After Earnings, Is Alphabet Stock a Buy, a Sell, or Fairly Valued?

With the cloud market becoming more segmented, here’s what we think of Alphabet stock.

Alphabet GOOGL/GOOG released its third-quarter earnings report on Oct. 24, after the close of trading. Here’s Morningstar’s take on Alphabet’s earnings and stock.

Key Morningstar Metrics for Alphabet

- Fair Value Estimate: $161.00

- Morningstar Rating: 4 stars

- Morningstar Economic Moat Rating: Wide

- Morningstar Uncertainty Rating: High

What We Thought of Alphabet’s Q3 Earnings

- While Alphabet beat third-quarter expectations on its top and bottom lines, its cloud growth decelerated a bit more than expected, especially considering Microsoft’s MSFT better cloud numbers. Google’s higher exposure to high-growth firms and startups, which have been more aggressive on cloud cost control, pressured that segment a bit.

- We believe reduced economic uncertainty, combined with the necessity of artificial intelligence to operate more efficiently, will bring in more cloud clients for Google and increase client usage, accelerating revenue growth in the fourth quarter and next year.

- The network effect for Google’s core advertising business remains strong, and as we anticipated, hesitancy among advertisers is lessening, demonstrated by accelerating revenue growth in both Search and YouTube.

- We increased our projections for Google Search and YouTube ad growth but lowered our expectations for Google’s ad tech revenue. Our model adjustments did not affect our $161 fair value estimate for Alphabet. Shares are trading at a 23% discount and remain very attractive.

Alphabet Stock Price

Fair Value Estimate for Alphabet

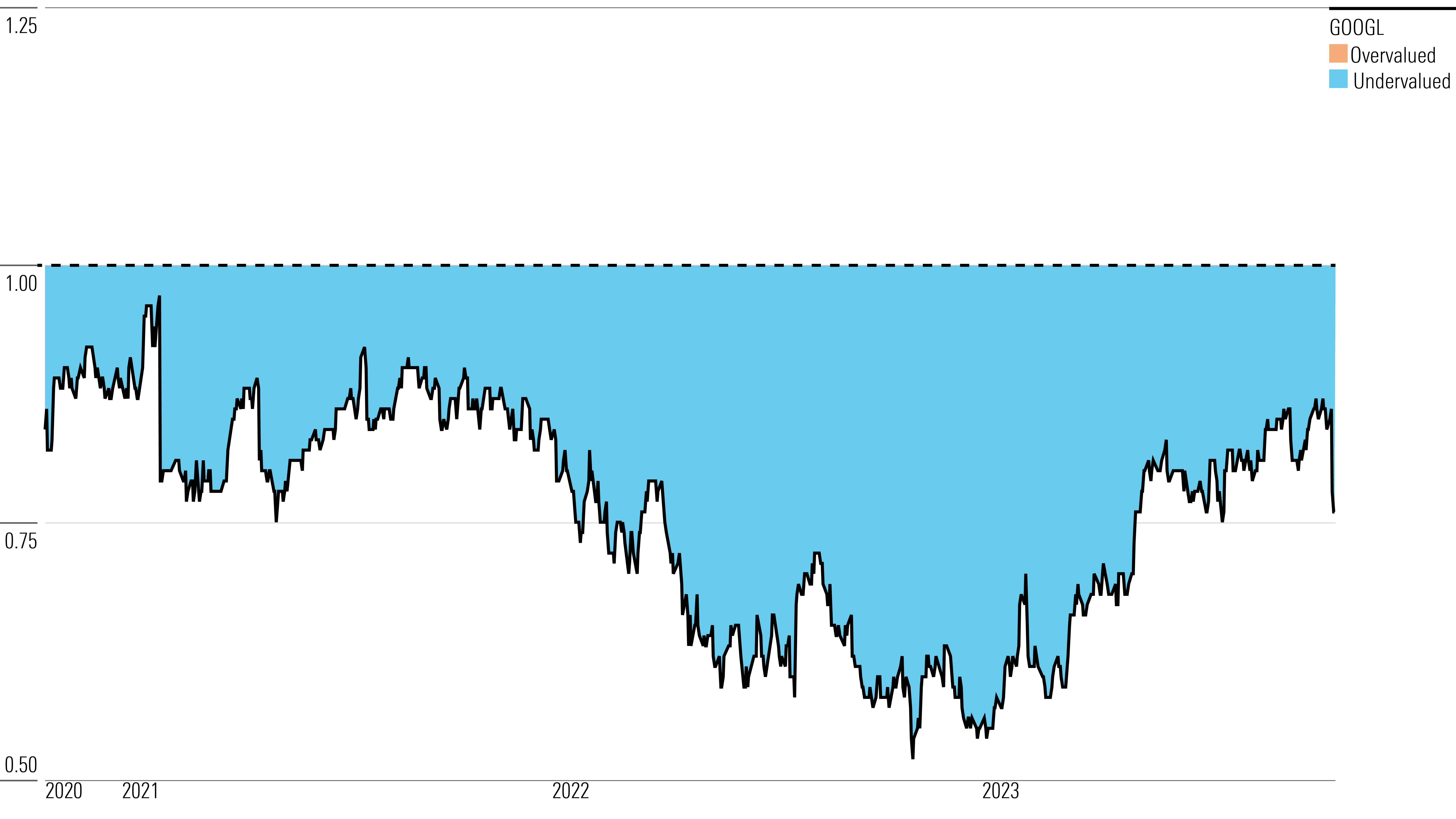

With its 4-star rating, we believe Alphabet’s stock is undervalued compared with our long-term fair value estimate.

Our fair value estimate is $161 per share, equivalent to a 2024 enterprise value/EBITDA ratio of 17. We expect margin pressure in 2023, given the firm’s aggressive hiring in 2022, continued investments in growth initiatives, and the slight short-term impact of Bing and generative AI. We look for margin improvement in 2024-27, driven by better generative AI search monetization and faster growth in the cloud, driven by wider adoption of generative AI. Our model assumes a five-year compound annual growth rate of nearly 11% for total revenue and a five-year average operating margin of 24%.

We expect advertising revenue to remain over 70% of Alphabet’s total revenue, driven by continuing growth in overall digital ad spending, albeit at a much slower rate than it’s historically had. We model nearly 6% ad revenue growth for 2023 due to economic uncertainty. We have estimated total Google ad revenue of $233 billion in 2023 and $247 billion in 2024. We think YouTube will contribute about 13% of Google’s advertising revenue in 2023 and 14% in 2024. YouTube growth should benefit from its impressive reach and usage frequency, plus its video-only content format, which is attractive to advertisers.

We believe the company will continue to gain traction in the cloud market, with 23% annual revenue growth through 2027.

Read more about Alphabet’s fair value estimate.

Alphabet Historical Price/Fair Value Ratio

Economic Moat Rating

We assign Alphabet a wide moat, thanks to its durable competitive advantages derived from its intangible assets and network effect.

We believe the firm holds significant intangible assets related to overall technological expertise in search algorithms and AI (machine learning and deep learning), as well as access to and accumulation of data deemed valuable to advertisers. We also believe Google’s brand is a significant asset. “Google it” has become eponymous with searching, and regardless of actual technological competency, the firm’s search engine is perceived as being the most advanced in the industry. While Bing is attempting to dethrone Google with AI technology from OpenAI, we think the firm can defend its dominance in search with its own AI technology, some of which OpenAI’s products are based on.

In our opinion, Alphabet’s network effects are derived mainly from its Google products, such as Search, Android, Maps, Gmail, and YouTube. Ultimately, we view Google’s network as heterogeneous. All these products have provided it with a massive consumer base that allows the company to collect data. And with its rich collection of data and large user base, Google can offer the best return on investment for advertisers and build a growing network of advertising customers. The addition of each new ad and advertiser improves the efficiency of Google’s programmatic advertising offerings, allowing the firm to better monetize the network.

Google Search’s large and growing user base has created a network effect that’s difficult to replicate, in our view. We believe each additional search on Google’s engine creates value for other users, as well as for advertisers and businesses. With AI technology, more requests made by current and/or new users improve the relevance of search results, creating value for users. More relevant results also decrease the likelihood of users jumping to another search engine, creating somewhat of a barrier to exit.

Read more about Alphabet’s moat rating.

Risk and Uncertainty

Our Morningstar Uncertainty Rating for Alphabet is High, primarily as a result of its high dependency on continuing online advertising growth. While we remain confident that Google will maintain its dominant position in the search market, a long-lasting downturn in online ad spending could have a negative impact on Alphabet’s revenue and cash flow, resulting in a lower fair value estimate. On the other hand, positive returns on Alphabet’s investments in cloud and moonshots could increase our fair value estimate considerably.

Although its intangible assets and network effect will help Alphabet retain its competitive advantages, the minimal switching cost to utilize a rival search engine remains a risk for the company. This risk remains manageable, in our view, as Microsoft’s Bing—the nearest competitor and the first mover in enhancing search with generative AI capabilities—currently does not have a significant presence in the mobile market, which is one of the main growth drivers of the search ad market. Google also has generative AI technology to defend its global search market share of over 90%.

Read more about Alphabet’s risk and Uncertainty.

GOOGL/GOOG Bulls Say

- As online users and internet usage increase, so will digital ad spending. Google will remain one of the main beneficiaries of this trend.

- Android’s dominant global market share of smartphones leaves Google well-positioned to continue generating top-line growth as search traffic shifts from desktop to mobile.

- The significant cash generated from Google Search allows Alphabet to remain focused on innovation and the long-term growth opportunities new areas present.

GOOGL/GOOG Bears Say

- There is little revenue diversification within Alphabet, as it remains heavily dependent on Google and the Search ad space.

- Alphabet is allocating too much capital toward high-risk bets, which face a very low probability of generating returns.

- Google’s dominant position in online search is not maintainable, as more companies and regulatory agencies are contesting the methods through which the company has been extending its leadership.

This article was compiled by Brendan Donahue.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZPLVG6CJDRCOTOCETIKVMINBWU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZZSPP5AYAJB2RIRVFE2XR23GUQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NYUEHSFI4BDCJPQZJ76HH4PKSM.jpg)