Can Homeownership Really Close the Racial Wealth Gap?

Here are three perspectives on whether homeownership is an effective way to shrink the racial wealth gap.

The racial wealth gap perpetuates inequality and prevents large swaths of American citizens from economic security and progress.

Homeownership can be a reliable way to build and pass down wealth within families. But, as discussed at our event Closing the Gap: Building Black Dollars, this may not be the case for all Americans.

We wanted to dig deeper into the issue. So, we asked a financial advisor, a behavioral researcher, and an equity analysts for their perspectives on this question: When it comes to the racial wealth gap, is homeownership an effective way to build wealth?

Here are their responses, edited for length and clarity.

Brian Thompson, CFP, financial advisor and tax attorney:

Homeownership has many upsides ... but it’s not perfect.

Families in the United States have long built intergenerational wealth through homeownership. The United States government, through tax policy and other incentive programs, heavily subsidizes home purchases. But it does so in a way that has historically shut minorities out.

For example, redlining was a central part of the American Housing Act. Even now that redlining is illegal, homeowners still face blatant and undercover discrimination when getting mortgages and selling their homes.

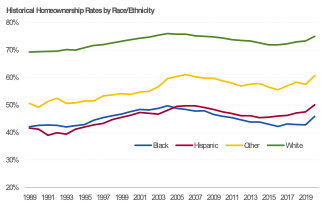

The homeownership rate for African Americans is about 42%-45%. That's about what it was in the 1970s--and down significantly from peak levels in the 1990s. On the other hand, white homeownership hit an all-time high in 2020 at 75%. Additionally, African Americans tend to take on more debt for less valuable homes, and, as a result, they benefit less from home appreciation than white homeowners.

Lastly, a recent study found that the gap between the appraised value of homes in predominantly white neighborhoods compared with comparable homes in mainly Black and Latino communities nearly doubled between 1980 and 2015.

While sweeping legislative and policy changes can help reverse the impact of decades of discriminatory federal guidelines, homeownership alone may not solve the racial wealth gap. Indeed, according to the Brookings Institute, depending on homeownership by itself may even widen racial disparities.

Homeownership has many upsides. It forces families to save, it allows them to benefit from the wealth-building potential of leverage, and it’s relatively inexpensive since federal programs subsidize borrowing.

But it’s not perfect.

A home is a significant, undiversified investment that is costly to buy and sell and whose value fluctuates depending on market conditions. Additionally, you tend to need a considerable amount of capital for the down payment, closing costs, and other costs for moving in. Minority groups are especially vulnerable to these downsides because they face systematic discrimination in buying, selling, and financing their homes.

Even if the government can implement its desired changes, it will likely take a long time for those changes to take effect. And if people of color concentrate their limited wealth in housing during that time, they may fall further and further behind.

As a result, Black families may benefit more from other avenues with a bit lower barrier to entry for wealth accumulation, including investing (baby bonds) and entrepreneurship, that may pay more dividends and close the wealth gap faster.

Sarah Newcomb, director of behavioral science at Morningstar:

“For many, the psychological value of ownership is an intangible asset of great personal value.”

A third of the wealth of the middle class in America is held in real estate, according to the Federal Reserve, and for many, it has been a stable wealth-building tool for generations. However, the calculus is somewhat different for white and non-white homebuyers.

In 2019, the Brookings Institute estimated that "owner-occupied homes in Black neighborhoods are undervalued by $48,000 per home on average, amounting to $156 billion in cumulative losses."

Racism is a well-documented economic drain, and the cost is paid by non-white homeowners. Looking forward, as populations and neighborhoods change in complexion, will this trend change as well? Perhaps. Until it does, non-white homebuyers will continue to have a more complex calculus to manage than most white investors have to consider.

All real estate investors need to be cognizant of the risks and variables associated with land and property as an asset class: geography, flood zones, local infrastructure, weather, schools, taxes, and so on. And, if you are looking at a long-term investment, then you also need to be thinking about how these variables are likely to change over the course of several decades.

In addition to these variables, non-white investors also need to factor in the effect of bias--both against themselves and against their neighbors--on the current and potential value of the asset. They also need to think about racial bias in mortgage lending--non-white applicants are more likely to be charged higher interest rates, leading to more money out of pocket overall.

Lastly, I want to mention that the benefits of homeownership extend beyond the financial balance sheet. Property ownership is a form of status and gives weight to one’s standing in a community. For many, the psychological value of ownership is an intangible asset of great personal value. Having a plot of land to call one’s own is a life goal for some and can represent socioeconomic progress across generations.

But, if you are a non-white investor considering real estate, I would not discount bias and neighborhood effects when you estimate the future value of the asset. Your assets need to mature on your timeline and not be overly dependent on the timeline of social progress.

Brian Bernard, CFA, CPA, director of industrials equity research for Morningstar:

Homeownership is a central component of building household wealth.

For one, it allows investors to accumulate equity in an asset class that, aside from the anomalous financial crisis, has generally appreciated over time. Secondly, homeownership can reduce household tax liability and help households build a strong credit history.

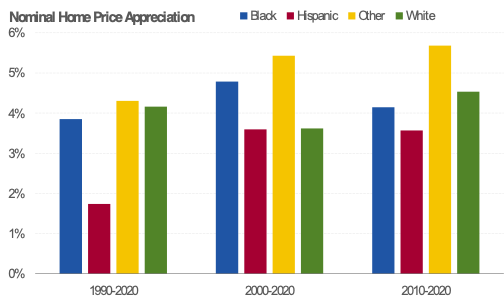

Nationally, the real estate values of newly built and existing residential homes have increased 4%-6% over the trailing 30, 20, and 10 years regardless of the homeowner's race, according to data from the Federal Reserve Board and U.S. Census Bureau. That said, home price trends can differ across regions and metropolitan areas because of varying supply and demand dynamics (for example, population and job growth) and other factors.

- source: Board of Governors of the Federal Reserve System, U.S. Census Bureau, Morningstar.

Regardless of race, real estate is one of the largest assets held on aggregate household balance sheets. In fact, according to the Federal Reserve and U.S. Census Bureau, real estate represents a greater proportion of aggregate assets for Black and Hispanic households (28% and 44%, respectively) as compared with white households (22%), primarily because the former have less wealth tied to stocks, mutual funds, and other investment vehicles.

According to the Federal Reserve Board's Survey of Consumer Finances, the median net worth for white households was $188,000 in 2019, compared with just $36,000 for Hispanic households and $24,000 for Black households. Based on the data, much of this wealth discrepancy can be explained by low homeownership rates and fewer and/or less valuable retirement accounts and investment holdings among Black and Hispanic households relative to white households.

- source: U.S. Census Bureau, Morningstar.

While many factors may explain the relatively low homeownership rate among Black and Hispanic households, income inequality is a significant factor. For example, according to the Federal Reserve’s Survey of Consumer Finances (SCF), in 2019, the median household income among white households was $69,000 compared with approximately $40,000 for Black and Hispanic households.

Lower household income, along with fewer financial assets, makes it more difficult for households to make a down payment and qualify for a mortgage. We believe such barriers have grown even more insurmountable recently given surging home prices and worsening housing affordability. That said, the current rate of home price appreciation is unsustainable, in our view, and will likely moderate with increased housing supply and higher mortgage rates.

While homeownership is a stable wealth-building vehicle for Americans of all races and ethnicities, structural barriers have made it more difficult for minority households to become homeowners. While there is likely no quick fix to this deep-rooted issue, well-crafted policies aimed at addressing income inequality, increasing the supply of affordable homes, and promoting more equitable lending practices could help lessen this issue over time.

/s3.amazonaws.com/arc-authors/morningstar/eb45a2f8-09a7-42a7-ad28-ee37a5f435d6.jpg)

/s3.amazonaws.com/arc-authors/morningstar/6c608d29-bb89-4580-943a-7819645ad538.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NNGJ3G4COBBN5NSKSKMWOVYSMA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6BCTH5O2DVGYHBA4UDPCFNXA7M.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EBTIDAIWWBBUZKXEEGCDYHQFDU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/eb45a2f8-09a7-42a7-ad28-ee37a5f435d6.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/6c608d29-bb89-4580-943a-7819645ad538.jpg)