Is Ford Stock a Buy, a Sell, or Fairly Valued After Earnings?

With the UAW strike behind the firm but a big warranty loss in Q3, here’s what we think of Ford stock.

Ford Motor F reported earnings on Oct. 6. Here’s Morningstar’s take on Ford’s earnings and the outlook for its stock.

Key Morningstar Metrics for Ford Motor

- Fair Value Estimate: $20.00

- Morningstar Rating: 5 stars

- Morningstar Economic Moat Rating: None

- Morningstar Uncertainty Rating: High

What We Thought of Ford Motor’s Earnings

Ford’s liquidity still looks in great shape despite the strike. Assuming the tentative deal with UAW is ratified, the firm can go back to focusing on its other problems, such as reducing warranty costs and figuring out how to best allocate capital in a world transitioning to electric vehicles.

Ford’s cost problem was a negative surprise stemming from a $1.2 billion year-over-year increase in warranty expenses. Unlike GM’s GM warranty increase, this was caused more by rising claims than just repair cost inflation. The company withdrawing its guidance was not a surprise, as the strike made the environment more uncertain, but we think some investors may have hoped it would stay due to the tentative agreement coming just before earnings. We don’t think management was comfortable with such a gamble.

Investors are going to have to be very patient for Ford to turn around its manufacturing and design cost problems. However, they get a respectable dividend payout yielding nearly 6% as of early November. We think the payout is safe too, barring a major recession like the ones seen in 2008 or 2020.

Ford Motor Stock Price

Fair Value Estimate for Ford Stock

With its 5-star rating, we believe Ford’s stock is significantly undervalued compared with our long-term fair value estimate.

Once the UAW contract is ratified and Ford briefs investors, we may reduce our fair value by at least $1-$3 per share. On the earnings call, CFO John Lawler said the strike has cost Ford about $1.3 billion in EBIT so far, so we are reducing our 2023 EPS by about 15% to account for this and some additional costs, such as a likely ratification bonus when UAW members eventually approve a deal. Ford also withdrew its 2023 guidance due to the uncertainty around the strike, but said it had been on track to meet its projected adjusted earnings of between $11 billion and $12 billion.

We think buying Ford’s stock may require investor patience for management to restructure the Ford Blue segment while scaling up the Ford Model e business. Most scaling for the Model e segment may not occur until after the BlueOval City BEV plant opens in Tennessee in 2025. Our midcycle total company EBIT margin number is nearly 7%. Ford introduced a 2026 target of 10% for the metric as part of its move to separate the BEV business from the Ford Blue combustion business, but the firm has said it’s a target rather than an exit rate, so we keep our midcycle below 10%.

We remain optimistic that CEO Jim Farley will be able to cut warranty costs and reduce vehicle design complexity to bring more scale over the long term, but the transition will not be fast. Leadership has often said that the company needs to be more physically fit, so Ford is in the midst of a multi-billion-dollar restructuring program, mostly for Europe. We like that Ford has exited or is downsizing unprofitable businesses to focus on light trucks, off-road vehicles such as the Bronco, launching profitable variants of popular vehicles (such as bringing the Raptor trim to the Bronco and Ranger), new segments like compact pickups in the United States, and investing $50 billion in all-electric vehicles for 2022-26.

Read more about our fair value estimate for Ford stock.

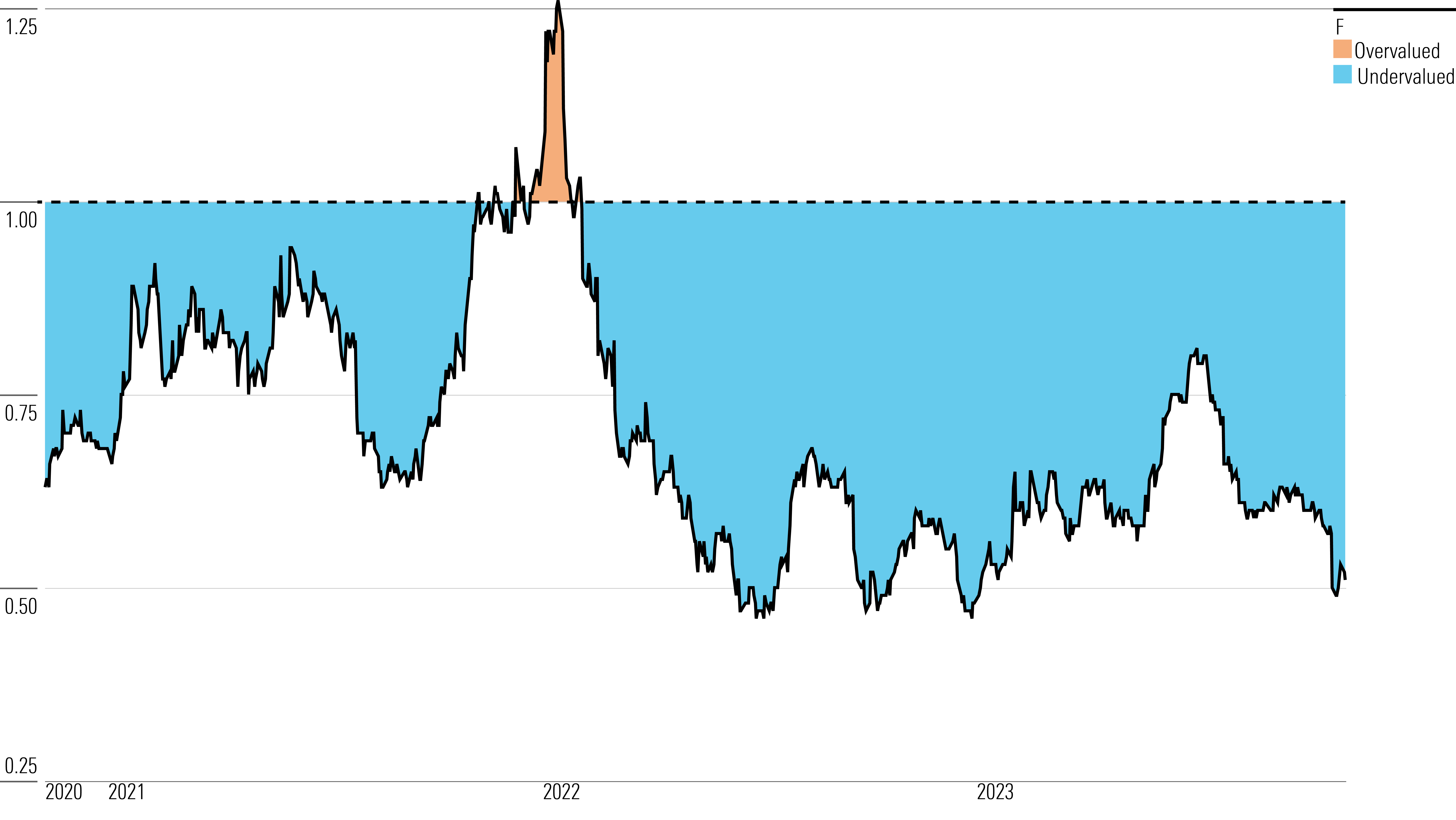

Ford Historical Price/Fair Value Ratio

Economic Moat Rating

Ford does not have a moat, and we do not expect that to change. Vehicle manufacturing is a very capital-intensive business, but barriers to entry are not as high as in the past. The industry is already full of strong competition, so it is nearly impossible for one firm to gain a durable advantage. Automakers from China and India may soon enter developed markets such as the U.S., and South Korea’s Hyundai and Kia have become formidable competitors, as has Tesla TSLA. Furthermore, the auto industry is so cyclical that in bad times even the best automakers cannot avoid large declines in return on invested capital and profit. Cost-cutting helps ease the pain but does not restore all lost profit.

Read more about Ford’s economic moat.

Risk and Uncertainty

Our Uncertainty Rating for Ford is High. The semiconductor shortage brings more uncertainty around recovery timing. Ford is spending $50 billion across 2022-26, betting that consumers will switch to electric vehicles, and so much capital will be wasted if that adoption is too slow or regulations change. Barriers to entry are declining as a growing global market reduces fixed costs as a percentage of sales for new entrants.

Jim Farley’s success or failure as a CEO will only be known with time, but we are not worried.

Read more about Ford’s risk and uncertainty.

F Bulls Say

- Ford’s turnaround will take lots of time due to many restructuring projects around the world, but so far the international business seems to be getting better.

- Ford is focusing its investments on where it gets the best return, which is why we think that mostly exiting North American car segments and production in South America is the right move.

- Ford has tried to remove some administrative layers, and we like Farley’s aggressive moves into electric vehicles, which the company was slow to do in the past.

F Bears Say

- The auto industry is very cyclical, and until recently Detroit automakers had been losing significant U.S. market share to foreign automakers for years.

- Long-term profitability could be hindered by unions, which traditionally have wanted their share of the pie. The nonunionized import automakers in the U.S. do not have this problem.

- Ford’s stock can sell off heavily on macroeconomic fears, even if the company itself is doing well. Furthermore, it takes significant investment to fund growth in the auto industry, which limits potential margin expansion.

This article was compiled by Tom Lauricella.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/222a1c0d-911c-4064-ac93-f9d4516d0a06.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NYUEHSFI4BDCJPQZJ76HH4PKSM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/L4B22R7UFVDBJN2ZYJWBSMCIJA.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZU2N7Y2TDFFL3EAFRGYANDSBJY.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/222a1c0d-911c-4064-ac93-f9d4516d0a06.jpg)