5 High-Quality Growth Stock Picks From Loomis Sayles Growth Fund

The manager of this top-performing fund highlights some of his favorite holdings.

In the world of high-flying growth stocks, Loomis Sayles’ Aziz Hamzaogullari could be the definition of a patient investor.

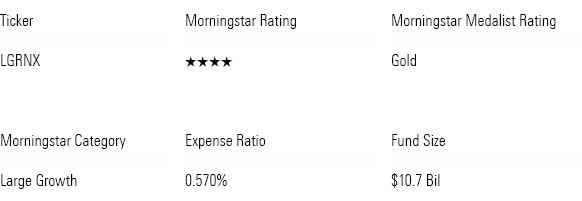

Out of the fund’s 10 largest holdings, six have been in the $10.7 billion Loomis Sayles Growth Fund LGRNX, managed by Hamzaogullari, for more than a decade. The average stock among the three dozen holdings has been held for 10 years; five have been there since even before Hamzaogullari took the reins in 2010.

There have been years when the fund hasn’t added a single new stock, and two years during which it saw only two new additions. When Hamzaogullari does look to add a new name, it usually takes the fund a year and a half to get to the size position he’s aiming for.

While stocks with the potential for strong cash flow growth are the focus, Hamzaogullari and his team of seven dedicated analysts look for companies that have the kind of strong competitive advantages that will enable them to outperform the competition over the long term. However, they will only buy those stocks when the companies are trading at a significant discount to their intrinsic value.

Among the names in the fund that reflect this approach:

“Hamzaogullari has crafted and faithfully followed a worthy approach,” writes Morningstar associate director Tony Thomas. “[He] has geared this strategy for long-term investing ... The team believes that patient, high-conviction, valuation-sensitive investing in companies with clear and persistent competitive advantages is key to success.”

Loomis Sayles Growth Fund Key Stats

For investors in Gold-rated Loomis Sayles Growth, this approach has been paying off. For the last one-, three-, five-, and 10-year periods, the fund’s performance ranks in the top quarter of the large growth category. Over the last five years, for example, Loomis Sayles Growth has returned 13.6% per year, ahead of the 10.8% annualized return for the average large-growth fund and the 13.2% average annual return for the Morningstar US Large-Mid Cap Broad Growth Index.

Even during the topsy-turvy market for growth stocks over the last two years, Hamzaogullari’s approach has outperformed. Like other growth-stock funds in 2022, the Loomis strategy took it on the chin, with a 27.6% loss. However, that was still better than the 29.9% drop in the average large-growth fund and the 31.7% drop in the Large-Mid Cap Growth Index.

Hamzaogullari’s strategy is built around looking for stocks for companies with durable competitive advantages, such as business lines that have high switching costs and strong barriers to entry. From there, the Loomis Sayles team combs for stocks with strong financial profiles. “For us, a high-quality company should be self-sufficient, meaning in the long term they should be able to meet their future growth needs with internally generated funds,” says Hamzaogullari.

Loomis Sayles Large Growth Fund Performance

Another leg of the quality stool is management, which Hamzaogullari says is reflected in a long-term focus when it comes to capital allocation and decision-making. Many of the companies they own are still run by their founders. Lastly, Loomis hunts for stocks trading at a significant discount to what the team assesses as a company’s intrinsic value. Through that, he says, “we can create a margin of safety.”

The stocks are put into a highly concentrated portfolio. As of the end of September, Loomis Sayles Growth held just 36 stocks, with 55% of its assets in the top 10 holdings of the fund.

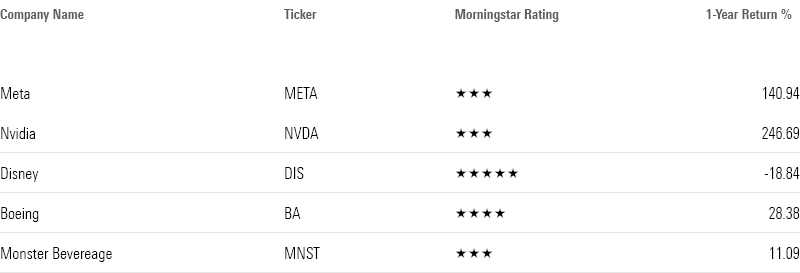

We asked Hamzaogullari to talk us through the investment theses for five of these stocks. There are two that have done well in the past year, one that has struggled, and two more of his choosing.

5 Stocks From Loomis Sayles Growth Fund

Two stocks that have been recent winners for Loomis Sayles Growth:

Meta Platforms

Loomis Sayles Growth is among the original owners of Meta stock from back when the social media company went public as Facebook in the second quarter of 2012.

“Meta’s competitive advantages are its network, scale, strong brands, and platform strategy,” Hamzaogullari says, along with its ability to target audiences based on its detailed personal knowledge of its users and engagement.

Meta’s financials are healthy, he says. “Margins and cash flow generation are very strong, making Meta self-sufficient to finance its growth.” He calls the balance sheet “robust” with a “substantial cash position.”

Looking ahead, Hamzaogullari says there “remains a large gap between the time spent online by consumers and the current level of online advertising, which we expect will close over time.”

The Loomis team expects continued secular growth in Facebook’s average revenue per user, which has already risen to over $40 in 2022 from $5 in 2012, a compounded annual growth rate of 23%. In addition, Hamzaogullari says Loomis expects Meta will eventually command approximately 10% of the total global advertising market.

Meanwhile, Meta stock is “trading at a significant discount to our estimate of its intrinsic value and offers a compelling reward-to-risk opportunity,” he says.

Nvidia

As a holding for Loomis Sayles Growth since the first quarter of 2019, Hamzaogullari says Nvidia’s competitive advantages include its intellectual property and brands. In addition, the “value of the company’s brands is reinforced by a large and growing ecosystem of software developers and hardware manufacturers in multiple fields creating software and devices that utilize the graphics processing unit computing platform.” He notes that Nvidia dominates the market for GPU-based data centers, with close to 100% share.

When it comes to financials, Nvidia “operates a capital-light model which outsources manufacturing and leverages third-party distributors,” he says. The company “generates strong free cash flow which consistently exceeds its cost of capital and enables it to reinvest substantially in R&D.”

Over the long term, the Loomis team expects growth in the “high teens” from gaming revenues and data center markets growth “in the high-20% range” leading Nvidia to sustained revenue growth above 20% a year. “As the business shifts increasingly towards its more profitable data center business, we believe operating profits will grow faster than revenues and that the company can generate strong double-digit growth in free cash flow,” Hamzaogullari says.

As for valuations, even after Nvidia’s 245% rally over the past 12 months, the company’s strong free cash flow growth prospects “are not currently reflected in its share price,” says Hamzaogullari.

A stock that hasn’t worked:

The Walt Disney Company

A portfolio holding since April 2020, Disney stock has been struggling, losing 19% over the past year. Much of the concern in the market appears to be around the company’s shift toward a heavier reliance on revenues from streaming video, Hamzaogullari says.

“They have a traditional part of the business which is transitioning to streaming, and that transition is creating uncertainty in terms of margins or revenue for the near term,” says Hamzaogullari.

However, he points to the value of Disney’s massive library of movies and other content created over its 100-year history. “These have incredible global influence, and we believe the company will have pricing power,” says Hamzaogullari. “If you look at Disney+ streaming products and what the consumer pays on a daily basis versus other options for their wallet, we believe that in the long term, Disney will be able to capture a good portion of that wallet.”

The Loomis team believes Disney’s direct-to-consumer segment will grow “in the mid-to-high teens” percentages per year, led by the Disney+ service. Against this backdrop, Hamzaogullari says they believe that at current prices, the market significantly underestimates Disney’s opportunity to monetize its intellectual property across global business segments, and the company’s ability to generate sustainable free cash flow growth.

Two more stocks from Loomis Sayles Growth:

Boeing

The commercial and defense aerospace giant has been a holding in Loomis Sayles Growth since March 2020, when the fund scooped it up as the company’s share price was hammered by the collapse of air travel during the COVID-19 pandemic.

Hamzaogullari notes that in 2020, a key metric for the industry—revenue passenger kilometers, which reflects the distance flown by paying passengers—saw its biggest decline in history. From 1980 through 2018, RPK grew at a 5.3% annual rate and was only negative in three years, but never by worse than 3%. In 2020, however, RPK collapsed 65%. Even as air traffic has recovered, demand for new aircraft has been slow to recover.

Boeing also took a significant hit from the grounding of its new flagship 737 MAX and ensuing management turmoil.

Hamzaogullari says the market is now underestimating the potential for Boeing to get back on track, especially given that the aerospace business is essentially a duopoly. (Boeing and Airbus capture some 95% of industry sales.)

“We believe Boeing will generate approximately 10% compounded annual growth in revenues over our long-term investment horizon, driven by a near doubling of aircraft deliveries over the next five years from still-depressed levels,” he says. In addition, “We believe the current market price is embedding expectations for free cash flow growth that are well below our long-term assumptions.” The Loomis team expects free cash flow will grow from around $3.5 billion to the low teens billions with a 30% compound annual growth rate.

The events of the past three years have created uncertainty around Boeing, Hamzaogullari notes, but “it’s a great business … and they have significant demand ahead of them.”

Monster Beverage

Monster popped into Loomis Growth Fund’s portfolio just over a decade ago. “Energy drinks have been one of the fastest-growing segments in this industry as per-capita consumption in developed and developing markets has increased meaningfully over the last 10 years,” Hamzaogullari says.

Meanwhile, the strength of Monster’s brands can be seen in the difficulty industry giants Pepsi PEP and Coca-Cola KO have faced in trying to make meaningful inroads in the profitable energy drink market. In fact, Coke partnered with Monster in 2014 for a deal wherein Coke essentially exited the energy market and took an equity stake in Monster.

The company generates strong cash flow returns on invested capital, thanks in part to its outsourcing of both manufacturing and distribution, Hamzaogullari says.

However, he says, “We believe the share price embeds lower expectations for long-term margins and growth for what we believe is one of the best businesses in the beverage industry.”

3 Dividend Growth Stocks to Buy from a Top-Rated Fund Manager

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ed529c14-e87a-417f-a91c-4cee045d88b4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ECVXZPYGAJEWHOXQMUK6RKDJOM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KOTZFI3SBBGOVJJVPI7NWAPW4E.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/V33GR4AWKNF5XACS3HZ356QWCM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ed529c14-e87a-417f-a91c-4cee045d88b4.jpg)