Gold Shines as a Haven in 2022

Gold consistently provides a buffer against market storms, but is best used in small doses.

So far, 2022 is turning out to be an unusually painful year for investors. Stocks lost more than 20% during the first half of the year, with even deeper losses for the growth-oriented tech stocks that previously led the market. At the same time, the Fed’s initial steps toward hiking interest rates—along with expectations for future interest-rate hikes—dented bond valuations. As a result, bonds have posted some of their worst returns in decades, with the Morningstar US Core Bond Index losing about 10% for the first six months of the year.

Gold, along with commodities and cash, was one of the few places where investors could take shelter. Gold has mostly stayed in a trading range in recent months (priced at about $1,737 per ounce as of this writing), but still ranks as one of the better-performing asset classes in this year’s market rout. While gold has proved its value as a safe haven, though, its ability to improve portfolio performance over longer periods is less convincing.

Gold’s Record as a Bear-Market Buffer

Gold has a long history as a safe haven. The price of gold is largely independent of other asset classes, and it has also traditionally been used as a refuge against weakness in the U.S. dollar. It can also serve as a hedge against inflation and market volatility.

There are two primary ways to invest in gold: buying the commodity directly (gold bullion) or buying shares in companies that mine and sell gold (gold equity). Because gold stocks have both financial and operating leverage, their results tend to magnify the impact of changes in the price of gold. They’re also significantly more volatile than bullion, which only depends on the underlying commodity price. In this article, I’ll focus on gold bullion, which is a better fit for investors seeking a hedge against market-related risk.

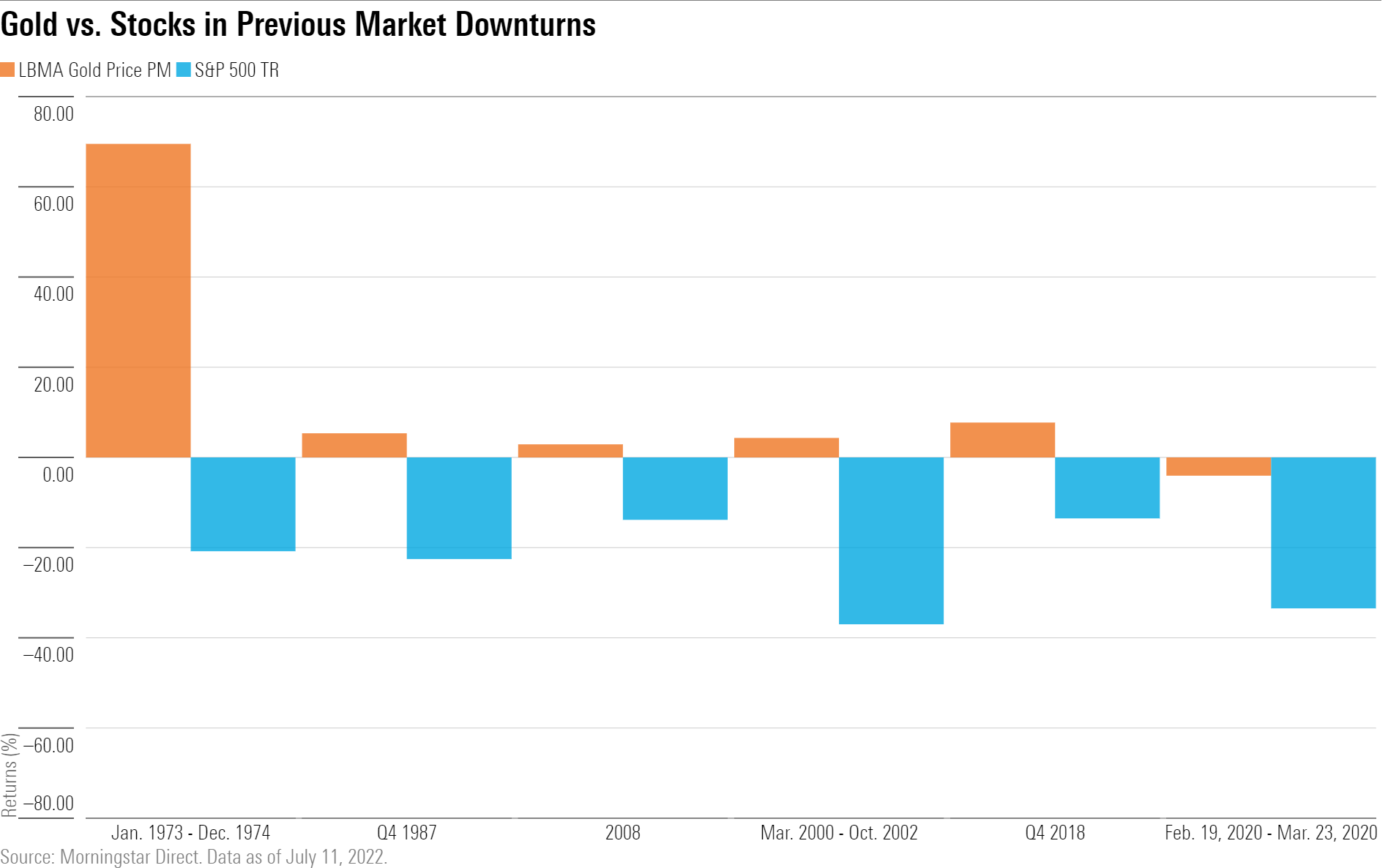

As mentioned above, gold has lived up to its reputation as a buffer asset in this year’s market drawdown. As shown in the chart below, the price of gold is down slightly so far this year (as of July 11, 2022), but it still has provided a cushion against much deeper losses in stocks.

Over longer periods, gold has consistently excelled during bear markets and periods of unusually high market volatility. As illustrated below, gold has posted significantly better returns during previous market drawdowns. While its performance during the novel coronavirus crisis was a partial exception, gold has more often notched positive total returns during periods of deep losses in the equity market.

Performance in the bear market from 1973 to 1974 was particularly impressive. As surging oil prices and a rapidly expanding monetary supply pushed inflation to historically high levels, stocks shed more than 20% of their value in both 1973 and 1974. Gold, meanwhile, racked up double-digit gains.

Does Gold Improve Long-Term Portfolio Performance?

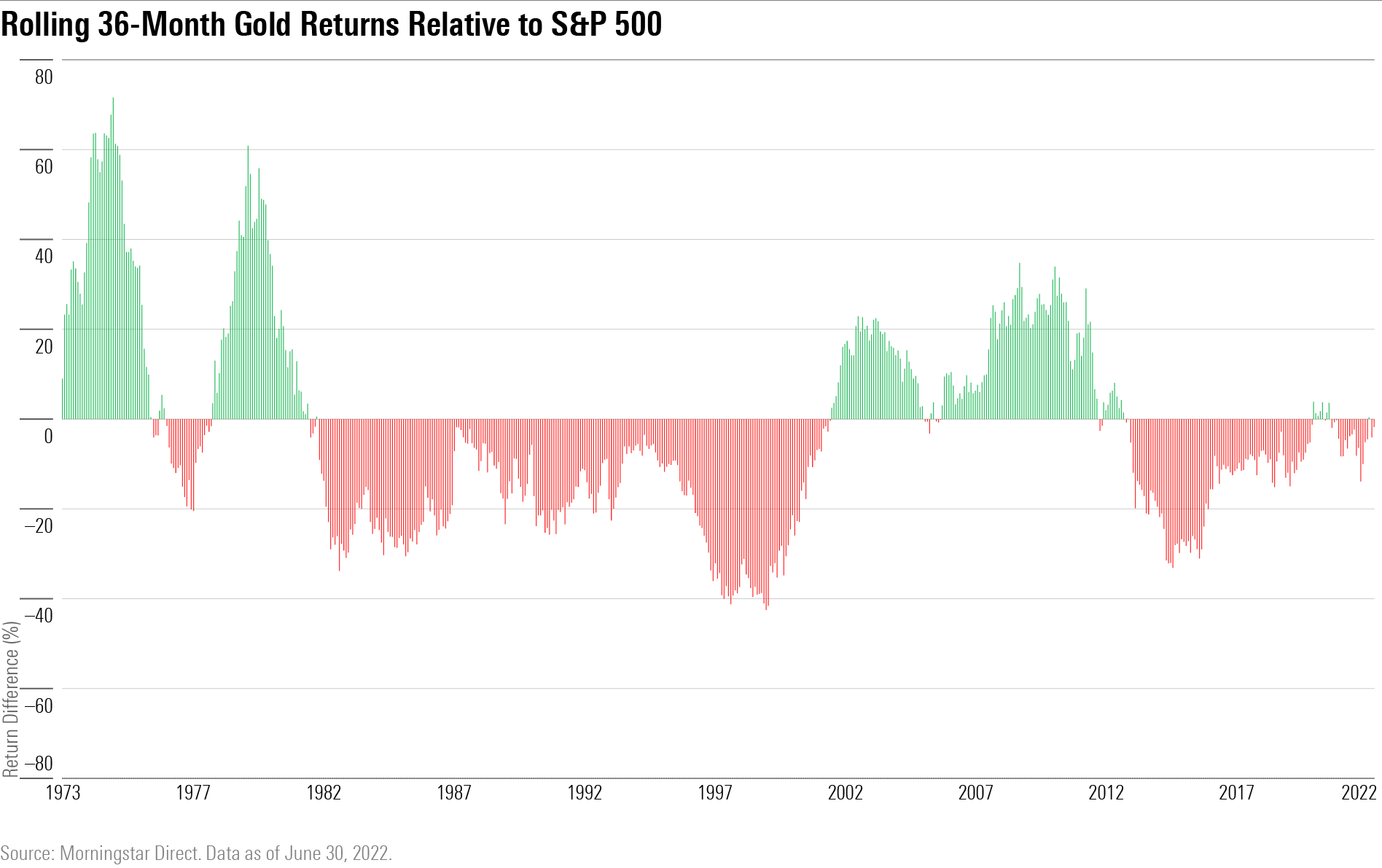

The problem with gold is that while it can excel in bear markets, its performance in other market environments is uneven, to say the least. For example, gold lagged stocks during most of the 1980s and 1990s, and generated negative returns, on average, during those periods. It excelled during the inflationary environment of the 1970s and the “lost decade” for stock returns in the 2000s, but then fell well behind stocks starting in early 2010.

The reason for this inconsistent performance is that gold is fundamentally different from other assets. As a commodity, it doesn’t generate any cash flows, and it’s only worth what someone else is willing to pay for it. During periods of economic uncertainty, for example, central banks often add to their gold reserves, which helps shore up the price. (Gold prices can also be affected by other changes in supply and demand, such as mine production levels and demand for jewelry and technology components. It also has an opportunity cost relative to other safe-haven assets: Gold typically fares better during periods when real (inflation-adjusted) interest rates are negative and worse when investors can generate positive real returns from holding bonds instead.

Does Gold Improve Long-Term Returns?

While gold has usually been a decent long-term hedge against inflation, there’s no reason to expect that it will generate positive real returns over the long term. It’s not a productive asset, so its ability to create economic value is limited. (As Warren Buffett says, it just sits there and looks at you.)

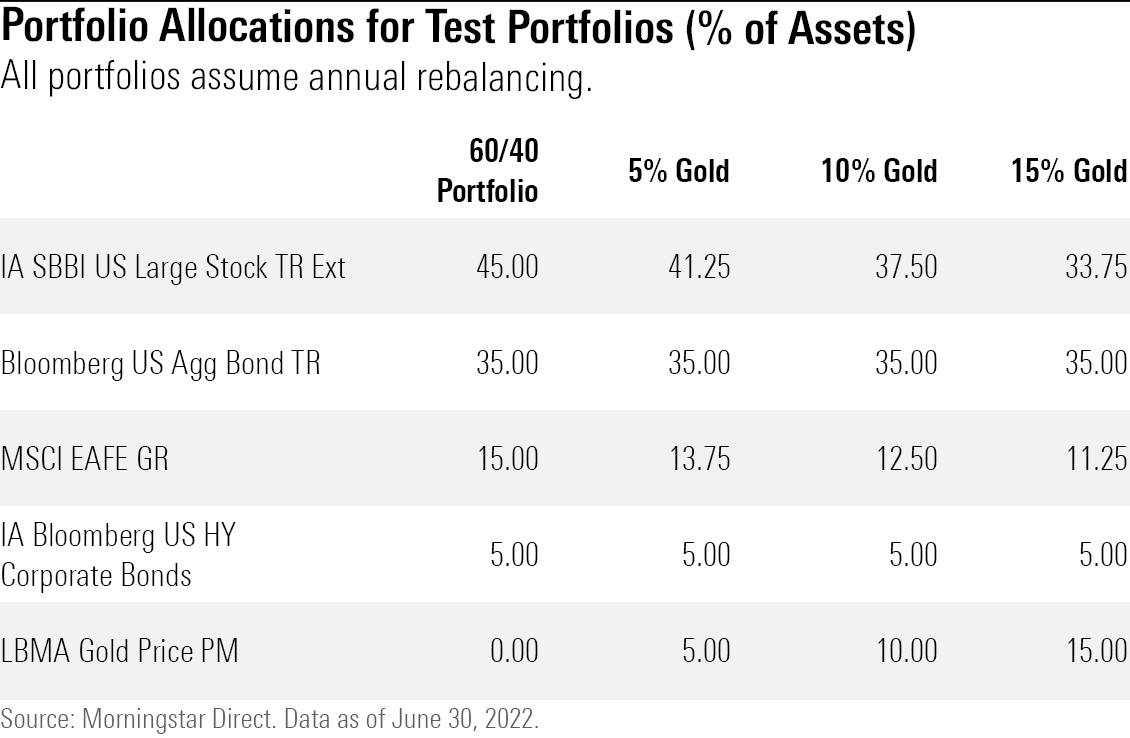

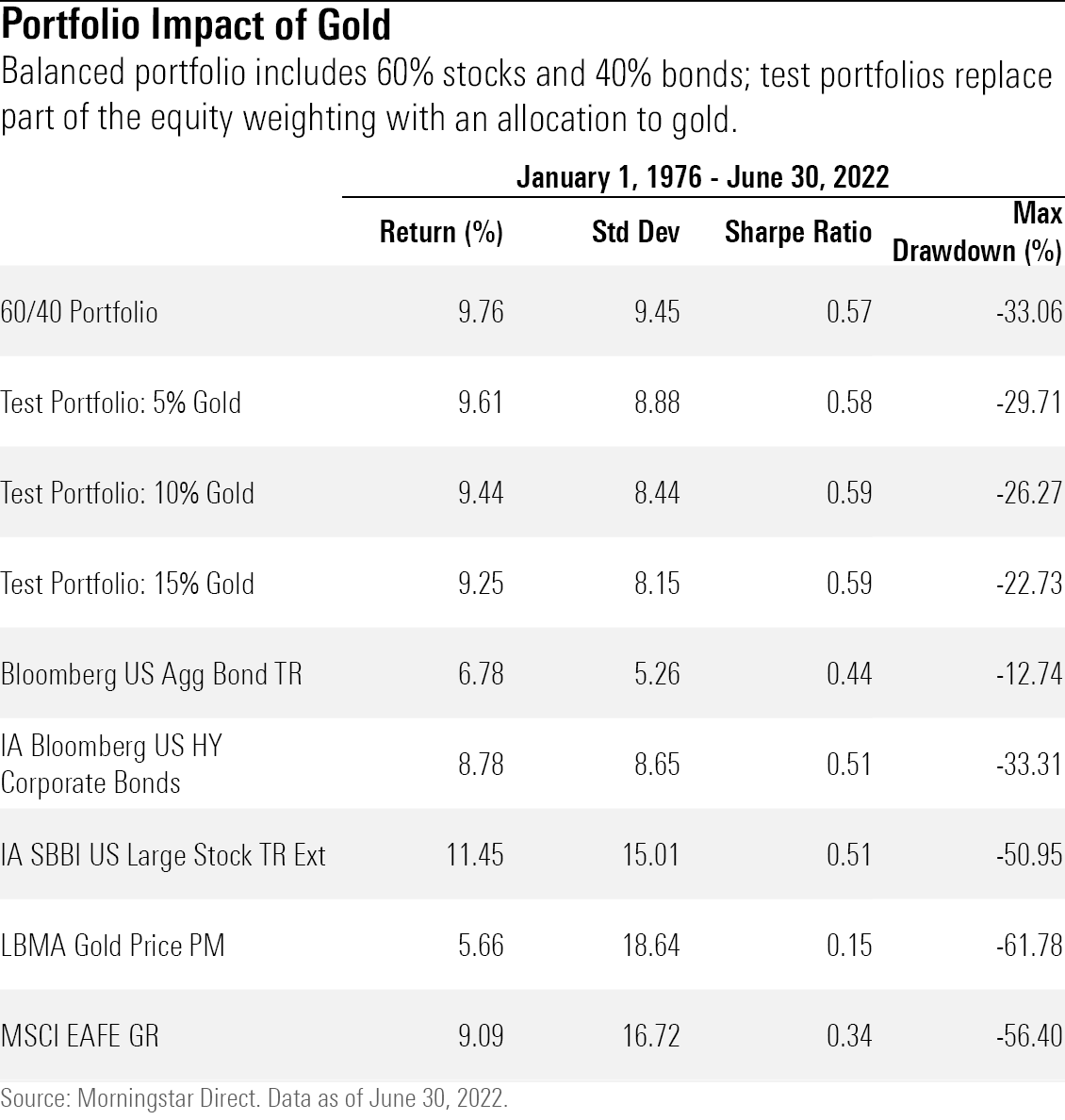

To examine whether gold really improves long-term portfolio performance, I set up four hypothetical portfolios with the allocations shown in the table below. Because gold’s volatility is so high, I carved out the gold allocations from the equity side and left the fixed-income holdings intact.

For all four portfolios, I assumed annual rebalancing and calculated risk and return metrics over the period from 1976 through June 2022.

The Results

Over the 46 ½-year test period, allocating a portion of assets would have reduced returns slightly. Gold in isolation is a risky asset—as witnessed by its 61.8% maximum drawdown over the test period—but its diversification value is what really helps it shine. Gold has consistently had a low correlation with stocks and other major asset classes; this low correlation helps reduce risk at the portfolio level.

As a result, adding gold would have reduced the portfolio’s overall risk level slightly and also limited drawdowns compared with the basic 60/40 portfolio with no gold. On balance, though, the improvement in risk-adjusted returns was pretty marginal. It’s hard to get excited about a Sharpe ratio moving up from 0.57 to 0.58 (for a 5% weighting) or 0.59 (for a 10% or 15% weighting). The larger gold allocations helped reduce drawdown risk, but also led to lower long-term returns.

Conclusion

Gold has consistently proved its mettle as a safe-haven asset and portfolio diversifier. In a portfolio context, though, its ability to improve risk-adjusted returns is a bit underwhelming. Overall, gold is best thought of as an insurance policy that’s best used in smaller doses.

/s3.amazonaws.com/arc-authors/morningstar/360a595b-3706-41f3-862d-b9d4d069160e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PLMEDIM3Z5AF7FI5MVLOQXYPMM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/I53I52PGOBAHLOFRMZXFRK5HDA.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CEWZOFDBCVCIPJZDCUJLTQLFXA.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/360a595b-3706-41f3-862d-b9d4d069160e.jpg)