9 Undervalued Stocks in Top-Performing Sectors

Energy, tech, and real estate are leading the market. Here are some names with room to run in 2022.

U.S. stocks are finishing the year posting strong gains, with energy, technology, and real estate stocks leading the way higher.

For investors who expect these trends to continue, the challenge is where to find opportunities among these stocks, many of which have posted outsize gains in 2021.

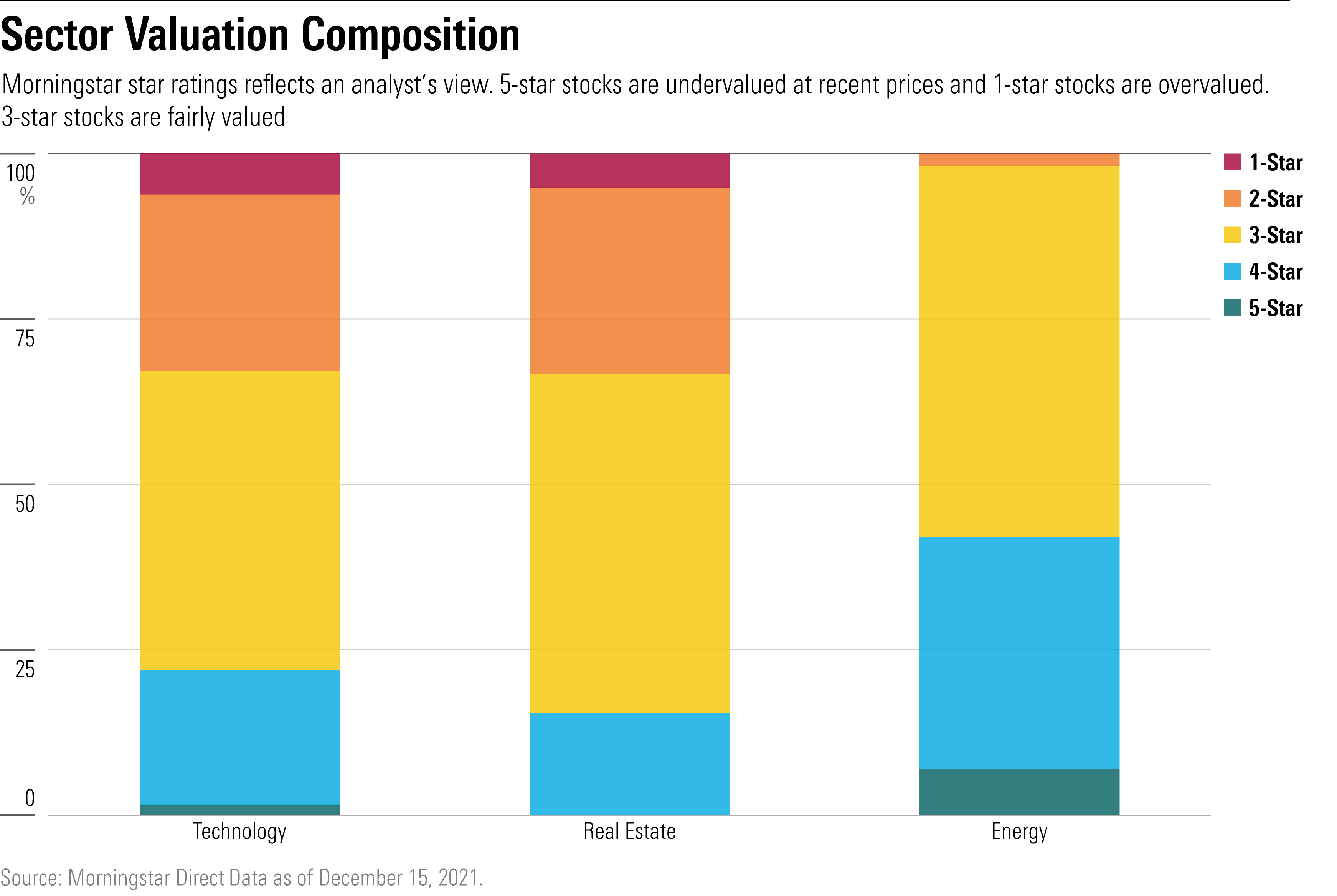

Technology and real estate stocks largely land on the overvalued side of the fence, making it especially difficult for stock investors to find a pick with at a reasonable price in these sectors. Among the tech stocks covered by Morningstar analysts, one third are in overvalued territory and roughly 45% are deemed fairly valued. It’s a similar story for real estate stocks, with one third overvalued and over half fairly valued. Energy stocks, however, remain largely undervalued based on Morningstar’s metrics.

We screened through Morningstar’s coverage list and found stocks in each sector that our analysts believe have room to run, including communications software company RingCentral RNG, business software company DocuSign DOCU, and healthcare-focused real estate investment trust Ventas VTR.

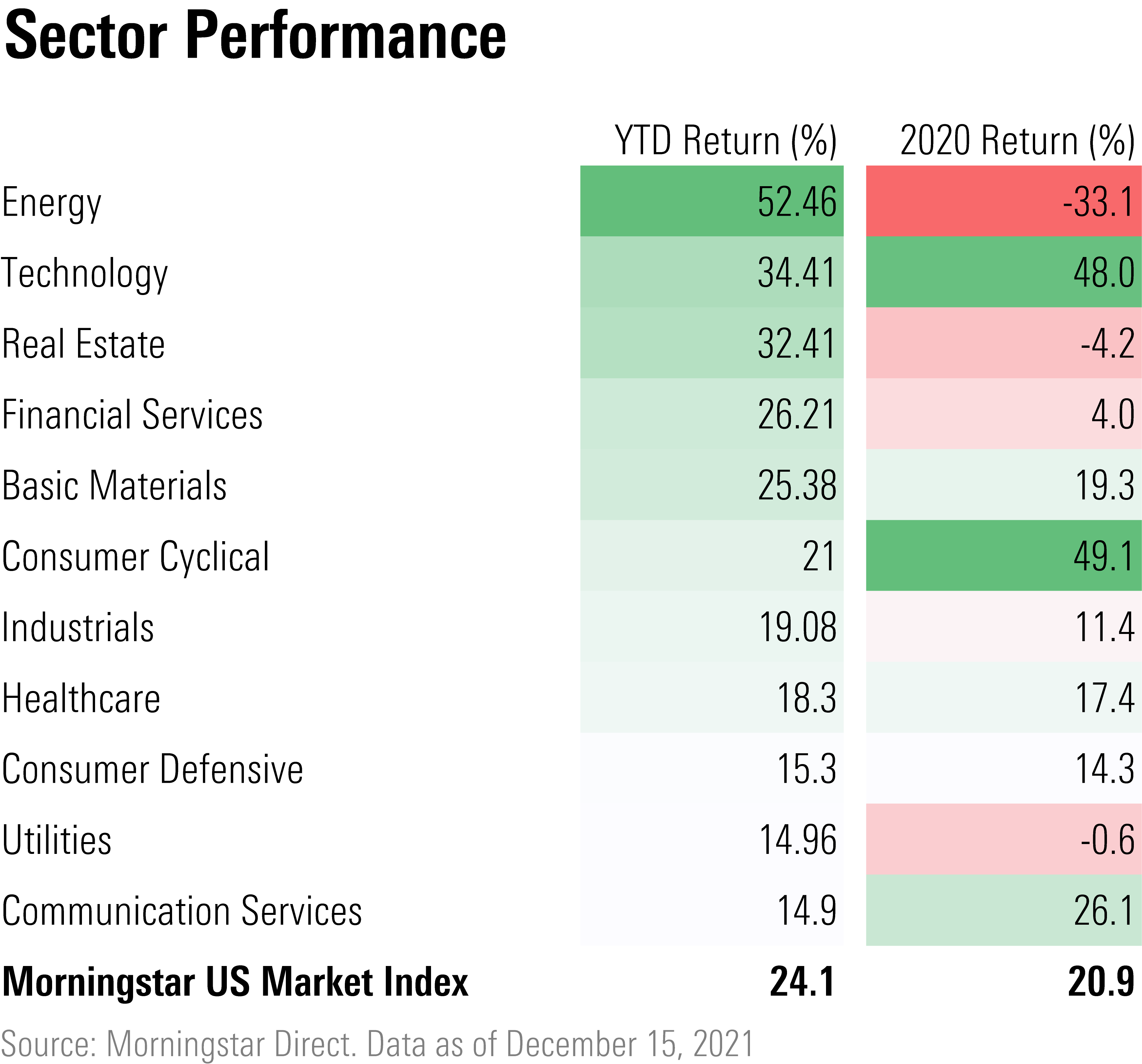

Over the course of 2021, the rally in energy stocks has been fueled by rebounding oil demand and a 46% rise in oil prices. The Morningstar Energy Index is up 52.5% this year--a sharp turnaround from the 33.1% loss in 2020.

Many technology companies, meanwhile, have benefited from the coronavirus pandemic business environment and extended their 2020 rally, albeit at a slower pace. The Morningstar Technology index is up a 34.4% return this year following a 48% return in 2020.

Real estate stocks are chalking up a 32.4% return as the economy emerges from the pandemic-driven recession, having lost 4.2% in 2020.

Among other sectors, financial services stocks is returning 26.2%, narrowly beating out the U.S. market, which is up 24.1% as 2021 draws to a close. Basic material stocks had a strong year thanks to rising commodity prices, returning 25.4% so far in 2021.

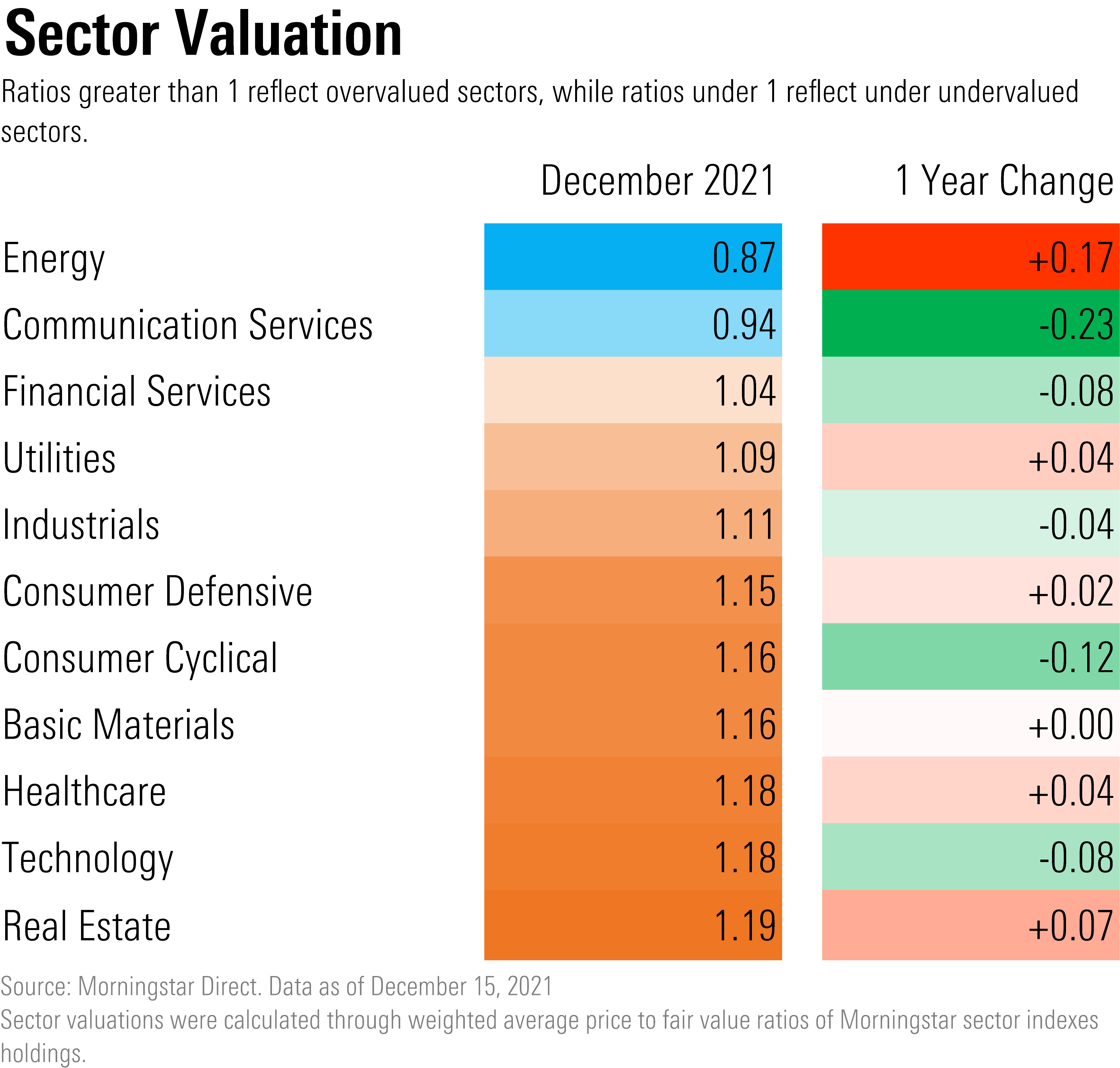

Most sectors remain overvalued as they were a year ago, but a few became significantly more overvalued. Real estate is currently the most overvalued sector in the market, with stocks on average trading at a 19% premium to their Morningstar fair value estimate. Energy remains the most undervalued sector, trading at 13% discount to fair values on average, down from their 30% discount last December.

Communication services stock valuations had the largest change over the year. The sector now trades at a broad 6% discount compared with a 17% premium a year ago.

We screened Morningstar’s U.S. coverage universe of 859 stocks to find the best entry points for these three sectors. Our screen started by filtering for stocks trading at a 5- or 4-star Morningstar rating. Of those, we selected from stocks with the lowest price/fair value ratios to allow for the largest margin of safety for investors. The result was three undervalued stocks for each of the best-performing sectors.

Here are the Morningstar analysts’ takes on each stock pick:

Technology

RingCentral RNG

"RingCentral provides a leading Unified Communications-as-a-Service platform that facilitates cloud-based business communication and collaboration via one application and enables a single user experience.

Channel partners are a key part of RingCentral’s go-to-market strategy. With thousands of partners, including Avaya and AT&T, among others, the firm has been able to expand within the enterprise and international markets over time. RingCentral currently has 2.5 million to 3 million UCaaS seats, and these partners provide access to 150 million to 200 million of the on-premises user base. This direct access should benefit the company in its go-to-market efforts as RingCentral strives to displace landline phones. We foresee healthy long-term growth as the firm increases seat penetration, expands enterprise adoption, and develops its international presence."

--Dan Romanoff, senior equity analyst

Sabre SABR

“Despite material near-term travel demand headwinds driven by the coronavirus, we expect Sabre to maintain its position in global distribution systems over the next several years, driven by a leading network of airline content and travel agency customers as well as its solid position in technology solutions for these carriers and agents. Sabre's roughly 40% GDS transaction share is the second-largest of the three companies (behind narrow-moat Amadeus and ahead of privately held Travelport) that combined control nearly 100% of market volume. Sabre is also a leader in providing technology solutions to travel suppliers.

Sabre's GDS enjoys a network advantage (source of its narrow-moat rating). As more supplier content (predominantly airline content) is added, more travel agents use the platform, and as more travel agents use the platform, suppliers offer more content.”

--Dan Wasiolek, senior equity analyst

Docusign DOCU

"DocuSign delivered generally solid results, exceeding our above-consensus revenue and profitability estimates while falling meaningfully short on billings in 2021’s third quarter. DocuSign noted customers were not buying with the same sense of urgency and as buying returned to normal, the sales organization took its eye off the ball as it had to transition from urgent order taking during the depths of the lockdowns to lead generation, which had been neglected. The firm announced various moves to address this and believes it will return to normal DocuSign levels of success. We do not disagree. That said, even though the shares were down 30% in after-hours trading following earnings, and we see meaningful upside to our fair value estimate, we are cautious on the stock and believe our very high uncertainty rating is particularly relevant. Shares had already sold off 25% over the last three months, so our initial inclination is the after-hours move is punitive toward management rather than fundamental. However, we believe annual guidance released next quarter for fiscal 2023 will serve as a catalyst, negative or positive, for the stock as expectations can be reset further.”

--Dan Romanoff, senior equity analyst

Real Estate

Macerich MAC

“Macerich has successfully repositioned the company over the past decade as a true owner and operator of Class A regional malls. Over the past nine years, the company has sold over $4 billion in mostly lower-quality assets, either directly owned or owned through joint ventures, and recycled the capital into acquiring new Class A malls, buying out its partners' share in the unconsolidated portfolio or redeveloping its own portfolio. As a result, the company's portfolio should produce higher tenant sales productivity, occupancy levels and rent and therefore is much better-positioned to face the economic headwinds of e-commerce. We expect Macerich to continue improving its portfolio through redevelopment, opportunistic acquisitions, and asset sales, which should deliver strong earnings growth for Macerich over time.”

--Kevin Brown, equity analyst

Ventas VTR

“With an increased focus on higher-quality care being performed in lower-cost settings, the best owners and operators in the industry that can provide better outcomes while driving greater efficiencies should see demand funneled to them from the best healthcare systems. Additionally, the baby boomer generation is starting to enter its senior years and the 80-plus age population, an age range that spends more than 4 times on healthcare per capita than the national average, should almost double in size over the next 10 years. In our view, Ventas will benefit from these industry tailwinds due to its portfolio of high-quality assets connected to top operators in the senior housing, medical office buildings, life science, and hospital segments.

Ventas has made a bet on the potential future of healthcare delivery by partnering with Ardent Health Services, an acute-care hospital owner and operator, and partnering with Wexford, a life science operator and developer. While the ultimate scope, scale, and success of these strategies remain to be seen, Ardent and Wexford give Ventas added platforms for consolidation as owners and operators potentially seek an efficient capital partner that can help provide an integrated healthcare infrastructure.”

--Kevin Brown, equity analyst

Park Hotels & Resorts PK

"Park Hotels & Resorts is the second-largest U.S. lodging REIT, focusing on the upper-upscale hotel segment. In the short term, the coronavirus significantly affected the operating results for Park's hotels with high-double-digit revPAR declines and negative hotel EBITDA in 2020. However, the rapid rollout of vaccinations across the country allowed leisure travel to quickly recover.

Management reported that 38 of the company's 48 consolidated hotels produced positive EBITDA during last quarter. With positive hotel EBITDA and asset sales, Park repaid $419 million of the outstanding term loan and paid down the remaining $13 million balance of the credit facility. Total company debt is now at its lowest level since the pandemic started, at $4.7 billion. We think the company should continue to see strong growth beyond 2021 as business and group travel also recover to prepandemic levels with Park eventually returning to 2019 levels by 2024 in our estimate."

--Kevin Brown, equity analyst

Energy

TechnipFMC FTI

“TechnipFMC has cultivated a reputation as a top provider for subsea equipment and services, a factor that’s crucial in a space where customers seek solutions for some of the most challenging engineering problems in the world. TechnipFMC ultimately aims to simplify subsea field layouts by acting as a one-stop shop for offshore producers, which, if successful, will reduce wellsite costs and production times for operators while creating a stickier, more profitable customer base for the firm.

So far, the firm appears to be executing well in its integration strategy. It’s dominated competitors in winning contracts over the last few years, posting record order intake in 2019 and winning over half of subsea tree contracts awarded in 2020. If the firm continues this trajectory, its integration strategy could lead to outperformance compared with its peers in the subsea industry, at least in the near term.”

--Katherine Olexa, equity analyst

NOV NOV

“While we see little likelihood that the company will be able to forge a worthy replacement to its rig-building empire of the past, investors shouldn't write-off NOV entirely. The company's non-rig businesses have room to grow as global oil and gas capital expenditures grow in coming years. Somewhat counterintuitively, we expect the rig-building business to see a large recovery in coming years despite a dearth of newbuilds, as the world's aging rig fleet will need increased volumes of replacement parts.

Although NOV is experiencing a somewhat delayed recovery from the pandemic oil market downturn (compared with peers), we think this largely reflects the temporary effects of business mix rather than any permanent disadvantage. NOV's sales of capital equipment should eventually catch up with a lag.”

--Preston Caldwell, senior equity analyst

Core Laboratories CLB

“We have long believed that Core Laboratories is one of the highest-quality oilfield-service companies. For one, with a wide moat rating, Core Lab possesses the strongest moat across our entire oilfield-service coverage. The company’s foundational core analysis business in the reservoir description segment, in particular, has been virtually unchallenged over the past three decades. The business passes the Warren Buffett quality test, whereby even an "idiot" could likely run the business with some profitability.

Yet, Core Lab has long been managed with the utmost skill, in our view. The 1998 acquisition of Owen Oil Tools and subsequent repositioning of the business to offer high-quality solutions for fast-growing U.S. shale markets was a stroke of brilliance. The combination of topnotch management plus a strong underlying business has delivered unrivaled levels of returns on capital over the past two decades.”

--Preston Caldwell, senior equity analyst

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/D2M6HBDLIZD3RLWRUR7IPUIVIU.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/2UWGQD7LCJCYNF3WQ5HHLP7UBE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WC6XJYN7KNGWJIOWVJWDVLDZPY.png)