3 Bank Stocks We Like Ahead of Earnings

Two regionals and one giant are among our top undervalued stock picks today.

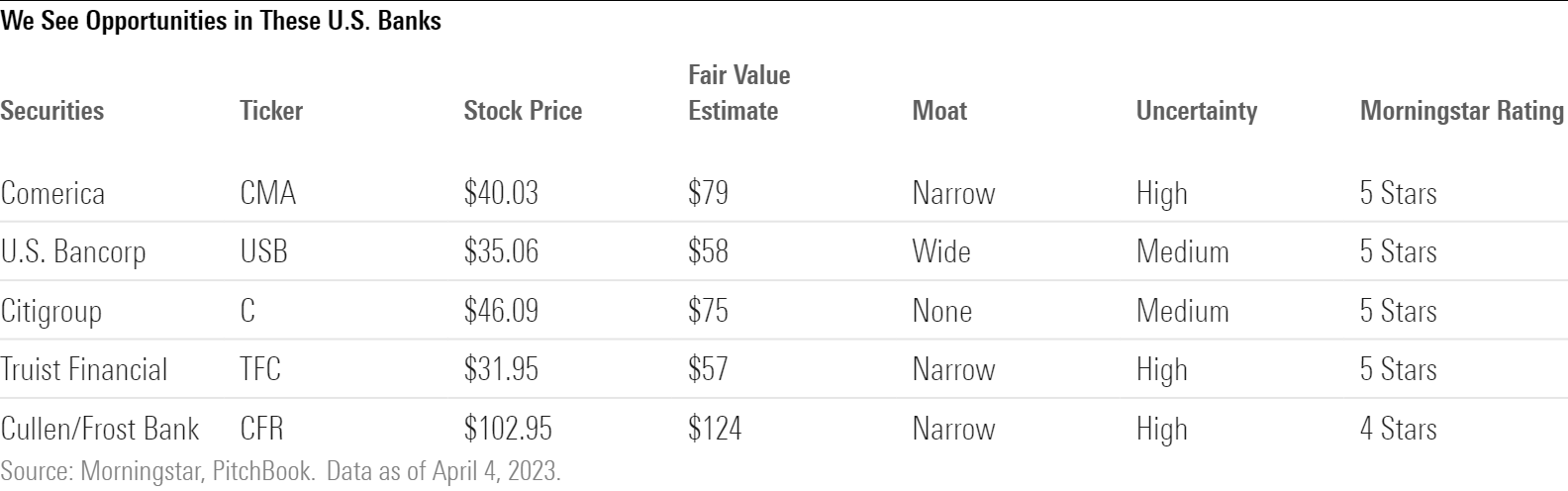

Although we believe the U.S. banking sector as a whole is currently undervalued, the three banks that we think most deserve investor focus in the lead-up to first-quarter earnings are Comerica CMA, U.S. Bancorp USB, and Citigroup C. Each has its own risk/reward setup.

We believe the biggest risks to our top picks would be negative surprises on deposit bases or funding costs, or the realization of a recession in the near term. While we think the U.S. banks are already trading at recessionary valuations, an actual recession would be unlikely to help valuations in the short term.

Comerica Holds Higher Risk but Also Higher Reward

The risks are higher for the smaller regional banks we cover—and Comerica is one of those banks—but we think the upside is therefore greater. We like this bank’s deep business relationships, and while investors may be concerned about the similarities between Comerica’s equity fund services business and Silicon Valley’s business, this segment makes up less than 2% of Comerica’s deposits. The bank also has what appears to be fairly manageable commercial real estate exposure, at roughly 15% of loans based on financial filings, with almost half of that amount related to multifamily. We like Comerica’s ability to reprice on the asset side of the balance sheet, which should help it if rates continue to rise, and the bank’s unrealized losses on securities are fairly average for the companies we cover. The bank trades at one of the steepest price/fair value discounts in our coverage, even after we’ve baked in additional headwinds from funding costs and deposit outflows. We view Comerica as our higher-risk/higher-reward regional pick. If its deposit base remains even remotely intact after first-quarter results, we would expect to see a rerating higher.

U.S. Bancorp Is Our Lower-Risk Megaregional Pick

While U.S. Bancorp has sold off like some of the regionals, we view the risk of deposit outflows as minimal, given that the bank is the largest regional. It does have slightly higher-than-average unrealized losses on securities, but we view this more as an earnings problem (lower-yielding assets stuck on the balance sheet) as opposed to a capital problem. While earnings could be pressured as rates rise, U.S. Bancorp’s size and wide moat rating, combined with a relatively better deposit positioning, make us think that the selloff in its shares is overdone. U.S. Bancorp is our lower-risk megaregional pick.

Citi’s Cheap but Will Require Patience

Citigroup was our top pick in 2022, and it has held up better over the past year than any bank we cover except for JPMorgan JPM. Even so, it is still trading at one of the largest discounts to fair value in our coverage. We see the risk of deposit outflows as minimal, given that Citi is a global systemically important bank. Citigroup has some of the lowest unrealized losses on securities relative to overall capital in our coverage, and it has some idiosyncratic catalysts—finishing the Mexico sale, selling off the rest of its noncore business units, providing expense guidance for 2024, and moving beyond regulatory hurdles—that we think can help it break the overall correlation with the banking sector over time. We also wonder if the recent turmoil in the European banking sector could open up additional opportunities for growth for Citigroup in the near to medium term.

While we like Citigroup’s valuation, investors should understand what they are getting into with the bank, which we view as a deep-value turnaround play with a multiyear time horizon. Also, a recession might uniquely pressure Citigroup, which has larger proportional credit card exposure relative to its peers. Still, we think long-term investors are being more than adequately compensated to bear these risks, and we see material upside to the current stock price.

Other Opportunities in U.S. Banks

Truist Financial TFC is very similar to U.S. Bancorp; it’s a megaregional that is trading at a similar discount to our fair value estimate, having sold off more like a midsize regional bank. We chose U.S. Bancorp to focus on due to its larger size, lower unrealized losses relative to capital, and lower exposure to commercial real estate, auto, and online consumer lending. Even so, it is a close call between the two names.

We also want to highlight the insider buying at Cullen/Frost Bankers CFR, which is unique among our coverage and something we’d like to see more of in the midst of this crisis of confidence. While it isn’t trading at quite the same discount to our fair value estimate as the other names we’ve highlighted, Cullen/Frost could have easily been highlighted on the basis of its conservative balance sheet positioning and insider buying. This bank rarely sells off, but we think it’s one to consider in the near term, should the valuation become more approachable.

Remove the guesswork and make informed decisions faster. Morningstar Investor’s stock ratings, analysis, and insights are all backed by our transparent, meticulous methodology. Learn more and start a seven-day free trial today.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/e03383eb-3d0b-4b25-96ab-00a6aa2121de.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZZNBDLNQHFDQ7GTK5NKTVHJYWA.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HE2XT5SV5ZBU5MOM6PPYWRIGP4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/AET2BGC3RFCFRD4YOXDBBVVYS4.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/e03383eb-3d0b-4b25-96ab-00a6aa2121de.jpg)