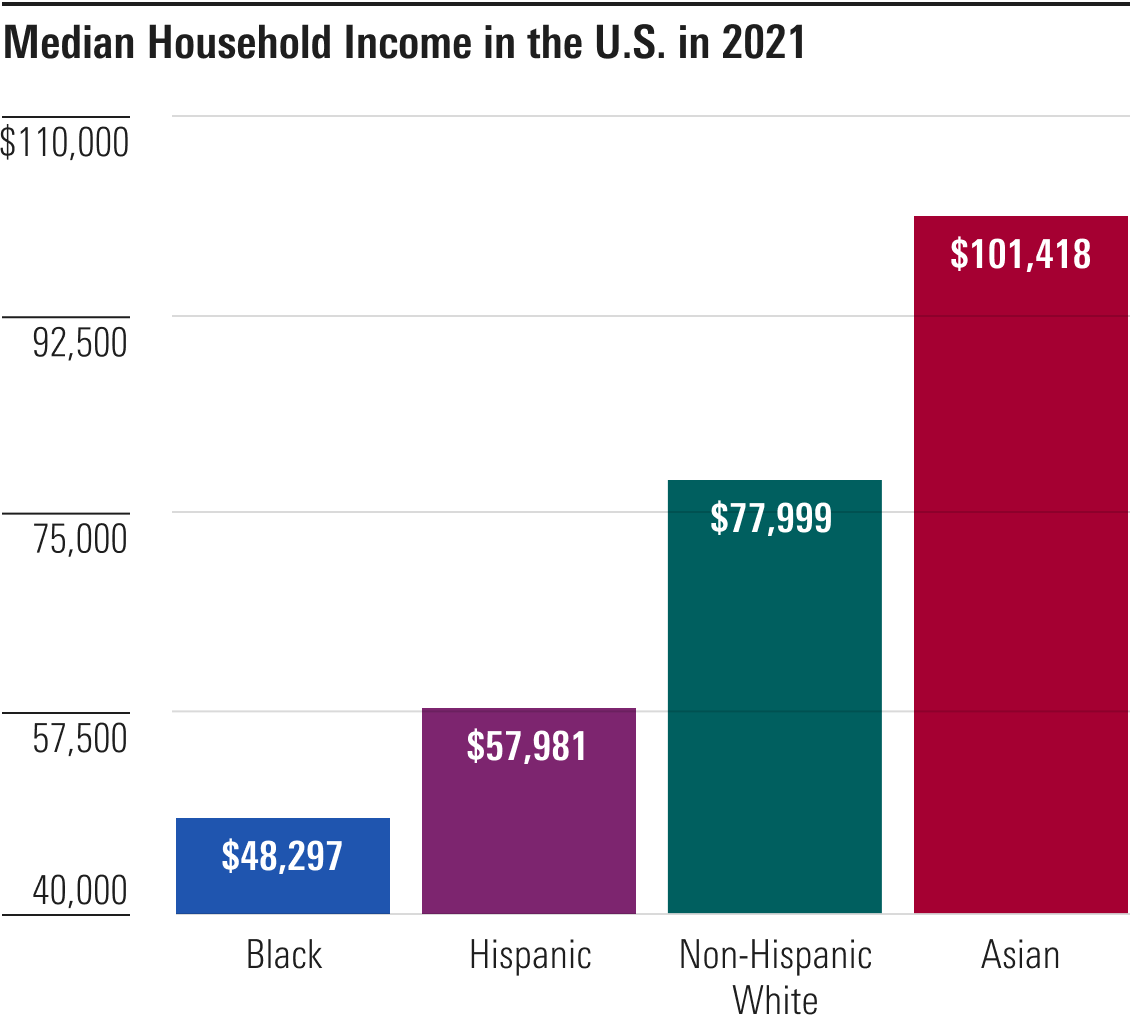

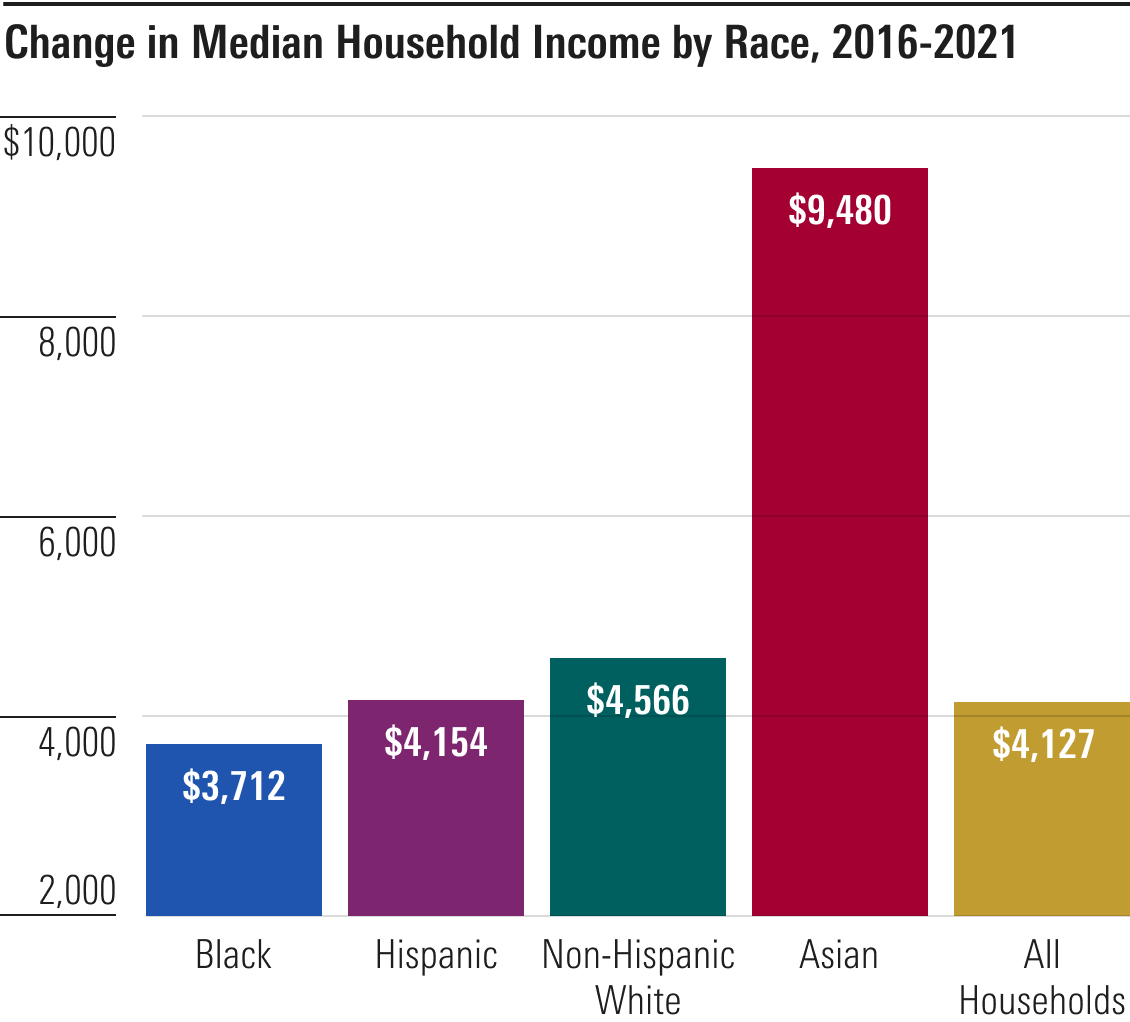

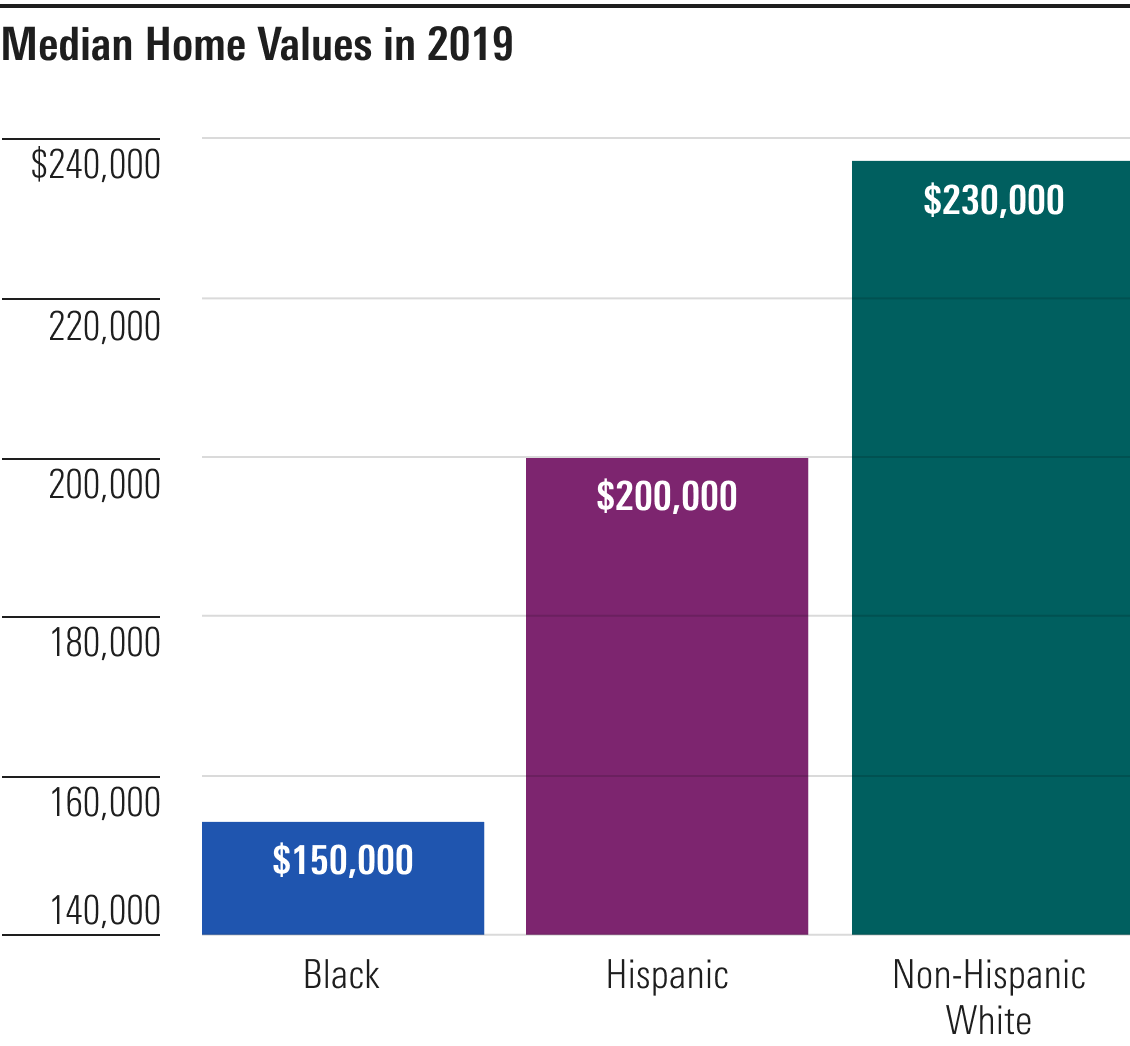

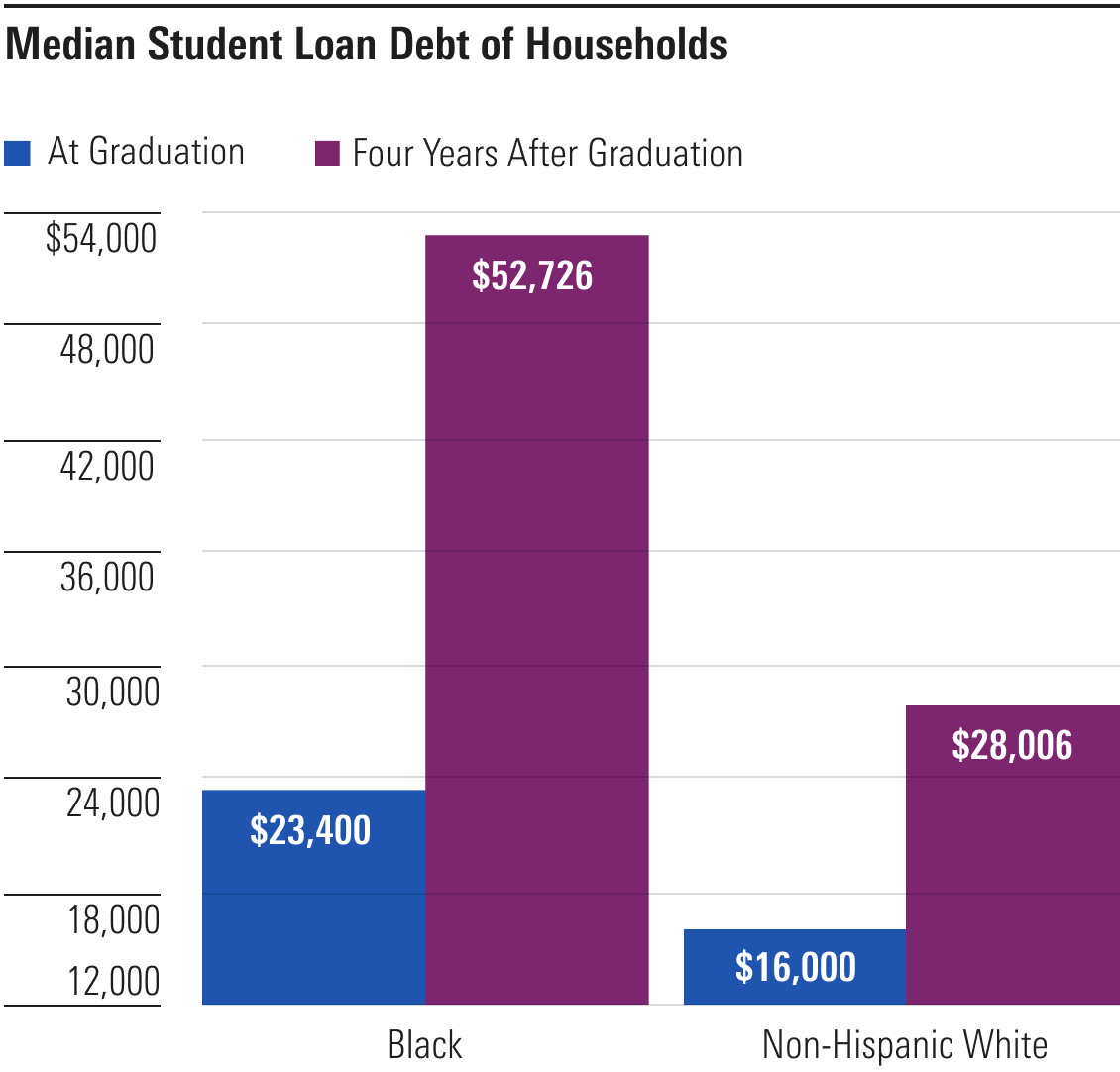

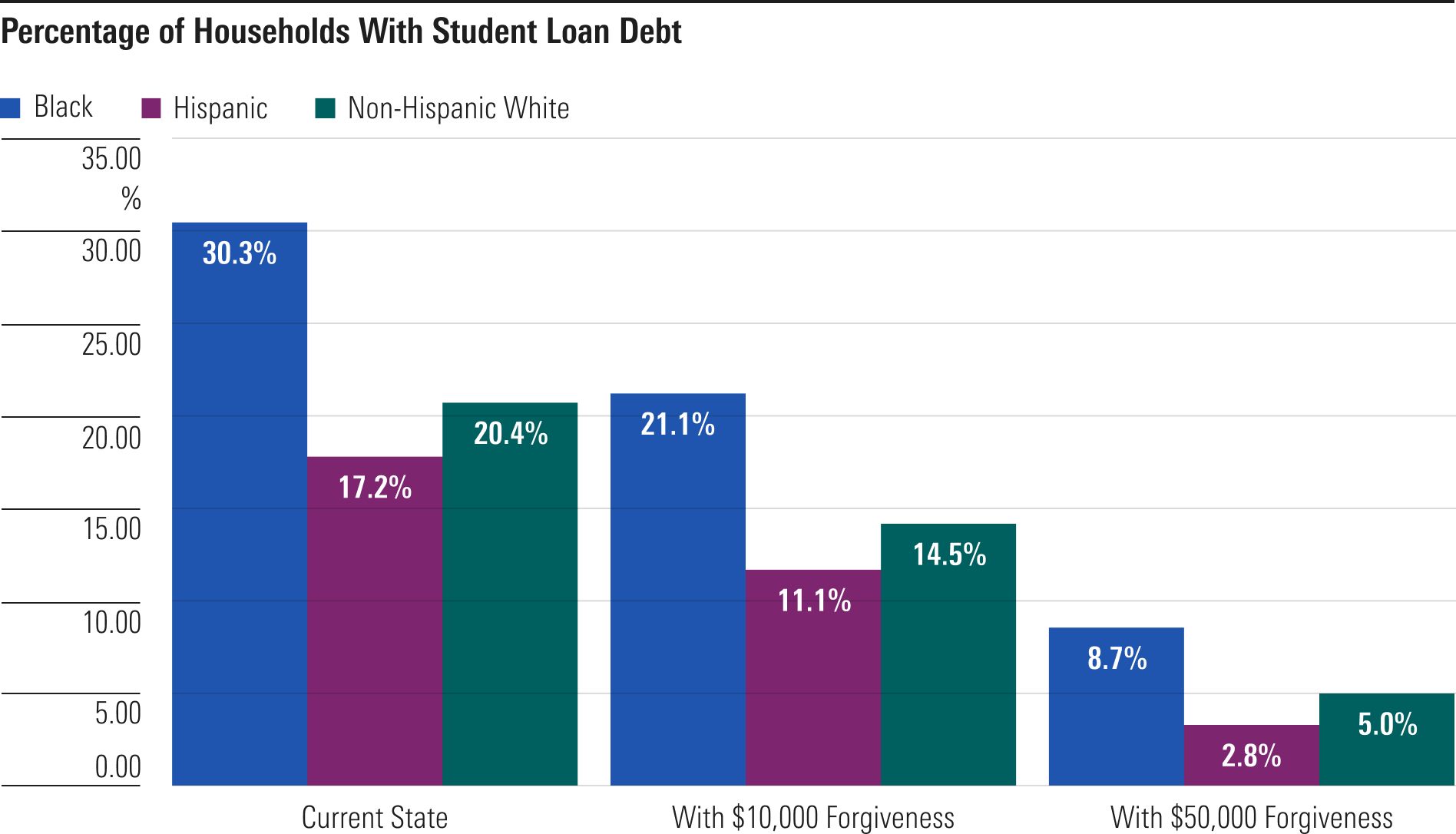

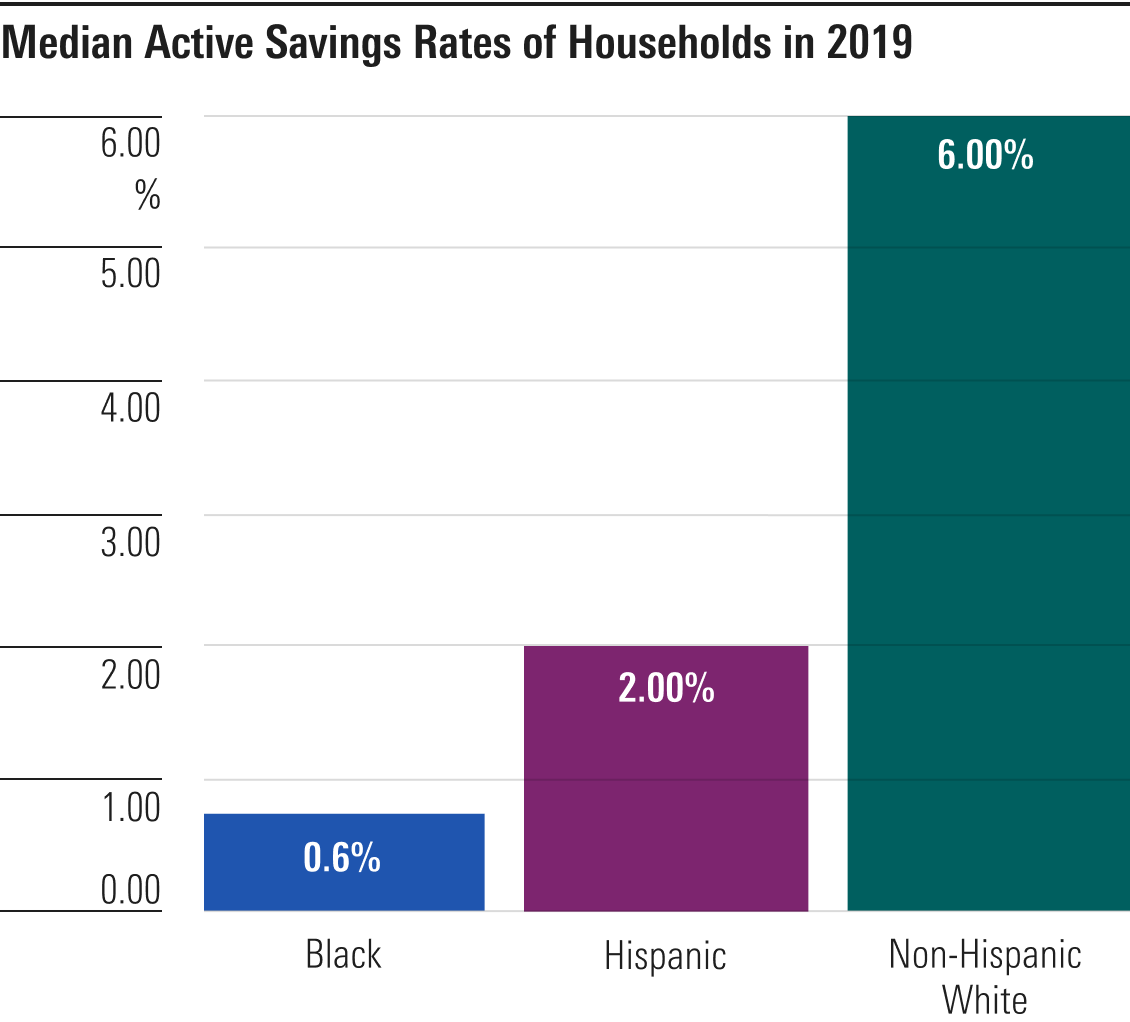

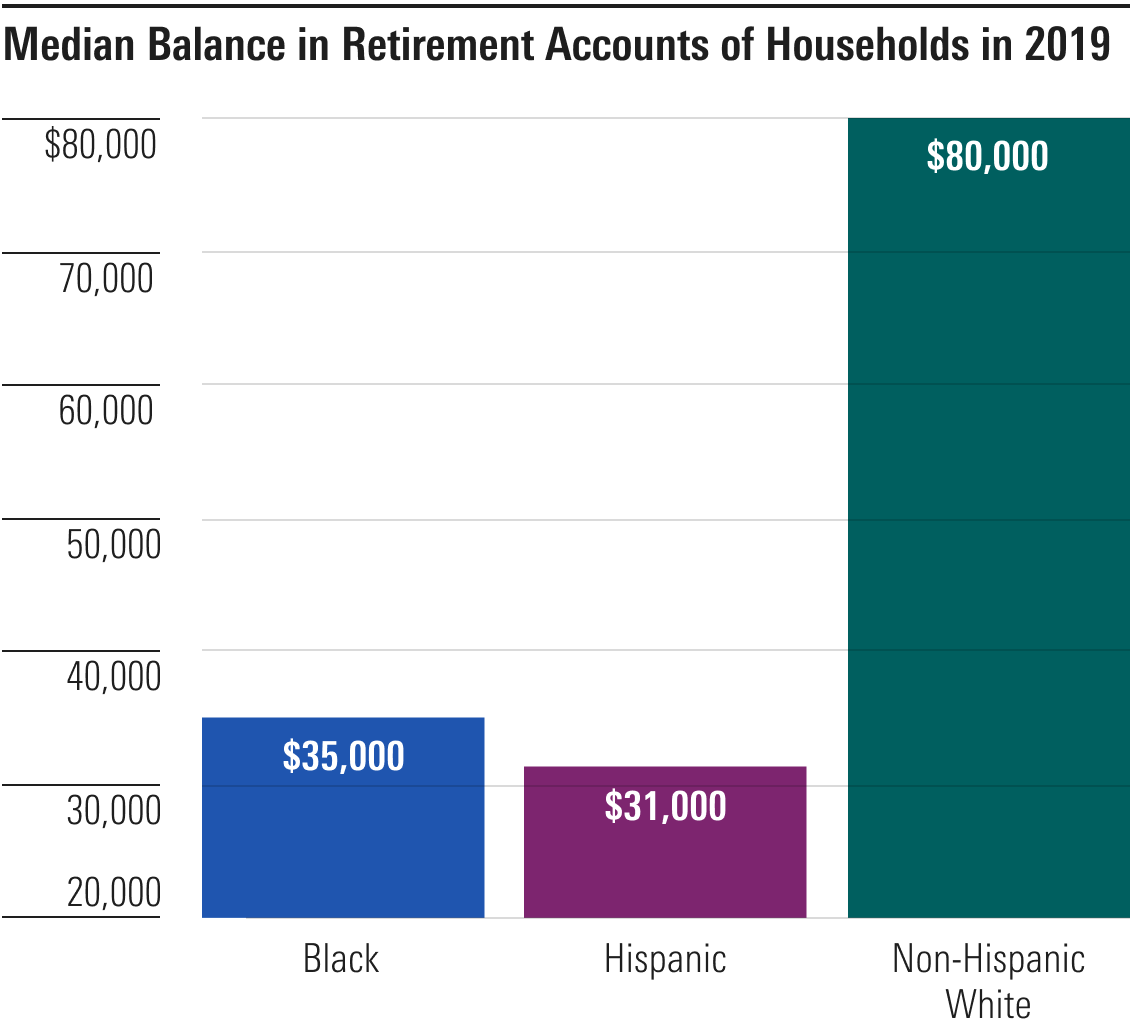

Racial inequality in the United States has many dimensions, but one of the most impactful and broad-ranging is economic. On average, people of color experience significantly lower levels of income, retirement savings, and rates of homeownership than non-Hispanic white Americans. They also face different struggles while paying down student loan debt.

Making strides toward improving these issues, let alone solving them, is far from simple. But a first step is acknowledging and understanding the magnitude of the problem.

Here are some key statistics about the impact of the racial divide for income, savings, and overall financial well-being. (You can find a full list of the stats in this previous article.)