Is Palantir Technologies Worth the Wait?

The company's shares are down this year, and that may have created an opportunity for investors willing to be patient.

Even after 19 years in business, Palantir Technologies PLTR still resembles an emerging startup: long on potential and short on profits.

The maker of powerful artificial intelligence data analytics platforms used by corporations and government agencies, such as the U.S. Defense Department and Immigration and Customs Enforcement, reported annual revenue of $1.5 billion and a net loss of $520 million for fiscal 2021. Only by excluding the hefty stock-based compensation it pays executives and employees did Palantir appear to become barely profitable on a per-share basis. It had a mere 237 customers as of the end of last year. Of those, the top three represented 18% of revenue, down from 25% in 2020. Its top 20 customers represent 56% of total revenue.

The company’s chairman and one of its founders is Peter Thiel, the billionaire venture capitalist who co-founded PayPal PYPL along with Elon Musk and an early backer of Facebook (now Meta Platforms FB). Rare among the Silicon Valley crowd, he threw his weight behind former president Donald J. Trump early on and continues to back him and his agenda. Palantir’s name is a reference to the "seeing stones," crystal balls that reveal past, present, and future events in J.R.R. Tolkein’s fantasy novel "The Lord of the Rings."

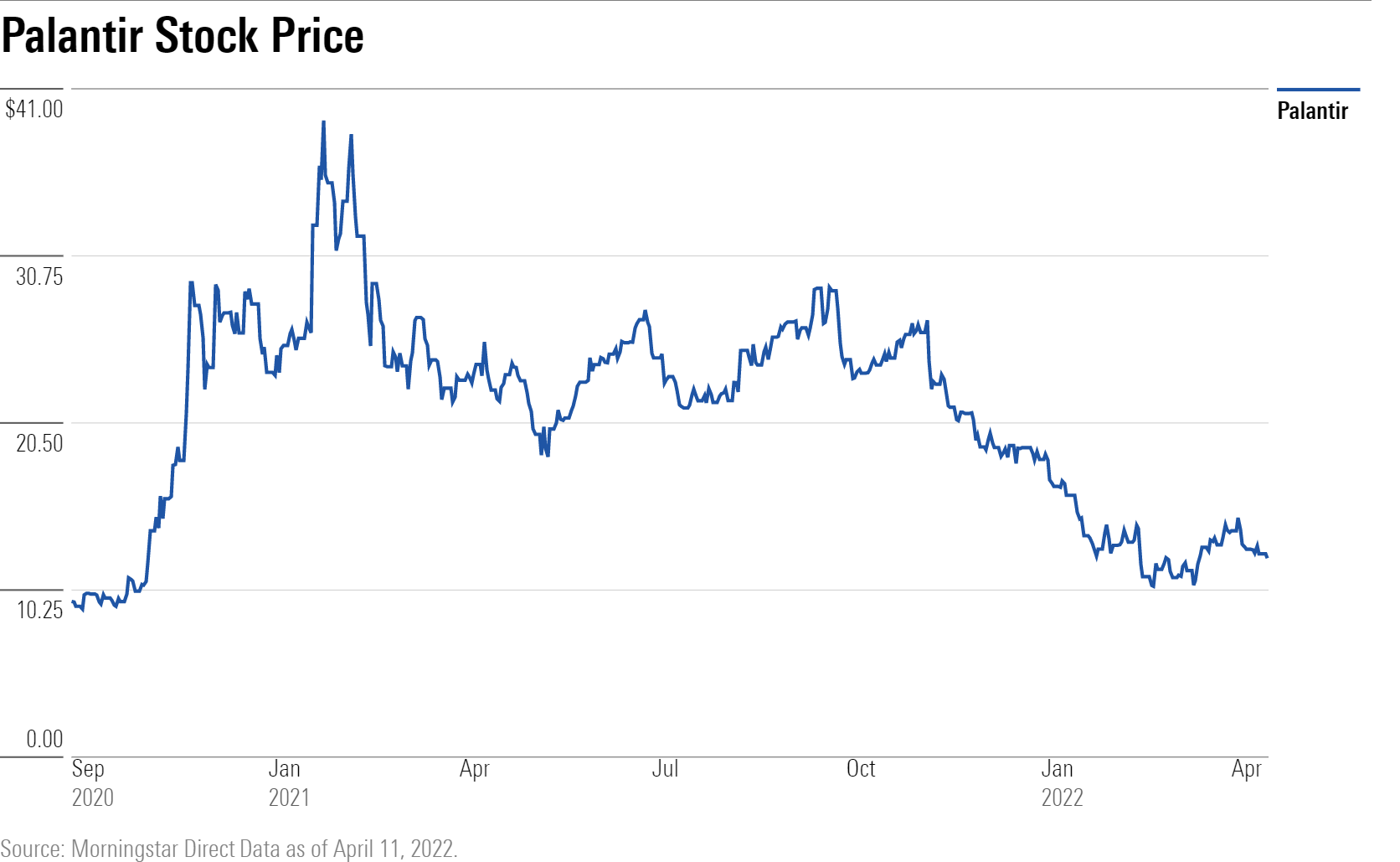

Palantir's Shares Are Down More Than 30%

After closing at $12.15 on Monday, the shares are down more than 30% this year. That compares with a 9.79% loss for the Morningstar US Small Cap Index and a 8.62% decline for the Morningstar US Market Index.

The stock trades at a 60% discount to its Morningstar fair value estimate of $31 and is up from a 52-week low of $9.74 on Feb. 24, the day Russia invaded Ukraine. Palantir came public at a price of $10 a share through a so-called direct listing in September 2020, when company insiders sold shares directly to investors.

Palantir's shares present an opportunity for investors with enough patience, Morningstar senior equity research analyst Mark Cash says.

“We think the selloff is near-term reactionary and is missing the long-term vision of Palantir becoming an essential component of data operations for commercial and government entities,” Cash says.

Palantir posted strong year-over-year revenue growth of 34% in the fourth quarter and reported positive free cash flow. “That’s more important than GAAP (generally accepted accounting principles) earnings,” Cash says. The company has no appreciable debt and slightly more than $2 billion in cash and liquidity. Cash is encouraged by Palantir’s push to sign more commercial customers both here and abroad. The fourth quarter marked the fourth straight period of accelerating commercial revenue growth, up 47% year over year. Cash is confident that as the age of big data progresses, the company’s business model will prevail.

“The reaffirmation of expecting at least 30% annual sales growth through 2025 with a keen focus on expanding margin with scale provides us with confidence that its prospects are still in their early stages,” Cash said.

Tread Carefully

Yet there are good reasons for investors to tread carefully when it comes to Denver-based Palantir.

First, there’s the unusual multi-share-class structure that concentrates control of the company among its founders, including Thiel and chief executive Alexander Karp. The public has access to Class A shares and is entitled to one vote per share. Class B shares are mostly owned by the founders and their affiliates and receive 10 votes per share; that ownership will likely increase through the exercise of warrants and stock options and restricted stock units. Class F shares are held in a voting trust established by the founders, further cementing control of the company in the hands of a few.

Then, too, it’s important to understand that investing in Palantir is not just a financial consideration but also an embrace of a certain ideology. Palantir’s founders frame the work of Palantir as driven by a mission to uphold “Western liberal democracy and its strategic allies,” according to disclosures in the company’s 10-K. Palantir, for instance, rules out conducting business with the Chinese Communist Party and won’t host its platforms in China, effectively cutting off the country as a potential source of future growth.

Much of Palantir’s government work is classified, and its ties to defense operations as well as Homeland Security and ICE can be controversial. Last September, for instance, an arm of the United Kingdom's National Health Service didn’t renew a data contract with Palantir, responding to concerns about privacy protections.

There’s reputation risk associated with Thiel as well. The outspoken libertarian is a big bitcoin promoter, and recently made headlines for calling Berkshire Hathaway’s BRK.B Warren Buffett a “sociopathic grandpa from Omaha” for being dismissive of cryptocurrency.

Thiel said in February he plans to leave Meta’s board, on which he has served since its start. The understanding of those close to Thiel is that he wants to concentrate on the midterm elections in November by supporting candidates who are in step with Trump’s agenda. Meta’s Facebook social media platform banned the former president following the Jan. 6 Capitol riot, saying its messages helped to stoke the violence.

Where Are the Profits?

Beyond the company’s structure and Palantir’s political leanings, a lack of profits has been a growing concern for investors. The company failed to meet fiscal fourth-quarter earnings expectations when it reported results in mid-February. Only after adjusting for the stock-based compensation did Palantir post a gain $0.02 per share in the fiscal fourth quarter, below the $0.04 expected. On a GAAP basis, the company lost $0.08 per share in the fourth quarter.

Moreover, unrealized losses on a portfolio of marketable securities, including stakes in many startups, had a negative impact of $0.02. Palantir counts many of those startups as customers, a financial arrangement whose quid pro quo appearance is seen as unorthodox at the least. Company officials have cautioned about continued volatility in earnings per share because of the portfolio, which also includes a nearly $51 million investment in gold bullion made in August 2021, which the company referred to as an inflation hedge. Adjusted expenses rose 42% in the fourth quarter from the prior year, as Palantir added to its sales team and boosted marketing in a push to expand its customer base.

Slowdown in Government Contracts

On top of that, growth in Palantir’s government division, which represents 58% of revenue, slowed to 26% in the fourth quarter from 33% in the prior quarter. The stock sold off sharply in the wake of fourth-quarter results, with ARK Investment Management’s Cathie Woods selling down once-sizable stakes in Palantir in many of her exchange-traded funds, noting the slowdown in the government segment.

The slowdown is particularly noteworthy given that Palantir has gained traction in its government segment since 2016 when it prevailed in a lawsuit against the U.S. Army. Palantir argued the army failed to comply with a 1994 law that requires government agencies to research commercially available solutions before embarking on internal product development when it failed to consider Palantir for a contract. The company’s lead attorney, Hamish Hume, also represented Elon Musk’s SpaceX successfully against the U.S. Air Force in a 2014 complaint.

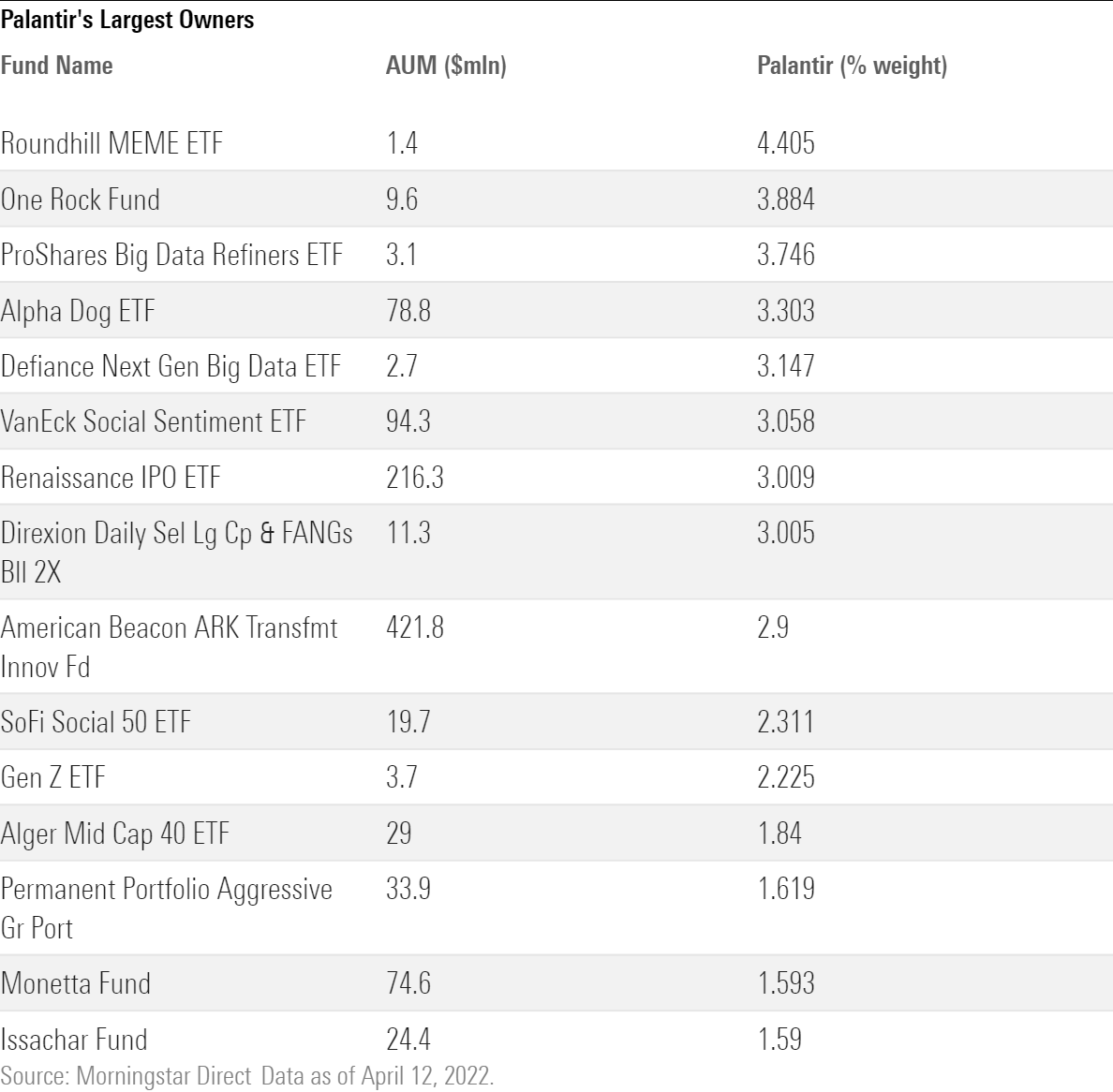

Funds with the biggest exposure to Palantir include Roundhill MEME ETF MEME, with $1.4 million under management, of which 4.4% is allocated to Palantir. One Rock Fund ONERX ranks second in terms of its exposure to Palantir: About 3.9% of One Rock’s $9.6 million in assets is invested in the company. One Rock is managed by Jeff Wrona, a former momentum investor with Pilgrim Baxter & Associates and Munder Capital Management.

/s3.amazonaws.com/arc-authors/morningstar/ed88495a-f0ba-4a6a-9a05-52796711ffb1.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WC6XJYN7KNGWJIOWVJWDVLDZPY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HHSXAQ5U2RBI5FNOQTRU44ENHM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/737HCNGRFLOAN3I7RKGB7VPEKQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ed88495a-f0ba-4a6a-9a05-52796711ffb1.jpg)