ESG Implications for Midstream Oil and Gas

Environmental issues take center stage.

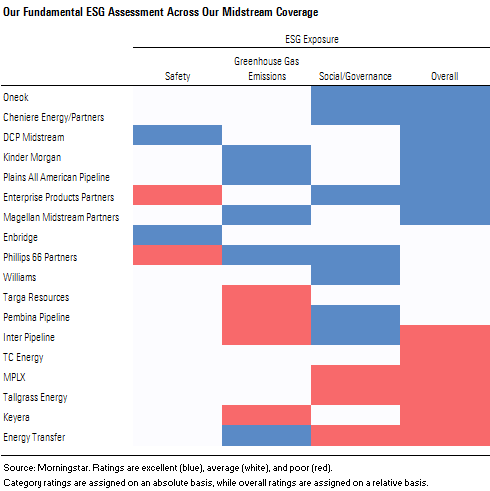

Investors are increasingly paying attention to environmental, social, and governance factors, and for midstream oil and gas companies, environmental concerns are paramount. Pipeline companies are “enablers” that encourage downstream consumption of fossil fuels, making them partially accountable for the greenhouse gas emissions that follow. Most midstream companies also emit waste gases directly, and the regular occurrence of pipeline spills creates a negative buzz around the industry, inviting further ESG scrutiny.

The direct financial burden associated with these issues is generally modest, as pipeline spill costs account for only a sliver of industry spending. If increased regulatory pressure eventually leads to a carbon tax, we would not expect major valuation changes, as companies would pass most of these costs to end consumers. However, the resulting reputational damage threatens relationships with stakeholders on pipeline projects, including local communities, indigenous populations, and government regulators. This often leads to lengthy project delays and increased construction costs, which can be meaningful.

Our top picks are Cheniere Energy LNG and Plains All American Pipeline PAA, which rank favorably on ESG issues and are attractively priced. Enbridge ENB also looks undervalued and should see concerns start to recede because of the emergence of lower-emission solvent-assisted technologies in the oil sands. Energy Transfer ET is one of the cheapest midstream companies we cover, but that could be connected to its relatively high exposure to ESG-related factors.

Key Takeaways Carbon taxes would modestly reduce our midstream fair value estimates. Our analysis of the impact of a what-if scenario where carbon taxes are a reality indicates a minor impact to our coverage. We estimate that about $3 billion in taxes would be paid in 2022 by our midstream coverage, based on a $23 per ton net charge. The impact ranges from 1% to 12% of our current fair value estimates. Energy Transfer would be paying the largest tax, at $551 million, because of its size, but its fair value estimate would shrink only by about 7%. DCP Midstream DCP would see the largest fair value estimate impact (a 12% reduction), as well as an uncertainty rating increase to very high from high, indicating it has work to do to improve its carbon efficiency. In total, the fair value estimate impact across our midstream coverage would be $22 billion.

Pipeline spills damage reputations but not pocketbooks. These incidents are notorious for creating negative buzz for the oil and gas industry. But despite the notoriety, spill-related costs have a minimal impact on pipeline operators’ cash flow. According to the Pipeline and Hazardous Materials Safety Administration, there have been 5,711 pipeline incidents in the 20 years from 1999 through 2018, averaging 286 incidents per year. Total reported spill costs were $8.1 billion, the median spill cost was $196,000, and the average spill cost around $1.6 million. With a typical midstream entity experiencing fewer than 10 reported spills per year, the typical impact to expenses is well under $10 million. Further, pipeline spills that cost more than $100 million represent only 0.1% of our data set (and insurance often covers a significant portion of the headline costs--Enbridge’s widely reported $1.2 billion in costs for the Line 6B spill was only $650 million after insurance).

Pipelines near indigenous communities face a higher chance of protests and delays. Some of the companies with the least amount of exposure in this area are Cheniere Energy/Cheniere Energy Partners CQP, DCP Midstream, Enterprise Products Partners EPD, Williams WMB, and Pembina Pipeline PBA because of the locations of their assets. In contrast, Kinder Morgan KMI, Enbridge, TC Energy TRP, MPLX MPLX, and Energy Transfer have all seen recent protests of new investments by indigenous tribes against major assets due to the pipe’s pathway of operation. About 30% of our coverage is vulnerable to NIMBY pressure, either through exposure to indigenous land or via poor relationships with other concerned parties such as politicians, landowners, and regulators. We think management teams struggle to accurately provide in-service dates because of the uncertainty around the scope and timing of legal and permitting challenges.

Community relations threaten future projects. First, Equitrans’ Mountain Valley pipeline experienced years of delays due to environmental-based legal challenges over permits and community complaints about construction approaches and right-of-way issues. The pipeline is expected to cost around $5.4 billion versus its original midpoint of $3 billion and come on line in late 2020, two years after its original target date. The increased costs not only reduce expected returns on the pipeline but also reduce our confidence level around returns on future projects because of damaged relationships, increasing uncertainty, and reflection on management in terms of poor stewardship. Second, Williams has nearly $400 million in capitalized costs relating to the Constitution pipeline--which has struggled with regulatory approvals--that it could write off if it cannot build the pipeline. Third, Kinder Morgan proposed its Trans Mountain pipeline in 2013, initially got approval in 2016, then faced legal challenges and protests that led to it being sold to the Canadian government in 2018. It still faces additional legal challenges to be completed in late 2019.

Top Picks for Midstream Investors In terms of valuation or exposure to ESG-related issues, wide-moat Cheniere looks attractive. Its assets are located on the U.S. Gulf Coast, where the community view on the oil and gas industry is generally favorable, with little to no exposure to indigenous land. Although its assets have been on line for a relatively short time, the company benefits from a strong safety record and its lack of gathering and processing exposure. We think investors are failing to appreciate the scale of China's long-term demand for gas, which cannot be fully satisfied with other supply sources such as domestic production and pipeline imports. Therefore, China must rely on U.S. liquefied natural gas, and Cheniere is the main exporter. The thesis fits nicely within an ESG framework because China's need to improve the quality of its air and overall environment (by reducing the usage of coal and increasing the use of cleaner natural gas) is spurring its shifting energy mix.

For ESG investors, wide-moat Plains All American scores very highly on our framework despite not yet meeting our expectations for related disclosures. We think this is one of the stronger midstream names from an ESG perspective, so it would make sense for management to address this in the near future. The company is most likely undervalued because investors do not appreciate the quality or durability of Plains’ wide-moat operations in the Permian Basin, the main growth engine for U.S. oil production growth. In the past, the collapse of the volatile supply and logistics segment (which has recently staged a recovery) has distracted investors. We focus on the attractiveness of the company’s fee-based asset network based in the Permian, which is growing at a double-digit annual rate.

From an ESG perspective, Enbridge scores above the average and median of our coverage and the highest among Canadian midstream operators. While Canadian pipeline operators are exposed to higher indirect emissions from the oil sands and strong opposition from indigenous communities, wide-moat Enbridge sports a top-tier safety record, has minimal G&P exposure, and is among the very best in ESG disclosures. Enbridge would score even higher if it had no exposure at all to the oil sands, as this still weighs on our scores, but over time there is scope for improvement due to the adoption of solvent-assisted technologies (improving indirect emissions).

No-moat Energy Transfer is one of the cheapest midstream companies we cover, and that could be in part because of the market’s ESG-related concerns. Energy Transfer has a tarnished reputation after the highly publicized Dakota Access project, not to mention its increasing oil and liquids exposure and concentrated management control structure. Investors could be overlooking the company’s positive environmental contributions (Energy Transfer’s oil and liquids infrastructure has reduced the need for less efficient and potentially unsafe rail and truck transport, and its gas network enables more use of natural gas in the power sector, lowering energy costs and carbon emissions). We expect the company to address its ESG shortcomings soon, making the current discount look like a buying opportunity.

Our Framework for ESG Assessment The energy industry is heavily exposed to ESG issues simply by nature of its operations, which involve finding, extracting, transporting, and refining hydrocarbons in ways that can be environmentally destructive. This is the key risk area for the midstream industry, too.

The environmental risks generally fall into two buckets: those related to pipeline leaks and other unplanned spillage of hydrocarbons (safety), and the direct or indirect emission of greenhouse gases. We also assess social and governance factors, including disclosure of ESG-related data and the likelihood of protests from indigenous landowners, pressure groups, and other stakeholders.

Safety Factors Pipeline spills such as Enbridge's Kalamazoo River spill can cost over $1 billion when considering cleanup costs, fines, and pipeline upgrades. Exposure to natural disasters such as hurricanes (Hurricane Harvey caused $125 billion in damages in 2017 and dumped over 50 inches rain in the Houston metro area) or wildfires (Fort McMurray wildfires in 2017 caused CAD 10 billion in damages) also need to be considered.

Safety record: We consider historical data from the industry’s regulatory body, the Pipeline and Hazardous Materials Safety Administration, on a company’s safety record, adjusted for pipeline network size. We believe this speaks to a midstream company’s exposure to cleanup, environmental, and regulatory costs.

Hydrocarbon mix: Data from the PHMSA indicates that gas pipelines are inherently safer than liquids ones. Construction standards support this as gas pipelines transport gas at pressures of 1,000 pounds per square inch or greater whereas oil pressures typically range between 600 and 1,000 psi. In addition, the Federal Energy Regulatory Commission must approve all natural gas transmission pipelines, whereas there is no similar federal regulatory approval required for oil transmission pipelines. While management commentary around changes in safety culture following an incident is helpful, we believe the hydrocarbon mix speaks to the likelihood of future safety incidents.

Disaster exposure: This metric focuses on the percentage of assets that are exposed to major natural disasters, mainly wildfires and hurricanes, with lower levels of exposure resulting in higher ratings. This allows us to differentiate between companies with heavy Gulf Coast (hurricane) exposure versus assets that are better located.

Greenhouse Gas Emissions Considering greenhouse gas emissions exposure is important because it helps us triangulate which companies would be most affected in a scenario where the United States introduces a federal carbon pricing scheme.

Gathering and processing exposure: This data point measures the percentage of a company’s assets that are pipelines and thus less greenhouse gas intensive. Gathering and processing refers to the activities around collecting hydrocarbons from the wellhead, stripping out impurities, and transporting them to a long-haul pipeline. A company that is nearly entirely pipelines and has few gathering and processing assets would receive an excellent rating, whereas the reverse would receive a poor grade.

Direct greenhouse gas emissions: This data point measures the direct greenhouse gas emissions emitted during the midstream process (heat, electricity, steam, and so on). Certain types of oil are much more energy-intensive to work with (mainly blended in situ Canadian oil sands and heavier Californian grades), penalizing companies that are exposed here versus preferred Texas-produced grades. Midstream companies that primarily handle gas fare worse here, as their operations are more carbon intensive.

Indirect greenhouse gas emissions: This measures the greenhouse gases emitted during the upstream and downstream processes so we can also capture the related negative environmental impacts outside of the direct midstream processes involved. The data is also oil grade specific, with some Canadian and California grades viewed negatively versus Texas-produced grades. Similar to our direct emissions definition, gas companies do well because of the lower levels of greenhouse gas emissions’ intensity.

Social and Governance Pipeline delays due to indigenous protests, as experienced by the Dakota Access pipeline, or regulatory delays, as experienced by TC Energy's Keystone XL pipeline, can create costs that could reach into the billions of dollars when including social costs over time.

Exposure to the likelihood of protests from indigenous parties: Protests by indigenous groups against pipelines typically occur when a pipeline path threatens areas of significant cultural value. The protests can cause extensive pipeline delays and higher construction costs due to time and costs for reworking the pipeline path, legal challenges, and resubmitting permits and other regulatory delays. More broadly, we think pipeline companies with protests against their pipelines have typically struggled to communicate effectively with the indigenous communities as part of their advance pipeline planning work. We grade pipeline companies on their estimated asset exposure to indigenous protests by considering their asset location relative to indigenous communities.

Potential regulatory delays: Certain states, primarily New York, have regulators that have taken an antipipeline stance in recent years, denying a number of permits for pipelines, requiring resubmittals, and entailing other legal challenges. The delays mean higher construction costs and legal bills and also speak to a challenged relationship with regulators. We grade pipeline companies based on their percentage of new capital expenditures exposed to regulatory delays.

ESG disclosure: This, in our view, helps illustrate the focus and prioritization of a company regarding ESG issues and allocating capital. Minimal disclosure on questions such as some level of policy and stances on key ESG issues merits a poor rating. An average level of ESG disclosure would include an annual report with detailed policies. An excellent rating might include detailed ESG statistics about a company’s operations as well as an annual report with detailed data that meets third-party reporting standards.

/s3.amazonaws.com/arc-authors/morningstar/efa3b691-314a-4c23-8933-a09951d6793b.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZPLVG6CJDRCOTOCETIKVMINBWU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZZSPP5AYAJB2RIRVFE2XR23GUQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NYUEHSFI4BDCJPQZJ76HH4PKSM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/efa3b691-314a-4c23-8933-a09951d6793b.jpg)