Bausch & Lomb IPO Attracts Investors Amid Turbulence

The eye care company's stock sale gives boost to lifeless IPO market.

Even as stocks continued to see wild swings, the market for companies offering new new shares cracked open.

Investors hungry for attractive initial public offerings pounced on Bausch & Lomb BLCO shares in their first day of trading Friday, driving the stock up more than 9% from its offering price of $18 once it began trading in the open market.

The deal moved forward after investors extracted a steep price concession from the eye care company, landing shares in an established and profitable business at a 14% discount from an already marked-down level. The offering on Friday came a day after one of the worst market selloffs this year and amid a moribund IPO market.

Bausch Health BHC raised $630 million, well below the $840 million it expected when it set a price range of $21 to $24 a share in late April.

The closely watched deal provided a ray of hope in an otherwise dismal landscape for new issues and may give the greenlight for Bausch Health to move forward with a second planned offering of shares in its Solta Medical unit, which focuses on skin-care therapies and treatments.

How Valuable Is Bausch & Lomb?

Bausch Health sold 10% of Bausch & Lomb, or 35 million shares, assigning an initial market value of about $6.3 billion to the newly spun-out company. If Bausch & Lomb sported multiples closer to its main competitor, the Switzerland-based eye care device company Alcon ALC, it would command a market valuation of $14 billion to $15 billion, according to Morningstar equity analyst Aaron Degagne. Alcon trades at 23 times enterprise value/EBITDA, or earnings before interest, taxes, depreciation, and amortization, and 5 times enterprise value/sales.

"At these prices, the company definitely looks undervalued," says Degagne. "We value Bausch & Lomb at $10.1 billion based on an implied share price of $28."

Bausch & Lomb now holds a higher market value than the $5.8 billion at which its parent trades. Parent company Bausch Health is expected to distribute its remaining 90% stake to shareholders once the lockup period expires in early September, and they stand to gain a more valuable stock. The IPO is unusual, too, in that the spun-out company represents 45% of the parent's revenue and its chief executive will move to Bausch & Lomb.

Bausch Health first signaled its intent to take Bausch & Lomb public in 2020 and was widely expected to sell a 20% stake at a higher price range. When terms of the deal were released in late April, investors expressed misgivings by selling off shares of the parent.

"It was a missed opportunity not coming in 2021," Morningstar's Degagne says. "I was expecting 20% and $2 billion raised rather than half that amount."

Degagne notes, too, that the proceeds from the IPO will barely make a dent in Bausch Health's $22 billion debt load. A spin out of Solta is expected to reap an additional $1 billion to $2 billion to help reduce the company's debt.

Bausch Health is the former Valeant Pharmaceuticals, which grew through serial acquisitions and whose shares collapsed spectacularly in 2015 amid an accounting scandal and accusations of price gouging.

How Strong Is Bausch & Lomb's Business?

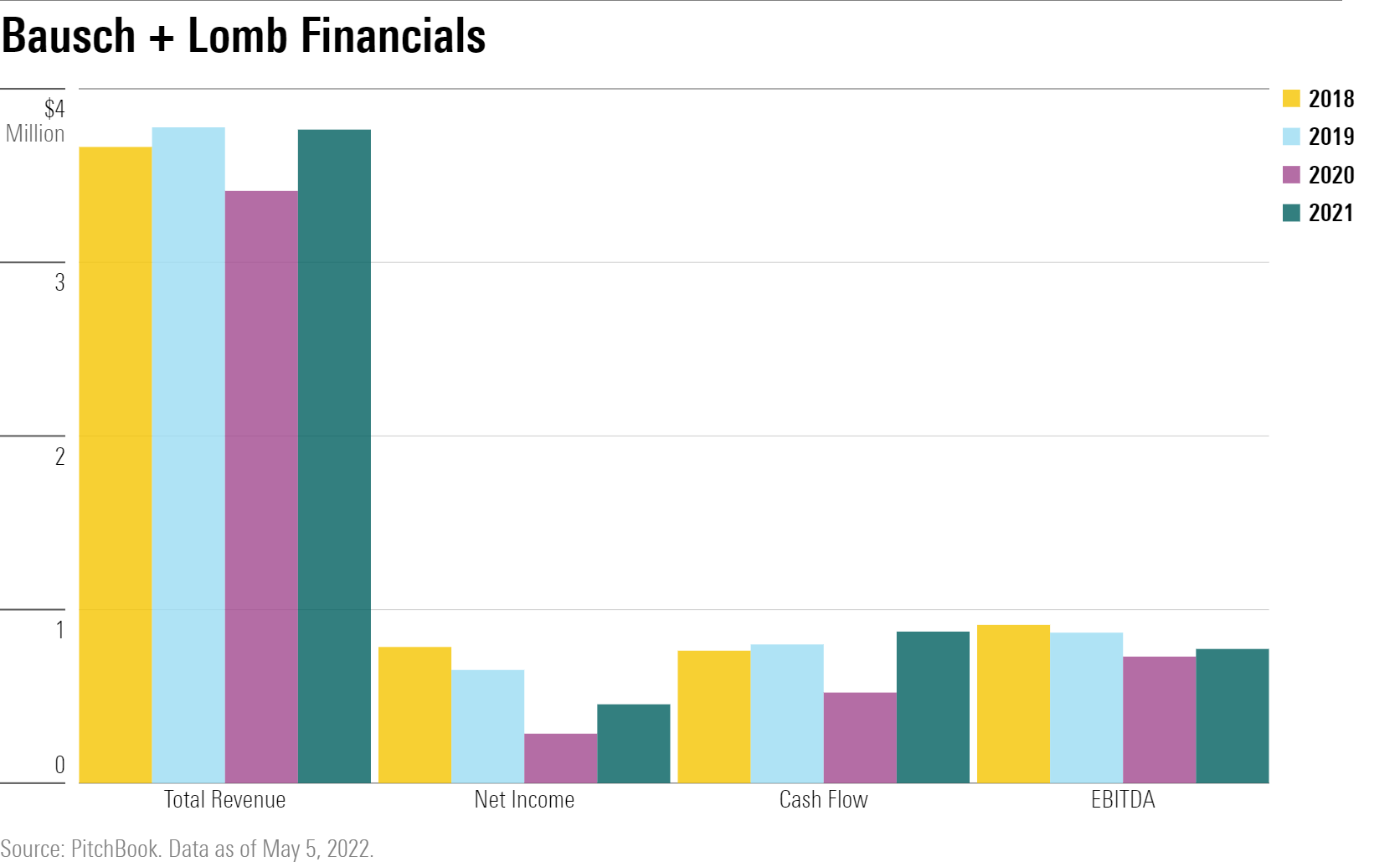

In Bausch & Lomb, investors get a brand-name, mature business with revenue that grew 9% to nearly $4 billion in 2021 as conditions for healthcare services and treatments improved amid the pandemic recovery. Conversely, sales fell by 10% in 2020 because of coronavirus restrictions. Typically, Bausch & Lomb can be expected to produce more steady-Eddie-type growth of 4%-5% a year in revenue.

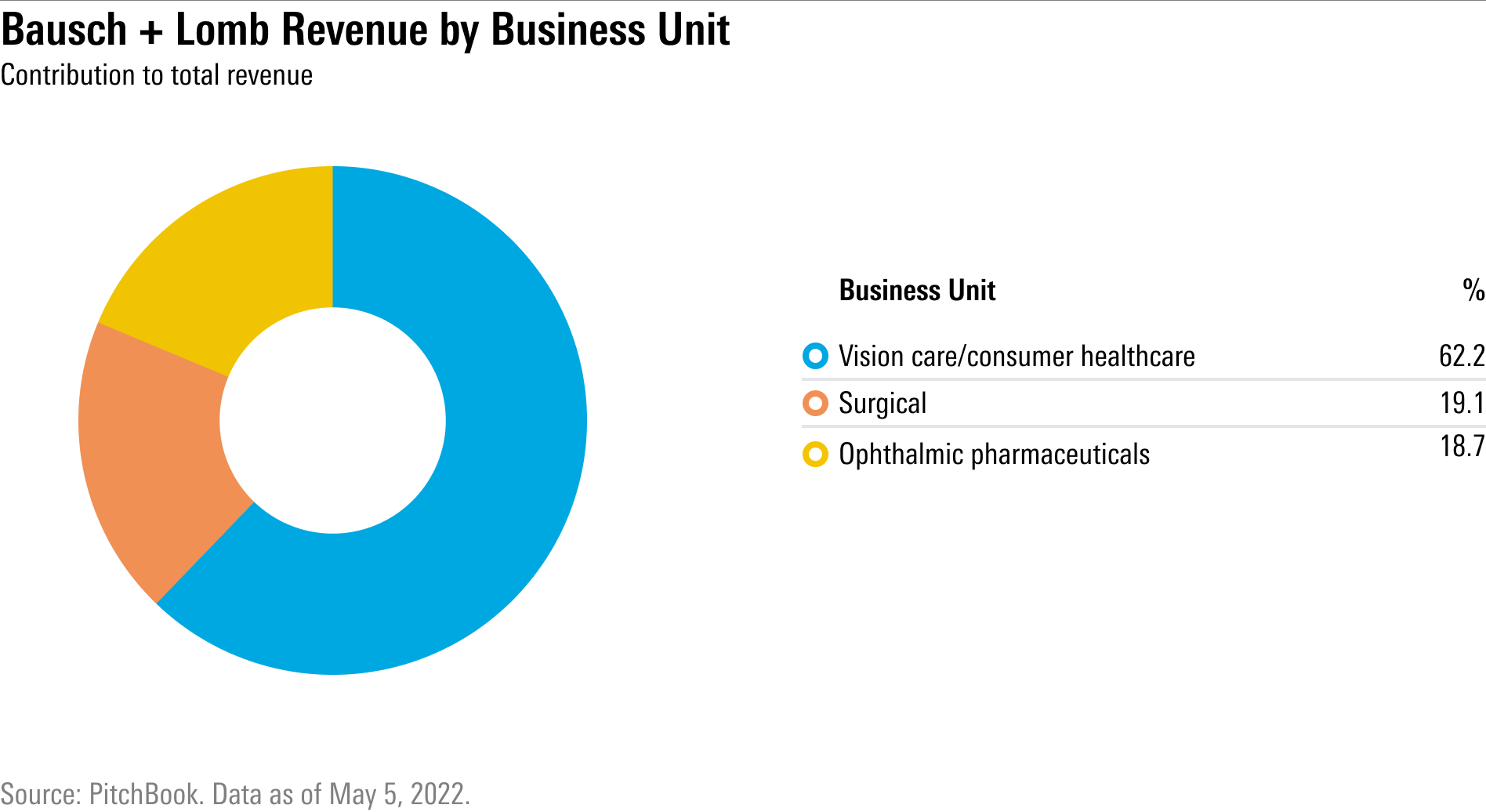

Its contact lens business accounts for more than 60% of revenues, followed by a surgical instrument segment representing about 19%, and a line of ophthalmology pharmaceutical products used to treat eye conditions such as glaucoma and macular degeneration at about 18%.

An aging population, new products, and new global markets are tailwinds for its continued growth, says Degagne.

What Has This Year's IPO Market Been Like?

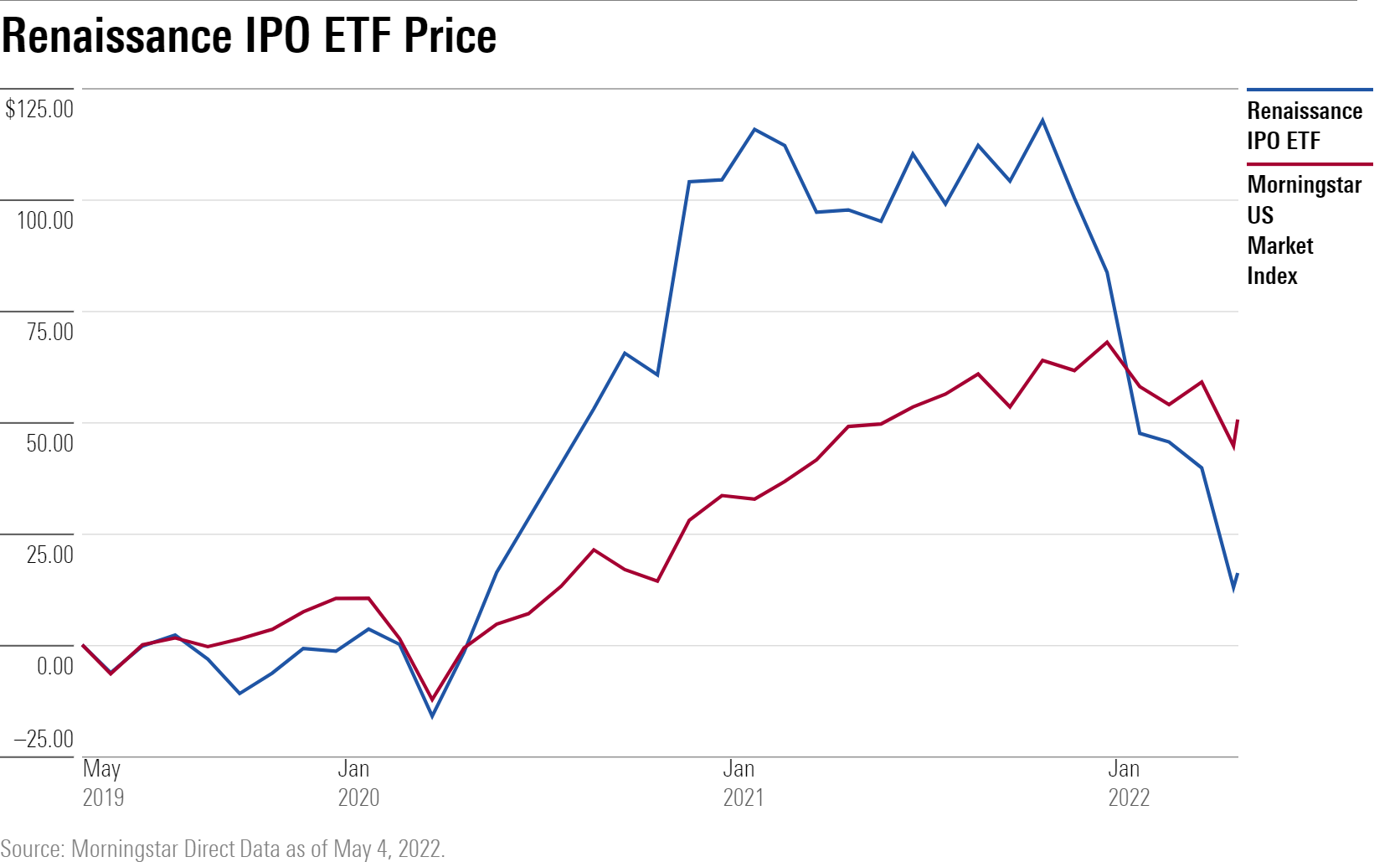

"The Bausch & Lomb launch is an encouraging sign in an overall challenging environment for the IPO market,” says Matt Kennedy, senior IPO market strategist at Renaissance Capital. Renaissance is an independent provider of pre-IPO research and IPO-focused exchange-traded funds, including the Renaissance IPO ETF IPO. "Investors are not making money in IPOs, and they are very skeptical. It's clear they will demand much greater price concessions or they won't participate."

Elevated inflation, rising interest rates, the Russian invasion of Ukraine, continuing pandemic lockdowns in China, and supply chain logjams have led to heightened uncertainty and increased market volatility and have turned boom times to bust in the IPO market.

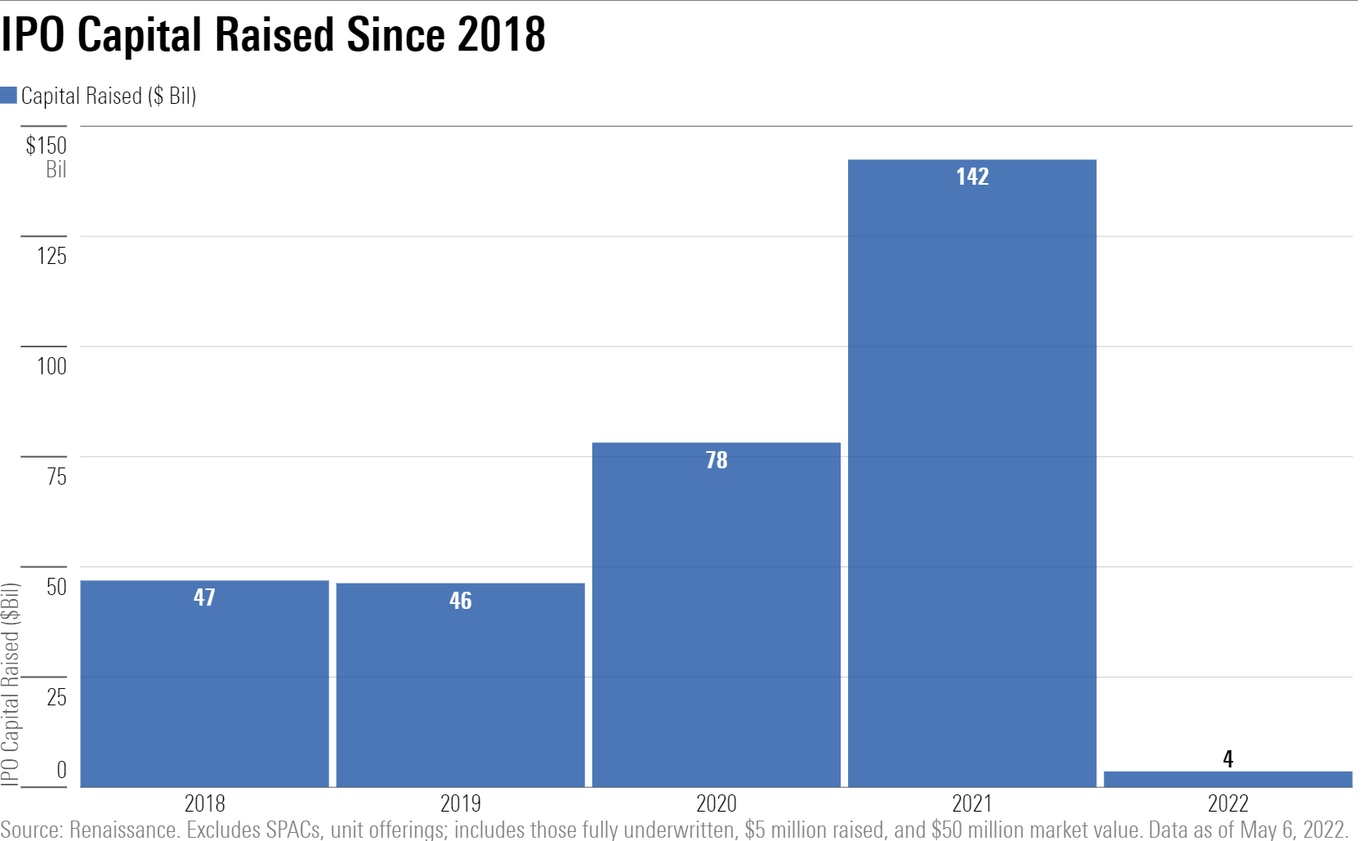

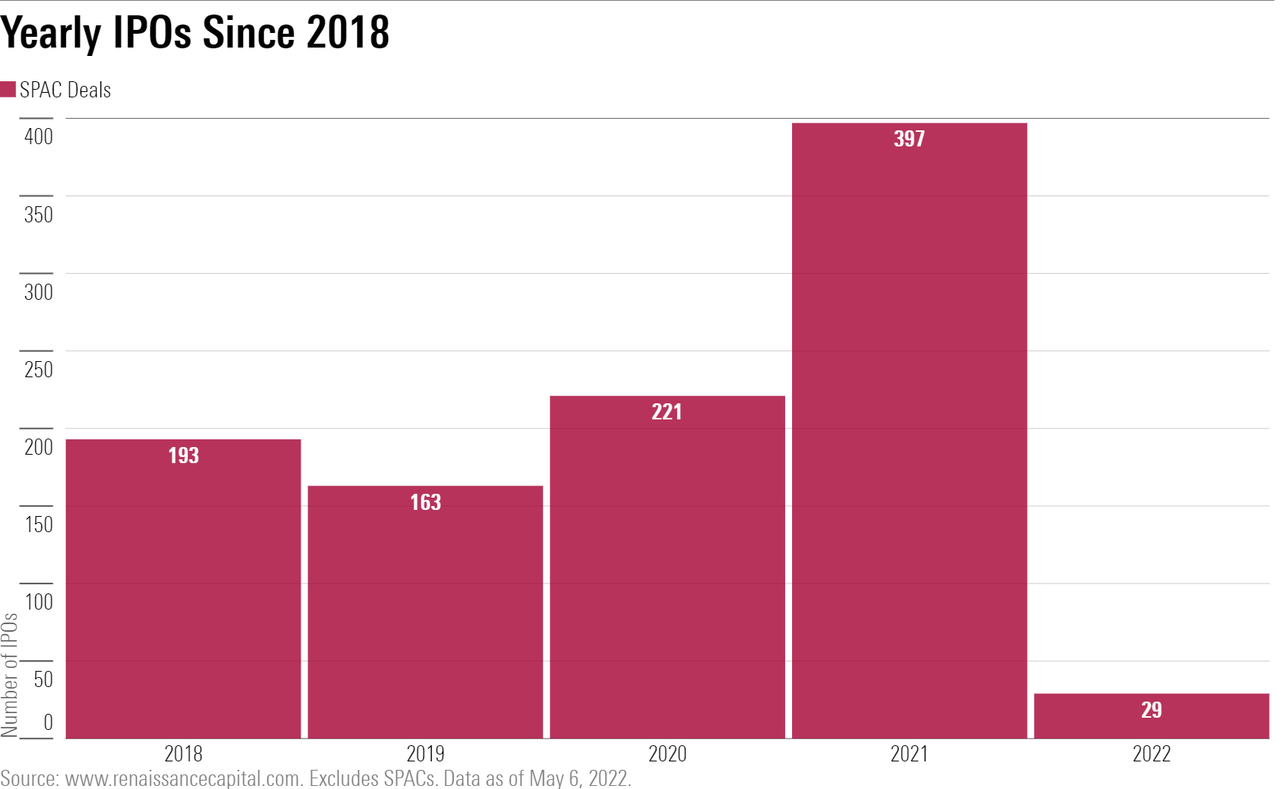

Bausch & Lomb is the second-biggest offering of 2022 behind private equity firm TPG's TPG $1 billion IPO in January. Excelerate Energy EE, a liquefied natural gas producer, ranks third, raising $416 million last month. Those three deals account for most of the $3.6 billion raised this year, though a total of 29 companies have come to market through May 6. That pace is well behind the record 1,014 companies that came to market last year, according to PitchBook, a Morningstar data analytics company.

The number of IPOs this year falls to 29 when excluding special-purpose acquisition companies, or SPACs, and unit offerings, and including those that were fully underwritten, raised at least $5 million, and achieved a market value of $50 million, according to Renaissance. The pace of new issues lags well behind the 397 companies that came to market in 2021, which set a record for issuance. If SPACs are included, the number rises to 1,010, according to Renaissance Capital. The previous record was set in 2020 when 221 companies came public, under Renaissance's criteria, or 469 if SPACs are included.

/s3.amazonaws.com/arc-authors/morningstar/ed88495a-f0ba-4a6a-9a05-52796711ffb1.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RFJBWBYYTARXBNOTU6VL4VSE4Q.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/YQGRDUDPP5HGHPGKP7VCZ7EQ4E.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/5WSHPTEQ6BADZPVPXVVDYIKL5M.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ed88495a-f0ba-4a6a-9a05-52796711ffb1.jpg)