After Earnings, Is Etsy Stock a Buy, a Sell, or Fairly Valued?

With consumers spending less, here’s what we think of Etsy’s stock.

Etsy ETSY released its third-quarter earnings report on Nov. 1. Here’s Morningstar’s take on Etsy’s earnings and stock.

Key Morningstar Metrics for Etsy

- Fair Value Estimate: $145.00

- Morningstar Rating: 5 stars

- Morningstar Economic Moat Rating: Wide

- Morningstar Uncertainty Rating: Very High

What We Thought of Etsy’s Q3 Earnings

- Earnings were pretty strong in the third quarter. The firm had 1.6% gross merchandise volume, or GMV, growth in the core Etsy platform, along with growth in active buyers on the core marketplace for the first time in seven quarters. The firm beat our expectations for sales ($636 million to our $630 million estimate), GMV ($3.04 billion to our $3.02 billion estimate), and adjusted EBITDA margin (28.6% to our 27.3% estimate).

- A lingering issue was lower-than-expected guidance for the fourth quarter, which drove negative reactions from investors. Softer buyer traffic in October led Etsy to guide for a slight decline in gross merchandise sales in the holiday quarter. Investors are still trying to decide whether the marketplace can return to strong double-digit growth coming out of this rough cyclical patch for consumer discretionary spending.

- The big thing investors should keep an eye on is a modest decline in platform spending per active buyer, which we believe fell slightly to about $127 on a trailing 12-month basis. An important part of the thesis is the firm’s ability to grow not just its base of active customers, but also how frequently they visit and how much they spend. We don’t know that the results were unexpected; during periods of economic pressure, we typically see consumers remain active but make fewer or cheaper purchases. The trick will be driving an inflection in 2024 or 2025. What gives us more comfort than the street is that spending patterns among new buyers have been pretty encouraging. The firm saw a 20% increase in spending from households in the top decile of income, suggesting that when pressures ease and the median consumer is feeling better, we’ll likely see a strong return to growth.

- There is some dissonance between the firm’s valuation, which is up about 30% from the third quarter of 2019, and its operational performance, with the marketplace boasting 3 times the revenue and 6 times the operating profit that it did in that period. On a P/E basis, the firm trades as if it’s never going to return to growth, which seems shortsighted. With Etsy growing its share in its four largest verticals relative to pure-play competitors and defending its share inclusive of discounters like Walmart WMT and Amazon AMZN (which is impressive, given where consumer psychology is today), we expect that gap between market prices and our intrinsic valuation to narrow as consumer discretionary spending recovers.

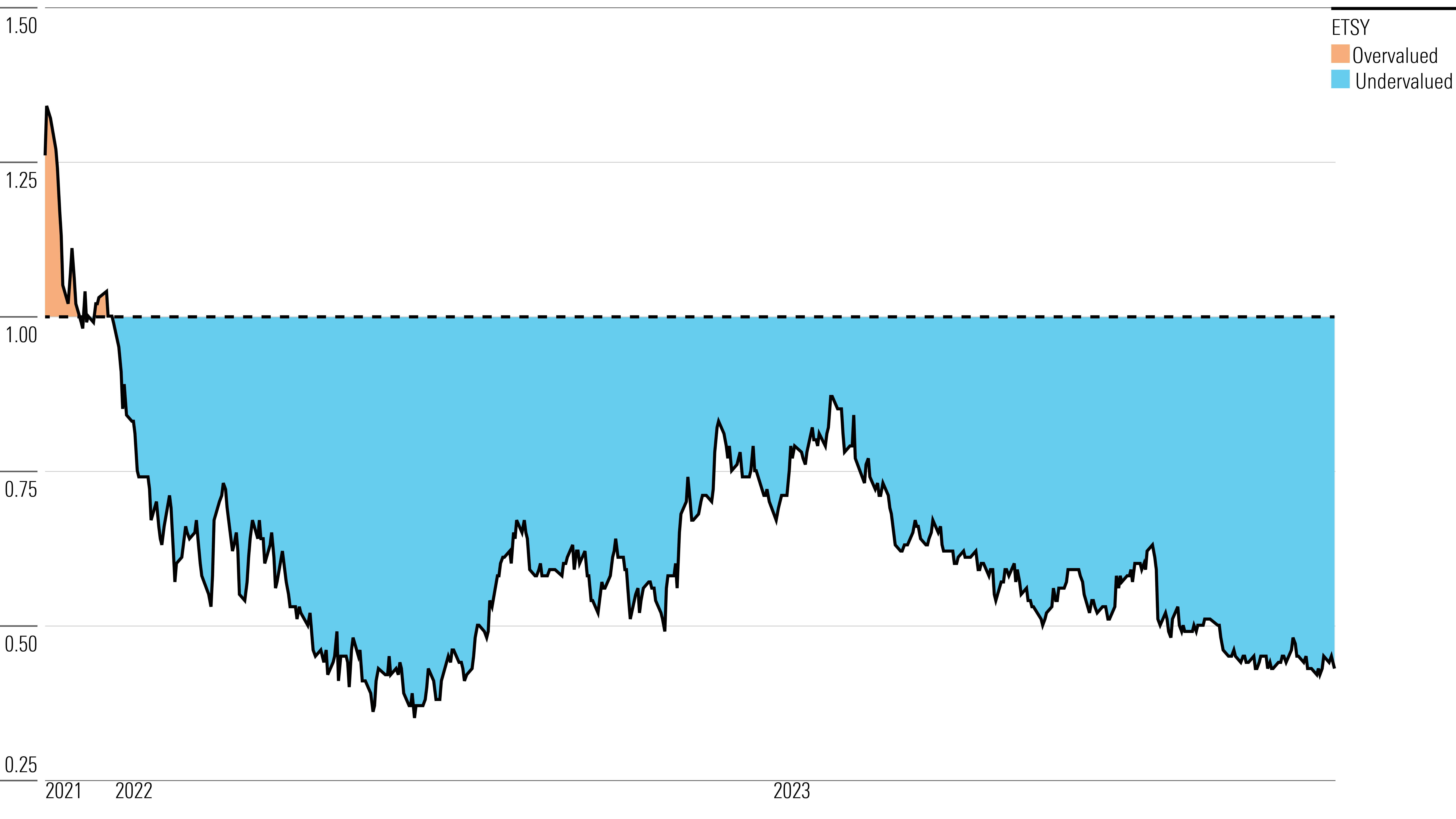

Etsy Stock Price

Fair Value Estimate for Etsy

With its 5-star rating, we believe Etsy’s stock is undervalued compared with our long-term fair value estimate.

We’re maintaining our $145 fair value estimate for Etsy after digesting its third-quarter results. While we’re sympathetic to the market’s concerns regarding the craft marketplace’s growth prospects and potential operating leverage, we continue to view this reaction as myopic. We still foresee a route to double-digit gross merchandise sales growth, and the margin leverage that begets, as soon as 2025.

We’re encouraged by Etsy’s ability to retain the lion’s share of pandemic-induced GMV gains, which has increased at a 36% compound annual growth rate over the past four years, healthily outpacing broader U.S. e-commerce. The firm’s improved scale drives a structurally more profitable model than what it had prior to the pandemic while magnifying the impact of any platform development or search optimization investments—features that we believe the market continues to underappreciate.

Ultimately, between 6% nominal growth in GMV per buyer and penetration just north of 165 million global buyers in 2032, we continue to view $40 billion as an achievable long-term GMV target for Etsy, suggesting that GMV almost triples in 10 years. With the Etsy marketplace already operating at 30% adjusted EBITDA margins and subsidiary marketplaces slowly getting up to speed, we view a route to nearly 20% average annual operating profit growth through 2032 as plausible, corroborating management’s assessment of competitively advantaged peer-to-peer marketplaces as “lightning in a bottle.”

Read more about Etsy’s fair value estimate.

Etsy’s Historical Price/Fair Value Ratio

Economic Moat Rating

We assign Etsy a wide moat due to its network effect and quantitative underpinnings.

In our view, Etsy is one of the few e-commerce companies poised to emerge as a long-term winner. The firm eschews competition in commoditized categories like fast-moving consumer goods, as it has recognized its inability to effectively compete for sales driven principally by price and fulfillment speed considerations. Instead, Etsy has built a competitively advantaged marketplace around a catalog of non-traditional, unique, customizable, and artisanal inventory, deriving a competitive edge from a network that grows more valuable as additional buyers and sellers join the platform. Further, Etsy benefits from access to an almost entirely non-standardized suite of more than 100 million products, with those items mapping to neither stock-keeping units nor universal product codes, allowing the firm to develop search algorithms that would be effectively impossible for peers to emulate.

While buyers are widely viewed as the economic engine of a marketplace, the buyer experience is beholden in some capacity to the quality and depth of the seller pool. Access to a platform with more and better sellers improves the buyer experience, reduces search costs, and improves product discovery, all of which continue to improve as more sellers are onboarded. On the seller side, access to a larger pool of buyers, particularly buyers with purchase intent and interest in their category, often results in better sale prices, quickened inventory turnover, and reduced illiquidity-induced discounts to product fair value. Thus the seller experience improves as new buyers join the platform, incentivizing further growth on both sides—a demand flywheel that is difficult to stop beyond key tipping points, which we’ve estimated as 10% of the internet-using population in a geography in past research.

Read more about Etsy’s moat rating.

Risk and Uncertainty

We assign Etsy a Very High Morningstar Uncertainty Rating.

E-commerce is intensely competitive, marked by constant innovation, increasingly rapid paths to scale, and low barriers to entry despite relatively high barriers to success. Players are forced to vie for developer talent, customer wallet share, and sellers, with operators seeking to differentiate their product breadth and uniqueness, prices, user experiences, and active buyer pools. While Etsy’s product suite is competitively differentiated, in our view, the firm’s difficult-to-parse addressable market, position in a quickly evolving e-commerce channel, and nascent younger marketplaces support its uncertainty rating.

In our view, international exposure and recent M&A activity represent substantial idiosyncratic risks. With 45%-50% of GMV tied to international markets, Etsy remains sensitive to foreign exchange rate fluctuations and must navigate sometimes discordant tax policies and tariffs across geographies. Moreover, though the acquisition of Depop offers exposure to attractive end markets, it also added a degree of integration risk, which could result in restructuring costs or fragmented management attention.

While Etsy is well-positioned with respect to environmental, social, and governance risks, we flag two areas of concern. First is its ability to attract sufficient developer talent to support the platform’s robust growth. Then there are potential data security concerns. The firm is responsible for its customers’ personally identifiable information, and recent regulations (like the General Data Protection Regulation in Europe and the California Consumer Privacy Act) have been increasingly punitive.

Read more about Etsy’s risk and uncertainty.

ETSY Bulls Say

- Etsy’s investments in its star seller program, purchase protection, and shipping time estimates should help improve platform trust and may allow it to move upmarket toward inventory with higher average prices.

- After more than doubling its 2019 buyer base, Etsy has likely reached a demand tipping point, with high-teens active buyer penetration across its core six markets increasing barriers to success for new entrants.

- The firm’s increased reach in international markets and among customers who identify as male should add a long-term leg to its active user growth journey.

ETSY Bears Say

- Without many high-frequency items on its marketplace, Etsy lacks the natural traffic draw that larger e-commerce peers like Amazon command and is commensurately more sensitive to cyclical factors.

- Local players may have an advantage in international markets, given their nuanced understanding of those cultures and regulation that often favors homegrown companies.

- Etsy’s super-discretionary product suite and the proliferation of drop-shipped, relatively commoditized goods could see it struggle to increase its average platform spending per user.

This article was compiled by Brendan Donahue.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/52d86652-ba2b-43fe-a8fc-523af1fa6e47.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/347BSP2KJNBCLKVD7DGXSFLDLU.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TP6GAISC4JE65KVOI3YEE34HGU.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-29-2024/t_d0e8253d77de4af9ae68caf7e502e1bf_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/52d86652-ba2b-43fe-a8fc-523af1fa6e47.jpg)