COVID-19 Vaccine Distribution and Herd Immunity to End Pandemic

Successful vaccine development and rollout will boost industry goodwill and reduce ESG risk, but we’re keeping our valuations steady.

In this first of three articles, we give our outlook for the COVID-19 vaccine market and distribution. Subsequent articles will cover coronavirus treatments and the prospects for the companies involved.

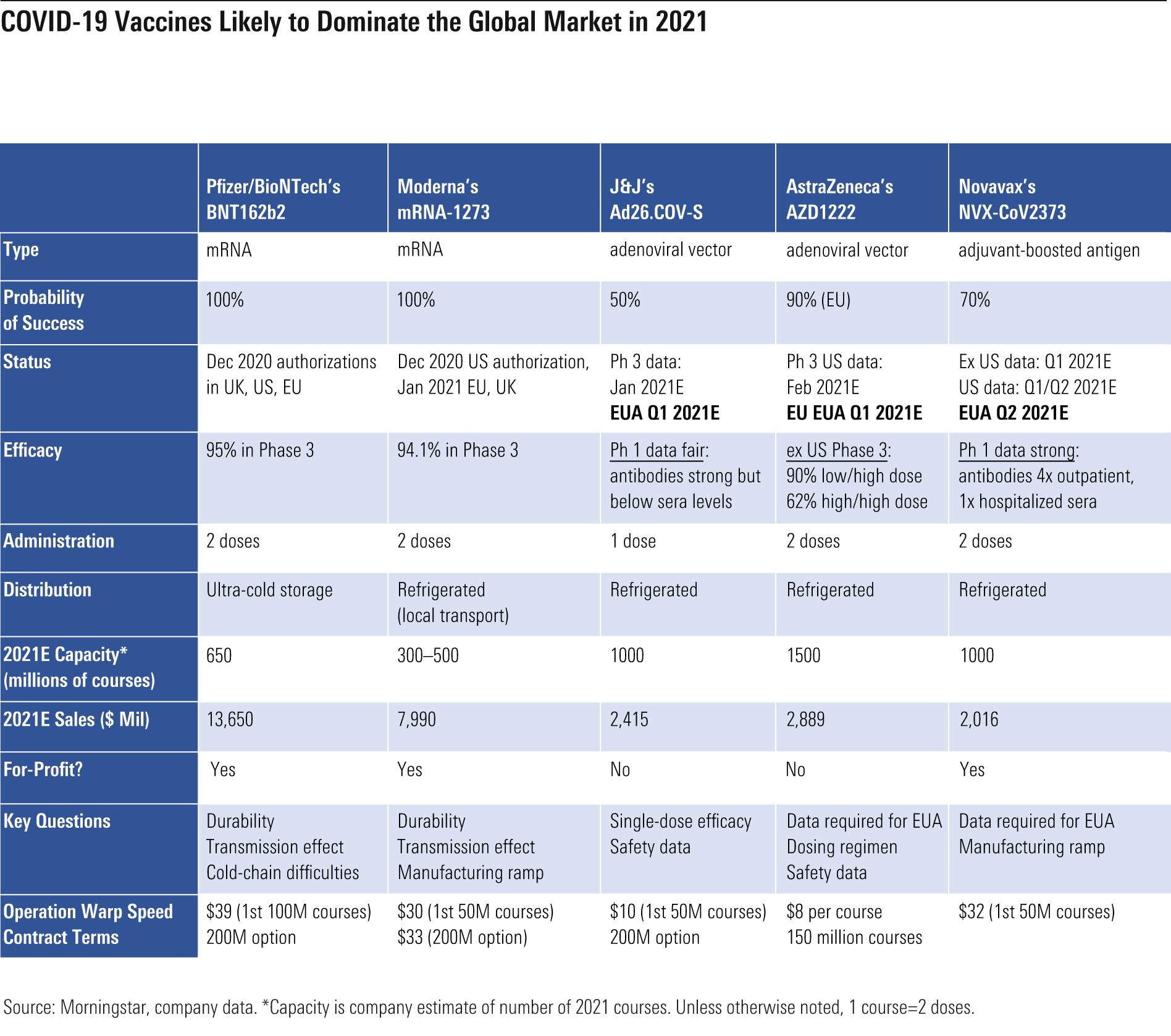

Following a year with more than 83 million cases and 1.8 million deaths reported globally due to COVID-19, 2021 begins with two newly authorized vaccines being distributed to high-priority populations in the United States and Europe. These mRNA vaccines from Pfizer/BioNTech PFE/BNTX and Moderna MRNA have set a high bar for efficacy and safety, and they appear poised to ramp up supply and dominate the U.S. market throughout the first half of the year, supporting a foundation for herd immunity in the U.S. by midyear. With additional support from Johnson & Johnson JNJ, Novavax NVAX, AstraZeneca AZN, and Chinese and Russian vaccine programs, global herd immunity looks achievable by 2023.

Despite significant vaccine sales potential in 2021, the uncertain market duration prevents significant impact on our discounted cash flow-based fair value estimates. COVID-19 vaccine companies generally appear fairly or overvalued, although AstraZeneca and Pfizer trade at slight discounts to our fair value estimates.

- We forecast a $39 billion COVID-19 vaccine market in 2021, as the most developed markets achieve herd immunity, and a $16 billion market in 2022, as less developed markets see vaccine distribution beginning in 2021 but extending into 2022-23.

- Our estimates assume 2021 vaccine supply for 2.6 billion people (3.3 billion if all programs are approved), well below manufacturer-cited capacity levels above 5 billion, as we factor in various postauthorization hurdles including supply, transportation, and state-level challenges.

- We expect $13.7 billion in global sales for Pfizer/BioNTech's Comirnaty in 2021 and significant profits through 2022, given premium pricing, strong supply, first-to-market status, and high efficacy.

- Despite its much lower manufacturing capacity, we expect Moderna to see $8 billion in 2021 revenue related to its COVID-19 vaccine mRNA-1273, driven by Operation Warp Speed in the first half of 2021 and sales to other developed markets in the second half.

- We see uncertainty around authorization of additional vaccines, but data from Johnson & Johnson, Novavax, and AstraZeneca in the first quarter will clarify how broadly capacity can stretch in 2021. We assume the U.S. will see sufficient supply to achieve herd immunity by mid-2021.

Speed of Vaccine Development Reinforces Moats, but Little Impact on Valuations The majority of the larger biopharma companies we cover have wide economic moats. We believe their innovative power reinforces the strength of the group's core pillar of competitive advantage that is sourced through intangible assets. We don't expect COVID-19 vaccines to generate a long duration of sales, as herd immunity is likely to cap sales over a much shorter period than is applicable to our decade-plus outlook for a moat, but the speed of the effective development shows how the industry can adapt and innovate to treat disease. We believe this partially reflects development strength that applies in more traditional disease settings where the sales cycle is much longer. Additionally, we believe the goodwill the industry has established with the world governments will lead to less pressure on drug prices through new policy reforms, as governments see the importance of a vibrant drug industry.

As we expect a relatively short period to achieve herd immunity to COVID-19, we don’t see a major impact from COVID-19 vaccines on the valuations of larger biopharma companies. Strong sales in 2021 are beneficial to valuations, but the steep sales drop-off means a relatively modest impact to our discounted cash flow valuation models. Nevertheless, we do expect the strong goodwill engendered with policymakers to begin to reduce the risk overhang on the group due to concerns over major drug pricing reforms, especially in the U.S., where aggressive drug pricing controls have been discussed but look less likely as the industry is solving the COVID-19 pandemic.

Drug and vaccine prices are a sore spot within the ESG risk of access to medicines. However, COVID-19 vaccines are priced low enough to ensure access globally, with several companies committed to nonprofit levels. While some vaccine companies did receive government funding, we believe the commitment to low and nonprofit prices will partially reduce the ESG risk of access to treatments for the industry.

Establishing Herd Immunity to End the Pandemic We expect that recent holiday travel and the initial slow rollout of vaccines are likely to create continued high infection rates in the first quarter of 2021. We assume nearly 12 million U.S. cases and roughly 100,000 U.S. deaths in 2021, largely in the first quarter.

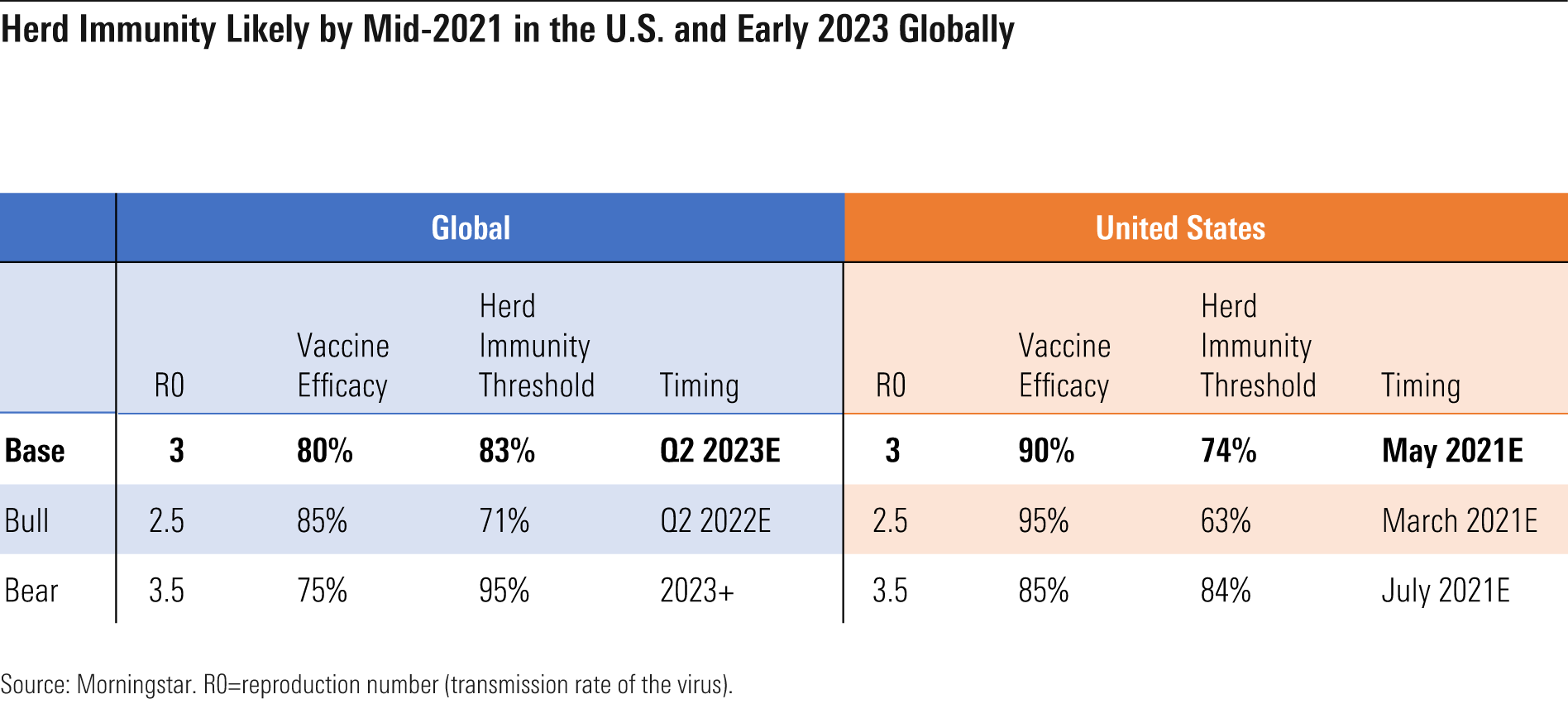

While social distancing, masks, and new COVID-19 treatments help combat the COVID-19 pandemic, herd immunity is likely needed to end it. Herd immunity will occur when enough of the population is immune to COVID-19, either by developing resistance via previous COVID-19 infection or by vaccination, that the virus runs out of susceptible individuals to infect, which leads to falling rates of infection even with no further interventions. Using our estimates for virus transmission, the percentage of the population that has recovered from infection, the efficacy of vaccination, and the speed of vaccine administration, we think herd immunity can be achieved in the U.S. by mid-2021 and globally by 2023.

COVID-19 Vaccine Rollout Underway Two mRNA vaccines are now broadly authorized in the U.S. and Europe, and four additional vaccines will be generating data during the first quarter that could quickly open up additional supply.

- Pfizer/BioNTech's vaccine, Comirnaty, was first authorized in the United Kingdom on Dec. 2 under an emergency approval, with European Commission conditional approval on Dec. 21. The U.S. issued an emergency use authorization of the vaccine on Dec. 11.

- Moderna's mRNA vaccine, mRNA-1273, received a U.S. emergency use authorization on Dec. 18. It was then granted conditional approval in the European Union on Jan. 6 and emergency approval in the U.K. on Jan. 8.

Johnson & Johnson’s phase 3 trial could have data in January, followed by AstraZeneca’s U.S. trial in February and Novavax and CureVac CVAC data later in the first quarter.

Vaccine development is underway at multiple other companies, but these could have tougher hurdles. We assume that AstraZeneca and CureVac do not supply the U.S. market, given AstraZeneca’s poor record of data disclosure and questions on efficacy and CureVac’s large European contract and longer timeline to availability. Globally, we see supply for 2.6 billion people globally in 2021.

We think there will be enough vaccine for all U.S. adults who want it by roughly mid-2021, with other developed countries seeing supply throughout 2021. However, not all will be able to pick their specific vaccine if variations in efficacy emerge, due to capacity limits on each vaccine. Our U.S. assumptions put us roughly in line with Operation Warp Speed’s latest projections for 100 million Americans to be vaccinated by the end of the first quarter (we assume 115 million).

The Covax Facility, coordinated by the World Health Organization, the Coalition for Epidemic Preparedness Innovations, and international vaccine alliance Gavi, represents 190 countries and more than 60% of the global population and hopes to vaccinate the most vulnerable 20% against COVID-19 by the end of 2021. We expect developing nations are likely to see enough supply for higher-risk individuals by the end of 2021, with broader vaccination going into 2022, consistent with Covax. We expect significant developing-market agreements with AstraZeneca, Johnson & Johnson, and Novavax could form the foundation of potential supply in the developing world, and these markets are therefore more reliant on success of upcoming clinical trials. China- and Russia-based vaccine programs are also contracting with developing markets, adding to potential supply.

We Forecast COVID-19 Vaccines to Yield Sales of $39 Billion in 2021 We see vaccine sales of $39 billion in 2021 followed by $16 billion in sales in 2022 on a probability-adjusted basis (accounting for development risks for vaccines still in trials).

Endemic Virus Could Create Long-Term Market for Vaccine Companies If reinfection is common and we can't vaccinate most of the world's population, the virus will become endemic. An endemic virus could mean the development of a long-term market for coronavirus vaccines, but we see significant uncertainties around evolution of this market beyond the current pandemic, which we assume runs through 2023 on a global level.

Reinfection could be driven by several factors, including asymptomatic individuals, waning immunity, and immune escape. Reinfection with common colds (endemic coronavirus) are common within a year, and the same flu strain can reinfect in less than two years, but SARS survivors had strong neutralizing antibodies for two to five years.

We currently assume that vaccinations could lead to global herd immunity by early 2023, which would lower the chances of the virus becoming endemic. Therefore, we do not model sales of vaccines beyond 2023.

If the virus becomes endemic and requires vaccination, we expect there are two basic ways the market could evolve:

- as a seasonal combination vaccine administered with an influenza vaccine, or

- as a stand-alone vaccine given every year, or perhaps every two to three years, depending on the duration of efficacy.

In either case, single-dose vaccination and refrigerator stability would be key differentiators. Adenoviral vector-based vaccines, like those from Johnson & Johnson and AstraZeneca, could be less effective in an endemic market, as immunity to the vectors could interfere with efficacy of booster shots.

Phase 1 data from Moderna’s vaccine released in December showed high antibody titers three months following the second dose in all age groups were still higher than median levels in convalescent serum samples. Therefore, duration for COVID-19 vaccine efficacy could fit well with seasonal annual influenza vaccine schedules.

The flu vaccine market is roughly $1.6 billion in the U.S. and $4 billion globally, with 500 million doses produced annually for the global market by leading vaccine markers including Sanofi SNY, Glaxo GSK, and CSL CSLLY. If coronavirus vaccines are required annually, we think it could be logical to offer a combination with seasonal influenza vaccines in the fall, and that we could see significant market disruption. For example, assuming a price around $15 (a premium to the global average flu vaccine price) and 1 billion vaccinated annually against flu and coronavirus (a significant step up from the 500 million flu vaccines sold globally each year) would lead to a $15 billion annual market.

The flu vaccine market is ripe for change, as it still relies on 40-year-old egg-based technology to produce inactivated virus for three or four strains of the flu virus each season, resulting in only roughly 50% efficacy. There is significant potential to reduce mRNA vaccine dosages for coronavirus vaccines with self-amplifying technology, and to include genetic code covering more flu variants that could boost flu vaccine efficacy. If these vaccines could be combined, the investment in mRNA vaccine technology during the pandemic could prove strong enough to lead to a significant disruption in the existing vaccine market. Several vaccine companies have already indicated they will be advancing combination vaccines, and we're seeing progress with flu vaccine programs at leading COVID-19 vaccine firms.

- Moderna started development of a flu vaccine in September 2020, with the potential goal of creating combination vaccines.

- Pfizer and BioNTech's initial collaboration was centered on a flu vaccine.

- Novavax had positive phase 3 data in March 2020 for its insect cell-based NanoFlu against Sanofi's Fluzone, and NVX-CoV2373 is entering late-stage trials for SARS-CoV-2.

However, if coronavirus vaccines last for a few years, we would expect a stand-alone vaccine market to develop, roughly $5 billion-$10 billion annually. While we only have four to six months of data showing continued efficacy for the leading mRNA vaccines, it is possible that vaccines will last more than a year. A recent study suggested that recovered COVID-19 patients still have enough immune cells to prevent illness six to eight months after infection, with modest declines in antibody levels, slight declines in T-cells (which can kill infected cells), and an increase in B-cells (which can make antibodies) over this time. The persistence of these cells could imply protection for years, perhaps mirroring the immune cell response that is still present in SARS survivors after 17 years.

In such a market, single-dose potential and room temperature or at least refrigerator stability would be differentiators; this could favor later entrants. Although mRNA vaccines require colder temperatures and two doses, multiple other vaccines appear to be stable at refrigerated temperatures. Merck MRK stands out as a high-risk/high-reward competitor in a long-term coronavirus market, as it has two candidates that could require a single dose and one that could be tested as an oral formulation.

Diving Into Safety and Efficacy at Different Vaccine Companies While the Food and Drug Administration's initial industry guidance on COVID-19 vaccine development in June 2020 had minimal details on requirements for emergency use authorizations, its October 2020 guidelines filled in the gaps. Both Pfizer/BioNTech and Moderna have met these requirements and were granted EUAs. Overall, we think the Pfizer/BioNTech and Moderna vaccines look strong and quite similar on efficacy, with slightly higher reactogenicity from Moderna's vaccine (potentially due to the higher dose).

While the Moderna and Pfizer/BioNTech mRNA vaccines used novel technology, such gene-based vaccines have produced very strong efficacy and safety data from phase 3 trials. This could partly be a result of the fact that gene-based vaccines more closely mimic natural infection, as the viral protein (in this case, the spike protein) ends up being displayed on a cell’s surface, potentially stimulating a better T-cell response than injected proteins. The mRNA vaccine could also have an edge over viral vector vaccines, as individuals can have pre-existing immunity to the vector itself, reducing effectiveness. We’re optimistic about the safety profile for mRNA vaccines, as short-term safety data is positive and rapid degradation of mRNA and the lipid nanoparticle shell in the body should minimize long-term risks, as well.

Even though the Pfizer and Moderna trials have met their primary efficacy endpoints and the vaccines have obtained EUAs, patients still need to be monitored for long-term efficacy and safety. However, if volunteers in the trials received the placebo, they could be eager to obtain the vaccine, whether as part of a trial follow-up or by leaving the study. In addition, as effective vaccines become available via EUAs, volunteers could become less interested in enrolling or staying enrolled in clinical studies for newer vaccines, which could slow enrollment or reduce data quality. Johnson & Johnson’s trial has completed enrollment, but AstraZeneca’s U.S. trial hadn’t as of Dec. 30. Future phase 3 trials for other vaccines could have different designs to avoid issues with placebo patients dropping out to get available vaccines.

Beyond trial design questions, there are still a large number of unknowns relating to the safety and efficacy of COVID-19 vaccines. On efficacy, we think the biggest outstanding questions are surrounding duration, efficacy against infection, and efficacy in children. Data on all of these should be available in 2021. On safety, vaccination of millions under EUAs will determine whether any rare side effects emerge; Bell’s palsy (mRNA vaccines), transverse myelitis (AstraZeneca), and anaphylaxis (Pfizer/BioNTech vaccine) are all areas that will be watched closely.

Vaccine Distribution Should Accelerate With the Help of Pharmacies With Pfizer/BioNTech and Moderna beginning vaccine distribution, the U.S. had tracked only 2.8 million vaccinations of the 12.4 million doses distributed as of Jan. 1. This is short of initial goals, but we expect vaccination rates to accelerate following the holidays and as pharmacies become more involved in vaccinations. While hospitals are covering the first vaccinations among healthcare workers, we expect pharmacies to play a critical role, initially with nursing home vaccinations and then as vaccination expands to the broader population. We assume pharmacies will give the U.S. the capacity for 70 million COVID-19 vaccine shots a month, consistent with peak influenza vaccination rates.

The role of pharmacies in vaccination has been expanding since the 1990s and was often cited in the success of swine flu vaccine administration 10 years ago. Pharmacies are also used to administering multidose vaccines, including shingles, hepatitis A and B, and HPV. The Department of Health and Human Services officially partnered with independent and chain pharmacies in November 2020 for administration of vaccines across the country. As pharmacies gain more control over the administration of vaccines in the U.S., we expect vaccination rates to accelerate dramatically.

Long-term care facilities began to sign up in mid-October for free vaccination for their residents by CVS CVS and Walgreens WBA, a process that began in mid-December and is expected to take roughly three on-site visits per facility over a two-month period. Walgreens and CVS announced in early January that they expect to complete first doses at skilled nursing facilities by Jan. 25. CVS is partnered with 8,000 of the roughly 15,000 such facilities in the U.S. and Walgreens with the balance. Administration has been slowed by a number of small facilities requiring in-room visits and slow uptake by staff. Including skilled nursing facilities, CVS will target 4 million residents and staff at 40,000 long-term care facilities and Walgreens is targeting 3 million at 35,000 facilities as part of the broad public-private partnership. CVS noted in early January that about three fourths of its targeted facilities have been activated by states already, with first doses expected largely in January.

Given the slow early rollout among healthcare workers and long-term care facilities--and growing vaccine inventory--many states are moving on to the next phases of vaccination earlier than we had expected. In early January, Operating Warp Speed said it would expand the federal program for vaccinations to 3,000-6,000 pharmacies later in the month, which we think will accelerate the vaccination process in broader populations, such as non-healthcare essential workers and Americans older than 65. Some states have already begun using pharmacies for these priority groups, with state-level rollouts, but the federal program allows direct allocation of vaccine to pharmacies. CVS has said its pharmacies are capable of administering 20 million-25 million shots per month, which appears consistent with our view that 70 million shots per month across all large pharmacies is achievable.

The government tracks COVID-19 vaccine shipments with a software program called Tiberius, linking government and shipping databases. As sites of administration in various states need more vaccines, they can place orders through Operation Warp Speed, which will direct Moderna (via McKesson MCK) or Pfizer (directly) to ship the product. There will also be a data exchange system “data lake” between public and private databases to connect shipping data to data from immunization registries, allowing states to track inventory in different locations. Vaccination sites are also expected to update immunization registries, either with existing vaccine registries or with the new vaccine administration management system, to support timely delivery of second shots for each vaccinated adult.

Potential Issues Remain With Vaccine Distribution Pfizer's vaccine must be shipped between negative 60 C and negative 90 C, roughly the temperature of dry ice (negative 78 C), and thermal shippers can track location and temperature and store vaccines for up to 15 days. That largely limits Pfizer's reach to developed countries, at least until it launches a lyophilized (freeze-dried) formulation, potentially in 2022. We think Pfizer's experience with shipping vaccine for trials--to 152 sites globally--should serve it well as it develops its commercial vaccine distribution and logistics plan. However, even if vaccine distribution to states runs smoothly, the states need to prepare for allocating across counties and in more rural areas would likely need to be prepared to open and repackage Pfizer/BioNTech vaccines into smaller shipments, since the minimum number of doses the vaccine companies can ship (a single tray) is 975.

Moderna’s vaccine is launching at roughly the same time with less stringent storage conditions, potentially due to its formulation and lipid system. Moderna’s less stringent shipping requirements--only standard freezer temperature required, similar to most chickenpox vaccines--should make its logistics slightly easier. We think states could opt to direct their Moderna supply to more rural areas. Moderna’s 10-dose vial can be kitted into 10-vial cartons or larger cases or pallets and shipped at negative 20 C (standard freezer temperature) in temperature-controlled trucks. Local transport can also be done at refrigerated temperatures. Moderna’s vaccine also doesn’t need to be diluted before administering, unlike Pfizer/BioNTech’s, which simplifies the vaccination process for pharmacists.

Even if vaccine delivery, tracking, and scheduling run as planned, vaccine makers still face multiple potential shortages. Therefore, in addition to probability-weighting our sales and supply numbers based on stage of development and likelihood clinical success, we also assume slightly lower 2021 manufacturing capacity than vaccine companies forecast to account for these uncertainties. For example, for Pfizer/BioNTech, our 1 billion-dose assumption is below the company’s own 1.3 billion projection, and our Moderna assumption is 540 million, below the low end of the company’s 600 million-1 billion dose guidance.

- The new mRNA vaccine production could create lipid bottlenecks.

- Glass vial shortage could build heading into 2022.

- Dry ice supplies should be sufficient.

- Syringe production ramp looks capable of keeping up with demand, but supply will be tight.

MORN DODFX VINIX VWILX TSVA EGO WU Brightstart429plan MRO VZ MOAT T NKE CMCSA GOOG

/s3.amazonaws.com/arc-authors/morningstar/558ccc7b-2d37-4a8c-babf-feca8e10da32.jpg)

/s3.amazonaws.com/arc-authors/morningstar/a90c659a-a3c5-4ebe-9278-1eabaddc376f.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/347BSP2KJNBCLKVD7DGXSFLDLU.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/UBLNP5GU6FGPFN3AAPXRHIRQ5U.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/G7LHSQ2WCVH73BP6DDQQS5H6FA.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/558ccc7b-2d37-4a8c-babf-feca8e10da32.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/a90c659a-a3c5-4ebe-9278-1eabaddc376f.jpg)