A Deeper Look at Three of Our Top Performing Ultimate Stock-Pickers

Ahead of our conversation with Stephen Yacktman, Dennis Lynch, and Michael Keller at the Morningstar Investment Conference, we examine their top holdings and where they are putting money to work today.

By Eric Compton | Associate Stock Analyst

Since we launched the Ultimate Stock-Pickers concept more than seven years ago, we've worked closely with our fund research group to maintain a list of managers that not only have a solid track record of investment performance, but also are more likely to generate outperformance in future periods. That's not to say that the 22 fund managers represented on our Investment Manager Roster are always outperforming, it's just that over the long run we expect them to produce better performance than the market as a whole. And as we've seen during the past decade, that has been a difficult task for most large-cap active equity managers, with 2007 being the last year that more than 50% of all large-cap managers tracked by S&P Dow Jones were beating their benchmarks.

Even worse, at the end of last year, just 17.9% of active large-cap fund managers on average had outperformed the S&P 500 TR Index during the past 10 calendar years. The results were worse for large-cap core and large-cap growth managers, with just 17.2% and 6.4%, respectively, outperforming their benchmarks. Large-cap value managers have fared much better, with 39.0% beating the S&P 500 Value Index during the past decade. It has been this dreadful track record of investment performance that has fueled the growth of exchange-traded funds, or ETFs, which provide investors with market exposure at meaningfully lower costs than they would pay for actively managed funds.

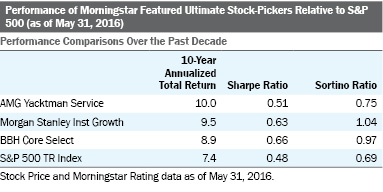

With most stocks trading at or above our analysts' fair value estimates from the start of 2013 to the middle of last year, it had been even more difficult for active managers to generate benchmark-beating performance. That has changed somewhat since the start of 2016, with nearly half of our Ultimate Stock-Pickers beating the S&P 500 TR index this year, but it will take an extended period of outperformance for our top managers' 1-, 3-, and 5-year numbers to get back on track. Even so, the 10-year performance results of our Ultimate Stock-Pickers remain top-tier, with more than 55% of them beating the S&P 500 TR Index, and the average amount of outperformance being 125 basis points.

We are fortunate to have three of these outperforming managers--Stephen Yacktman of Yacktman Funds; Dennis Lynch from Morgan Stanley Investment Management; and Michael Keller with Brown Brothers Harriman--join us for a panel discussion at the

on June 15, where we will be talking about some of their top holdings in the pursuit of some good stock ideas. For the sake of this article, we though that we'd take a deeper look at each of the strategies they employ for the funds that we track--Gold-rated

All three of our highlighted managers have outperformed the S&P 500 TR Index, as well as their respective categories, during the 10-year period ended May 31 (figures that have not changed much over the past several weeks). The value of compounding--something that Warren Buffett from

While the absolute and relative returns are great for all three of our funds, what about risk? After all, risk management and being compensated for risk should be at the forefront of all investors' minds. This is what the Sharpe and Sortino ratios attempt to normalize for. The Sharpe ratio is simply a measurement of risk-adjusted return. In this case, risk is defined as standard deviation, or volatility, and returns are defined as total returns minus the risk-free rate. The larger the ratio, the better the risk-adjusted returns. Here again, all three managers have outperformed the benchmark index, with BBH Core Select having the largest spread over the S&P 500.

The Sortino ratio adds a slightly different twist, where the denominator, instead of simply being the standard deviation of all returns, measures only downside deviations. This means that the Sortino ratio only penalizes downside volatility. Obviously, investors would desire all of the upside volatility they could get, think of the volatility of a 100% gain. Here again, all three managers have handily outperformed the S&P 500 TR Index, with both BBH Core Select and Morgan Stanley Inst Growth having wider spreads over the benchmark than AMG Yacktman Service. The key takeaway here is that when risk is defined as volatility, these three managers have added alpha. This is especially relevant in an environment where investors are questioning the value of active management.

As many of us have seen over the years, there are many different investment strategies, and no single approach works at all times. It is also difficult at times to distinguish pure luck from investment skill, which makes analysis difficult, especially in the short term. While many argue about what truly is an appropriate time horizon, we continue to believe that it is important to measure returns and make judgments from a long-term perspective. Although we pay close attention to 1-, 3-, and 5-year returns (as we think that they can be indicative of burgeoning trends in manager performance), we put more weight on 10-year performance, which should, in our view, be a long enough period of time to reveal patterns of genuine skill. We think that managers who have a solid investment strategy, and stick to it during different market cycles, tend to outperform in the long run. While each of the three managers run somewhat different strategies, there are commonalities that we believe have led to their success.

BBH Core Select is currently run by co-managers Timothy Hartch and Michael Keller. Hartch, who acts as the lead manager, has been running the fund since 2005. While Keller was named co-manager in 2008, he has been with the fund as an analyst since it adopted its current name in strategy in late 2005. BBH Core Select is classified as a Large Blend fund, investing primarily in large capitalization stocks with a blend of growth and value characteristics. The managers of the fund screen for companies with strong balance sheets, high free cash flow, and high returns on invested capital. That tends to narrow the pool of investable ideas down to around 150 companies, which the managers and their analysts then scrutinize for (among other things) managerial acumen and earnings growth potential. Any firm that they consider adding to the portfolio must be attractively priced, with a share price that reflects a discount of at least 25% to the team's estimate of intrinsic value. As their holdings approach 90% of those estimates, the managers begin trimming positions.

The portfolio tends to be fairly concentrated, with the norm tending to be anywhere between 25 and 30 holdings, because Hartch and Keller invest in only their best ideas. At the end of May, the fund had 30 total stock holdings, with its top 10 equity positions holdings accounting for half of the portfolio's overall value. The managers regard permanent capital loss, not volatility, as risk. Despite the portfolio's concentration, though, performance swings have been relatively modest over the years. Combine this loss-averse philosophy with the managers' stock-selection criteria, and the result has been a portfolio focused on high-quality market dominators, with 10-year performance comfortably above both the S&P 500 TR Index and the Morningstar Large Blend Category.

We believe that several things make BBH Core Select's strategy noteworthy. First, the fund's using bottom-up, fundamental analysis to arrive at an intrinsic value for each company it is investigating, and basing both buy and sell decisions on this methodology, provide it with a disciplined and consistent approach. While it may not seem special, and BBH Core Select is certainly not the only fund doing this type of in-depth fundamental research. There are many different strategies out there that rely on factors other than intrinsic value, and even for the ones that do consider fundamental analysis they often do so on a relative basis, not on an absolute basis.

This leads us to the second thing that is noteworthy about BBH Core Select, which is the fund's focus on long-term absolute returns in an environment where short-term relative performance seems to gather most of the attention. And finally, we would note that Hartch and Keller view the permanent loss of capital and not volatility as the true measure of risk. This may not seem like a meaningful distinction, but it is a key differentiator between the risks seen by those seeking fundamental value versus those who are swayed by what the often volatile and seemingly risky short-term voting of the markets may say.

Evidence of BBH Core Select's long-term approach can be found in the fund's annual turnover ratio, which is on the lower end of the spectrum of long-term funds, coming in at 8% relative to the Large Blend category at 60%. This aligns with the fund managers' penchant for finding quality companies and sticking with them. Hartch and Keller's penchant for companies generating high ROICs, with proven management teams with track records of shareholder-centric capital allocation, has also led them to invest more in companies with economic moats. Looking at the fund's most recent holdings, roughly 95% of BBH Core Select's portfolio is invested in firms with wide (70%) or narrow (25%) moats.

We find it striking that all 10 of BBH Core Select's top holdings are wide-moat rated firms, a testament to the importance of sustainable competitive advantages. Investors interested in what the managers of this fund have done lately should turn to our

, where we discussed BBH Core Select's new-money purchase of

Morgan Stanley Institutional Growth is classified as a Large Growth fund, investing primarily in big U.S. companies that are projected to grow faster than other large-cap stocks. Since 2004, Dennis Lynch has run the fund with a cadre of five co-managers working with him closely for more than a decade. A focus on disruptive change research and a long-term investment horizon have typically set the fund apart from its large-growth competitors. Lynch and his team generally look for companies with defensible business models that earn high ROICs and generate significant amounts of free cash flow. These companies often dominate their markets or benefit from a strong network effect.

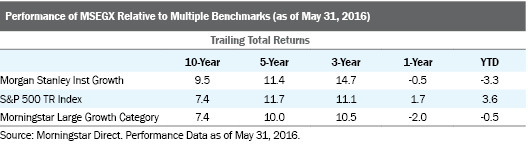

The team will also invest in less-established names, with spin-offs and the leftover "stub" companies frequently piquing Lynch's interest, as he finds that they often have few comparable competitors, and are generally misunderstood by the markets. Given their short histories and often less predictable earnings, these names (as well as those picked up through initial public offerings) tend to have meaningful short-term performance swings, leaving the fund with more volatile results (even for the Large Growth category). Fortunately, much of the fund's volatility has worked in its favor, with trailing 3-, 5-, and 10-year returns through May placing it in the category's top quartile.

While Morgan Stanley Institutional Growth employs much of the same core focus on fundamental analysis, with an emphasis on long-term competitive dynamics, that we saw at BBH Core Select, the fund's overall focus on large-cap growth stocks does lead to a portfolio with relatively few overlaps with its Large Blend brethren. The goal for Lynch and his team is to find firms that are still relatively early in their development and therefore have longer runways of above average growth ahead of them. This has led the fund to search for firms that are disruptive and are usually either evolving rapidly themselves or involved in nascent or rapidly changing industries. Understanding these firms, and assigning value to them, requires greater effort on forecasting future growth and identifying broad industry changes.

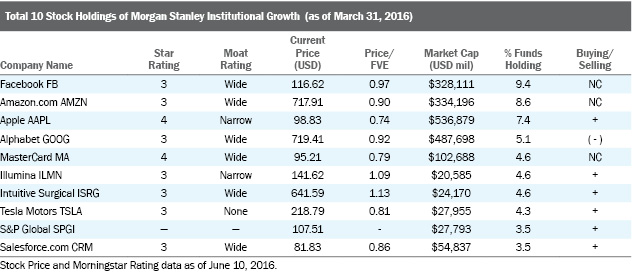

Lynch and his team focus on a 5- to 10-year competitive outlook for any company they are looking to invest in. In fact, they are so worried about the changing competitive dynamics of the marketplace that they have an analyst whose full-time job is to research disruptive changes, with this research incorporated into all of the other research that is done by other analysts covering specific companies and sectors. With this focus on competitive advantages it is no surprise that eight of the fund's top 10 holdings have narrow or wide economic moats. In addition to having promising futures built on structural competitive advantages, Lynch insists that the firms they invest in rely on different end markets and have low correlation relative to one another over the long run.

The managers of the fund are willing to go wherever their best stock ideas take them, though, and consequently pay little heed to the sector weightings of the benchmark indexes. Because they also manage separate small- and mid-cap investment mandates using the same philosophy, Morgan Stanley Institutional Growth tends to stay reliably in the large-cap zone, with most holdings having a market capitalization in excess of $10 billion. Annual turnover is marginally higher for the fund, though, at 34% at the end of the most recent period, compared with 8% for BBH Core Select (3% for AMG Yacktman) and 64% for the Large Growth category. Despite having just 32 stock holdings, the fund is also more concentrated than BBH Core Select (and more on par with AMG Yacktman), with its top 10 holdings accounting for 56% of the overall value of the fund at the end of the first quarter.

Given Morgan Stanley Institutional Growth's focus on emerging firms, many of their investments tend to have relatively short histories, with more than half of the portfolio's nine Internet-related stocks having held IPOs in the past five years. This is in stark contrast to the more "established" focus of our two other fund managers--BBH Core Select and AMG Yacktman. Internet-oriented names, such as wide-moat-rated

What is the fund currently looking at? During the

, we didn't see any drastic moves, but Lynch's additional purchase of shares of narrow-moat

We've highlighted Apple several times in the past few months, and Morningstar analyst Brian Colello continues to believe that the firm--trading at 74% of his $133 per share fair value estimate--is undervalued. Colello agrees that macroeconomic headwinds are largely driving the current weakness in Apple's shares, and he believes that the iPhone business and iOS ecosystem remain structurally sound, with Apple's lack of growth recently not pointing to a weakening competitive position or a loss of customer loyalty. We should also note that Ultimate Stock-Picker Berkshire Hathaway recently made a conviction buy of Apple, picking up 9.8 million shares during the first quarter.

AMG Yacktman Service is currently run by co-managers Stephen Yacktman and Jason Subotky. Yacktman's father Donald had run the fund for more than 20 years before his retirement in early May of this year. This officially completed a transition that was years in the making, as Stephen and co-manager Subotky have been more or less running things for several years now. That said, Donald Yacktman will remain on as an advisor at Yacktman Asset Management, with the aging manager still beholden to a 10-year employment contract that the team signed with

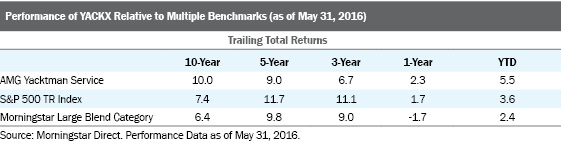

Like BBH Core Select, AMG Yacktman Service is classified as a Large Blend fund, investing primarily in large-cap stocks with a blend of growth and value characteristics. While the fund has struggled against both the S&P 500 TR index and the Large Blend category in each of the past four calendar years, Yacktman and Subotky are sticking with the methodology that led to the fund's longer-term success. The fund's managers have a reputation for being very patient investors and are comfortable with being temporarily out of step with the market. Their belief in the portfolio's collection of high-quality companies paid off during the 2015-16 correction, with the fund's 1-year and year-to-date results besting both the benchmark index and the Large Blend category. AMG Yacktman Service still trails both benchmarks over the trailing 3- and 5-year periods but leads by a big margin during the past 10 years.

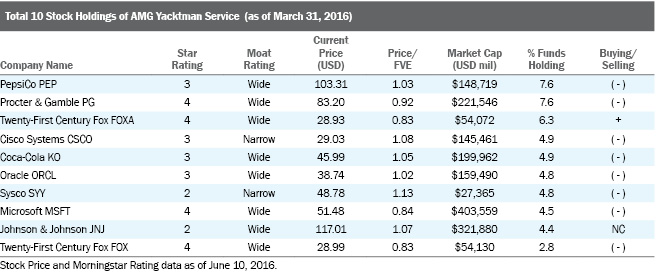

Similar to our other two other highlighted funds--BBH Core Select and Morgan Stanley Institutional Growth--AMG Yacktman Service has a long-term investment approach based on fundamental research. As part of their investment process, the managers of the fund attempt to identify companies that are trading at prices below their intrinsic value, with structurally advantaged businesses and shareholder-oriented management teams. Their preference for companies with strong free cash flows, reasonable debt, high ROICs, and modest cyclicality tends to lead them to high-quality consumer staples and discretionary companies, with a penchant more recently for technology firms. Branded consumer staples and discretionary stocks represent about half of the fund's stock holdings, compared with less than 25% for the S&P 500 TR index. Not surprisingly, the fund is also fairly concentrated, with its top 10 stock holdings accounting for 53% of the portfolio at the end of March.

The annual turnover ratio for AMG Yacktman Service is 3% compared with the Large Blend category at 60%. This aligns with the fund managers' penchant for finding quality companies and sticking with them. Yacktman and Subotky's penchant for companies generating high ROICs, with proven management teams with track records of shareholder-centric capital allocation, has also led them to invest more in companies with economic moats. Looking at the fund's most recent holdings, roughly 75% of BBH Core Select's portfolio is invested in firms with wide (56%) or narrow (19%) moats. The managers also have no issue with letting cash build up (to as much as 20% of assets) when they think that they cannot find good companies trading at reasonable prices. At the end of March, the fund had close to 18% of its total holdings in cash and cash equivalents.

The managers at AMG Yacktman Service are both picky and efficient. While being picky, using fundamental research as the foundation for investing, and ignoring the crowd are all classic investment truisms that sound nice in theory, they are much harder to carry out in real life. Indeed, the fund has been left for dead on more than one occasion, including during both the late 1990s and the mid-2000s, and again from 2012 through mid-2015. While the fund's managers are not deep contrarians, their value leanings and the fund's concentrated portfolio can leave it out of step with the broader market, especially in the latter stages of bull markets when the team often gets defensive. But this defensiveness ultimately led to outstanding relative returns during the 2000-02, 2008, and 2011 bear markets. Any lost gains during rallies have been made up on the downside.

While there is very little overlap between the holdings of Morgan Stanley Institutional Growth and the other two managers we're highlighting, there is a decent amount of overlap between AMG Yacktman Service and BBH Core Select. Wide-moat-rated

While most investors are constantly on the hunt for buy ideas, it can be valuable to take heed when our top managers are selling. Looking more closely at AMG Yacktman Service, the fund made high conviction sales of wide-moat-rated

Coca-Cola was a solid performer in the quarter, along with the general strength in the consumer staples sector. Given the market turmoil and global uncertainty, staples were favored due to the quality and consistency of their businesses. We think Coca-Cola could benefit from the recent Dollar weakness and achieve solid margin expansion as the company focuses on cutting costs.

We hope to use the format of our question-and-answer panel at the Morningstar Investment Conference to suss out more details than Michael Keller, Dennis Lynch or Stephen Yacktman reveal about their holdings in their quarterly commentaries, as well as how they think when they put money into names (as well as take it out), and what stocks might be more attractive to them right now. There are some differences among how these three managers run their portfolios, as well as the types holdings they prioritize, and we intend to focus our inquiries on names that are currently held in common (and in some cases not held where one would think they would be), and we'll give each of the managers an opportunity to talk a bit about those holdings and how they fit into their portfolios.

As part of our preparation for the event, we've put together a list of seven wide-moat-rated stocks--Oracle, Comcast, Microsoft,

While BBH Core Select actually increased its exposure in the first couple of months of the year, in April Keller took the fund's stake back down to beginning of the year levels. As for Yacktman, he believes that Oracle's best days of growth are likely behind it, but that the company should still produce strong and growing free cash flows over time. Even so, he reduced his fund's stake by 12% during the first quarter, with no meaningful commentary about the sale, but noting the following about the holding:

Oracle’s shares rallied after the company reported better-than-expected results. We continue to think the shares are attractive at the current valuation. Although Oracle’s best days of growth are likely behind the company, we think the business can produce strong free cash flow and continue to expand its business over time.

Morningstar analyst Rodney Nelson recently changed the moat trend rating on Oracle to negative from stable. Nelson notes that while he believes that the firm's wide economic moat remains intact the company is at a crossroads as it works to migrate application software and middleware customers to the cloud as it simultaneously combats the erosion of its legacy database business. In lowering his fair value estimate to $38 per share from $44, Nelson is basically acknowledging that the firm is fairly valued right now.

The most important takeaway from our revised outlook for Oracle is the ever-expanding assault on the firm's legacy database business. Historically, software compatibility concerns and minimal viable alternatives have allowed Oracle to command premium pricing on its database solutions. Nelson notes, though, that the rise of lower-cost alternatives from legacy rivals such as Microsoft's SQL Server and open-source upstarts is beginning to erode Oracle's database business, from both revenue and switching cost perspectives. This is increasingly apparent in public cloud environments, where open-source solutions have matured to the point to mitigate compatibility concerns with Oracle’s products while the extreme cost savings are lowering customer switching costs. While Nelson believes that Oracle can manage this decline elegantly, he expects database revenue to continue to wane over time.

Nelson goes on to note that the application and middleware businesses should retain their wide-moat characteristics, built on customer switching costs and intangible assets. He expects the former moat source to be maintained as customers continue to value Oracle’s applications around CRM, ERP, HCM, and Java-based Fusion middleware, with rip-and-replace viewed as too costly of a move. Nelson also believes that Oracle’s vertical-specific application portfolio looks attractive, particularly given the intimate knowledge required to build (and ultimately train end users) to use these products. While he ultimately feels that Oracle should be able to sustain its wide economic moat, Nelson acknowledges that there is ample heavy lifting in the offing.

If you're interested in receiving e-mail alerts about upcoming articles from The Ultimate Stock-Pickers Team, please sign up here.

Disclosure: Eric Compton own no shares of any of the securities mentioned above. It should also be noted that Morningstar's Institutional Equity Research Service offers research and analyst access to institutional asset managers. Through this service, Morningstar may have a business relationship with fund companies discussed in this report. Our business relationships in no way influence the funds or stocks discussed here.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/BG4IFJHA25B6RKD3XNUYKROBBM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/4QBQ2NBJMFG5HGQTDEYCXY5OOI.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/2RGHQJTF4ZEURNSAGBY7CSHCUQ.jpg)