After Earnings, Is Disney Stock a Buy, a Sell, or Fairly Valued?

With positive surprises from streaming revenue and a strong rally in its stock, here’s what we think of Disney’s outlook.

Walt Disney DIS released its fiscal first-quarter earnings report on Feb. 7, and the stock has since rallied roughly 15%. Here’s Morningstar’s take on Disney’s earnings and the outlook for its stock.

Key Morningstar Metrics for Walt Disney

- Fair Value Estimate: $115.00

- Morningstar Rating: 3 stars

- Morningstar Economic Moat Rating: Wide

- Morningstar Uncertainty Rating: High

What We Thought of Walt Disney’s Fiscal Q1 Earnings

- We’d argue that the results didn’t have any major surprises or solely cause the stock to jump as much as it did; rather, the jump came from several flashy announcements. Streaming had some positive upside surprises. Disney+ average revenue per user jumped 9% year over year, and the segment cut its loss significantly to $138 million from almost $1 billion a year ago. More broadly, the firm is making better progress than expected on its $7.5 billion cost savings program. Also, linear ESPN sales dropped only 0.6% year over year.

- Outside ESPN, linear networks revenue dropped nearly 13% year over year, and consolidated Disney sales in the quarter were basically flat year over year despite a 7% rise in experiences revenue, which got what we expect to be the last “artificial” bump from lapping a quarter affected by COVID-19-related restrictions (in some Asian parks in the fiscal first quarter of 2023). Management has essentially promised that it will be moving toward profitability in streaming for fiscal 2024. It remains to be seen how Disney balances streaming prices and subscribers with the cannibalization of the linear business.

- The stock move makes the company fairly valued, in our view, as risks surrounding linear television remain. But premier assets should preclude a more pessimistic outlook surrounding secular challenges. At these stock levels, the market is pricing in improved profitability, which we believe is warranted.

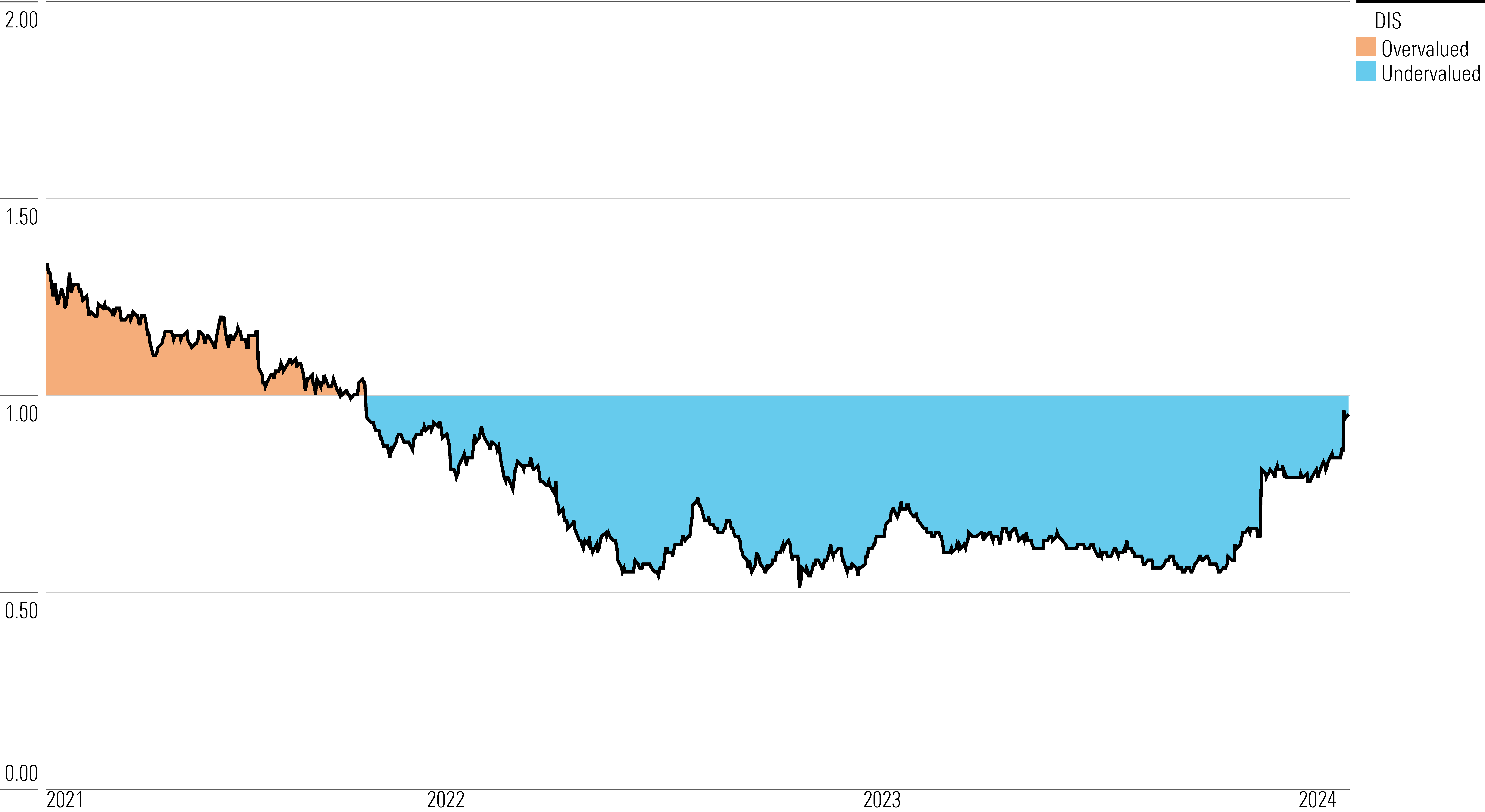

The Walt Disney Company Stock Price

Fair Value Estimate for Disney

With its 3-star rating, we believe Disney’s stock is fairly valued compared with our long-term fair value estimate of $115 per share.

We project linear networks revenue (which no longer includes ESPN after the firm changed its reporting segments) to average 1%-2% annual growth over our five-year forecast. We expect growth to be somewhat choppy from year to year, mostly due to advertising revenue. We project a slight annual decline in the affiliate fees Disney receives from pay-TV distributors, due to a continuing decline in the number of subscribers to pay-TV services. However, we expect the pace of cord-cutting to slow, and the decline should be largely offset by growth in fees over time.

We project the most growth out of the experiences segment, driven by theme parks and related hospitality services, as well as new cruise ships that are due to arrive in 2025 and 2026. However, the recovery in attendance after the pandemic shut down some theme parks as recently as 2022 is now virtually complete, so we don’t expect the double-digit growth of the past few years. We project a 4% average annual revenue growth over our five-year forecast.

Read more about Disney’s fair value estimate.

Disney Price/Fair Value Chart

Economic Moat Rating

We are maintaining our wide moat rating for Disney. Ultimately, we believe the firm’s ownership of timeless characters and franchises and its ability to continue creating and attracting top-tier content outweigh its near-term challenges related to the evolving media industry. Although we think it’s likely that the lack of the traditional cable television bundle as a foundation will keep Disney from returning to the level of profitability it routinely achieved in years past, we still expect the firm’s returns on invested capital to comfortably exceed its cost of capital over the next 20 years.

Recent struggles at Disney are related to the shift from the linear television model—wherein nearly all U.S. households subscribed to a pay-TV service offered by distributors like cable and satellite providers—to the direct-to-consumer, or DTC, streaming model. The attraction of Disney’s top-tier networks, led by ESPN, ABC, and the Disney Channel, resulted in this package of channels being included in nearly all subscriptions at industry-leading rates. Relatively high levels of television viewership also boosted advertising revenue. Cord-cutting and a decline in linear viewership have dampened both of those revenue streams.

We believe Disney’s experiences segment, which consists mostly of theme parks and other vacation-related revenue streams, has the most durable advantage. Disney characters have proven timeless, and we think it would be nearly impossible for new competitors to offer equally attractive destinations. Even if one were to secure and build the infrastructure on such a massive project, it wouldn’t have the depth of popular characters to drive interest at a national or global level. These characters and franchises also drive licensing revenue on consumer products, a high-margin source of continuing revenue for Disney. In short, the firm can provide a type of experience that we expect will drive consistent demand, and its offering for that type of experience is unique and best in class.

Read more about Disney’s moat rating.

Risk and Uncertainty

Our Uncertainty Rating for Disney is High. The current evolution of the media industry is the main factor behind our assessment. Outside its parks and experiences business, Disney historically had three main sources of revenue: fees it received from pay-TV distributors to carry the Disney bundle of channels, television advertising, and licensing fees for movies and television programming distributed by third parties. All these sources are now under pressure. Cord-cutting and diminished linear television viewership have depressed carriage fees and advertising revenue. Shorter runs in movie theaters and an industry shift toward DTC streaming services have depressed licensing revenue.

Read more about Disney’s risk and uncertainty.

DIS Bulls Say

- No peer can match the depth of Disney’s iconic characters, franchises, or content library, which will keep the firm’s streaming services in high demand and give it a leg up in creating new movies and television shows.

- The decline in linear television will slow, so the value of the assets associated with it will start to shine. ESPN remains the premier brand in sports; putting it on a streaming service will open it up to a new set of consumers.

- The allure of Disney’s parks business is unmatched, and it will be a continuing profit engine.

DIS Bears Say

- Linear television will continue to decline. Even if successful, newer revenue sources like DTC streaming will never equal the profitability Disney once enjoyed.

- Disney now competes with tech companies for major sports rights, and they may have incentives to continue driving up prices. Sports remain material to Disney’s future, and being forced to pay up for critical content will depress profits.

- Too many streaming platforms now exist, and it’s questionable whether consumers will be willing to pay high prices or stick with individual services month in and month out.

This article was compiled by Frank Lee.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/83fcd1d4-0576-422a-a260-91e1689417ed.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RNODFET5RVBMBKRZTQFUBVXUEU.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LJHOT24AYJCHBNGUQ67KUYGHEE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/V33GR4AWKNF5XACS3HZ356QWCM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/83fcd1d4-0576-422a-a260-91e1689417ed.jpg)