After Earnings, Is Snap Stock a Buy, a Sell, or Fairly Valued?

With mixed fourth-quarter results and big drop in its stock, here’s what we think of Snap’s outlook.

Snap SNAP released its fourth-quarter earnings report on Feb. 6. Here’s Morningstar’s take on Snap’s earnings and the outlook for its stock.

Key Morningstar Metrics for Snap

- Fair Value Estimate: $14.00

- Star Rating: 3 stars

- Economic Moat Rating: None

- Uncertainty Rating: Very High

What We Thought of Snap’s Q4 Earnings

- Snap reported mixed fourth-quarter results, with the top line coming in below expectations. In addition, the firm’s first-quarter guidance was below the consensus forecast.

- We maintain our $14 fair value estimate, and the stock is now trading at nearly a 20% discount after a 30%-plus decline in reaction to the fourth-quarter results. The decline may have created a margin of safety for some investors.

- We were pleased by Snap’s improved monetization in developed markets. We still expect the firm to reach full-year profitability in 2027, driven by user growth, enhanced engagement, improved advertising solutions, and recent cost cuts.

- We believe Snap’s revenue growth during the next few years will be driven mainly by growth in users, increases in user engagement on Spotlight (which should attract advertisers), and further improvement in ad measurement tools (which should retain more advertisers). The faster revenue growth, the firm’s headcount reduction measures (whose impact will likely be seen in the second quarter and beyond), and more measured infrastructure investments in AI can create operating leverage. We expect gradual improvement in operating losses during the next few years, leading to slight GAAP profitability in 2027 and margin expansion thereafter.

Snap Stock Price

Fair Value Estimate for Snap

With its 3-star rating, we believe Snap’s stock is fairly valued compared with our long-term fair value estimate of $14 per share, which represents a 2024 enterprise value/sales multiple of 4 times. We project Snap will see a 10-year average project revenue growth rate of 12%. Within our discounted cash flow model’s initial 10-year projection, we assume Snap will become profitable in 2027 and improve its current operating loss to an operating margin of 22% by 2033.

Revenue growth will be driven primarily by increases in the firm’s daily active users, user engagement, overall online advertising spending, more adoption of augmented reality ads, an increasing allocation of online ad dollars toward mobile and social network ads, and Snap’s more aggressive monetization of Snap Map and Spotlight. We expect 11% year-over-year growth in 2024 (after it was nearly flat in 2023), due to less macro uncertainty.

We model improving gross margins going forward as the firm reduces original programming investments. While costs related to hosting are generally fixed, we expect the firm to invest in the cloud more aggressively due to its attempt to enhance AI capabilities for users and advertisers. We look for continuing growth in operating expenses as more investments in R&D, plus higher sales and marketing expenses, which are necessary for Snap to differentiate itself and attract more users. We project that such costs will keep Snap in the red in the near term, but recovery in revenue growth beginning in 2024 and gross margin expansion will lead to operating leverage and help Snap become profitable in 2027, with further expansion thereafter.

Read more about Snap’s fair value estimate.

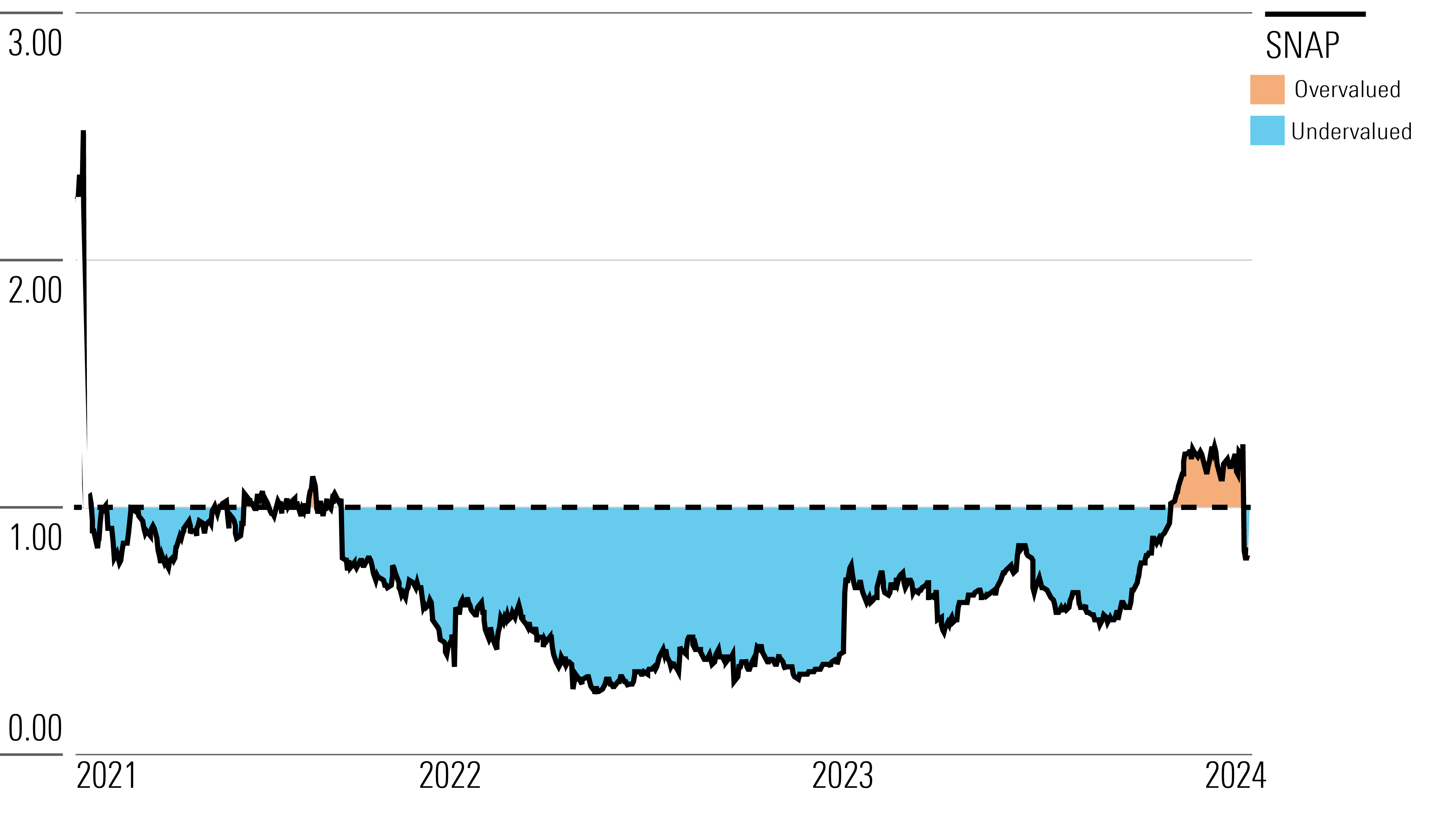

Snap Historical Price/Fair Value Ratio

Economic Moat Rating

We do not assign Snap a moat. While we believe the firm has a network effect among its users and has begun to compile intangible assets in the form of valuable user data, we are not yet convinced it will effectively generate excess return on capital for at least 10 years. The firm is still in its early growth stage, and during its brief history, it has not generated excess returns. We do not see any indications that it will do so soon.

Further, in our view, the competition is overwhelming, including Meta Platform’s META Facebook with its 2.1 billion daily active users. The larger ecosystems of Snap’s competitors may have also created somewhat of an exit barrier for their users, which we think will further limit the growth acceleration of Snapchat users. In addition, growth in new users, user engagement, and time spent on Snapchat may be constrained in the long run, given the limited amount of time each person has to spend on social media apps each day. While digital ad budgets continue to grow, so does the number of ad inventory providers in the space, so there is no guarantee that a larger portion of new digital ad dollars will flow to Snap.

Read more about Snap’s moat rating.

Risk and Uncertainty

Given the evolution of the barriers to exit for Facebook’s billions of users, we believe that competitor’s growth and race to further innovate remain key risks for Snap. While most consumers use more than one social network, we think Instagram could be viewed as a substitute for Snapchat as well. Any downturn in online ad spending could also weigh on Snap, in our view. A decline in digital ads would hurt its revenue growth more than that of its competitors and could delay or change its path toward profitability.

Given Snapchat’s current features, the app is likely will continue to attract mainly users between 18 and 34. The firm may not be able to develop products for older users, limiting its total addressable market size and not differentiating it from more complete social media ecosystem providers. In addition, as the firm adds users and compiles user behavior data, possible limitations from regulatory agencies around the world on what user and usage data Snap can compile and how the data can be utilized, remain a risk. In addition to such data privacy issues, the firm also faces the risk of data security, both of which we view as environmental, social, and governance risks. Furthermore, some governments may simply forbid access to Snapchat, which could result in lower user growth and user interaction.

Read more about Snap’s risk and uncertainty.

SNAP Bulls Say

- With unique multimedia app features focusing on further differentiation, Snap may take social media market share from X and Meta.

- Snap’s hold on younger users may provide significant value to advertisers seeking a younger demographic.

- Aggressive investments in innovation, which also brought about Snap’s Spectacles, may expand the firm’s ecosystem, diversify its revenue sources, and make the company profitable earlier than expected.

SNAP Bears Say

- Snap may struggle to capture enough digital advertising dollars from incumbent platforms to achieve profitability.

- Snap is late getting into a market that Meta dominates. Many of its users may also belong to other social networks, so the firm will continually have to fight to capture new users, their time, and their interactions.

- By issuing only nonvoting shares for its initial public offering, Snap’s management is protecting its control over the firm, which can be viewed as a significant risk.

This article was compiled by Freeman Brou.

The author or authors own shares in one or more securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZPLVG6CJDRCOTOCETIKVMINBWU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZZSPP5AYAJB2RIRVFE2XR23GUQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NYUEHSFI4BDCJPQZJ76HH4PKSM.jpg)