Dividend Leaders and Laggards Among Utilities

Equity valuations remain rich but still offer opportunities for income.

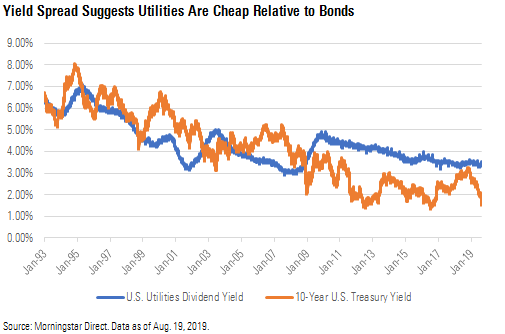

Just over halfway through 2019, utilities continue to impress, with good growth prospects, secure dividends, and sound balance sheets. Investors have taken note, with the U.S. utilities we cover trading at a median 12% premium to our fair value estimates as of mid-August. That means investors’ long-term capital gains are at risk even if utilities make good on their 5%-7% earnings and dividend growth potential. However, utilities remain an attractive source of yield for income investors. Even with elevated equity valuations, the spread between utilities’ dividend yields and the 10-year U.S. Treasury yield remains above historical levels.

We think NextEra Energy NEE, Sempra Energy SRE, and American Water Works AWK have the highest dividend growth potential, driven by strong capital growth opportunities and relatively low payout ratios. We forecast Southern SO and Dominion Energy D will be dividend growth laggards, constrained by high payout ratios and capital investment needs. Finally, PPL’s PPL struggles in the United Kingdom will probably result in no dividend growth and could lead to a dividend cut after the RIIO-ED2 regulatory outcome.

Utilities Look Expensive, but Still Attractive vs. Bonds The U.S. utilities sector hit fair value for the first time in three years at the beginning of 2019 but has rallied 18% through mid-August, including dividends. This has matched the S&P 500 and inflated valuations to levels we last saw in late 2017.

All of the conventional valuation metrics using earnings, book value, and dividend yield suggest utilities are overvalued. This is particularly true for the 21 fully regulated utilities we cover, which trade near multidecade highs and a premium to their less regulated peers.

It’s difficult to recommend utilities as a total-return investment, but their current yields are historically attractive compared with bond yields. Climbing bond yields in 2018 nearly erased the interest-rate yield premium that utilities investors had enjoyed for more than a decade. But continued dividend growth and falling bond yields once again make utilities look cheap relative to bonds.

Utilities Dividends Supported by Strong Growth Prospects We think utilities that can increase their dividends faster than peers offer investors the best income potential. This group is buoyed not only by low payout ratios from years of focusing on internal growth opportunities, but also by forward earnings growth well above the 5%-7% peer average.

One of the main trends fueling utilities’ dividend growth is continued investment opportunities in aging infrastructure, including distribution infrastructure, transmission, and renewable generation. The industry shows no signs of slowing. Our expectation for low long-term natural gas prices provides ample room for utilities investment with minimal impact on customers’ bills.

In 2018, electric utilities spent approximately $127 billion on capital investment, well above the 10-year inflation-adjusted average of $105 billion. We take our in-depth knowledge of each company to come up with a consolidated view of capital expectations between 2019 through 2022. For 2019, we forecast $142.9 billion in capital investment, with a four-year forecast of $547.6 billion.

Utilities’ investment plans typically drive earnings growth, assuming consistent and constructive regulation. Earnings growth then typically drives dividend growth, adjusting for funding needs for maintenance and growth capital investments. We think the top utilities that combine growth investment with constructive regulation will support the highest dividend growth.

Dividend Leaders NextEra Energy, Sempra Energy, and American Water Works are the clear dividend growth winners in our analysis. These utilities have large capital investment programs that support sector-leading earnings and dividend growth. These utilities aren't cheap and trade well above our fair value estimates. However, we think long-term income-oriented investors can benefit from owning these stocks, given their earnings and income potential.

NextEra's Growth Potential Across Operations Drives Dividend NextEra Energy has two growth drivers supporting our 9.8% earnings growth outlook and above-average dividend growth: its regulated Florida utility and its energy resources subsidiary that focuses on renewable energy development. Overall, we project NextEra to spend just over $40 billion through 2023, the largest program among our coverage.

We forecast that NextEra Energy can increase dividends 14% annually over the next five years, well above its peer group average and the highest in our coverage. Additionally, NextEra’s 61% payout ratio--slightly lower than peers’--gives it greater flexibility to increase its dividend as cash flows become more stable at NextEra Resources with long-term renewable energy contracts and the divestiture of its unregulated thermal generation.

NextEra’s growth in Florida will be focused on solar development, which until recently had few renewable development opportunities. While Florida demographics are ripe for solar development, regulators wisely waited for economics to improve before offering incentives to the states’ investor-owned utilities to develop solar generation. In 2017-18, NextEra’s Florida Power & Light installed 600 megawatts of new solar for $800 million, with an additional 600 MW and $800 million of investment planned for 2019-20. FPL is in the early stages of an additional $1.1 billion in development. By 2030, FPL aims to have installed more than 30 million solar panels that will allow 40% carbon-free generation, including nuclear.

Florida regulators have highly constructive regulatory rate-setting mechanisms for recovery of capital investments, including solar generation. FPL’s 10.6% allowed return midpoint and automatic rate-base adjustments upon completion limit regulatory lag and help drive our 6% rate-base growth estimate. NextEra consistently earns at or near the high end of its allowed return on equity range, at 11.6%. These mechanisms provide cash flow certainty needed for future dividend increases. NextEra Energy wisely increased its Florida exposure by recently acquiring Southern’s Florida operations for $6.475 billion, further supporting growth.

NextEra’s other unit is its renewable energy development business, NextEra Energy Resources. NextEra is the largest wind power producer in the United States, proving to be a best-in-class renewable energy operator and developer.

NextEra aimed to be a leader in renewable energy in the early 2000s. While the technology was still economically unfeasible in many areas, NextEra developed early know-how and relationships that have allowed it to continue to be the largest domestic renewable energy developer. Although these renewable energy developments are not subject to regulated rates, the investments tend to have regulated-like returns. Management enters into long-term contracts to sell the power from its projects, significantly mitigating cash flow volatility relative to uncontracted generation projects that are exposed to volatile commodity prices.

Management’s continued execution on its Energy Resources development program leaves us confident that NextEra will deliver at the high end of its plan to add 10.1-16.5 gigawatts from 2017 to 2020 and supports our dividend outlook at the high end of management’s 12%-14% guidance. During 2018, the subsidiary added roughly 6.5 GW of renewable energy projects to its backlog. Favorable start-of-construction tax guidance from the Internal Revenue Service related to solar investment tax credits positions NextEra well for solar development beyond 2020. We forecast that NextEra will add approximately 2.0 GW of wind capacity annually through 2023, with an additional 6.3 GW of new solar capacity through 2023.

NextEra’s early entry into battery storage will enhance its competitive positioning in the market. Energy Resources already has 125 MW of battery storage with a 266 MW backlog.

Sempra's Portfolio Derisking Provides Certainty for Dividend Growth Sempra Energy has long maintained a diversified portfolio of traditional regulated utilities and unregulated energy operations, which constrained its ability to drive dividend growth, given the cash flow volatility from the unregulated operations. However, Sempra has begun to derisk its portfolio, focusing on regulated distribution and transmission utilities that are the keys to its healthy capital investment plan. This portfolio pivot, lower payout ratio, and contracted Cameron LNG Trains 1-3 earnings contribution will allow Sempra to increase dividends 11% annually over the next five years, exceeding our 10% annualized earnings forecast during this period.

Sempra has wisely expanded its regulated operations with proceeds from its asset divestitures, notably gas storage and merchant renewable energy projects. To do this, Sempra acquired regulated assets in Texas to pair with its regulated California utilities. It acquired Oncor in 2018 for $18.8 billion and more recently InfraREIT for $1.275 billion, combining two transmission and distribution utilities in a constructive regulatory environment. We think Texas offers numerous benefits for Sempra, particularly the increase in earnings contribution from regulated utility operations, which provide more stable cash flows than Sempra’s unregulated businesses.

Oncor and InfraREIT offer plentiful opportunities for capital investments. After closing the Oncor transaction, Sempra has increased Oncor’s capital expenditure forecast to $10.6 billion, up from $7.5 billion when the transaction was originally announced, driving 8% rate-base growth. This supports our long-held belief that there are significant additional capital investment opportunities under a parent with a strong balance sheet and lower cost of capital, unlike Oncor’s previous parent, the bankrupt Energy Future Holdings. In Texas, the regulated operations benefit from above-average electricity demand. We forecast 1.4% annualized Texas electricity growth through 2030, higher than the 1.25% electricity growth we forecast for the consolidated U.S.

Additionally, Sempra’s Texas subsidiaries’ transmission assets should continue to benefit from Texas’ aggressive wind generation build-out. In ERCOT, there are roughly 87 GW of proposed renewable energy new-build projects (37 GW of wind, 47 GW of solar, and 3 GW of energy storage) in the interconnection queue, highlighting the continued appetite for renewable energy in the state. Sempra’s management notes that this has led to 4.3 GW of interconnection requests in the Panhandle region alone. Rate-base growth should drive earnings growth as Oncor invests in electric transmission and distribution to support both renewable energy and population growth in Texas.

Even though Texas regulators were sticklers during the Oncor acquisition approval process, we still consider the state a highly constructive regulatory jurisdiction. While 9.9% allowed returns on equity are only slightly higher than the national average, forward-looking rate-setting mechanisms and trackers reduce regulatory lag, allowing Sempra to turn capital investment into cash flow with minimal delay. This bodes well for the company’s aggressive capital plan in the state.

While we view California’s regulatory environment less constructively than other states’, Sempra’s emphasis on distribution-related safety and reliability infrastructure upgrades provides an attractive growth opportunity. Its investments are squarely in line with the regulators’ goals under California’s RAMP program, which focuses on risk mitigation across the utilities’ footprint.

Outside opportunities under RAMP, Sempra has numerous other capital investment opportunities in the state. We expect San Diego Gas & Electric to increase rate base 6% per year through 2023, supported by investments in transmission, fire hardening, information technology, and gas pipeline modernization and integrity. We expect Southern California Gas to increase rate base 9% through 2023, with transmission and distribution investments, gas pipeline modernization, and greenhouse gas emissions as key investment areas. Investments across these subsidiaries lead to combined 6.5% rate-base growth in the state.

Our less-than-favorable outlook for California utility regulation stems from increased regulatory risk, as demonstrated by Sempra’s less-than-perfect 2012 and 2016 rate-case outcomes. But the California Public Utilities Commission is a relatively constructive partner compared with regulators in many other states. The utilities’ upcoming general rate case will be a near-term indicator of the state regulatory environment under the RAMP program.

Aside from Sempra’s healthy regulated growth opportunities, investors should also benefit from its exposure to the growing liquefied natural gas market. Importantly, the structure of these contracts provides regulated-like returns for investors, supporting our dividend outlook. We think this is one reason management will hold on to its fast-growing natural gas infrastructure business, which capitalizes on the increasing incorporation of natural gas into the U.S. and Mexican economies, as well as the burgeoning integration of global natural gas markets. U.S. natural gas consumption set a record in 2018, and total demand could grow another 10% or more due to export facilities coming on line in the next few years.

The Cameron import facility initially suffered from weak U.S. gas pricing relative to global gas markets, but Sempra’s ability to convert it to an export facility should make it a valuable asset for shareholders long into the future. While the facility experienced delays, management expects all three trains to be producing LNG by mid-2020, and it is financially protected from any cost overruns or delays. In May, Sempra reached the final commissioning stage for Cameron Train 1.

What impresses us most is the ability of Sempra Energy’s management to move forward with its significant LNG development opportunities. At Cameron, Sempra has an opportunity to add two more trains, giving it five in total. Its Port Arthur facility on the Gulf Coast is well positioned to supply Europe. On the West Coast, Energia Costa Azul can economically supply Asian countries.

Sempra is moving toward solidifying these opportunities. Management recently announced a memorandum of understanding with Total that would allow the company to contract up to 9 million tons per year of LNG from future Sempra LNG projects, including ECA and Cameron Trains 4 and 5. The memo excludes Port Arthur, but we think that could be added later. These opportunities set up Sempra’s LNG unit to be a significant growth contributor in the middle of the next decade. Overall, we believe Sempra’s LNG terminal has some moatworthy characteristics, given its low cost basis relative to world LNG supply, long-term contracts, and favorable location.

We also think Sempra will retain its majority ownership in IEnova. It has an early-mover advantage in a time of Mexican infrastructure build-out, and it has strong relationships that could make it harder for outside investors to bid on new growth projects. This should keep competitors at arm’s length for now. IEnova’s portfolio consists mostly of long-term take-or-pay dollar-denominated and dollar-linked contracts. Infrastructure investment opportunities in Mexico are plentiful, given the country’s need for gas infrastructure, renewable energy, electric transmission, and refined products.

American Water Works' Renewed Focus on Dividend Rewards Investors Since its initial public offering in April 2008, American Water Works has increased earnings at a low-double-digit pace, topping most of its regulated peers. The earnings growth has rewarded investors with a total return of almost 500% in the 11 years since the spin-IPO by German utility RWE. Management historically focused on growth opportunities over its dividend payout, but management recently renewed its focus on dividend growth. American Water Works has now begun accelerating its dividend increases, averaging over 10% per year over the past few years. We expect an annual dividend growth rate of 10% for the next five years. The company's 54% projected payout ratio based on adjusted 2019 earnings is low for the sector, leaving plenty of room to increase the dividend faster than our 9% earnings growth forecast.

Improving regulatory frameworks, increasing operations and maintenance efficiency (adjusted O&M divided by adjusted revenue), and acquisitions have driven earnings growth. In late 2017, management trimmed its growth objectives for its nonregulated businesses, or market-based segment, targeting 10% of consolidated earnings by 2022 versus the previous 15% target by 2021. In 2018, nonregulated businesses generated about 9% of adjusted earnings before parent and other expenses, and we are bullish on the strategy. We project annual earnings per share growth of roughly 12% from the market-based segment over the next five years, allowing the company to achieve management’s 10% goal by 2020 or 2021.

Dividend Laggards On the opposite end of the spectrum are those utilities that we think will struggle to increase dividends in line with earnings, though they are among the most attractive on a price/fair value perspective. Southern is constrained by a high payout ratio from operational mishaps at Kemper and Vogtle. Dominion Energy's material equity issuances have pushed its payout ratio higher, limiting growth over our five-year outlook. And PPL's U.K. headwinds will create dividend uncertainty, resulting in no growth for several years and the potential for up to a 10% dividend cut in a worst-case scenario.

Southern's Operational Mishaps Lower Dividend Growth Outlook Southern has long been a consistent dividend growth machine, providing investors with annual dividend increases of about 3.5% for the past 10 years. We expect increases to continue at this rate, but that makes it one of the lowest growth rates among peers. We estimate Southern's dividend payout ratio on 2019 adjusted earnings will be near 80%, making it difficult for the company to continue to increase dividends in line with our earnings growth projections.

Still, we think the dividend is secure. Although Southern’s payout ratio is higher than the sector average, earnings power is spread over several jurisdictions, and the diversity increased with the AGL acquisition. We expect its payout ratio to fall into the mid-70s over the next five years as earnings growth outpaces dividend growth.

Southern is undergoing one of the most dramatic transformations in the usually stodgy world of regulated utilities. In 2000, almost 80% of electricity sold to customers was generated using coal. By 2030, we estimate it will be less than 20%, and the company recently announced a goal of low- and no-carbon generation by 2050 that will probably require the closure of its remaining coal plants. Nuclear, natural gas, and renewable energy are all increasing their share of generation.

However, the transformation has had hiccups. In 2017, wholly owned Georgia Power took over construction of the Vogtle nuclear plant after Toshiba’s Westinghouse Electric, which was building the two new units, declared bankruptcy. Vogtle’s total capital cost is now estimated to be over $20 billion, with Georgia Power’s share approximately $8.5 billion net of a $1.7 billion settlement payment from Toshiba. Although the plant is five years behind schedule and more than double the initial cost estimate, we believe the project will meet the revised schedule and the first reactor should begin operation by November 2021.

Another problem associated with Southern’s transformation is the delays and cost overruns at the Kemper (Mississippi) project, an integrated gasification combined-cycle power plant that was intended to convert lignite coal to synthesis gas and be the first commercial-scale generator to use carbon capture. The plant was three years behind schedule and more than double its initial cost estimate when wholly owned Mississippi Power abandoned the lignite-to-gas conversion.

The Kemper plant is now running using natural gas. In early 2018, Mississippi Power reached a settlement that allows it to charge customers for the generation side of the facility only. This led Southern to write off about $6 billion pretax related to investment in the abandoned lignite-to-gas operation.

Although these problems have been an embarrassment to one of the best management teams in the industry, we don’t believe the financial impacts will derail our estimated long-term annual EPS growth rate of 5% or put the company’s dividend or dividend growth at risk.

Dominion's Equity Needs Lower Dividend Growth Potential Although Dominion's annual dividend increases have averaged 9% over the past five years, we believe the currently attractive yield, elevated payout ratio, and an estimated 178 million more common shares outstanding (28% increase) by 2019 year-end versus 2017 will result in the board reducing dividend growth to the low single digits.

Reducing dividend increases to 2.5% per year would lower the payout ratio to about 78% by 2023. Although we are now less bullish on dividend increases, we still think the dividend yield and earnings growth could deliver low-double-digit returns through the next decade. Dominion remains the most attractive utility on a valuation basis in our coverage, trading at an 8% discount in an environment where we see utilities as 12% overvalued.

Dominion Energy changed its name from Dominion Resources in 2017. The company has also made a strategic pivot. Since 2010, it has focused on the development of new wide-moat projects with conservative strategies, exited the exploration and production business, sold or retired no-moat merchant energy plants, and made significant investments in moaty utility infrastructure.

The $4 billion Cove Point LNG export facility loaded its first tanker in 2018. We now expect the 48%-owned Atlantic Coast Pipeline to cost roughly $8 billion and not be in complete commercial operation until 2022. Both wide-moat infrastructure projects illustrate Dominion’s conservative strategy pivot.

Dominion has accelerated its capital expenditures and now expects growth investments to be roughly $26 billion, with about two thirds of the investment directed to its regulated utility in Virginia. Including maintenance capital expenditures, we expect total capital expenditures and equity investments in ACP to reach $35.5 billion over 2019-23. This should drive EPS growth over 5% annually.

Wide-moat businesses generate about 45% of Dominion’s operating earnings versus roughly half before the acquisition of Scana and acceleration of regulated utility investments. The balance of earnings will come from regulated gas and electric utilities with some of the most constructive regulation and attractive growth potential in the country.

PPL's U.K. Worries Will Limit Dividend Growth; Worst Case Is a Cut While the near term for PPL has attractive regulated growth opportunities that could produce 5.5% annual rate-base growth through 2021, it is the uncertainty around its U.K. operations that leaves PPL the only utility on our list at risk for a dividend cut beyond 2021.

We project roughly 1% dividend increases annually through 2021 as management cautiously readies itself for a U.K. regulatory outcome, with no increase in 2022 and 2023. Our dividend payout ratio rises to an uncomfortable 79% in 2022, as we forecast just 4% allowed returns for the RIIO-ED2, in line with what U.K. regulators recently proposed for gas distribution, gas transmission, and electricity transmission utilities. Best-case scenario, we think there will be no dividend growth in 2022 and 2023 as PPL manages earnings headwinds. PPL’s regulated cash flows should allow management to navigate a high payout ratio.

However, developments in the U.K. regulatory environment have consistently been below our bearish expectations. The U.K. has historically been a constructive regulatory jurisdiction, but political and regulatory environments are proving to be a significant headwind. If the U.K. regulatory environment deteriorates beyond our expectations, we think a worst-case scenario could result in PPL cutting its dividend 10% to a more manageable 70% payout ratio.

PPL plans to spend $14.3 billion at its domestic and international utilities over the next five years, but we think it will be difficult to offset declining returns in the U.K. We expect consolidated earnings to drop in 2022 and 2023. PPL’s international delivery segment is the largest distribution utility in the U.K., but it has added significant shareholder risk as the U.K. energy companies face political and regulatory pressure. Recently, U.K. regulators put in place elements of the next regulatory framework, RIIO-2. Positives of the framework include a calculation of regulated asset value and returns that remain economically similar to the current structure; no change in the economic asset life for depreciation; and an option for fast-track eligibility, for which PPL qualified under the last framework.

However, returns will probably be much lower. U.K. regulators recently suggested just 4% rates of return for gas distribution, gas transmission, and electricity transmission. If electricity distribution rates of return are subject to similar treatment, we think it will be difficult for PPL to invest significant growth capital to help offset what we expect will be materially lower returns. PPL has consistently done an excellent job earning incentive revenue, but we don’t think this will be enough to offset lower allowed returns.

PPL’s domestic regulated operations provide some stability to PPL’s cash flows and dividend payout. PPL has achieved constructive rate outcomes in Pennsylvania and Kentucky. Recently, the Kentucky commission allowed PPL’s KU and LG&E subsidiaries $187 million in rate increases as part of its review, including $110 million of bill credits associated with tax reform, with an allowed return on equity of 9.725%, in line with its peers’ allowed returns. We expect regulators to continue to support PPL’s growth projects in the state.

/s3.amazonaws.com/arc-authors/morningstar/689ab3b8-4029-4d7c-9975-43e4305e927a.jpg)

/s3.amazonaws.com/arc-authors/morningstar/ea0fcfae-4dcd-4aff-b606-7b0799c93519.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/347BSP2KJNBCLKVD7DGXSFLDLU.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/UBLNP5GU6FGPFN3AAPXRHIRQ5U.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/G7LHSQ2WCVH73BP6DDQQS5H6FA.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/689ab3b8-4029-4d7c-9975-43e4305e927a.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ea0fcfae-4dcd-4aff-b606-7b0799c93519.jpg)