After Earnings, Is Snowflake Stock a Buy, a Sell, or Fairly Valued?

With the company continuing to dominate among database management systems, here’s what we think of Snowflake stock.

Snowflake SNOW released its third-quarter earnings report on Nov. 29. Here’s Morningstar’s take on Snowflake’s earnings and stock.

Key Morningstar Metrics for Snowflake

- Fair Value Estimate: $231.00

- Morningstar Rating: 4 stars

- Morningstar Economic Moat Rating: None

- Morningstar Uncertainty Rating: Very High

What We Thought of Snowflake’s Earnings

Snowflake’s third quarter was mixed, in our view. Revenue came in above our expectations while the bottom line came in under, as we had rosier expectations than the market. Encouragingly, though, full-year fiscal 2024 guidance was raised for revenue and profitability. Shares have popped 7% upon results, inching the stock somewhat closer to our $231 fair value estimate while leaving room for ample upside.

Overall, Snowflake is extremely well-positioned to benefit as the world is rapidly collecting more data, which requires both a place to live and a playground like Snowflake’s to work with to extract more value. While these are passive tailwinds, we think Snowflake’s technical expertise and execution will make it more than a passive beneficiary in data management software. We still believe the name is a top pick under our technology coverage.

Snowflake reported third-quarter revenue of $734 million and product sales of $699 million, growing by 32% and 34% year over year, respectively. Solid results came thanks to execution and a stabilizing macroeconomic environment. Management noted that they hardly hear “AI” and “budget” in the same sentence, and we think this leaves the firm in a sweet spot, with customers eager to be at the forefront of cutting-edge technology. We think this safeguards the uncertainty that can come with a consumption-based revenue model.

We think Snowflake has a clear path to reach over $22 billion in revenue by 2033, paired with GAAP operating margins past 27%. Such a trajectory relies on strong switching costs, which continue to be exemplified by strong net revenue retention rates (135% as of October). We believe Snowflake is acting wisely by investing heavily in customer acquisition now to reap massive benefits later.

The company’s fourth-quarter outlook includes year-over-year growth in product revenue at a midpoint of 29.5%. Fiscal 2024 product revenue is guided for year-over-year revenue growth at a midpoint of 37% (an increase from 34% previously). Non-GAAP operating margins are expected to be 4% in the fourth quarter and 7% for the overall year. Despite the favorable boost to the outlook, we caution investors not to be overly eager for significant upside this year beyond guidance. Snowflake has a slew of new products going into public preview this year, which will be a temporary headwind for margins as associated costs start to get capitalized. Nonetheless, we think the new product investments will pay off, as we foresee ample scale ahead.

Snowflake Stock Price

Fair Value Estimate for Snowflake

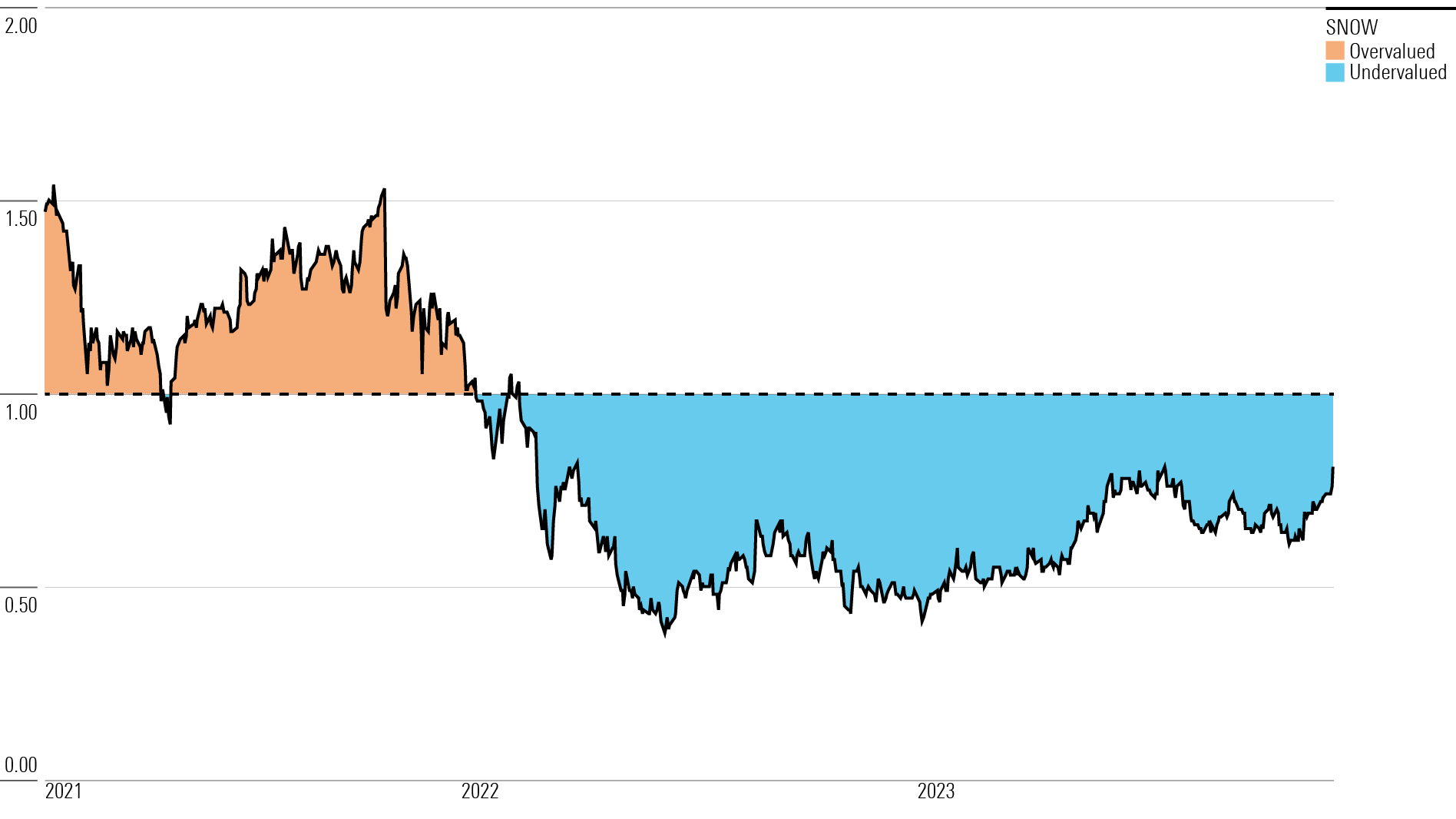

With its 4-star rating, we believe Snowflake’s stock is undervalued compared with our long-term fair value estimate.

Our fair value estimate is $231 per share. Our valuation implies forward fiscal-year enterprise value/sales of 25 times and a free cash flow yield of 1%. Our assumptions are based on our expectation of Snowflake achieving a compound annual growth rate of 34% over the next five years and 26% over the next 10 years. Snowflake is in its infancy, but it has a massive market opportunity and a large runway for growth.

This substantial growth is driven by workloads continually shifting to a cloud environment, resulting in Snowflake accumulating more share of the overall database management system market. Our forecasts also assume substantial usage growth per customer, as we expect customers to scale their data storage significantly after migrating to the cloud due to reduced costs and the ease of such scaling.

Read more about Snowflake’s fair value estimate.

Snowflake Historical Price/Fair Value Ratio

Economic Moat Rating

We do not think Snowflake has a moat. Though the firm benefits from switching costs and a network effect, protected by its unique multi-cloud strategies, we cannot say with complete certainty that this will lead to excess returns on invested capital 10 years from now, given its limited public history and significant current lack of profitability.

Snowflake is a fast-growing provider of data lake, data warehousing, and data sharing solutions. The company’s value proposition lies in overturning the faults of existing data storage architectures and even more recent methods of storing data in the cloud through its combined data lake and data warehouse platform. The rise of the public cloud has resulted in an increasing need to access data from different databases in one place. A data warehouse serves this need. Data lakes are used to store not just structured data within a database or data warehouse, but also data that is not yet fully indexed (either unstructured or semistructured data). This data in a lake is ingested into AI models to create novel insights. These insights are indexed and therefore are considered structured data, which is then housed in a data warehouse to easily be queried.

We think Snowflake’s switching costs are strong even without locking in multiyear subscriptions. Roughly 93% of the firm’s revenue is consumption-based, meaning it is not a subscription-as-a-service company. Clients typically commit to set consumption rates on an annual basis. We think Snowflake benefits from a network effect in its data-sharing business. It’s the only platform that allows for the sharing of data sets in a multi-cloud fashion through the Snowflake Data Marketplace, and this data can be purchased by other companies.

Snowflake is a key supplier for a host of enterprises. We ultimately foresee the firm achieving massive growth, but it’s racking up significant operating losses during its growth phase. Such growth is a necessity for the company to generate excess returns on capital, and it’s a bit early in its lifecycle for us to have absolute certainty that it can earn these returns in the long run.

Read more about Snowflake’s moat rating.

Risk and Uncertainty

Snowflake runs the risk that other cloud-neutral software will enter its market, or that a public cloud company will open its data warehouse and data sharing to be interoperable outside its cloud. While we think it’s unlikely that either Amazon.com AMZN will open AWS or Microsoft MSFT will open Azure, they have vastly greater resources to compete in this space if they so choose.

Furthermore, Snowflake is at risk of compromising the data on its platform, either through data breaches or in the case compliance tools are unable to do their job. For example, the firm offers a number of features for ensuring data is compliant with regulations like the General Data Protection Regulation.

Read more about Snowflake’s risk and uncertainty.

SNOW Bulls Say

- Snowflake could remain the only multi-cloud offering of its kind for much longer than anticipated, letting it increase its top line more with minimal pricing pressure.

- Snowflake could move to a subscription model from a usage-based one, boosting the monetization of its products.

- Snowflake could expand to other multi-cloud data needs, pushing spending per customer to greater heights.

SNOW Bears Say

- Other multi-cloud data providers may emerge to compete with Snowflake, or in-house data warehouses at AWS or Azure could potentially adopt a multi-cloud strategy.

- Snowflake could fail to expand its data-sharing network extensively, leaving it vulnerable to competition with larger networks.

- Migration of existing workloads to the cloud could occur at a slower pace, extending Snowflake’s unprofitable years.

This article was compiled by Adrian Teague

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/f497c984-8e67-4c32-8c6c-210934e57017.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RNODFET5RVBMBKRZTQFUBVXUEU.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LJHOT24AYJCHBNGUQ67KUYGHEE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/V33GR4AWKNF5XACS3HZ356QWCM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/f497c984-8e67-4c32-8c6c-210934e57017.jpg)