U.S. Stock Market Looks More Attractive in September Following Pullback

The selloff and rising underlying valuations result in a greater U.S. market discount.

September Stock Market Outlook Key Takeaways:

- U.S. stocks pulled back in August after five months of gains.

- The combination of a selloff and rising underlying valuations increased the discount to our fair value composite.

- The technology sector remains slightly overvalued, but less so now.

After just touching fair value at the end of July, the Morningstar US Market Index dropped 1.81% in August, its first monthly decline since February 2023. Stocks retreated in the first half of August as earnings reports were softer than hoped for. However, markets recaptured some of the losses in the second half of the month. Economic indicators lifted market sentiment, and the bond market priced in a lower probability of future rate hikes by the Federal Reserve.

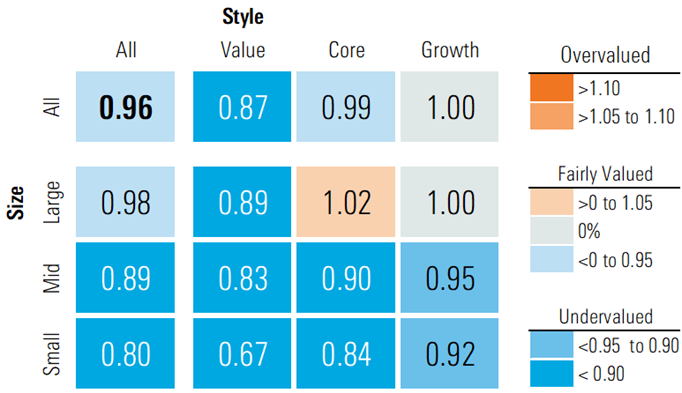

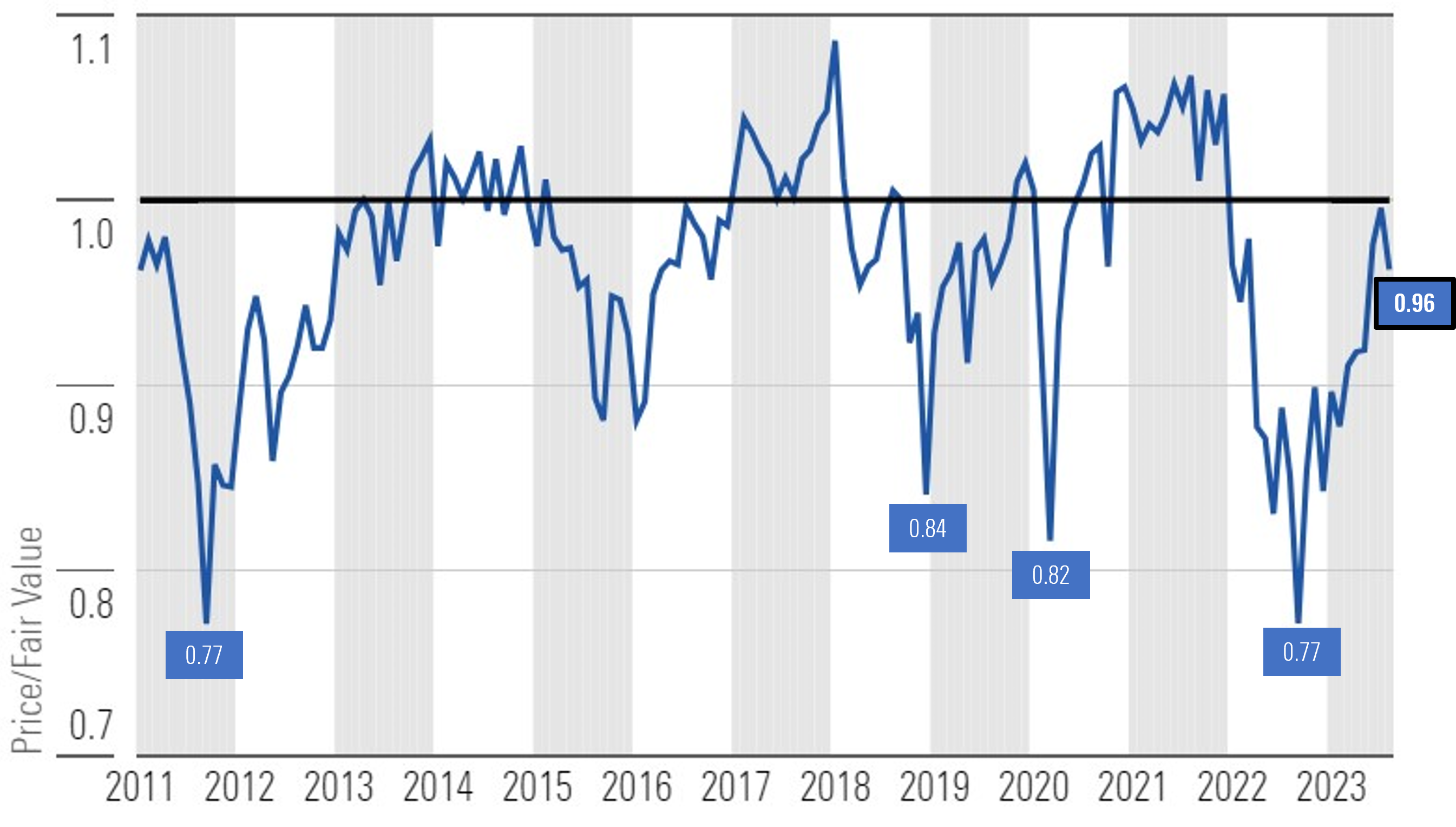

As of Aug. 31, 2023, according to a composite of the more than 700 stocks we cover that trade on U.S. exchanges, the U.S. equity market was trading at a price/fair value ratio of 0.96.

The greater discount to fair value was due to the broad market pullback in conjunction with increases among our underlying fair value estimates. In August, the number of stocks for which we increased our fair value estimate was almost double that of those where we decreased our fair value. The increases included several companies with some of the largest market capitalizations. For example, we boosted our fair value on Nvidia NVDA by 60%, increased Amazon.com AMZN by 9.5%, lifted Chevron CVX by 7%, and bumped up Procter & Gamble PG by 5%.

Morningstar Equity Research Price/Fair Value by Style Box

Since the end of 2010, the U.S. equity market has traded at a greater discount to fair value than the current discount only 40% of the time.

Historical Morningstar U.S. Equity Research Coverage Price/Fair Value at Month's End

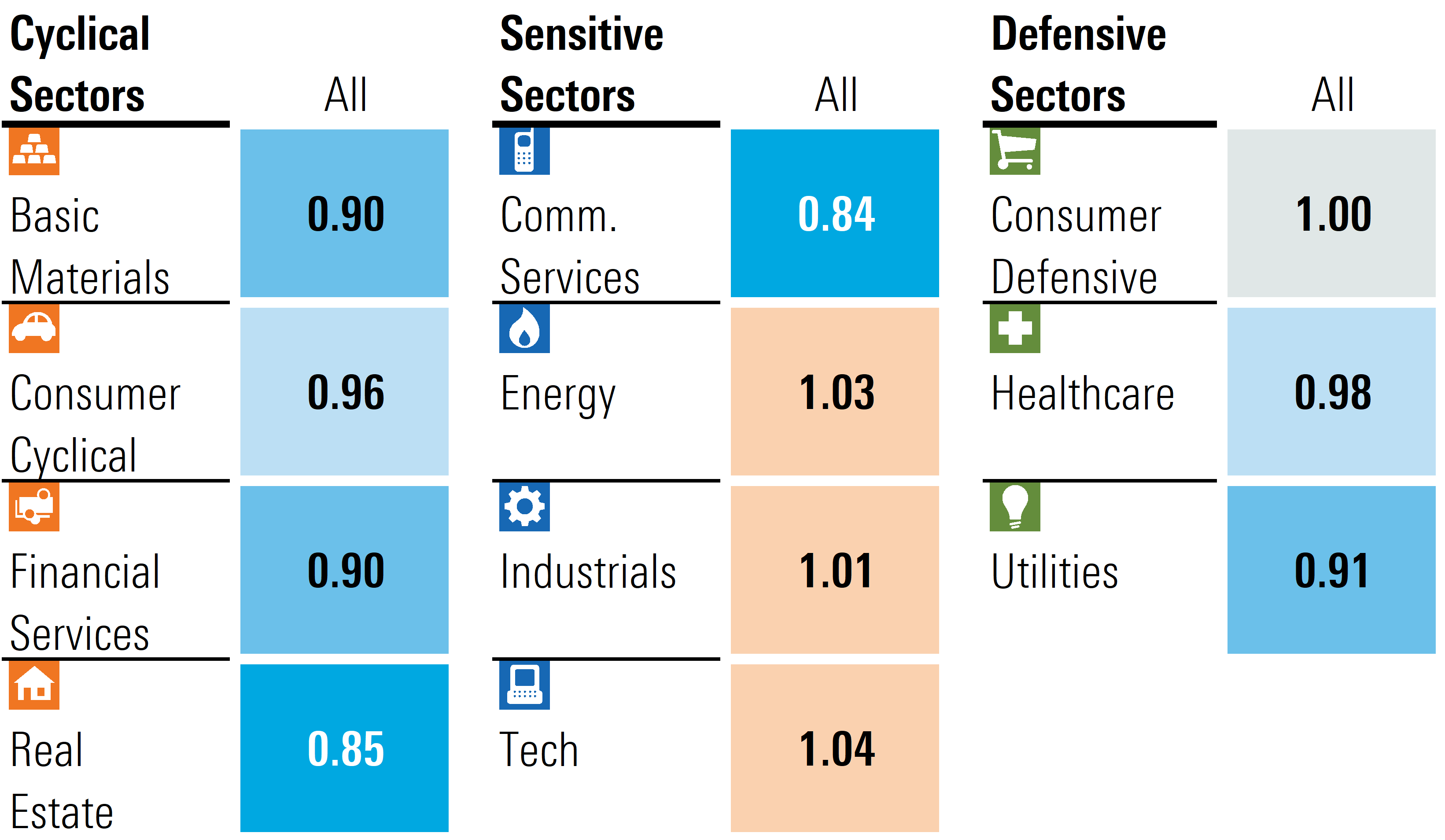

Notable Changes in Sector Valuations and Outlooks

Technology

One of the most notable changes across our sector valuations was the technology sector. The price/fair value metric dropped to 1.04 from 1.11. The decline was due to a 1.62% decline in the Morningstar US Technology Index along with a significant increase in our fair value estimate for Nvidia. Following Nvidia’s earnings release, Morningstar sector director Brian Colello relaunched coverage of the company. Susan Dziubinski and I reviewed the underlying assumptions in our Monday morning show. Excluding Nvidia, within the technology sector we had an almost equal number of stocks that we increased our fair values as compared with the number that we cut our fair values.

Utilities

Utilities was the worst-performing sector in August, dropping 6.24%. As such, the sector is now trading at a 9% discount to our fair value estimate; it was only at a 2% discount last month. The pullback was likely due to a continued increase in interest rates, which may make fixed income more attractive to investors who have used utilities as a proxy for bonds in their portfolios. It may also be a result of contagion following the severe decline in Hawaiian Electric HE, whose stock dropped 60%.

We lowered our fair value on Hawaiian Electric to $13 per share to account for our estimate of potential losses following the disastrous fires in Maui. We also increased our Morningstar Uncertainty Rating to Extreme from Very High to account for the wide range of possible outcomes from lawsuits filed against the company.

Among other sector losers in August were real estate and basic materials, which each dropped 3.12%, and consumer defensive, which dropped 3.08%.

Real Estate

Real estate continues to be under pressure from the combination of higher interest rates and negative investor sentiment surrounding commercial real estate valuations. While urban office space may continue to be at a heightened risk, we think valuations in many other areas across the real estate sector have been pushed down enough and are attractive at current levels.

For example, Host Hotels & Resorts HST and Ventas VTR fell 14% and 10%, respectively. We held our fair value estimates steady for both companies, at $23 per share for Host Hotels and at $68 per share for Ventas.

Basic Materials

Within the basic-materials sector, there were a number of stocks that sold off too much following weak short-term results as compared with our long-term valuations. For example, Compass Minerals CMP fell 20%, yet we held our fair value steady. Scotts Miracle-Gro SMG fell 19%, but we only reduced our valuation by 9%. International Flavors & Fragrances IFF fell almost 17%, and we cut our fair value by 7%. We think each of these cases provides an opportunity for investors who have a long-term focus and can withstand short-term volatility. Compass Minerals and IFF have Morningstar Ratings of 5 stars, and Scotts Miracle-Gro is rated 4 stars.

Consumer Defensive

Stocks broadly fell across the board in the consumer defensive sector. We have long thought that this sector was fully valued. Generally, we are seeing margins squeezed as many of these companies are unable to raise their prices fast enough to offset their own inflationary cost increases. The good news for investors is that following these selloffs, we are beginning to see a greater number of undervalued opportunities.

Similar to the basic-materials sector, there were several stocks whose prices fell by much more than our valuations. For example, Dollar Tree DLTR and Dollar General DG fell 21% and 18%, respectively, yet we only reduced our valuation on Dollar Tree by 1% and lowered our valuation on Dollar General by 6%. Of these two, according to our valuations, Dollar General is more attractive with a 4-star rating. Dollar Tree is rated 2 stars.

Energy

Energy was the sole winning sector in August, rising 2.02% as oil prices continued their climb. While we agree with the market that oil prices will remain high in the short term, we think the sector is already fully valued. We continue to forecast that oil prices will subside later this decade. This assumption is predicated on our forecasts for declining demand and increasing supply.

On the demand side, electric vehicles will continuously make up a larger percentage of outstanding vehicles, reducing the demand for gasoline. We forecast that by 2030, two thirds of new global auto production will be electrified. On the supply side, we expect oil exploration and production companies will increasingly shift their capital allocation back toward exploration and new production. Currently, oil companies have been dedicating a significant amount of their profits to pay high dividends and repurchase stock.

The leader in August was 4-star-rated APA Corp APA. This stock rose more than 8% during the month, and considering that our fair value estimate is $55 per share, we think it still has further to run. APA is one of our top picks in the energy sector and one of the few E&P companies that we think is undervalued.

Morningstar Price/Fair Value by Sector

Looking Forward

In defiance of tight monetary policy, the U.S. economy has remained stronger than expected thus far this year. We even recently boosted our forecast for economic growth in the third quarter. However, we also remain convinced that high interest rates will soon take their toll.

In our current projection, while we still expect that the U.S. will dodge a recession, we forecast that the rate of economic growth will begin to slow during the fourth quarter. We further forecast that the economy will continue to slow until bottoming out in the second quarter of 2024. Our forecast for gross domestic product projects that economic growth will slow from 2.3% in 2023 to 1.4% in 2024.

This could lead to a bout of heightened stock market volatility in the fourth quarter and/or the first quarter of 2024. Once the rate of economic growth begins to slow it will also pressure earnings growth. Management teams may look to lower their earnings guidance either when third-quarter earnings are reported in October or when they report year-end earnings in early 2024.

In our view, with the market trading back to a slight discount to fair value, investors should look past these potential pullbacks. Depending on the depth of the pullbacks and where risk tolerance allows, investors can use these opportunities to move from market-weight positions back into overweight positions.

Weekly Livestream to Provide You With What You Will Need to Know for the Week Ahead

Interested in staying up to date with our research and learning about new investment ideas? Join Susan Dziubinski and me on Monday Morning Markets With Morningstar at 8 a.m. Central/9 a.m. Eastern on YouTube as we discuss what investors should be watching the week ahead, new financial research from Morningstar that you shouldn’t miss, and weekly stock picks and pans.

Over the past two weeks, Susan and I have been keeping investors up to date with earnings and highlighting those stocks that we think are undervalued and worth your attention. Our most recent episodes include:

3 High-Dividend Stocks to Avoid. We covered why we think the economy will continue to surprise to the upside, our assumptions underlying our increase in our fair value estimate on Nvidia after its earnings report, and why investors should steer clear of Xerox XRX, International Business Machines IBM, and Seagate Technologies STX.

5 Undervalued Dividend Stocks to Buy. We highlighted five high-yield dividend stocks that we think are significantly undervalued.

4 Stocks to Buy After Earnings. We reviewed our takeaways from earnings season and identified four undervalued stocks that were well-positioned following their earnings reports.

3 Undervalued Growth Stocks to Buy. Growth stocks as a category may be fully valued, but Susan and I reviewed three that the market rally has left behind.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/54f9f69f-0232-435e-9557-5edc4b17c660.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/G3DCA6SF2FAR5PKHPEXOIB6CWQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/JYGMFDSZ6ZCJJKNOD2CMBUGOOM.jpg)

/d10o6nnig0wrdw.cloudfront.net/05-13-2024/t_4b82c3dc40354f6f812c5eab796cbf3e_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/54f9f69f-0232-435e-9557-5edc4b17c660.jpg)