Is Coinbase Stock a Buy, a Sell, or Fairly Valued?

With Coinbase having staged a big rally ahead of spot bitcoin ETF approval, here’s what we think of the stock.

Coinbase COIN stock has surged 250% in the past year, as investors bet the company would benefit from renewed interest in cryptocurrencies ahead of the approval of spot bitcoin exchange-traded funds. Here’s Morningstar’s take on the company and the outlook for its stock.

Key Morningstar Metrics for Coinbase

- Fair Value Estimate: $100.00

- Morningstar Rating: 2 stars

- Morningstar Economic Moat Rating: None

- Morningstar Uncertainty Rating: Very High

What We Think of Coinbase

At the start of 2023, Coinbase was undervalued, as the market focused too heavily on short-term results during a weak cryptocurrency market. Investors also underappreciated the firm’s ability to improve its cost structure, which it had allowed to balloon out of control in 2022. After major cost-cutting and layoffs, the company was able to reduce its operating expenses by more than 40% from the start of the year, placing it on a much stronger financial footing, even without a recovery in cryptocurrency.

News and speculation surrounding bitcoin spot ETFs have led to a major rally in cryptocurrency prices over the last few months, with the overall cryptocurrency market increasing around 100% from the start of 2023. Coinbase’s results have historically been highly correlated with cryptocurrency prices, as strong cryptocurrency markets lead to higher trading volume and higher asset-based fees from its custody business. Trading volume on Coinbase’s platform has already increased significantly because of these market trends, and higher trading revenue combined with the company’s leaner cost structure will likely push it back into profitability if trading conditions remain resilient.

But while 2023 did have very positive trends for Coinbase, we think the stock has become overvalued as the market has gone too far in responding to these events. While we are seeing a drastic increase in cryptocurrency trading volume, institutional trading is likely providing most of the increase, with institutional traders paying a fraction per trade of what Coinbase’s retail users pay, meaning trading volume has likely increased more than actual revenue.

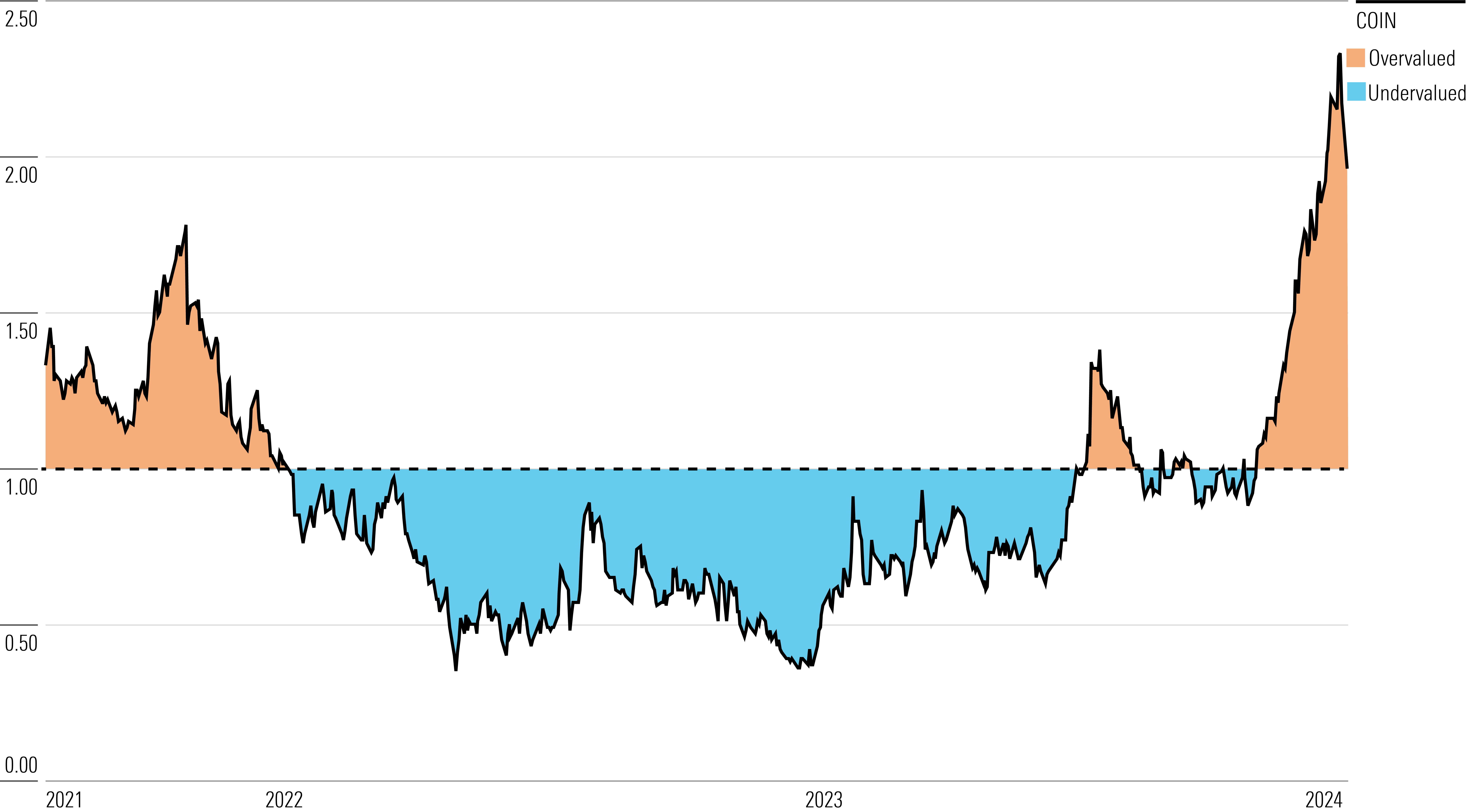

Coinbase Global Stock Price

Fair Value Estimate for Coinbase

With its 2-star rating, we believe Coinbase is currently overvalued compared to our fair value estimate.

We are increasing our fair value estimate of the company’s stock from $80 to $100, as a strong recovery in cryptocurrency prices and trading activity has placed the company in a much better position as 2024 begins. The bulk of the increase comes from higher near-to-medium-term trading revenue expectations, as cryptocurrency trading volume has more than doubled from its 2023 lows. Around $5 of the positive adjustment comes from higher projected custody revenue, as Coinbase benefits directly from higher cryptocurrency prices through its asset-based custody fees.

We think the shares are significantly overvalued, as the market has gone too far in responding to positive market trends. Cryptocurrency markets are inherently volatile and their current strength cannot be extrapolated, so while Coinbase is enjoying a significantly improved operating environment, there is a risk that this rally will prove short-lived. Finally, the company’s regulatory issues with the Securities and Exchange Commission have not gone away, and there is still material event risk if these battles do not go their way. Overall, there is still significant market and regulatory risk for Coinbase, and with the shares already up so dramatically, we don’t think it has an attractive risk-return dynamic right now.

Read more about Coinbase’s fair value estimate.

Coinbase Historical Price/Fair Value Ratio

Economic Moat Rating

In our view, Coinbase does not have an economic moat, even though it’s the leading cryptocurrency exchange in the United States. The company has carved out a strong place by positioning itself as a reliable and compliant platform on which to buy and sell cryptocurrency in an industry filled with risk, weak security practices, and spotty regulatory enforcement. This has let Coinbase charge higher fees than many of its peers while building a large pool of liquidity. The company’s reputational advantages have only grown in recent years, following the collapse of one of its largest rivals, FTX, due to financial fraud. While we do expect fee compression to occur in the long term, recent events will likely let Coinbase continue to charge a premium in the immediate future.

However, Coinbase is inherently reliant on the growth and success of bitcoin, ethereum, and other cryptocurrencies for generating returns on its invested capital. Cryptocurrency is still highly speculative, and its long-term success and viability are by no means guaranteed. Speculation on future price appreciation remains a key part of the space’s appeal, particularly for lesser-known “altcoins,” creating further uncertainty about the value and longevity of current prices. Coinbase has built a strong competitive position, but without more confidence in the long-term viability of cryptocurrency as an asset class, there is too much potential for the firm’s returns on invested capital to rapidly evaporate for us to award it a moat.

Read more about Coinbase’s moat rating.

Risk and Uncertainty

We give Coinbase a Very High Morningstar Uncertainty Rating. The company gets more than half of its net revenue from trading fees at its exchange business. Fees are charged as a percentage of the underlying assets being traded, creating direct exposure to cryptocurrency prices. The cryptocurrency market is highly volatile and deeply cyclical. In 2022, Coinbase’s revenue fell more than 59% from the prior year as cryptocurrency prices collapsed. This is still a highly speculative market, and the number of active traders on Coinbase’s platform can vary sharply based on market performance. On an even broader scale, should cryptocurrency prove to not be durable as an asset class, it is unlikely that Coinbase’s business would be able to retain much (if any) value. The company also has interest rate exposure through its participation in USDC, which generates significant interest income.

There is also a material amount of environmental, social, and governance risk in Coinbase’s business. The firm operates with a broad scope, acting as an asset custodian, broker, and exchange. This creates significant potential for conflicts of interest, which could lead to reputational damage or regulatory action. There are also legal and regulatory gray areas in Coinbase’s business. It is possible that some of the assets that trade on the platform could be ruled as unregistered securities, forcing the firm to delist them.

Read more about Coinbase’s risk and uncertainty.

COIN Bulls Say

- Coinbase has established itself as the leading U.S. cryptocurrency exchange and established a strong reputation for security in an industry filled with risk.

- Cryptocurrency prices increased sharply at the end of 2023, leading to much higher trading volume and revenue.

- Approval from international regulators will allow Coinbase to expand its operations and increase its footprint globally.

COIN Bears Say

- Cryptocurrency markets have historically been deeply cyclical, with long periods of low prices and depressed trading volume. This adds considerable volatility to Coinbase’s revenue flow.

- The regulatory landscape and long-term viability for cryptocurrency remain unclear, with regulators becoming more aggressive in the aftermath of the high-profile fraud and failure of FTX.

- The SEC has accused Coinbase of acting as an unregistered securities exchange, creating major regulatory and legal uncertainty for the firm.

This article was compiled by Jülide Sengil.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/5GAX4GUZGFDARNXQRA7HR2YET4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/U746MWXQHFFZPLSMTEJSUD7HLY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KPHQX3TJC5FC7OEC653JZXLIVY.jpg)