5 Undervalued Biopharma Companies: Our 5-Year Forecast

We expect innovation and moats will help the biopharma industry outrun patent expirations.

We believe the market is underappreciating the significance of innovation in the biopharma industry, and forecast 4.5% compound annual earnings growth in the industry over the next five years (excluding COVID products).

The market appears overly concerned by U.S. drug policy changes in the Inflation Reduction Act, the drag on acquisitions from Federal Trade Commission scrutiny, and patent losses. We think the biopharma-related policies in the Inflation Reduction Act are manageable, and that innovation will offset the patent losses.

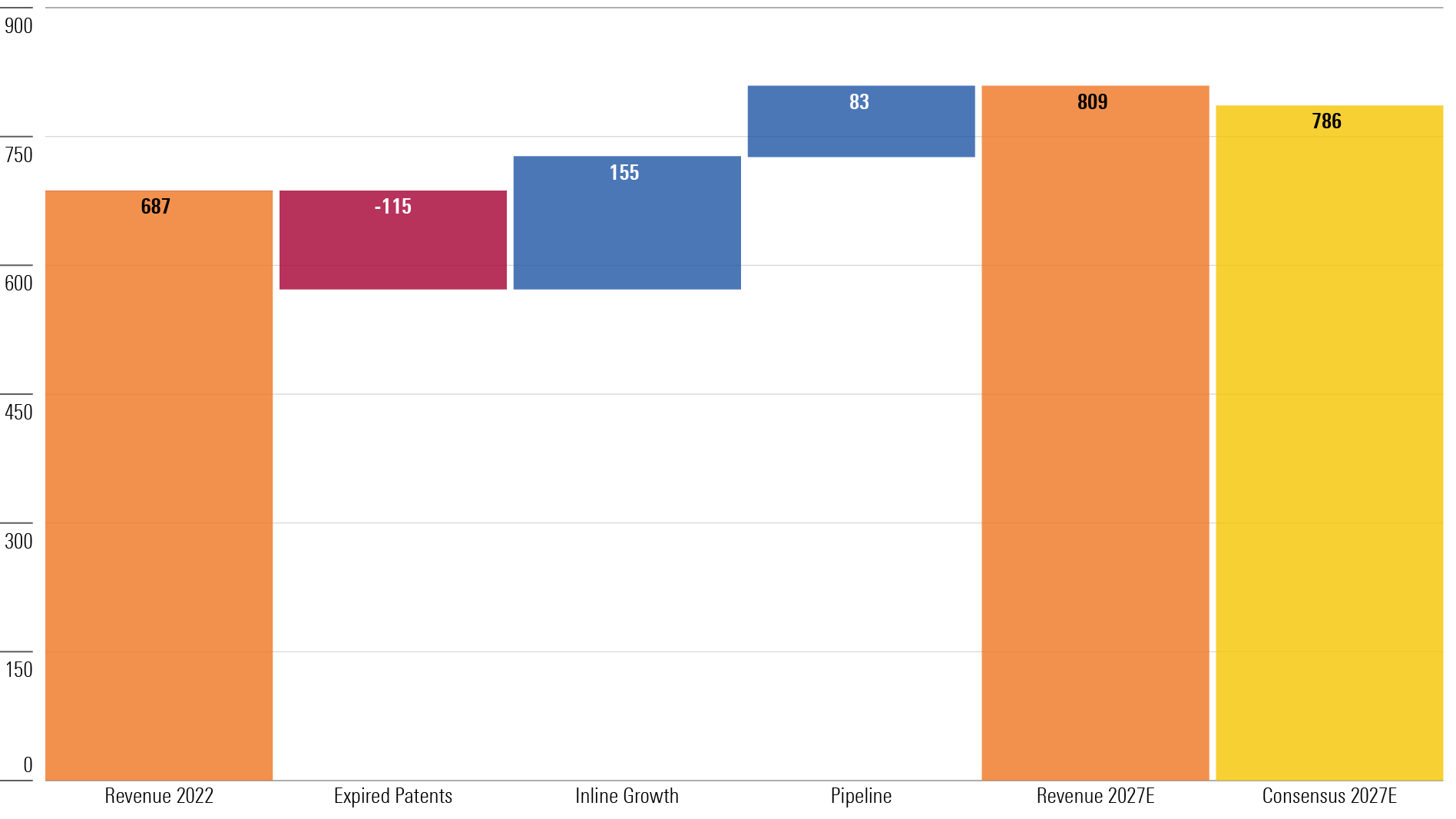

Large-Cap Biopharma 5-Year Outlook (USD Billions)

We also share our analysis of the most undervalued large-cap biopharma companies.

Five-Year Outlook: Solid Innovation in Pipelines Offsets Patent Losses to Support the Moats

We project a five-year compound annual growth rate of 3.3% for the industry; 4.5% when excluding COVID-19 products.

The industry is still outrunning patent losses with innovation, particularly after factoring in COVID headwinds, but the biopharma group still looks undervalued. We expect double the amount of sales from newer products ($238 billion) versus sales lost to patent expirations ($115 billion) over the next five years.

The biggest patent expiration headwinds through 2027 are:

- AbbVie’s ABBV immunology drug Humira. We expect a loss of 75% of Humira sales over the next five years, as it faces patent expiration and multiple biosimilars erode U.S. sales. Though AbbVie lacks a strong late-stage pipeline, its phase 1 and 2 drugs look promising.

- Bristol-Myers Squibb’s BMY myeloma drugs Revlimid and Pomalyst. We think several recent launches in immunology and cancer will help offset these losses well. Bristol hasn’t backfilled its late-stage pipeline well, but we are bullish on cardiometabolic drug milvexian.

- Merck’s MRK diabetes drug Januvia. This expiration will make the firm even more reliant on oncology drug Keytruda for growth. Though getting to be late in their lifecycles, Keytruda as well as HPV vaccine Gardasil look poised for further gains.

- AstraZeneca’s AZN rare disease drug Soliris. We think this is mitigated by the firm’s more convenient treatment option, Ultomiris. AstraZeneca’s gains are also largely being driven by cancer drugs, though we are somewhat concerned with the bullish consensus estimates.

Inflation Reduction Act Is Driving Firms to Shift Strategies but Should Be Manageable

We see three key revenue impacts to biopharma firms from the Inflation Reduction Act:

- Shifting Medicare Part D cost-sharing away from the government and patients and toward payers and biopharma companies for expensive drugs.

- Penalizing firms for raising Medicare prices faster than inflation.

- Price cuts on Medicare drugs that have extended patent protection (negotiation provision).

When we first incorporated these changes last fall, we cut our fair value estimates by an average of 2%, as firms have varying but manageable exposure to the roughly 15% of global drug sales in Medicare.

Since then, biopharma firms have reacted to these changes by suing the federal government about the negotiation provision and beginning to steer pipelines to minimize effects on profitability.

For example, we see firms beginning to focus more on biologics (which have a longer protection from negotiation than small molecules do) and on rare disease and immunology therapies that treat younger patients covered by private insurance (rather than products that treat older patients who may be covered by Medicare).

We think firms like AstraZeneca, Gilead Sciences GILD, and Novo Nordisk NVO have higher exposure to Medicare negotiation risk, as they have drugs that could be eligible long before patent expiration. Roche RHHBY and BioMarin BMRN stand out for their global diversification and biologics focus, which reduces exposure.

Biopharma’s biggest weapon against these changes is the power to launch new innovative drugs at higher prices to compensate for expected negotiation.

Obesity Drugs: Novo Nordisk and Eli Lilly to Remain Market Leaders

Demand for obesity drugs is skyrocketing, as new offerings have demonstrated mild side effects and efficacy that rivals bariatric surgery.

Novo Nordisk’s semaglutide (approved in obesity as Wegovy) and Eli Lilly’s LLY Mounjaro (approved in diabetes and likely to gain FDA approval in obesity by the end of 2023) are in the highest demand, but their pipelines are expanding with new oral drugs as well as higher efficacy injectables, further supporting these firms’ wide Morningstar Economic Moat Ratings.

Overall, we think the market for obesity drugs will climb to $65 billion in 2031, before slight declines as Novo’s semaglutide patent expires in 2032. We assume that Novo Nordisk and Eli Lilly will maintain roughly 75% share of this market in the long run owing to both these existing offerings as well as other drugs in their pipelines.

That said, pipeline programs at Amgen AMGN and Pfizer PFE could begin to chip away at price to gain share beyond 2026.

Our Top Picks for Investing in Biopharma Companies

Bayer

Morningstar Rating: 5 Stars

Morningstar Economic Moat Rating: Wide

Fair Value Estimate (as of Sept. 21, 2023): $22.50

- Expiring Patents: Patent losses for key drugs Xarelto and Eylea will make growth more challenging over the next five years.

- In-Line Products: Recently launched cancer drugs (Nebeqa and Vitrakvi) and kidney disease drug Kerendia hold solid potential.

- Pipeline: Cardiovascular drug asundexian could be a major blockbuster.

Gilead Sciences

Morningstar Rating: 4 Stars

Morningstar Economic Moat Rating: Wide

Fair Value Estimate (as of Sept. 21, 2023): $97

- Expiring Patents: HIV drugs Viread, Truvada, and Atripla saw generic competition beginning in 2017 in Europe and beginning in 2018 in the United States. The next wave of generic HIV competition has been delayed by settlements with generic manufacturers, with the next big U.S. expiration coming in 2029 for Genvoya.

- In-Line Products: Biktarvy, Gilead’s newest TAF-based HIV regimen, continues to rapidly take share from both older TDF-based regimens and other TAF-based regimens. This effectively extends Gilead’s protection on its top HIV treatment until 2033. Strong growth in oncology for Trodelvy and CAR-T therapy Yescarta are making these products a more significant portion of sales, and we expect continued growth as usage extends to earlier-stage patients.

- Pipeline: In oncology, the Forty Seven acquisition (magrolimab) looks unlikely to pay off, although we remain bullish on the Arcus collaboration, which has brought multiple immuno-oncology drugs into late-stage trials. In HIV, we’re also bullish on Sunlenca’s potential both as an every-six-month prophylaxis as well as part of an oral or injectable HIV treatment regimen in the long term.

GSK

Morningstar Rating: 5 Stars

Morningstar Economic Moat Rating: Wide

Fair Value Estimate (as of Sept. 21, 2023): $54

- Expiring Patents: GSK faces more limited patent expirations over the next five years. Generic Advair launched in 2019 and will continue to weigh on sales growth, but the magnitude of pressure is dissipating and not causing significant pressure on the next-generation respiratory triplet drug Trelegy.

- In-Line Products: Long-acting HIV drug Cabenuva/Apretude should mitigate the competitive pressures on the older HIV drugs. Outside of the drug group, the strong entrenchment in vaccines should help drive growth. In particular, shingles vaccine Shingrix is well positioned to generate peak sales above GBP 5 billion.

- Pipeline: GSK’s pipeline is improving with the recent launch of RSV vaccine Arexvy, but more high-potential drugs are needed in late-stage development.

Pfizer

Morningstar Rating: 4 Stars

Morningstar Economic Moat Rating: Wide

Fair Value Estimate (as of Sept. 21, 2023): $48

- Expiring Patents: While Pfizer faces some patent losses over the next five years, the losses increase significantly starting in 2028.

- In-Line Products: Lost COVID-19 sales will weigh on growth, but we are more bullish on the long-term outlook for the tail of these COVID sales. Also, Vyndaqel (rare disease) and Prevnar (vaccine) sales should hold up despite potential competition because of strong efficacy that sets a more difficult bar to displace. However, Ibrance (breast cancer) will likely face continued market share losses as competitors have shown better efficacy data.

- Pipeline: Pfizer’s late-stage pipeline includes several drugs with peak sales potential of above $1 billion annually, but fewer major blockbusters than we would expect for a firm of this size.

Roche

Morningstar Rating: 5 Stars

Morningstar Economic Moat Rating: Wide

Fair Value Estimate (as of Sept. 21, 2023): $56

- Expiring Patents: Roche’s older biologics Rituxan, Herceptin, and Avastin should see an additional CHF 8 billion hit to sales through 2027 as biosimilar launches continue globally, and biosimilars for Actemra, Xolair, and Perjeta are approaching the market.

- In-Line Products: Most of Roche’s core products have patent protection through the end of the decade, including oncology drug Tecentriq, multiple sclerosis drug Ocrevus, spinal muscular atrophy drug Evrysdi, hemophilia drug Hemlibra, and ophthalmology drug Vabysmo.

- Pipeline: Roche has a large late-stage pipeline and a solid earlier pipeline. In oncology, we’re particularly watching for the expansion of recently launched blood cancer bispecifics Columvi and Lunsumio into earlier stages of lymphoma, as well as TIGIT data. We also expect data that could expand approval of Duchenne muscular dystrophy gene therapy Elevidys into a wider age group by the end of 2023.

This article was compiled by Emelia Fredlick.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/558ccc7b-2d37-4a8c-babf-feca8e10da32.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZC6ZGSUHJVG4TN3DQFP6S7VEEY.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/QK4UAVKQMJACFGURDC5APNEA3U.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PVJSLSCNFRF7DGSEJSCWXZHDFQ.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/558ccc7b-2d37-4a8c-babf-feca8e10da32.jpg)