3 To-Dos to Get the Most Out of Earnings Season

Companies’ reporting periods can be more than just noise.

The mere mention of earnings season, the often-stressful period in which public companies report their quarterly financial results, can send chills down the spines of equity analysts, company management teams, and investors alike. Four times a year, conference calls, updated spreadsheets, and copious analyst notes fill investors’ calendars and inboxes, while market volatility abounds.

Given their massive time commitment, it is worth asking whether we need to pay this much attention to earnings. It’s clear that companies should regularly report their financial statements, but if we’re planning to hold stocks for the long haul, isn’t a single quarter’s worth of data just noise?

This argument has some merit. There’s no shortage of discussion among management teams and analysts about short-term issues that aren’t likely to affect long-term value. (Some of my personal pet peeves are this year’s tax rates, intraquarter working capital items, or earnings guidance that covers only three months). But there can be signals within the noise.

Ahead of the upcoming earnings season—and hopefully for many more—I’ve put together a to-do list for long-term investors to get the most out of the upcoming rush of information:

Earnings Season To-Do List

Test Long-Term Assumptions

First, don’t worry too much about company “beats” and “misses” of Wall Street analysts’ quarterly estimates. While stock prices may react to volatility, this false precision misses the point of being a long-term investor. Instead, the latest financial figures and management commentary can identify pivot points that could indicate a “break” in your long-term expectations.

Most quarters won’t lead to major changes. A quick glance at the full-year earnings season in February across Morningstar’s equity research team’s global coverage of nearly 1,300 stocks on a calendar-quarter reporting cycle shows that only about 9% saw a substantial (more than 10%) change in their fair value estimate.

But so goes the famous quote often attributed to economist John Maynard Keynes: “When the facts change, I change my mind. What do you do, sir?” It’s OK to change your expectations!

Take, for instance, our equity analyst’s reassessment of healthcare company Gilead Sciences GILD in February. Following a solid 2022 and indications that the company was progressing its pipeline more successfully than anticipated, its fair value estimate was raised to $97 per share from $77 on the back of boosted multiyear sales forecasts for several products. Importantly, the valuation uplift also led to an upgraded rating, with the stock now trading in 4-star (or undervalued) territory.

Hold Management Accountable

Management teams tend to be paid optimists. While there are certainly lots of great executives, it’s in their best interest to point investors to positive parts of earnings results and underemphasize anything negative.

Fortunately, regular reporting requirements make it easy to compare notes from prior periods, to determine whether management is walking the path it set out on. There are of course bound to be alterations and setbacks to previously planned outcomes as competition evolves and economic conditions shift. But sometimes executives’ messaging so obviously tries to sugarcoat a bitter pill that it could prove to be a red flag.

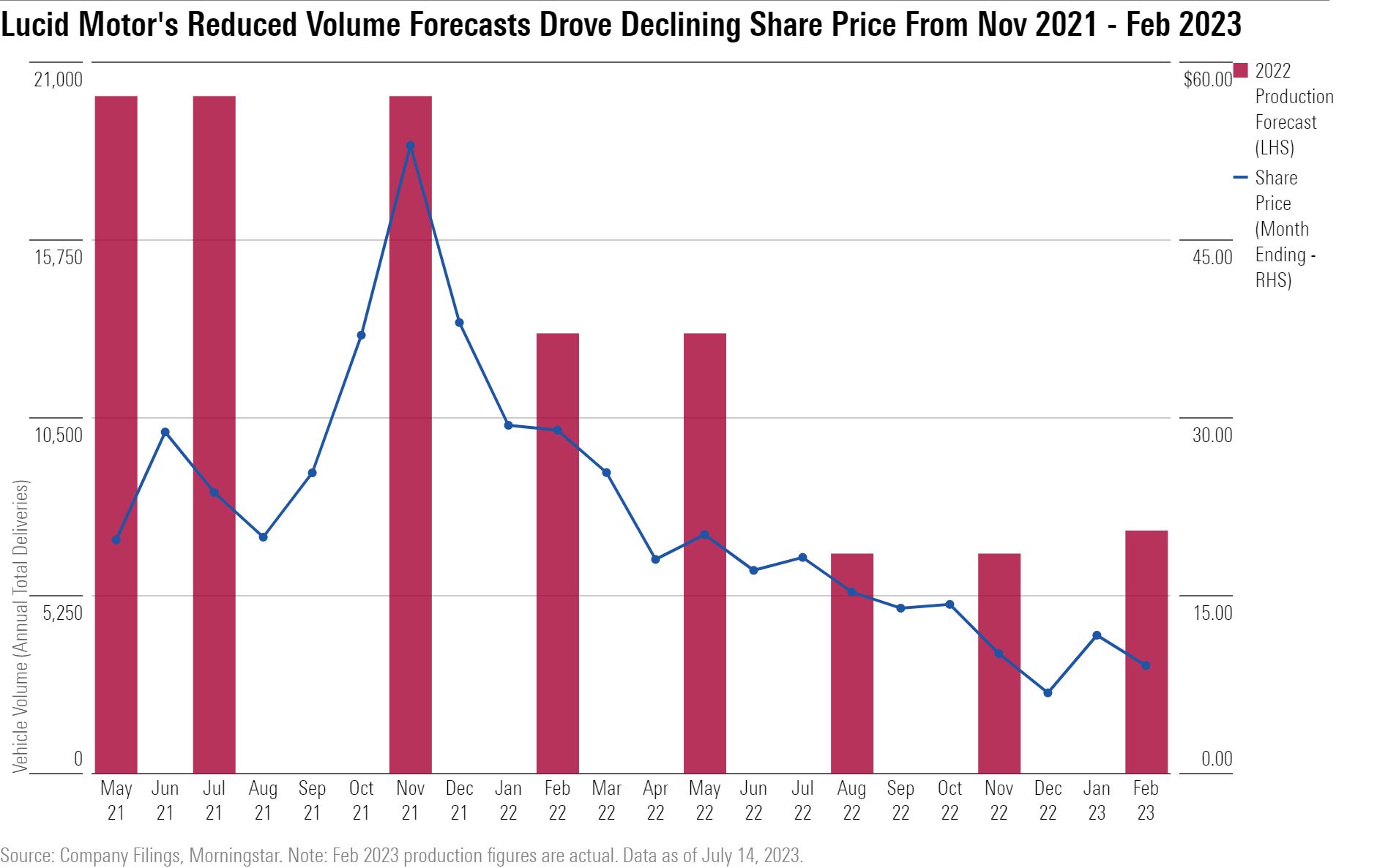

Here, I’d call out Lucid Motors LCID, the electric vehicle competitor to Tesla TSLA. No doubt, the EV market remains nascent, and innovative firms at the beginning of their business journeys should be given some leeway in their forward-looking projections. But Lucid runs afoul of drastically moving its goal posts and then celebrating barely crossing them.

In May 2021, the company announced that it was planning to deliver 20,000 units of its Lucid Air in calendar 2022, ramping up to 49,000 in 2023; it reiterated these figures again in July and November of that year. However, in February 2022, reported supply chain and logistics challenges led management to lower this target to a range of 12,000-14,000. These factors were again cited in August 2022, when Lucid pulled down the forecast to a range of 6,000-7,000 and announced a restructuring of its logistics and manufacturing organization.

None of this would have been terribly egregious, had the company not celebrated its final production of 7,180 vehicles as “exceeding annual production guidance” when reported in February 2023, which was nearly 65% below its full-year target from only 18 months prior. Alongside its most-recent goal from May 2023 of “more than 10,000″ units for 2023, Lucid’s share price has slid nearly 85% from its November 2021 high of $55.

Lucid Motor's Reduced Volume Forecasts Drove Declining Share Price from Nov 2021-Feb 2023

Gather Information From Other Companies

Given the plethora of information during earnings season, it’s tempting to spend time reviewing only your individual holdings. But it can be just as important to review results from other closely related public companies, too. Data and commentary from competitors, supply chains, and customers of stocks you own can add details and insight you may otherwise miss.

Morningstar’s coverage of TripAdvisor TRIP provides a good example. Here, our equity analyst compares the company’s reported branded hotel segment results to competitors by calculating an industry metric for revenue per available room. In the latest quarter, for instance, the company reported 24% year-over-year growth in this segment but reached just 78% of 2019′s comparable level, well below the 113% mark across the U.S. hotel industry.

Similarly, an analysis of TripAdvisor would be incomplete without considering other review and travel aggregators like Alphabet GOOGL (Google Maps’ parent), Meta Platforms META, and even Amazon.com AMZN, which have the potential to extend their platforms’ reach into travel in the coming years, presenting incremental competition to the industry. In fact, we recently downgraded the Morningstar Economic Moat Rating for TripAdvisor to none from narrow, as we expect growing competition will drive lower revenue share and profits in the company’s core business.

That said, investing remains a game of expectations, and we think investors continue to severely discount the company’s experiences and dining assets. The stock currently has a 4-star rating.

Have a Plan and Stick to It

Earnings season can be productive and informative, but it can also be much like drinking from a fire hose. For investors looking to make active decisions about their individual stock holdings, having a plan going in is crucial. Focusing on key long-term drivers, comparing results (and promises) to past periods, and connecting the dots from other companies across the investing landscape can help drive success.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/35091ad9-8fe9-4231-9701-578ec44b5def.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6A6R4SGLDNGMXHAH3K2CIQTF3Q.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PVJSLSCNFRF7DGSEJSCWXZHDFQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/F5UMFVVKMVFRPGGUY4LONIK6OY.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/35091ad9-8fe9-4231-9701-578ec44b5def.jpg)