Going Into Earnings, Is Berkshire Stock a Buy, a Sell, or Fairly Valued?

Watching Buffett’s cash levels, stock buybacks, and Geico’s profitability.

Berkshire Hathaway BRK.A/BRK.B is up 18% over the last 12 months. Ahead of its third-quarter earnings report, here is Morningstar’s take on what to look for in Berkshire’s earnings and our outlook for its stock.

Key Morningstar Metrics for Berkshire Hathaway

- Fair Value Estimate BRK.A: $600,000.00

- Fair Value Estimate BRK.B: $400.00

- Morningstar Rating: 4 stars

- Morningstar Economic Moat Rating: Wide

- Morningstar Uncertainty Rating: Low

Berkshire Earnings Date

Saturday, Nov. 4.

What to Watch for in Berkshire Hathaway’s Q3 Earnings

Third-quarter earnings will not be the only thing investors will be focused on when Berkshire posts its results. They’ll also look at the company’s cash levels, how much stock CEO Warren Buffett bought back during the quarter, how much more the firm added to its equity investment portfolio, and how well it held up in a more difficult market for stocks.

On the operating side, these are our biggest questions:

- How pressured were growth and profitability at Geico? The personal auto insurance business in the United States is still losing money. Geico and its peers—including the publicly traded Allstate ALL, Travelers TRV, and Progressive PGR—have been heavily impacted by significant cost inflation and supply shortages in the automotive market, which has made repairs and replacement far more expensive. These companies have also seen an increase in accident severity and rising medical costs. While pricing has improved, and the industry has shown it can recover from negative claims trends fairly quickly, higher prices and greater selectivity tend to suppress earned premium growth. It seems like this time around, it may take more time for the industry to overcome the magnitude of claims cost inflation. Geico has struggled far more than Progressive (its closest peer) on this front, and we’re not expecting much to have changed this quarter.

- Is price hardening in the commercial and reinsurance markets boosting results at Berkshire Hathaway Primary Group and Berkshire Hathaway Reinsurance Group? Pricing momentum picked up in primary and reinsurance lines in 2019, and this positive trend accelerated through the COVID-19 pandemic and largely maintained its momentum over the next two years. Higher prices were necessary to offset a rise in social inflation and other claims trends. While pricing has started to level off, the industry has enjoyed the highest increases in close to two decades, which should keep underwriting profits elevated even if earned premium growth slows. While both BHRG and BHPG are benefitting from last year’s Alleghany acquisition, which should keep earned premium growth elevated, we are curious to see how their combined ratios are faring. The third quarter is generally the start of hurricane season, and Berkshire increased its hurricane exposure this year, so we’re also curious about how much catastrophe losses hit the bottom line.

- Given the macroeconomic environment and BNSF Railway’s reluctance to adopt precision scheduled railroading, we’re wondering how well it performed. Union Pacific UNP, which is usually a good proxy for BNSF, saw average revenue per car/unit (including fuel surcharges) decrease 6.7% during the quarter, with total volumes declining 2.7%. This led to a 9.5% decline in total revenues, with the railroad’s operating ratio falling to 63.4% from 59.9% in the year-ago period. Given that BNSF’s results have been trailing Union Pacific’s for much of the past year, we are not expecting Berkshire’s railroad to have broken that trend in the third quarter.

- Berkshire had $147.4 billion in cash at the end of the second quarter, dangerously close to the $150 billion level Buffett laid out as untenable to shareholders. Absent share repurchases, additional investments, and/or acquisitions, it is highly likely that the firm passed that threshold, as quarterly free cash flow has averaged around $7 billion in the past three years. That said, other than the nearly $500 million in proceeds Berkshire made from sales of HP HPQ shares in September, we have little insight into its stock investments during the third quarter. We’ve also not heard much about any bolt-on deals that might have been made during the period. As for share repurchases, Berkshire has been tight with the purse strings this past year, purchasing an average of $2.4 billion worth of its stock each quarter, compared with $4.7 billion per quarter the previous year. Our current forecast has the company acquiring $1.7 billion worth of its stock during the September and December quarters (akin to the $1.4 billion it acquired in the June quarter).

Berkshire Hathaway Stock Price

Fair Value Estimate for Berkshire Hathaway

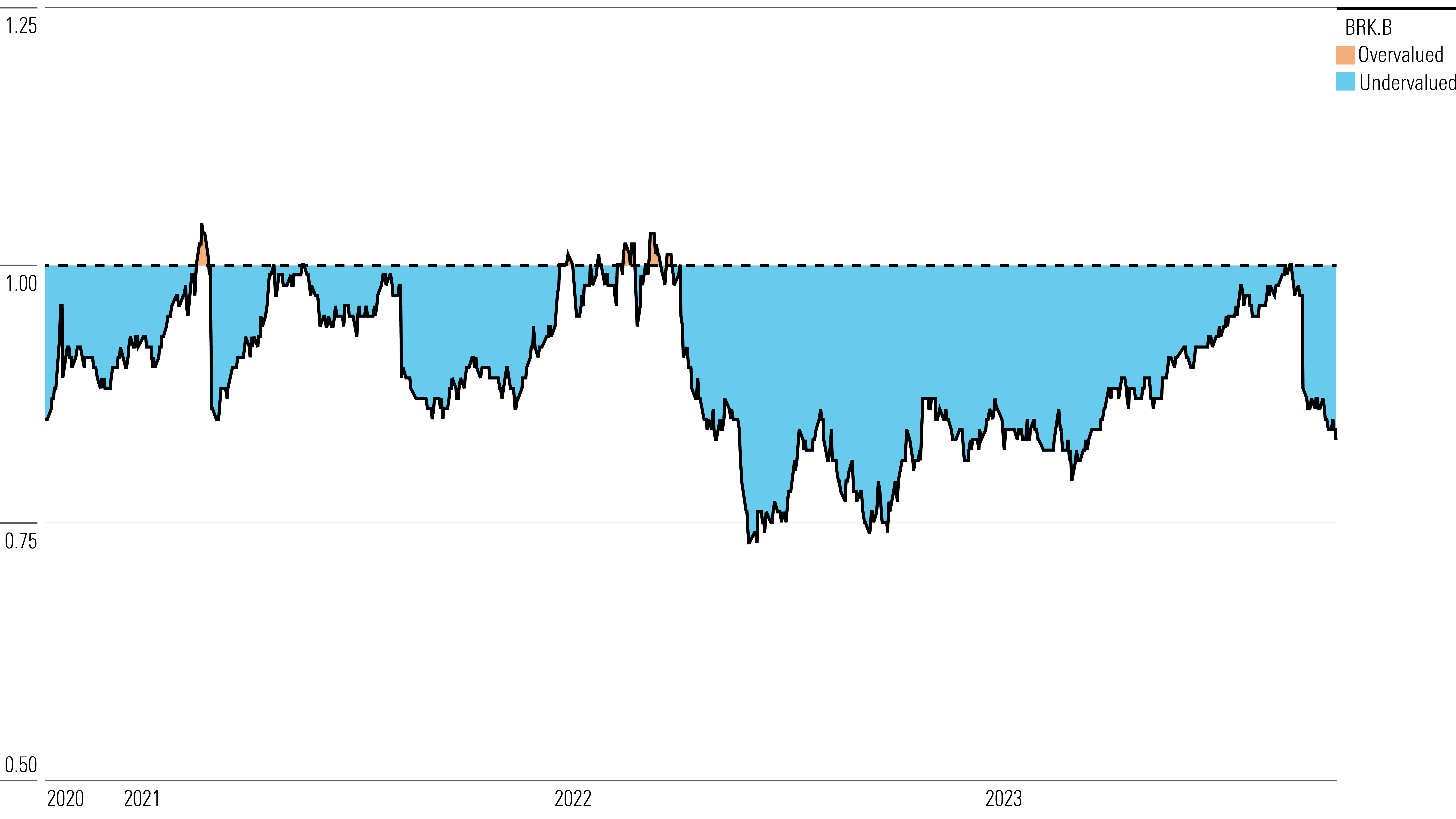

We’ve raised our fair value estimate to $600,000 per Class A share from $555,000 after updating our forecasts for the company’s operating businesses and insurance investment portfolio. The fair value estimate for Class B shares is $400.

Our new fair value estimate is equivalent to 1.43 times our estimate of Berkshire’s book value per share at the end of 2024 (1.32 times for 2025). For some perspective, over the past five years, the shares have traded at an average of 1.4 times their book value per share at the trailing calendar year’s end. We use a 9% cost of equity in our valuation and assume that Berkshire pays a minimum of 15% corporate alternative minimum tax on adjusted financial statement income for taxable years beginning in 2023.

Our fair value estimate is derived by valuing each of Berkshire’s operating segments separately and then adding those values together. After revising our projections for 2023-27, we have increased our valuation for Berkshire’s insurance operations to $297,000 per Class A share from $257,500, owing primarily to adjustments we’ve made to earned premium growth, underwriting profitability, and returns and overall yield on the investment portfolio.

Our forecast assumes Berkshire generates earned premium growth (including the Alleghany acquisition) of 9.2% on average annually during 2023-27 (compared with 4.3% during 2018-22), with the insurance operations overall posting an average annual combined ratio of 97.0% (an improvement from 98.6% on average during 2018-22 as Geico improves its loss ratios). We also expect the insurance investment portfolio (including market gains/losses and additional investments) to expand at an 11% compound annual growth rate during our projection period.

Read more about Berkshire’s fair value estimate.

Berkshire Hathaway Historical Price/Fair Value Ratio

Economic Moat Rating

We’ve historically believed that Berkshire’s economic moat is more than a sum of its parts, although the parts are fairly moaty. The insurance operations—Geico, Berkshire Hathaway Reinsurance Group, and Berkshire Hathaway Primary Group—remain important contributors to the overall business. Not only are they expected to account for around 30% of Berkshire’s pretax earnings (and 50% of our valuation of the firm), but they are also overcapitalized (maintaining a larger-than-normal equity investment portfolio for a property and casualty insurer) and generate low-cost float.

These temporary cash holdings, which arise from premiums being collected in advance of future claims, have allowed Berkshire to generate additional returns as the company invests these funds in assets that are commensurate with the duration of the business being underwritten. And they have tended to come at little to no cost to Berkshire, given the company’s proclivity for generating underwriting gains over the past several decades.

That said, we don’t believe the insurance industry is particularly conducive to the development of maintainable competitive advantages. While there are some high-quality firms (with Berkshire having some of the best operators in the segments where it competes), the product that insurers sell is basically a commodity, with excess returns difficult to achieve on a consistent basis. Insurance buyers are not inclined to pay a premium for brands, and the products themselves are easily replicable. Competition is fierce, and participants have been known to slash prices or undercut competitors to gain market share. Insurance is also one of the few industries where the cost of goods sold (signified by claims) may not be known for years, providing an incentive for companies to sacrifice long-term profitability for near-term growth. In reinsurance, this dynamic can be even more pronounced, as losses tend to be large and may not be realized for many years after a policy is written.

However, insurers can develop maintainable cost advantages by either focusing on less commodified areas of the market or developing efficient and/or scalable distribution platforms. What they can’t do is gain a maintainable competitive advantage through investing, even when gains are the result of the investing prowess of someone like Warren Buffett. We believe insurers that consistently achieve positive underwriting profitability are better bets in the long run, as insurance profitability tends to be more maintainable than investment gains and income.

Read more about Berkshire’s moat rating.

Risk and Uncertainty

Our Morningstar Uncertainty Rating for Berkshire is Low. We don’t currently consider any environmental, social, or governance issues at the firm to be material enough to affect our rating, primarily due to the firm’s lower exposure to some of the main ESG risks inherent to the industries where it competes. However, Berkshire has generally scored lower on governance issues because of the makeup of its board and board committees, the unequal voting structure of its shares, and its historical opaqueness on governance issues.

Berkshire faces the risk that insurance claims exceed loss reserves, or that material impairments affect its investment portfolio. Several of the firm’s key businesses—insurance, energy generation and distribution, and rail transport—operate in industries that are subject to high regulatory oversight, which could affect future business combinations and the setting of rates charged to customers. Many of the company’s noninsurance operations are exposed to the cyclicality of the economy, with results suffering during economic slowdowns.

Read more about Berkshire’s risk and uncertainty.

BRK.A/BRK.B Bulls Say

- Book value per share (which is a good proxy for measuring changes in Berkshire’s intrinsic value) increased at an estimated 18.3% CAGR during 1965-2022, compared with a 9.9% annualized return for the S&P 500 TR Index.

- Berkshire’s stock performance has generally been solid, increasing at a 9.5% CAGR in 2018-22, compared with a 9.4% average annual return for the S&P 500 TR Index.

- At the end of June 2023, Berkshire had approximately $166 billion in insurance float. The cost of its float has been negative for much of the past two decades.

BRK.A/BRK.B Bears Say

- Given its size, Berkshire’s biggest long-term hurdle will be its ability to consistently find deals that not only add value but are large enough to be meaningful.

- Another big issue is the longevity of chair and CEO Warren Buffett (who turned 93 in August) and managing partner Charlie Munger (who turns 100 in January 2024).

- Berkshire’s insurance business faces competitive and highly cyclical markets that occasionally produce large losses, and several of its noninsurance operations are economically sensitive and focused on U.S. markets.

This article was compiled by Tom Lauricella.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ECVXZPYGAJEWHOXQMUK6RKDJOM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KOTZFI3SBBGOVJJVPI7NWAPW4E.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/V33GR4AWKNF5XACS3HZ356QWCM.jpg)