Is CarMax Stock a Buy, Sell, or Fairly Valued After Earnings?

Long-term investors benefit from this quality narrow-moat company.

CarMax KMX released its fiscal first-quarter earnings report on June 23. Here’s Morningstar’s take on what to think of CarMax’s earnings and stock.

CarMax Stock at a Glance

- Fair Value Estimate: $135

- Morningstar Rating: 4 stars

- Morningstar Economic Moat Rating: Narrow

- Morningstar Uncertainty Rating: High

What We Thought of CarMax Earnings

We’ve long believed that, though it will be a protracted process, CarMax customers’ used-vehicle affordability problems will slowly improve as new-vehicle sales grow. That process appears to be underway, based on the company’s fiscal 2024 first-quarter results.

CarMax beat earnings per share expectations by a large margin. The consensus was expecting far worse sales and profit headwinds, due to expensive inventory procurement and poor same-store sales. While same-store unit sales were indeed down 11%, this wasn’t as bad as what was expected.

CarMax’s cost-control actions for selling, general, and administrative expenses in prior quarters—including less advertising spending and some headcount reductions at the store and corporate levels—helped drive the EPS surprise.

We were mostly interested in average selling prices continuing to fall sequentially, as they have for several straight quarters. ASP was down year over year but up 2.5% from the previous quarter to $27,258. With new-vehicle sales rising as inventory improves, vehicle prices should keep moving back down toward prepandemic levels. Still, the number of off-lease vehicles will be very low for the next several years due to the effects of the pandemic and chip shortage.

In the long term, Morningstar sees nothing wrong with CarMax’s business model or the decisions of its management team. Used vehicles will eventually become more affordable for both retailers (to procure inventory) and consumers (to buy vehicles), and as that happens we expect CarMax’s gross margins to improve.

For a long-term investor, now seems like a good time to buy shares of this quality business (which, in Morningstar’s view, is rarely cheap), provided one has the patience to see the stock rise.

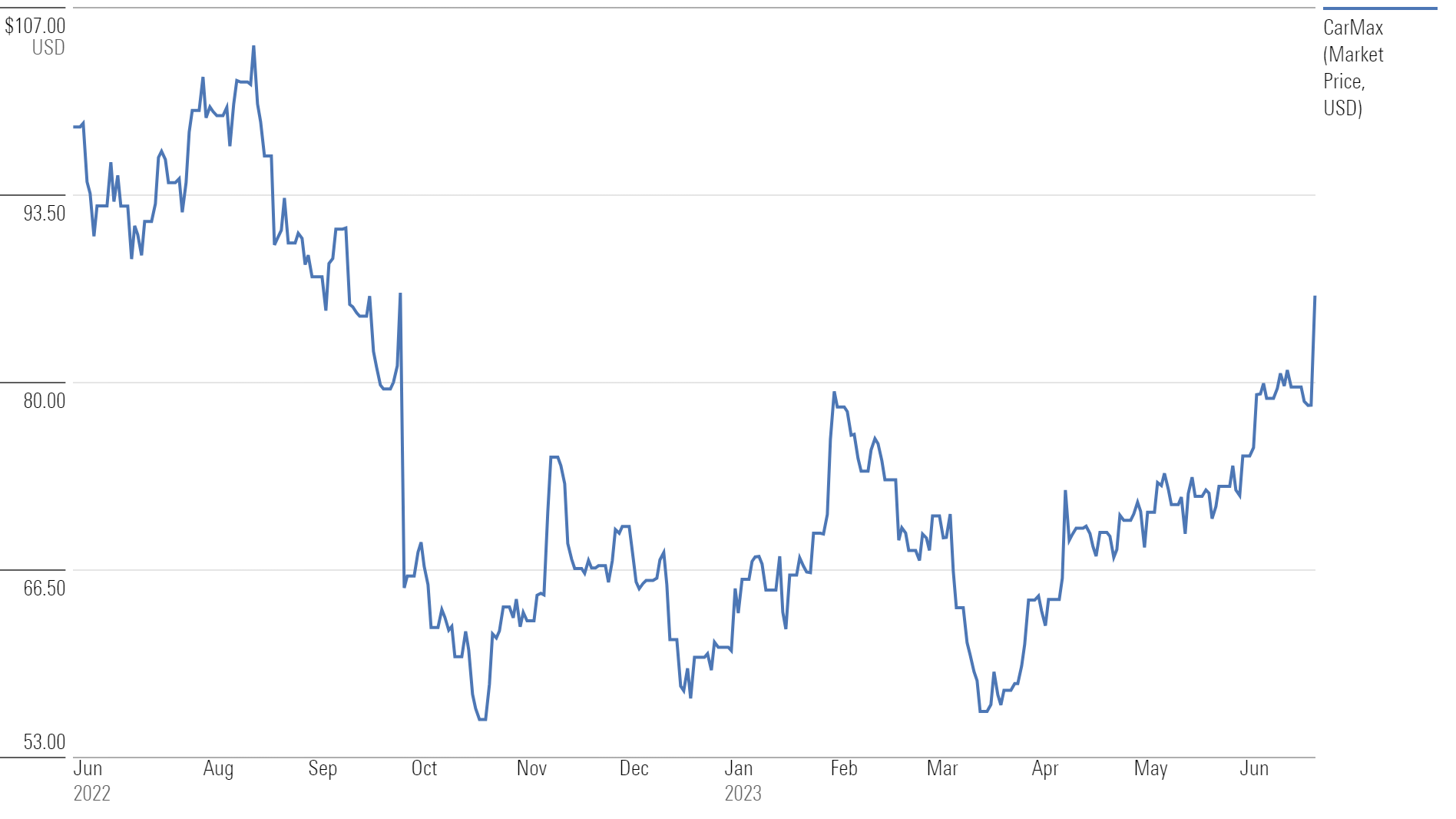

CarMax Stock Price

Fair Value Estimate for CarMax

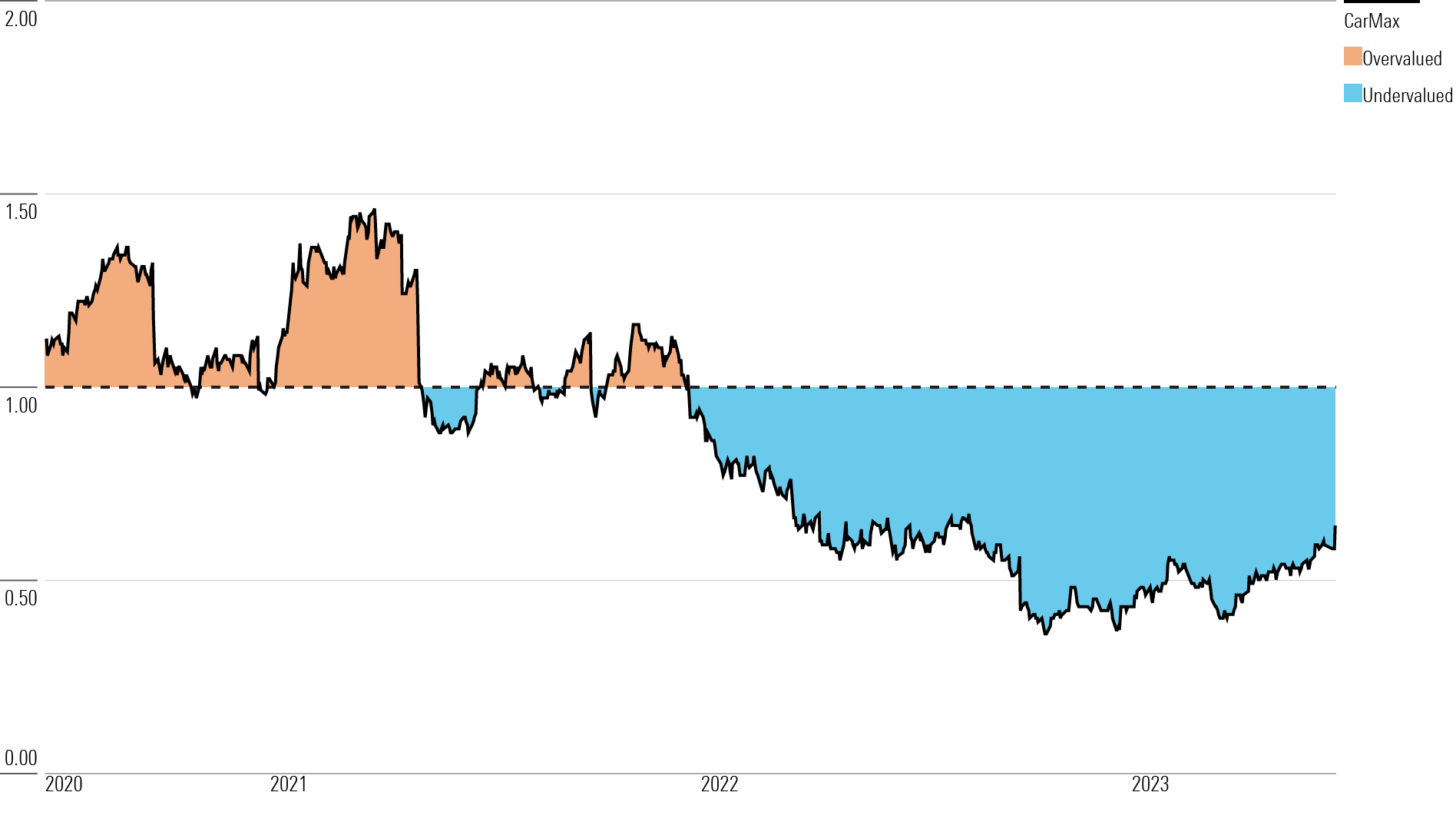

With a 4-star rating, we believe CarMax stock is undervalued compared with our fair value estimate.

We are lowering our fair value estimate to $135 per share from $141. The change comes after rolling Morningstar’s model forward a year for the annual report, mostly due to reducing our five-year explicit revenue forecast by 1.4% (down to $160.4 billion) from our prior model to account for consumer affordability weighing on sales in fiscal 2024 and fiscal 2025.

We expect strong headwinds from high prices and interest rates to continue affecting consumer affordability over the next two fiscal years. Supply of late-model used vehicles (those with zero to four years of prior use) will be constrained due to poor new-vehicle sales since spring 2020, caused by the pandemic and chip shortage. Our tax rate assumption remains at 24.5%.

Read more about CarMax’s fair value estimate.

CarMax Price/Fair Value Ratio

Economic Moat Rating

CarMax’s moat stems from its intangible assets and cost advantage. Many elements of CarMax’s moat are theoretically replicable, but Morningstar analysts believe they are difficult to copy well. CarMax’s intangible assets are its strong brand equity and valuable cache of historical auto pricing and lending data. CarMax is the largest used-vehicle retailer in the world, with a very well-recognized brand that is known for its no-haggle selling process, excellent customer service, superior inventory selection, and convenient financing and delivery options.

The company’s selling process is unique compared with other dealers. The process is transparent, with the customer seeing the same information as the company associate, which makes the process less adversarial.

We view CarMax’s big data advantage as an intangible asset as well. The firm’s sales and appraisal data goes back to its founding in 1993 as part of the now-defunct Circuit City. This data cannot be purchased by a competitor.

Read more about CarMax’s moat rating.

Risk and Uncertainty

CarMax operates in the cyclical auto industry, and any downturn brings uncertainty as to the timing and extent of a recovery in demand for used vehicles. Also, nothing is stopping a competitor from trying to emulate CarMax. Proof can be found in various rival used-car brands: Lithia Motors’ LAD Auto Stores, Asbury Automotive’s ABG now-defunct Q Auto, AutoNation’s AN USA, and Penske Automotive Group’s PAG CarShop. In 2014, franchise vehicle dealer Sonic Automotive SAH opened its EchoPark stand-alone used-vehicle stores.

The industry is so fragmented that all these firms may find success, though competitors will need at least a decade to rival CarMax in size and expertise. When used-vehicle prices rise, management will likely keep the same target for gross profit dollars, which can hurt margin and cash flow, as happened in fiscal 2022-23. Morningstar analysts think highly of CarMax’s management and business model, and macroeconomic variables pose the highest risk for the firm, rather than company-specific factors.

Read more about CarMax’s risk and uncertainty.

KMX Stock Bulls Say

- CarMax has increased revenue and profitability at a remarkable rate, and we think it is positioned to gain market share in any environment. The firm’s omnichannel strategy helps this story, as it gives consumers maximum flexibility.

- In April 2022, CarMax announced aggressive growth plans to reach about $33 billion-$45 billion of revenue in fiscal 2026 and be the online leader in used-vehicle retailing.

- No competitors have successfully duplicated CarMax’s business model, providing the company with a considerable head start on would-be imitators.

KMX Stock Bears Say

- CarMax operates in a cyclical industry, and its strong model is not immune to a recession.

- In the past, the company was not free-cash-flow-positive as new-store openings ramped up, but we think investing today to outearn the cost of capital is worth it. In recent times outside the chip shortage, the company has generated strong free cash flow and return on invested capital despite opening new stores.

- Some of the largest franchise auto dealers are trying to replicate CarMax’s success with their own stand-alone used-vehicle stores, and startups such as Carvana are also competing.

This article was compiled by Maggie Guidici.

Get access to full Morningstar stock analyst reports, along with data and tools to manage your portfolio, through Morningstar Investor. Learn more and start a seven-day free trial today.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/222a1c0d-911c-4064-ac93-f9d4516d0a06.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/4JOND5R2SBFPZE63XWPYQDG56A.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/K36BSDXY2RAXNMH6G5XT7YIXMU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/BG4IFJHA25B6RKD3XNUYKROBBM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/222a1c0d-911c-4064-ac93-f9d4516d0a06.jpg)