Energy: Stocks Outperform, Helped by Tight Oil Market

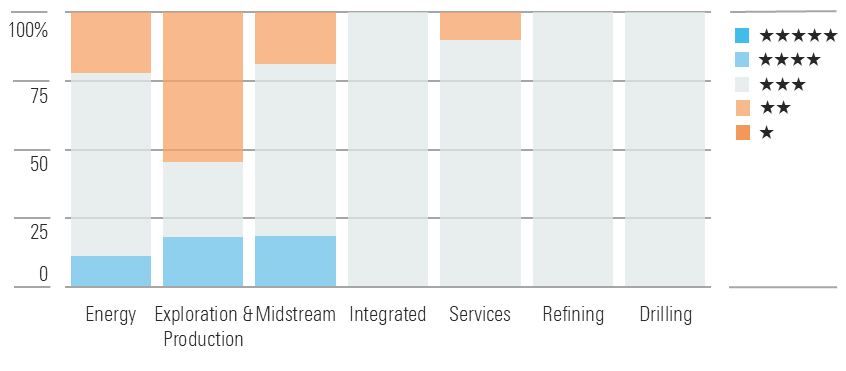

With less than 15% of the sector undervalued, investors are clearly underwriting a higher-for-longer oil price scenario.

With the improvement in oil and gas prices, it’s no surprise that energy stocks returned to outperforming the market in the third quarter. However, with less than 15% of our energy coverage undervalued, investors are clearly underwriting a higher-for-longer oil price scenario and have already assumed poor gas market conditions in 2023 and 2024 will reverse over the long run.

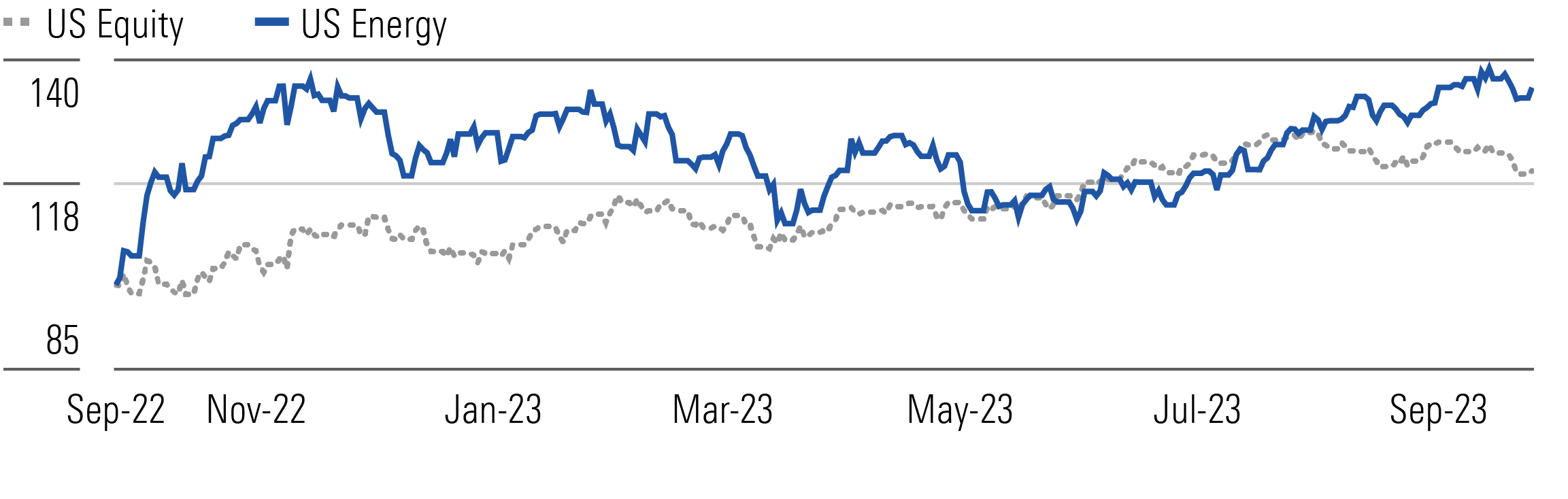

Stronger Oil and Gas Prices Prompted a Surge In Energy Stocks

Natural gas prices in the U.S. (Henry Hub), Asia (JKM), and Europe (TTM) improved significantly from the prior quarter, with respective increases of 35%, 45%, and 28%. We see this primarily as a risk-on trade, as investors are more concerned about the potential for Australian liquefied natural gas strikes, disruptions to U.S. LNG supply, and the prospects for a colder-than-normal winter than they are with sizable gas consumption declines in the European Union. A very warm U.S. summer helped U.S. gas inventories, given the increase in power demand.

The Energy Space Looks Fairly Valued Across All Subsectors

Global oil prices have increased by 20% (WTI) and 27% (Brent) since the prior quarter. We attribute this mainly to the actions taken by Saudi Arabia and Russia to tighten the oil market over the last few months, driving a large supply deficit. The countries’ repeated extensions of about 1.3 million barrels of oil per day in cuts indicate concerns over the sustainability of China’s oil demand (the majority of global oil demand growth this year), increased Iranian supply, and the need to fund significant social spending efforts. However, we also think the extensions were timed to sow additional market uncertainty around short-term supply, maximizing near-term oil prices.

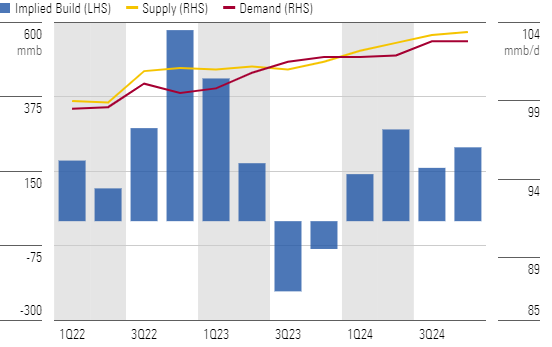

The Oil Market Will Be Short of Supply for the Rest of 2023

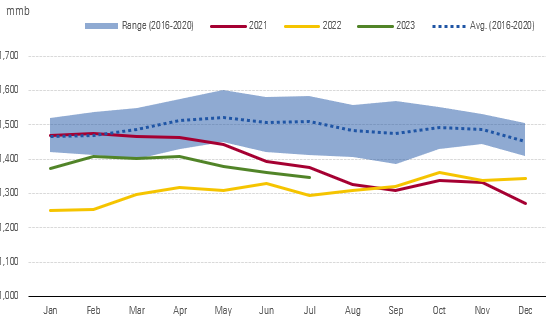

Since June, Saudi Arabia and Russia have extended their respective monthly supply cuts of 1 million bpd and 300,000 bpd to the end of 2023. These cuts were initially described as temporary, but they have been repeatedly extended, to the market’s surprise. The extension and steep earlier cuts from the rest of OPEC have pushed the market into what is likely one of its biggest supply deficits in the last decade, with at least a 2.3 million bpd shortage expected for the third quarter. Inventory has declined by nearly an estimated 60 million barrels since the start of 2023, and it remains well below five-year averages. Ongoing declines are a near certainty given the size of the supply deficit, which will require barrels from storage.

OECD Inventory Will Continue to Decline to Meet Supply Gap

Top Energy Sector Picks

Devon Energy

- Fair Value Estimate: $61.00

- Morningstar Rating: 4 stars

- Morningstar Economic Moat Rating: Narrow

- Morningstar Uncertainty Rating: High

A high-quality inventory and cost-focused management team make Devon DVN one of our top picks. Its exemplary management team allocates capital very well in an industry that has cost shareholders billions of dollars. For example, we are fans of its variable capital return model. After 50% of free cash is distributed, the remainder will fund buybacks and strengthen the balance sheet.

TC Energy

- Fair Value Estimate: $48.00

- Morningstar Rating: 4 stars

- Morningstar Economic Moat Rating: Narrow

- Morningstar Uncertainty Rating: Medium

TC Energy TRP is dealing with multiple investor concerns: too-high debt, lingering worries over Coastal GasLink overruns, and skepticism over the planned 2024 liquids spinoff. In contrast, we think the planned CAD 5 billion-plus sale in process, plus another CAD 3 billion in additional sales and CAD 1 billion in optimization opportunities, provide plenty of capital to reduce debt. We see Coastal GasLink as 91% complete, and TC management has emphasized its confidence in meeting its schedule and budget. Finally, we see the liquids spinoff as highlighting the quality and growth opportunities available in the gas and power portfolios, including carbon capture and hydrogen.

Equitrans Midstream

- Fair Value Estimate: $15.00

- Morningstar Rating: 5 stars

- Morningstar Economic Moat Rating: Narrow

- Morningstar Uncertainty Rating: High

With the path forward now clear for Equitrans’ ETRN Mountain Valley Pipeline, we continue to think the company’s stock is undervalued, as investors are no longer pricing in the cancellation of the pipeline but are also not fully reflecting its contributions. We think Equitrans will likely bring online the related Hammerhead and MVP Southgate (Equitrans owns 47% via a joint venture) projects. Combined, these efforts should increase EBITDA by about 30% from 2023 levels.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/efa3b691-314a-4c23-8933-a09951d6793b.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZEMES5XIZBD2LHOJ4CE4VEBM6I.png)

/d10o6nnig0wrdw.cloudfront.net/05-13-2024/t_3bda971142bb429e90b0e551f31b1fbb_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/B26QQUGWL5BVLMVULGYK3QQASI.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/efa3b691-314a-4c23-8933-a09951d6793b.jpg)