After Earnings, Is Netflix Stock a Buy, a Sell, or Fairly Valued?

With the crackdown on password sharing and high levels of subscriber additions, here’s what we think of Netflix’s stock.

Netflix NFLX released its third-quarter earnings report on Oct. 18 after the close of trading. Here’s Morningstar’s take on Netflix’s earnings and stock.

Key Morningstar Metrics for Netflix

- Fair Value Estimate: $350.00

- Morningstar Rating: 3 stars

- Morningstar Economic Moat Rating: Narrow

- Morningstar Uncertainty Rating: Very High

What We Thought of Netflix’s Q3 Earnings

- Netflix’s results were fantastic. A high level of subscriber additions surprised the market, and the firm expects fourth-quarter additions to show similar strength. Margins and free cash flow were also very strong, and the price increases and progress Netflix has made toward its advertising revenue stream should lead to future strength in average revenue per subscriber.

- The quarter reinforced everything an investor in Netflix would want to see. The strength of the platform was apparent with the subscriber success it has had following its password-sharing crackdown. Netflix is very successfully monetizing its business, and there’s reason to believe monetization will get even better with ads and higher prices.

- However, some of the outsize strength was not indicative of normal levels, and it seems the market is acting like it is, so the stock has become less attractive. Notably, free cash flow and subscriber additions were artificially high. The writers’ and actors’ strikes halted many productions, leading to higher levels of cash. Once production begins again, there should be a drop in free cash flow.

- As for subscribers, new additions are being boosted by the crackdown on password sharing. This speaks to the strength of the Netflix brand, but it is a tailwind that will fade. The strength is significantly attributable to getting existing users to sign up. Eventually, subscriber growth will have to be driven again by greater penetration of those who don’t yet use Netflix.

Netflix Stock Price

Fair Value Estimate for Netflix

With its 3-star rating, we believe Netflix’s stock is fairly valued compared with our long-term fair value estimate. We raised our fair value estimate for Netflix to $350 from $330, implying a price/earnings multiple of about 25 times our 2024 earnings estimate.

Due to the addition of lower-priced ad-supported plans and lower prices in markets like India, we expect the global streaming paid subscriber base to expand to 320 million by 2027 from 230 million in 2022. This includes the subscriber base in the United States and Canada growing to about 80 million in 2027 from under 75 million in 2022.

Our domestic subscriber and pricing forecast generates an average annual revenue growth of 6% between 2023 and 2027, as Netflix benefits from price increases every 18 months. We also expect advertising revenue to keep average revenue per subscriber rising despite more new subscribers choosing the low-cost ad tier. However, customers will become more price-sensitive as the standard plan gets closer to $20, and competitors like Disney+ are already undercutting Netflix’s prices, which should temper pricing power over subscriptions.

On the international side, we expect increased customer penetration will generate an average revenue growth of 12% in Europe, 8% in Latin America, and 12% in Asia-Pacific through 2027. We expect average revenue per member in Asia-Pacific to decline slightly as the firm adds more subscribers from lower-priced emerging markets, offsetting pricing increases in more mature countries.

Overall, we forecast an average revenue growth of 8% for Netflix, with the operating margin expanding to 26% in 2027 from 21% in 2021.

Read more about Netflix’s fair value estimate.

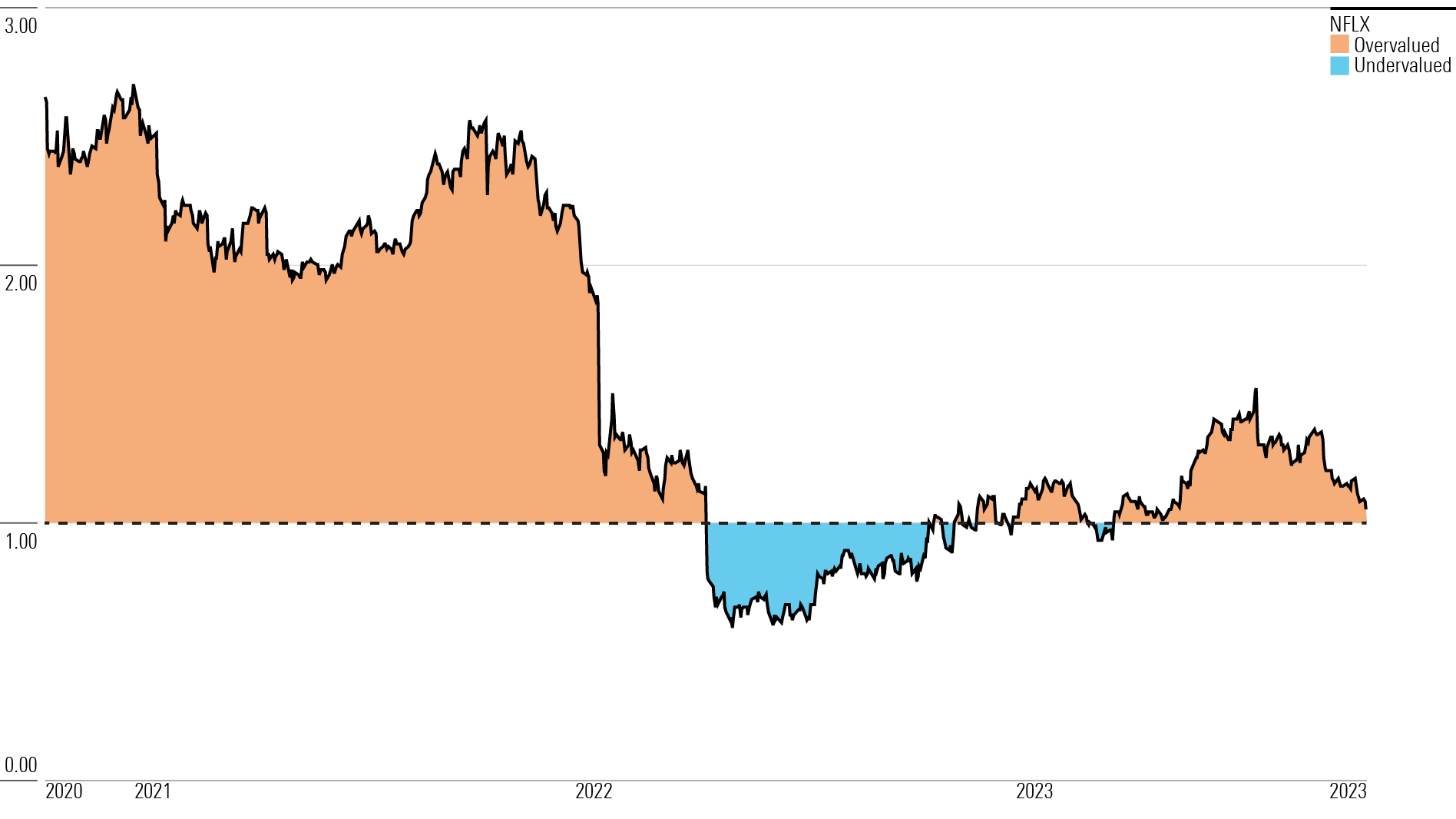

Netflix Historical Price/Fair Value Ratio

Economic Moat Rating

We assign Netflix a narrow moat. Netflix is the largest subscription video-on-demand provider in the U.S. and is rapidly expanding internationally. This fast-growing subscriber base creates a humongous data set that the company mines so it can better purchase and create content. This new content not only strengthens its relationship with its current customers, but also attracts new customers via word of mouth and the halo effect from critical acclaim and award nominations.

Through streaming video, Netflix tracks every customer interaction, from the major (total time spent with the platform) to the minute (whether a user presses fast-forward). This data is aggregated in a massive cloud database housed across multiple data centers worldwide. Netflix can query this information to better understand network and device performance, customer behavior, and content popularity.

While current and future competitors such as Amazon.com AMZN and internet access providers could create similar databases, Netflix’s data set is and will remain significantly larger due to the size advantage of its subscriber base and the amount of time spent on the service. According to the 2018 Sandvine Global Internet Phenomena Report, Netflix accounted for 26% of all global video streaming traffic (the largest source), beating out YouTube at 21% and Amazon Prime at 6%. The average Netflix user now watches more than 90 minutes of video per day.

Read more about Netflix’s moat rating.

Risk and Uncertainty

Netflix’s move to rely on original content has added costs and risks. The company now depends heavily on its ability to find and create compelling new original programming within relatively tight schedules on an ongoing basis. If this pipeline falters, subscribers could bolt to competitors.

The firm’s expansion outside the U.S. could continue to drag on margins because of different tastes and lower pricing. While Netflix has experienced some success in using its non-U.S. content in other markets, much of the local language content will likely not travel as well. Additionally, pricing in large emerging markets, such as India, remains considerably below that of the U.S. and Western Europe. With increased competition in this market, Netflix may need to lower pricing.

Increasing the subscription price in mature markets could limit growth and increase churn. While churn spikes have been temporary in the past, Netflix is now one of the most expensive services in markets like the U.S., and further price hikes could cause subscribers to cancel. While the introduction of ads could help Netflix attract and increase revenue from price-sensitive consumers, the new offering could also dilute its brand equity. Additionally, efforts to crack down on password sharing after years of winking at the practice could make churn spike.

Read more about Netflix’s risk and uncertainty.

NFLX Bulls Say

- Netflix’s internal recommendation software and large subscriber base give it an edge when deciding what content to acquire.

- Netflix has built a substantial content library that will benefit it over the long term.

- International expansion offers attractive markets for adding subscribers.

NFLX Bears Say

- The firm continues to burn billions of dollars to create its original content, with no end in sight.

- Competition is increasing and will continue to do so in the near future.

- The need for increased content and marketing spending outside the U.S. will limit the rate of margin expansion for the international segment.

This article was compiled by Adrian Teague.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/83fcd1d4-0576-422a-a260-91e1689417ed.jpg)

/d10o6nnig0wrdw.cloudfront.net/05-03-2024/t_8ba91080cb4d43acae9d9119875abede_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KD4XZLC72BDERAS3VXD6QM5MUY.png)

/d10o6nnig0wrdw.cloudfront.net/05-02-2024/t_7b0d5ad1cbc64c2db440c298c6bcccd7_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/83fcd1d4-0576-422a-a260-91e1689417ed.jpg)