Arm Stock Has Soared, but It’s No Nvidia

With a big jump in Arm’s stock price, how much of its AI story is reality vs hype?

Key Morningstar Metrics for Arm Holdings

- Morningstar Rating: 1 star

- Fair Value Estimate: $57.00

- Price/Fair Value Ratio: 2.18

- Fair Value Uncertainty: High

- Morningstar Economic Moat Rating: Wide

Update on Arm Stock Valuation

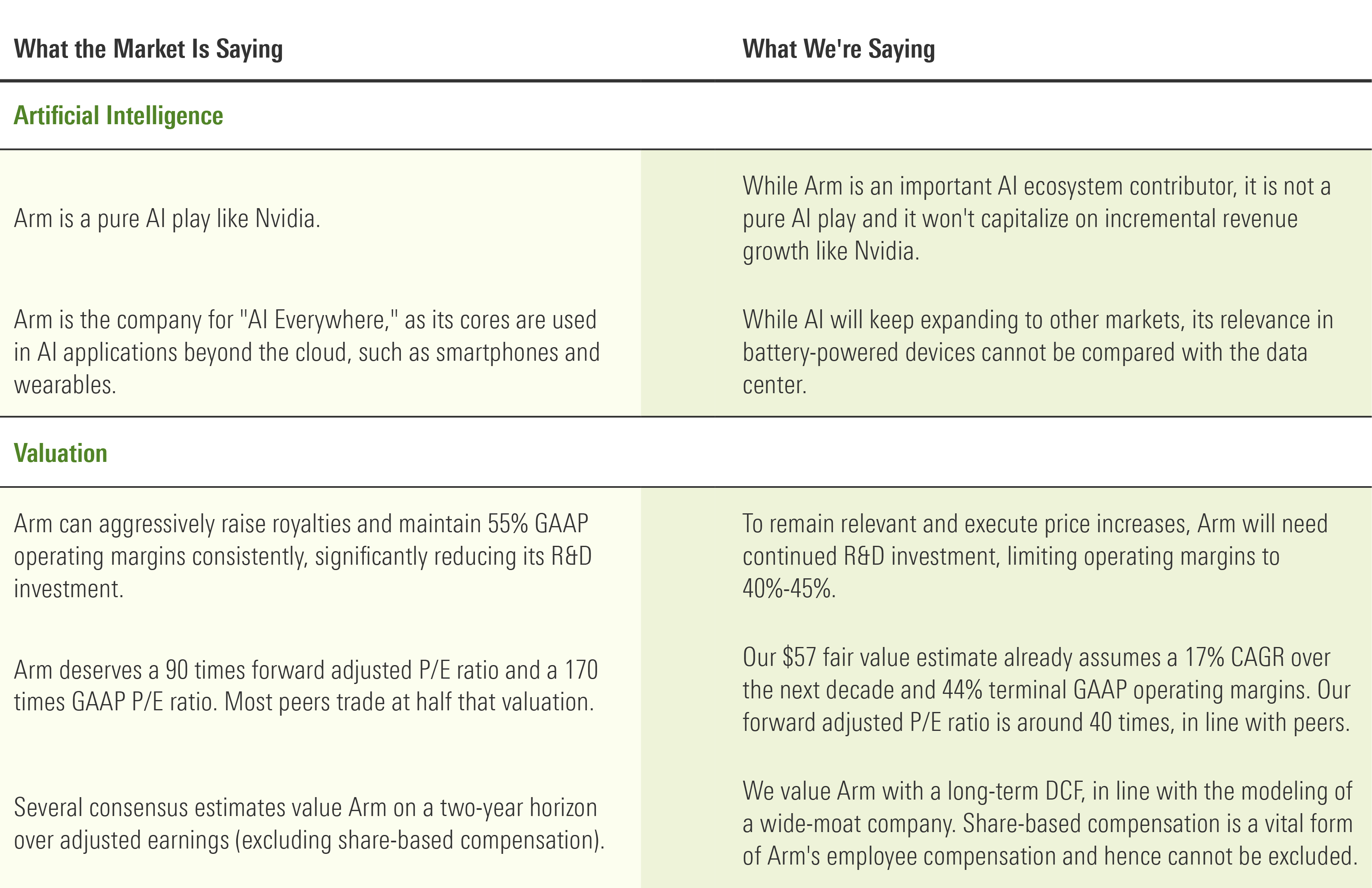

Arm Holdings ARM has many virtues, but its share price is not one of them. After the company reported earnings on Feb. 7, its shares soared more than 50% and traded close to $140 before falling back. The jump was propelled by an exaggerated artificial intelligence narrative combined with excitement about recent increases in royalty rates after the introduction of the firm’s newest architecture, Arm. While Arm is executing well and is an AI beneficiary, we believe its AI story is ancillary and do not expect an earnings inflection anywhere close to Nvidia’s NVDA.

- Although semiconductor ecosystem providers like Arm will benefit from AI, they won’t to the same extent as Nvidia, given their different business models and lower operating leverage and pricing power. Put simply, Nvidia does not need to spend 50 times more in software or pay 50 times more to Arm in royalties to design an “AI chip” that sells for 50 times more. We expect Arm’s profits will likely grow more in line with revenue.

- Arm faces a paradox in innovation versus profit margin. If it aims to gain market share and keep raising royalty rates to accelerate top-line growth, it will need to do so with a better, more efficient architecture, which requires continued reinvestment in R&D. However, this would be inconsistent with the 55% long-term operating margin needed to justify the current $140 share price, which implies a forward P/E ratio of 88, nearly double that of peers.

Forward Price/Earnings of Arm and Peers

- A $140 share price would require Arm to quintuple its royalty rates in just eight years (an 8.5% blended rate in 2030, compared with 1.7% in 2022) and grow at much higher rates than the semiconductor market for two decades. We think this proposition is too aggressive and would encourage customers to look for alternatives.

- Our $57 fair value estimate addresses this paradox. It assumes Arm will need to invest $15 billion in R&D in the next seven years, or 33% of revenue on average, to reach a 5% blended royalty rate by 2030 and 6% in 2033. This will result in a 17% revenue CAGR and a 44% terminal GAAP operating margin in the next decade.

Morningstar's More Bearish View on Arm Stock

Fair Value and Profit Drivers

With a 1-star rating, Arm stock is significantly overvalued compared with our fair value estimate, which we recently increased to $57 from $45 to account for higher royalty rates going forward.

We estimate Arm will reach a blended royalty rate of around 5% in 2030 and 6% in our terminal year, 2033. Arm’s newest architecture, v9, carries double the royalty rates of its predecessor, v8. We estimate royalty rates for v9 are 4%-5%, compared with the 1.7% blended rate the firm reported in its IPO filing for 2022. Adoption of v9 keeps increasing mainly because of adoption in high-end smartphones and the data center, and management sees increased adoption in the next few years. Our fair value estimate represents an enterprise value/GAAP EBIT multiple of 65 times in fiscal 2025 and 50 times in fiscal 2026.

Arm Holdings Stock Price vs. Fair Value Estimate

For more on Arm’s fair value estimate click here.

Economic Moat

We assign Arm a wide moat based on intangible assets and switching costs. Arm is the IP owner and developer of the Arm (Acorn RISC Machine) architecture, which is used in 99% of the world’s smartphone CPU cores. The firm also has a high market share in other battery-powered devices like wearables, tablets, and sensors.

In a chip, the instruction set architecture is the middleman between the hardware and the software, a set of instructions that dictate how the hardware behaves when it receives a software instruction. Examples of architecture instructions include arithmetic instructions (addition, subtraction, multiplication), memory instructions (which facilitate the transfer of data between the CPU registers and the memory), and data pathway instructions (which define the speed at which data moves between the CPU and the registers). Software written for a certain architecture won’t straightforwardly work in a different architecture, creating switching costs.

Click here for more on Arm’s economic moat.

Financial Strength

We think Arm is in a financially healthy position, with $1.6 billion of cash on hand and no debt. The company does not intend to pay any dividend on its ordinary shares, according to its IPO filing. We also don’t expect any significant M&A to happen, as Arm would probably face antitrust scrutiny in any mid- or large-sized deal due to its very high market share.

Given the lack of dividends and M&A opportunities, we expect Arm will use its internally generated cash flow to reinvest in the business through R&D or fund share repurchases, or to simply build more cash on the balance sheet.

More about Arm’s financial strength can be found here.

Risk and Uncertainty

We give Arm a High Uncertainty Rating, with key risks coming from China and the slow but steady adoption of RISC-V architecture.

More than 20% of Arm’s business comes from China. Arm China is the only entity allowed to sell Arm’s IP in China, but it is not controlled by Arm Holdings. Arm licenses IP to Arm China, which then sublicenses it to Chinese customers like Xiaomi or Huawei. Arm’s revenue recognition from China is dependent on the information Arm China provides, and financial reporting controls have historically been weak. SoftBank (Arm Holdings’ main shareholder) still has significant influence over Arm China, but if SoftBank leaves Arm Holdings, this would leave an intricate plot of corporate subsidiaries.

For more on Arm’s risks and uncertainty, click here.

ARM Bulls Say

- We expect Arm will keep gaining market share in the data center from x86 architecture, as its chips consume less power and data centers need to minimize energy consumption. We also expect share gains in automotive, thanks to the transition to electric vehicles.

- The overall trend toward the Internet of Things and battery-powered devices is a long-term tailwind for Arm, given its architecture is the most energy-efficient.

- If Arm managed to change its business model and charge royalties on a per-device basis, this would provide huge revenue and margin upside.

ARM Bears Say

- If Arm manages to charge royalties on a per-device basis, or if it were to meaningfully increase its royalty rates per chip, it could become a double-edged sword. Too much royalty revenue may encourage customers to adopt open-source RISC-V instead.

- Arm China is one of Arm’s largest clients, representing more than 20% of revenue. Arm China’s financial reporting has historically been opaque, and there could be attempts to steal Arm’s intellectual property.

- Arm’s revenue concentration is very high, with its top five customers representing close to 60% of sales.

This article was compiled by Tom Lauricella.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/347BSP2KJNBCLKVD7DGXSFLDLU.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TP6GAISC4JE65KVOI3YEE34HGU.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-29-2024/t_d0e8253d77de4af9ae68caf7e502e1bf_name_file_960x540_1600_v4_.jpg)