After Earnings, Is Walmart Stock a Buy, a Sell, or Fairly Valued?

Amid a precarious economic outlook, here’s what we think of Walmart stock.

Walmart WMT released its third-quarter earnings report on Nov. 16. Here’s Morningstar’s take on Walmart’s earnings and stock.

Key Morningstar Metrics for Walmart

- Fair Value Estimate: $147.00

- Morningstar Rating: 3 stars

- Morningstar Economic Moat Rating: Wide

- Morningstar Uncertainty Rating: Medium

What We Thought of Walmart’s Q3 Earnings

- Walmart reported third-quarter results that were mostly in line with our expectations. Comparable sales (excluding fuel) improved nearly 5% in its U.S. segment, led by a 3.4% increase in transaction volume. Despite the strong sales growth, operating margin for Walmart U.S. was modestly pressured due to unfavorable sales mix—sales continue to skew towards the lower-margin grocery category—and elevated expenses related to wages and store remodels, though continued margin headwinds were to be expected. Sam’s Club also continued to deliver solid growth, with comparable sales improving nearly 4%, driven entirely by transaction gains.

- The retailer continues to attract value-conscious consumers with its impressive scale and enticing low-price value proposition. Amid a more precarious economic outlook, we believe Walmart is well-positioned to continue posting strong comparable sales growth and modest market share gains, particularly in high-frequency categories such as grocery. As its merchandise offerings skew toward nondiscretionary and high-frequency items, Walmart’s business model tends to be more insulated from economic turmoil than retailers that primarily sell discretionary goods like electronics and home furnishings.

- Before Walmart reported third-quarter results, its stock was trading in 2-star territory, near $170 per share. Since then, the stock sold off and now trades around $157, falling into 3-star territory, compared to our $147 fair value estimate. Despite our favorable near-term outlook, we do not think Walmart’s shares trade at a bargain.

Walmart Stock Price

Fair Value Estimate for Walmart

With its 3-star rating, we believe Walmart’s stock is fairly valued compared with our long-term fair value estimate.

We have modestly raised our fair value estimate of Walmart to $147 per share from $145. The company’s third-quarter earnings report was mostly consistent with our expectations, and we expect the firm to continue gaining market share in the grocery category as value-conscious consumers search for deals.

We expect fiscal 2024 to remain choppy as economic uncertainty and inflation pinch consumer’s wallets. Nonetheless, we believe Walmart’s low-price value proposition tends to resonate with consumers during uncertain economic periods, driving share gains in its grocery category. As a result, we expect the company to deliver modest growth in transaction volume and low-single-digit price growth due to inflation. However, we expect operating margins to remain pressured as discretionary spending abates and Walmart’s domestic sales mix leans toward lower-margin groceries.

We surmise Walmart will deliver modest margin expansion off a depressed fiscal 2023 base as the firm moves past a retail environment that was recently pressured by inundated inventory levels and elevated discounting. However, we expect margin benefits from a recovering retail environment to be partially offset by continued investments in the company’s omnichannel capabilities, third-party marketplace, and third-party fulfillment capacity.

Read more about Walmart’s fair value estimate.

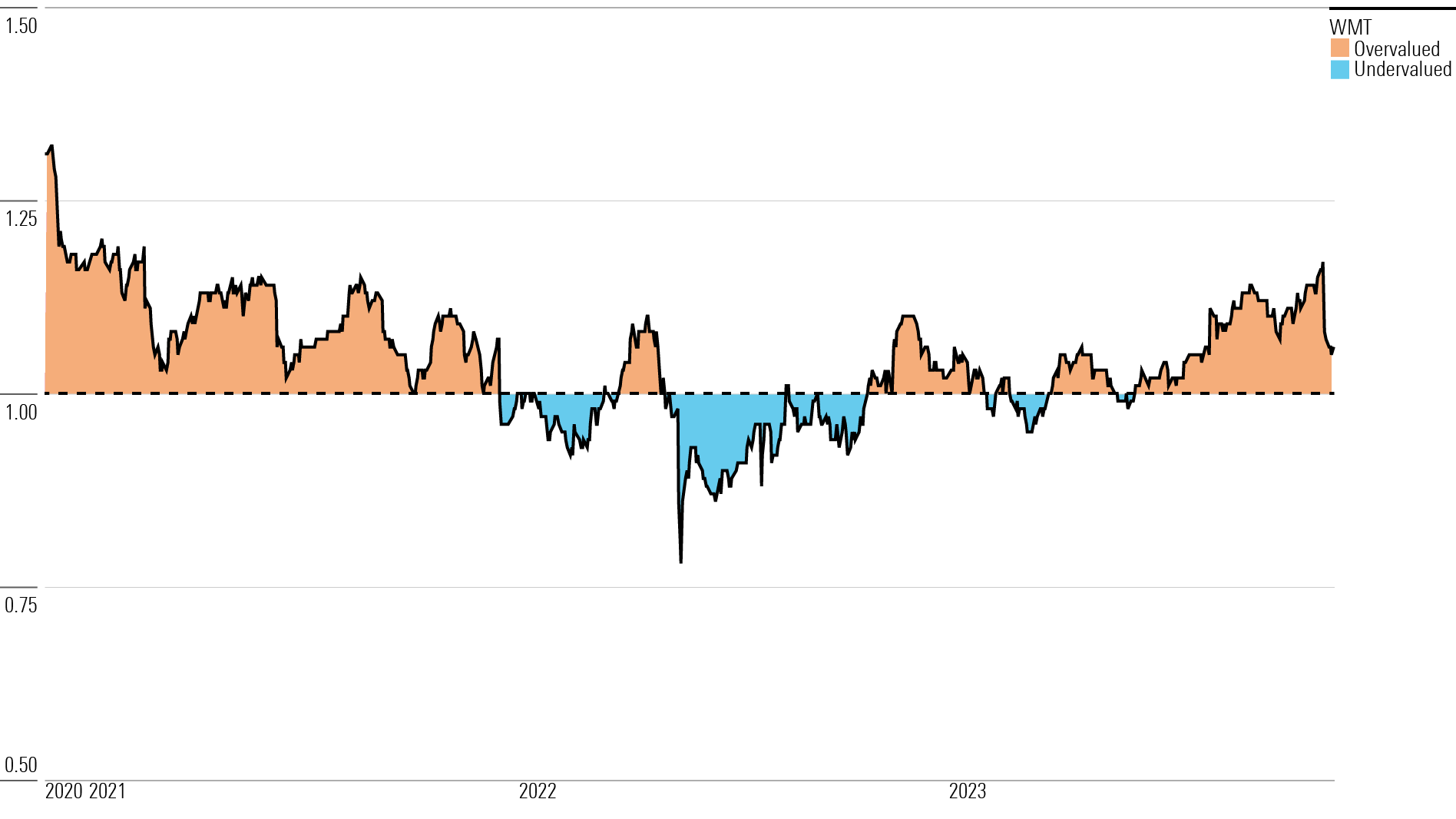

Walmart Historical Price/Fair Value Ratio

Economic Moat Rating

We believe Walmart warrants a wide economic moat rating, underpinned by its ubiquitous brand representing low prices in the domestic market, as well as its cost advantage. Walmart is the largest retailer in the United States, with over $420 billion in annual sales and a massive footprint of over 4,700 namesake locations (nearly 2.5 times that of rival Target TGT). Despite the fragmented and competitive landscape inherent in retail, we surmise Walmart has carved out an enviable position, as it benefits from its close proximity to the vast majority of U.S. consumers, driving repeat foot traffic. Walmart supercenters (over 3,500 in the U.S.) provide an extensive product assortment at low prices, creating a convenient one-stop shopping experience for consumers.

While the retail industry is properly characterized as cutthroat due to the virtual nonexistence of switching costs, Walmart has built a resonant brand over the past five decades. In our view, the firm’s moat is predicated on reinforcing the flywheel between that strong brand recognition, which drives consumer foot traffic and unit sales, and its leverage over suppliers and vast supply chain network, which drives down costs.

The ubiquity of Walmart’s brand and physical store base accentuates its moat, as its stores are located within 10 miles of 90% of the U.S. population. Its position in U.S. retail is uniquely entrenched, as many companies rely on its access to customers to drive sales. This access allows Walmart to engage in slightly more favorable contract negotiations with consumer packaged goods companies than its smaller retail peers.

The company’s ability to drive recurring foot traffic has let it boast a dominant position in the domestic retail grocery channel, with a 25% market share. For comparison, Walmart’s market share in U.S. grocery outpaces the aggregate market share of the four next-largest grocery channel retailers: Kroger KR, Costco COST, Target, and Albertsons ACI (a 23% combined market share). Grocery items were 59% of Walmart’s U.S. sales in fiscal 2023, and the retailer’s wide assortment of nondiscretionary goods and perishable foods at low prices induces consistency in foot traffic and top-line resiliency even during times of economic stress.

Read more about Walmart’s moat rating.

Risk and Uncertainty

We assign Walmart a Medium Uncertainty Rating. The rise in e-commerce penetration is the most formidable threat to its traditional brick-and-mortar retail model. While Walmart’s sales are underpinned by grocery items, which tend to be more insulated from online penetration, we surmise the company faces tough online competition for sales of general merchandise such as electronics, apparel, and home decor, which is unlikely to abate any time soon.

Given the higher margins merchandise sales typically carry over that of grocery, margin pressure could ensue over time if grocery becomes a larger part of its mix. Furthermore, Amazon.com AMZN has entertained expanding its physical presence in grocery beyond its existing Whole Foods and Amazon Fresh footprint. While we view the threat to Walmart as low due to Amazon’s lack of physical storefronts, it is worth monitoring competition from the corporate behemoth.

Read more about Walmart’s risk and uncertainty.

WMT Bulls Say

- Margin pressure should abate as Walmart’s recent investments in omnichannel fulfillment and its third-party marketplace continue to scale.

- Walmart’s vast grocery offering insulates it from digital competition, given the perishability of the merchandise.

- Walmart’s recent investments in supply chain automation should drive margin expansion. The firm may also reinvest the cost savings to hold down prices and drive foot traffic to its stores—a benefit relative to many smaller retailers.

WMT Bears Say

- Walmart’s third-party marketplace and third-party fulfillment capacity pale relative to Amazon’s scale. We posit that Amazon can underprice Walmart on commissions, listing fees, and fulfillment services related to its marketplace.

- Sam’s Club has woefully underperformed Costco in recent years, and the brand does not provide a compelling value proposition that would allow it to take share.

- Walmart’s sales mix of higher-margin general merchandise categories stands to decline due to strong digital penetration, prompting long-term margin degradation.

This article was compiled by Adrian Teague.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RNODFET5RVBMBKRZTQFUBVXUEU.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LJHOT24AYJCHBNGUQ67KUYGHEE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/V33GR4AWKNF5XACS3HZ356QWCM.jpg)