Is Lowe’s Stock a Buy, Sell, or Fairly Valued After Earnings?

With growth in pro sales and rising margins, here’s what we think of Lowe’s stock.

Lowe’s LOW released its first-quarter earnings report on May 23. Here’s Morningstar’s take on what to think of Lowe’s earnings and stock.

Lowe’s Stock at a Glance

- Fair Value Estimate: $218

- Morningstar Rating: 3 stars

- Morningstar Uncertainty Rating: Medium

- Morningstar Economic Moat Rating: Wide

What We Thought of Lowe’s Q1 Earnings

- Overall results were better than our expectations, although a combination of lumber deflation, unfavorable weather, and softer demand led to a 4.3% decline in comparable sales.

- We were encouraged by continued growth in pro sales (quantitatively stated) despite lapping 22% growth in the prior-year quarter. More importantly, Lowe’s operating margin expanded 47 basis points to 14.4% as multiple productivity initiatives offset higher wages and sales deleverage.

- Nonetheless, guidance was slightly tempered owing to a lower near-term outlook and softer sales. But we maintain our $218 fair value estimate since we haven’t altered our long-term outlook.

- Our long-term prognosis for the business remains intact. Despite the current economic backdrop, we believe Lowe’s will continue to generate robust cash flow and return value to its shareholders through share repurchases and dividends.

- Moreover, we see some room for profitability upside, stemming from ongoing supply chain initiatives and productivity efforts, with our long-term operating margin forecast reaching 14% from 13% in fiscal 2022.

Lowe's Stock Price

Fair Value Estimate for Lowe’s Stock

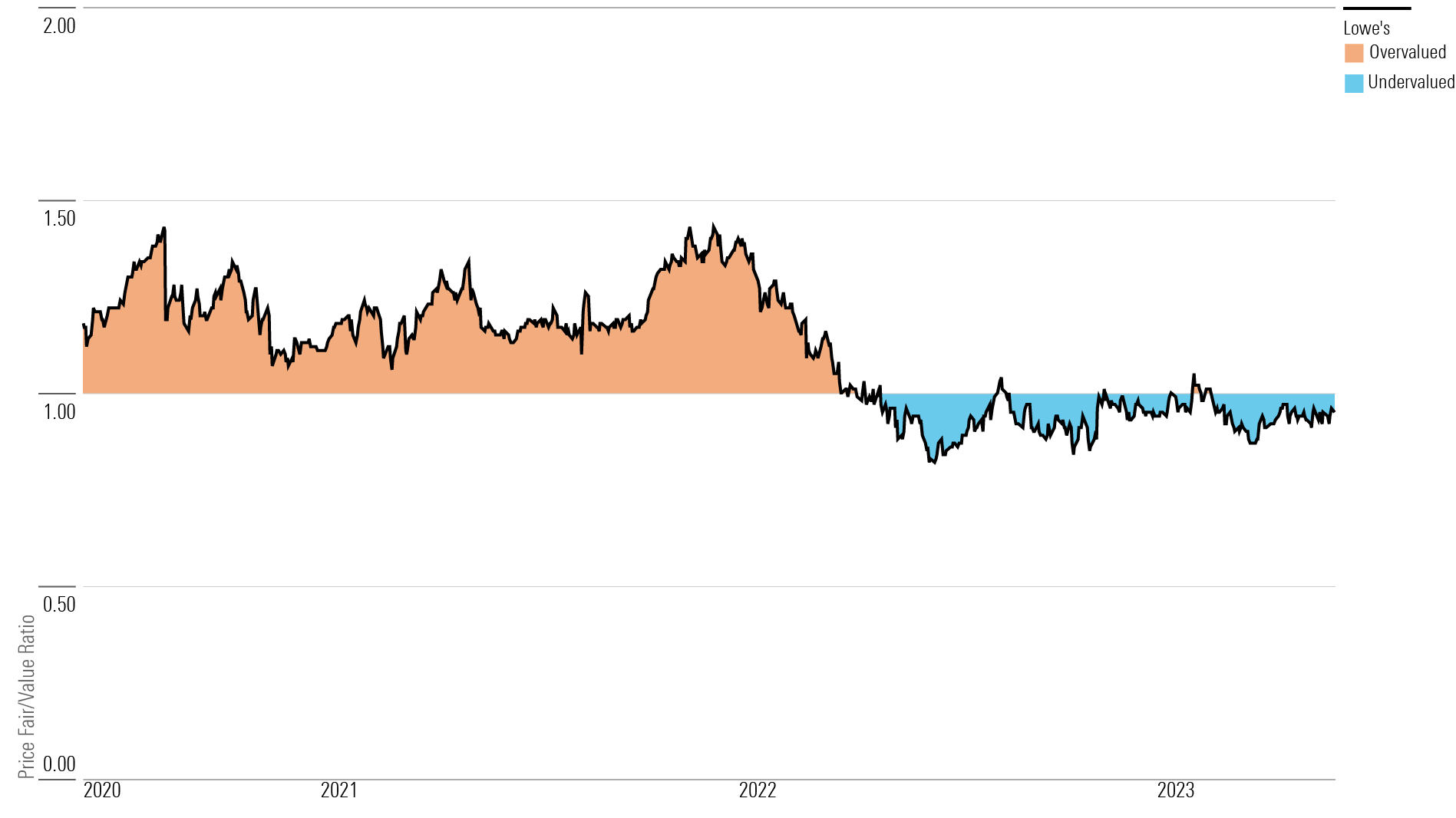

With its 3-star rating, we believe Lowe’s stock is fairly valued, in line with our long-term estimate.

We are maintaining our fair value estimate of $218 per share. While incorporating recent results and an updated full-year outlook reduced our valuation by a mid-single-digit rate, updating the year-end share count to reflect repurchases offset this change. Lowe’s first-quarter net sales of $22.3 billion (down 5.5%) were hurt by comparable sales that declined 4.3% because of lumber deflation, unfavorable weather, and softer demand as customers engaged in smaller, less-discretionary projects.

As demand continues to normalize with reduced coronavirus regulations, we expect throughput for home improvement products to depend mostly on changes in the real estate market, which are driven primarily by prices, interest rates, and turnover, given the maturity of the industry. We expect sales to increase at a low-single-digit pace over the long term (2% to 4%, after our forecast for an 8% decline in 2023), supported by consistent single-digit same-store sales (averaging 3% between 2024 and 2032) and moderate location growth (netting five boxes per year) as household formations rise.

Read more about Lowe’s fair value estimate.

Lowe's Price/Fair Value Ratio

Economic Moat Rating

We assign Lowe’s a wide economic moat. We believe that the company, as the second-largest global home improvement retailer, will continue to gain incremental share in the North American home improvement retail segment (which Lowe’s has estimated as being around a $1 trillion market), given its extensive distribution network, economies of scale, and the brand awareness it has built with consumers and professionals. Dissecting the components of its competitive edge, Lowe’s has been able to capture economic rents from its brand, forming an important intangible asset.

In our opinion, it would be difficult for another retailer to enter the market and threaten Lowe’s position, as smaller retailers would have a hard time building vendor relationships strong enough to undermine the company’s pricing prowess. While the threat of manufacturers creating their own retail network could jeopardize the availability of products in Lowe’s retail channel, we doubt such an endeavor would be successful in the long term.

Read more about Lowe’s moat rating.

Risk and Uncertainty

We assign Lowe’s a Medium Uncertainty Rating because of its strong brand recognition, which has helped stabilize sales through the cycle. Lowe’s operates in a cyclical retail environment in which sales are driven in large part by homeowner spending. With heightened existing-home prices (and thus elevated home equity), we don’t see imminent concern around a significant slowdown in repair and remodel spending. However, a continued rise in interest rates and uncertainty around the economic environment could broadly temper discretionary spending (recently displayed by consumers trading down to smaller-ticket projects).

Turnover of homes is a key factor driving home improvement spending. Existing-home sales growth had stabilized at the beginning of 2020 until COVID-19 struck, sending sales tumbling at a double-digit pace that year between April and June before achieving a consistent recovery. However, existing-home sales have contracted meaningfully in recent months, and any additional economic headwinds—like a spike in unemployment, predatory pricing tactics, or a slowdown in consumer confidence—could reduce revenue and profitability.

Read more about Lowe’s risk and uncertainty.

LOW Stock Bulls Say

- We forecast Lowe’s to reach a 13.3% operating margin in 2023 after divesting the dilutive Canadian business and investing in productivity efforts.

- Higher home prices and aging housing stock support demand, generating an estimated cumulative free cash flow to the firm of $39 billion over the next five years, which should help finance $21 billion in repurchases.

- Perpetual productivity initiatives could improve the supply chain and inventory management, which would in turn boost inventory turnover and working capital generation above the levels we currently anticipate.

LOW Stock Bears Say

- The closure of smaller peers may intermittently lead to competitive pricing pressures, constraining expansion of return on invested capital and limiting sales growth.

- Higher interest rates, flat housing price growth, or tighter lending standards could slow inventory turnover, postponing home improvement projects and hindering sales.

- Lower sales could pressure profitability if lower-margin acquired businesses—like those that compose the Lowe’s Pro Supply line—operate less than optimally. Further margin pressure could ensue if demand for pro and maintenance, repair, and operations services become onerous.

This article was compiled by Maggie Guidici.

Get access to full Morningstar stock analyst reports, along with data and tools to manage your portfolio, through Morningstar Investor. Learn more and start a seven-day free trial today.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/3559e02b-f74d-4a72-a821-b50f61ba05e9.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PLMEDIM3Z5AF7FI5MVLOQXYPMM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/I53I52PGOBAHLOFRMZXFRK5HDA.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CEWZOFDBCVCIPJZDCUJLTQLFXA.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/3559e02b-f74d-4a72-a821-b50f61ba05e9.jpg)