After Earnings, Is Oracle Stock a Buy, a Sell, or Fairly Valued?

With solid margin performance and improvements in cloud gross margins, here’s what we think of Oracle’s stock.

Oracle ORCL released its fiscal third-quarter earnings report on March 11. Here’s Morningstar’s take on Oracle’s earnings and outlook for its stock.

Key Morningstar Metrics for Oracle

- Fair Value Estimate: $84.00

- Morningstar Rating: 1 star

- Morningstar Economic Moat Rating: Narrow

- Morningstar Uncertainty Rating: Medium

What We Thought of Oracle’s Earnings

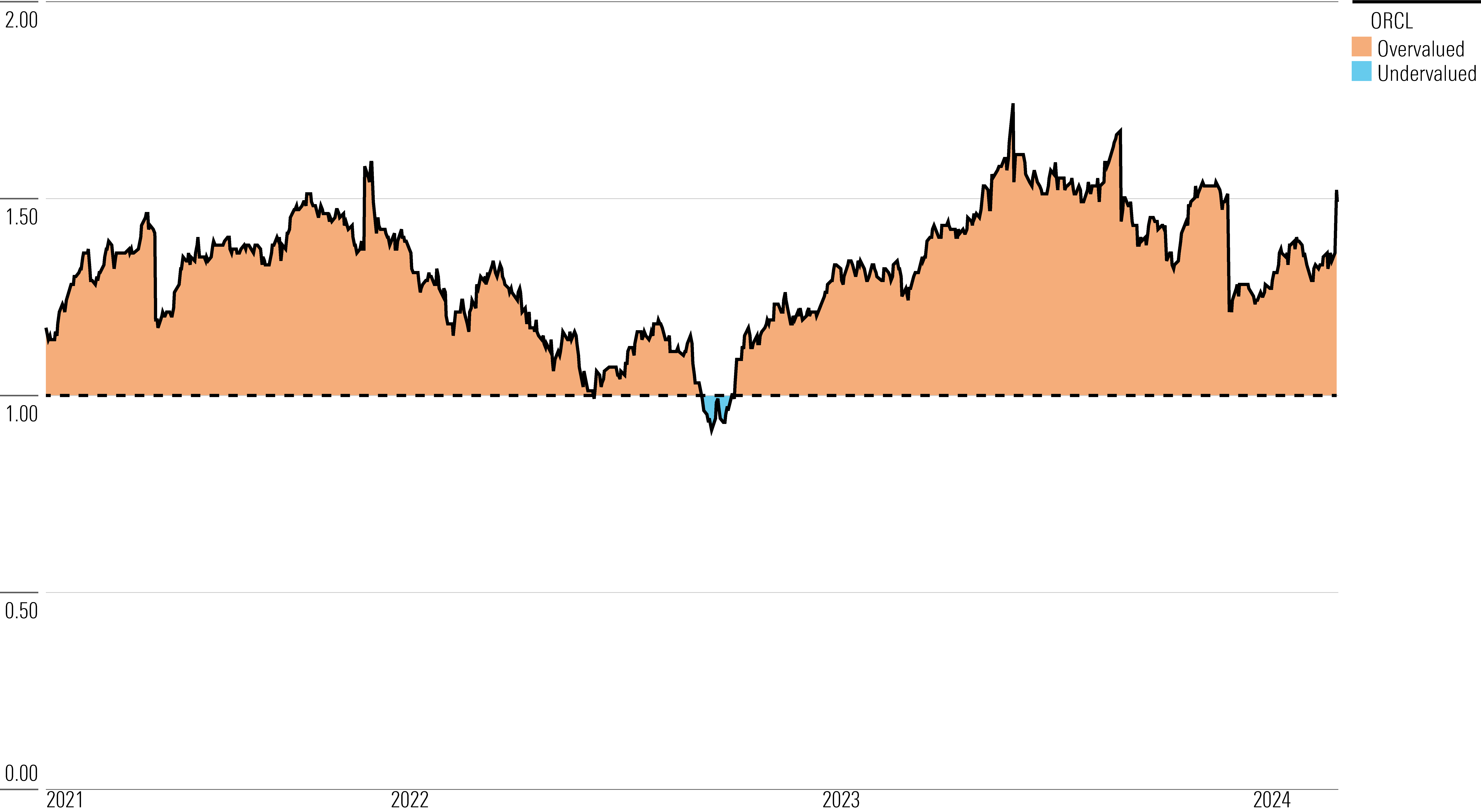

- Oracle’s third-quarter results fell short of our aggressive estimates on the top and bottom lines but were closer to broader investor expectations. Despite the stock’s recent performance, we maintain our fair value estimate of $84 per share and see it as overvalued. The firm is progressing well on initiatives in both Cerner and Oracle Cloud Infrastructure, or OCI, in line with what we anticipated for the quarter and our longer-term growth and margin cadence.

- There is reason to be excited for the next several years, as cloud growth and bookings are impressive. In the third quarter, total revenue increased by 7% year over year in constant currency to $13.3 billion. Further bolstering this, remaining performance obligations were up 29% year over year to more than $80 billion, which we view as a strong indicator of both good demand trends and revenue acceleration next year, which is already baked into our model. Like its enterprise software peers, Oracle said there was strength in large deals. In one highlight, cloud revenue was up 2%, while cloud infrastructure revenue rose 49%.

- Margin performance is solid as improvements in cloud gross margins arising from scale drive year-over-year improvement, which we expect to continue over the next several years. These improvements are already part of our long-term estimates, so we have not changed our margin outlook. Oracle achieved a 43.6% non-GAAP operating margin in the quarter, compared with 41.8% a year ago and our estimate of 43.7%.

Oracle Stock Price

Fair Value Estimate for Oracle

With its 1-star rating, we believe Oracle’s stock is overvalued compared with our long-term fair value estimate.

Gross margins in cloud services and license support would remain vulnerable in the short term as more companies switch to Oracle SaaS, which is cheaper than on-premises software. Oracle does not mind this, given its expectation that SaaS customers will triple their spending. These decreases should also be partially offset by an increase in gross margin in Oracle’s hardware business as it sheds more commodity hardware, along with a decreasing mix of lower-margin services revenue.

Altogether, we forecast gross margins to increase to 76% in fiscal 2028 from 73% in fiscal 2023. We expect the shifting mix to the cloud should drive operating leverage such that operating margins expand to 36% in fiscal 2028 from 28% in fiscal 2023.

Read more about Oracle’s fair value estimate.

Oracle Historical Price/Fair Value Ratio

Economic Moat Rating

We assign Oracle a narrow moat based on its switching costs. Although it’s an industry-leading software provider, the company is encountering headwinds as it transitions to the cloud. In turn, we foresee less certainty about the firm’s ability to retain its customers and generate excess returns on capital in the long run, which prevents us from assigning it a wide moat.

Oracle is by and large known for its relational database, Oracle Database. The firm offers on-premises database licenses and an autonomous database via infrastructure-as-a-service, and in our view, both have significant switching costs. Enterprises rely on data more than ever before, meaning how they store it is critical. Changing storage and access methods creates numerous headaches that aren’t dissimilar to switching costs in enterprise software, such as a significant learning curve in using new databases. One can imagine the disaster if a faulty migration accidentally stored employee salary data in database cells meant for their emails.

Read more about Oracle’s economic moat.

Risk and Uncertainty

We assign Oracle a Medium Uncertainty Rating. We do not foresee any material environmental, social, or governance issues.

We think Oracle’s greatest risk stems from the shift to cloud computing and whether it can effectively transition its client workloads from on-premises software into its cloud. This change affects every aspect of Oracle’s business, eliminating the need to buy its hardware to run on-premises databases. More importantly, if customers move to a competing cloud provider, they block themselves from the ability to use Oracle cloud-native software, Fusion, and the change to competing ERP software could instill a change in databases.

The risk here is exposed from all sides. Customers could leave Oracle’s software for best-of-breed cloud-first enterprise software like Workday or Coupa, or they could leave its databases out of a need to scale in the cloud. We think the effects of the covid-19 pandemic pose a related risk, potentially accelerating enterprises’ digital transition efforts.

Read more about Oracle’s risk and uncertainty.

ORCL Bulls Say

- Oracle’s relational database should post strong growth as customers depend on its quality features.

- Oracle’s autonomous database and IaaS were built with ease of use in mind, which could bring in a significant base of first-time users, strengthening top-line results.

- Oracle’s stake in TikTok Global and cloud services for TikTok’s US operations should significantly boost Oracle’s top line and attract more general-use cloud customers.

ORCL Bears Say

- Oracle could suffer below-average growth as customers change databases and software providers as they transition to the cloud.

- Oracle’s cloud business could struggle to win business as alternative SaaS and database systems leave little incentive to select Oracle IaaS.

- Covid-19 could accelerate Oracle customers’ digital transitions, causing Oracle to lose customers faster than expected.

This article was compiled by Frank Lee.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/f497c984-8e67-4c32-8c6c-210934e57017.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RNODFET5RVBMBKRZTQFUBVXUEU.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LJHOT24AYJCHBNGUQ67KUYGHEE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/V33GR4AWKNF5XACS3HZ356QWCM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/f497c984-8e67-4c32-8c6c-210934e57017.jpg)