macro headwinds. Clean energy is a multi-decade trend that favors utilities. All paths to net-zero greenhouse gas emissions go through utilities. Investments in renewable energy, electric vehicle infrastructure, building electrification, and energy efficiency are the core of our 5%-7% annual earnings growth outlook for most utilities.

Utilities' Dividend Yield Premium Should Protect Against Rising Rates

Source: Morningstar analysts

Our top utilities picks have long runways of clean energy infrastructure growth, above-average dividend yields, and constructive relationships with regulators, politicians, and customers. These include

Even if inflation subsides, investors should still be cautious of utilities’ valuations. We think the sector is 4% overvalued based on our median price/fair value estimate as of late December. Utilities' average price/earnings multiple is 20% higher than the 10-year trailing average. Fourth-quarter earnings could be disappointing after a mild start to winter. Altogether, utilities stocks appear set for another steady but underwhelming performance in 2022, much like 2021.

Solar Is Utilities' Biggest Growth Opportunity

Source: Morningstar analysts

Top Picks

Edison International

EIX

Star Rating: ★★★

Economic Moat Rating: Narrow

Fair Value Estimate: $71

Fair Value Uncertainty: Medium

Edison offers a triple play of value, growth, and income with a yield above 4%. California's progressive energy policies offer more growth opportunities than in other states. Edison has widespread support for $6 billion of annual electricity grid investments that facilitate wildfire mitigation, renewable energy, and electric vehicle adoption. Edison is one of the few utilities with no direct carbon emissions exposure. We forecast 6% average annual earnings growth during the next five years with similar dividend growth. We think the market is too concerned about Edison's wildfire liability risks and long-term capital needs.

AEP

Star Rating: ★★★

Economic Moat Rating: Narrow

Fair Value Estimate: $89

Fair Value Uncertainty: Low

Most of the states where AEP operates were slow to embrace renewable energy, but that is changing. AEP plans to install 10.6 GW of wind generation and 5.9 GW of solar generation while retiring nearly 5 GW of coal generation. AEP's predominant business is transmission and distribution, its network is the largest in the U.S., and it will benefit as other utilities connect renewable energy projects. More than 80% of AEP's five-year $37 billion investment plan is dedicated to expanding and modernizing its network to support renewable energy. This is a key driver of our 6% earnings growth estimate through 2025.

NI

Star Rating: ★★★★

Economic Moat Rating: Narrow

Fair Value Estimate: $30.00

Fair Value Uncertainty: Low

NiSource's clean energy transition should support growth into the next decade, yet the stock trades at a discount to other high-growth utilities. NiSource derives about 60% of its earnings from its six natural gas utilities and 40% from its electric utility. We expect NiSource to invest $10 billion over the next four years in projects supporting safety, reliability, and clean energy. Favorable rate regulation and policy support should drive 7% annual earnings and dividend growth.

/s3.amazonaws.com/arc-authors/morningstar/ea0fcfae-4dcd-4aff-b606-7b0799c93519.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ECVXZPYGAJEWHOXQMUK6RKDJOM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KOTZFI3SBBGOVJJVPI7NWAPW4E.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/V33GR4AWKNF5XACS3HZ356QWCM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ea0fcfae-4dcd-4aff-b606-7b0799c93519.jpg)