How Are Hispanic Households Saving for the Future?

Explaining low savings rates among Hispanic households.

This article was originally published on Sept. 30, 2021.

Hispanic households are 17% less likely than white households to have access to a retirement plan through their employer.

Private retirement plans do not fill the gap, either, as only 8% of Hispanic households report having an individual retirement account or similar private plan.

With such a significant difference in their finances, researchers at Morningstar took a closer look at the saving habits of Hispanic American households.

Hispanic Americans, in this case referring to anyone who identifies as "Hispanic," "Latina/Latino," or "Chicana/Chicano," account for over half of U.S. population growth over the past two decades. Yet, there are relatively few studies devoted to them, given the complexities of analyzing such a diverse population, which includes descendants of Indigenous peoples, multilingual individuals of different racial backgrounds, and many recent immigrants.

In our new study, using data we processed from the Panel Study of Income Dynamics, we examine patterns of asset accumulation and key drivers that influence saving practices of Hispanic households. Here are a few of the key insights we found:

- At the median level, Hispanic households have substantially lower assets than white households. They also have lower savings rates than white households--largely due to gaps in income.

- Hispanic households are more likely to own wealth through low-yield assets such as houses and automobiles.

- Location and education level have an impact on saving rates. For example, Hispanic households save more in the Western U.S. compared with the Northeast and less in urban areas. Also, higher education has a strong positive impact on increasing retirement savings rates.

Hispanic American Households Invest More in Low-Yield Assets

Only 31% of Hispanic households with employment income (part-time or full-time) report that they are currently participating in a retirement plan--compared with 51% of similar white households. This may be due to multiple reasons, including limited access to retirement plans.

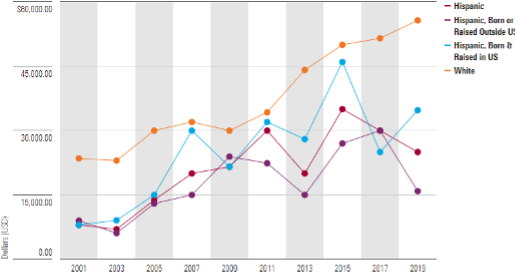

Low retirement savings are largely linked to Hispanic households led by adults born or raised outside of the United States, who have far lower retirement account ownership than Hispanic households led by adults born and raised in the U.S. The trend in employer retirement savings over the past 20 years is not encouraging for Hispanic households, either, as they have more-volatile rates and inconsistent growth when compared with median account balances of white households (see below).

- source: Morningstar Analysts

We found that Hispanic households are not using other high-return vehicles to offset these lower retirement savings.

Compared with white households, Hispanic households hold more of their wealth in homes (48% versus 30%) and automobiles (11% versus 5%) and less wealth in nonretirement investment accounts (5% versus 11%) or businesses (4% versus 7%). Existing research suggests that there is a progression of assets in relation to income, where individuals start with homes and vehicles then move on to higher-return assets as their income grows. So, consistently lower income may be a factor for why Hispanic household wealth may concentrate on lower-yield assets.

How Income, Location, and Education Affect Hispanic Household Savings Rates

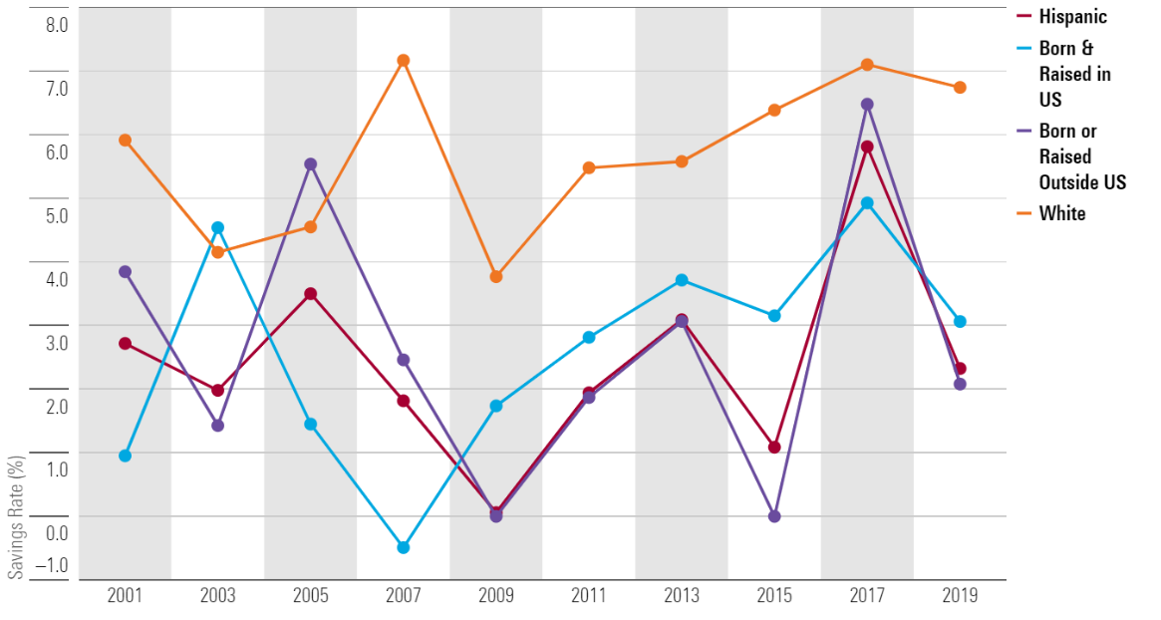

Beyond current wealth, our research also examined overall savings rates and retirement savings rates. The next exhibit shows the volatile savings rates of the median Hispanic household over the past two decades, which are also consistently lower than their white counterparts.

- source: Morningstar Analysts

Even when we account for a wide range of factors that may affect saving, the median Hispanic household’s active savings rate is still 1.3 percentage points lower than white households. We estimated this through regression models that simultaneously account for multiple factors including race, geographic region, urban vs. rural location, income, household structure as well as the age, nativity, and education of the head of household.

A major factor that drives savings rates across all households is income; however, its impact can be different based on ethnicity and nativity.

Every 10% increase in income is associated with a 0.48-percentage-point increase in the savings rate for white households, whereas this results in a 0.30-percentage-point increase for Hispanic households and only a 0.23-percentage-point increase for Hispanic households with adults born or raised outside the U.S.

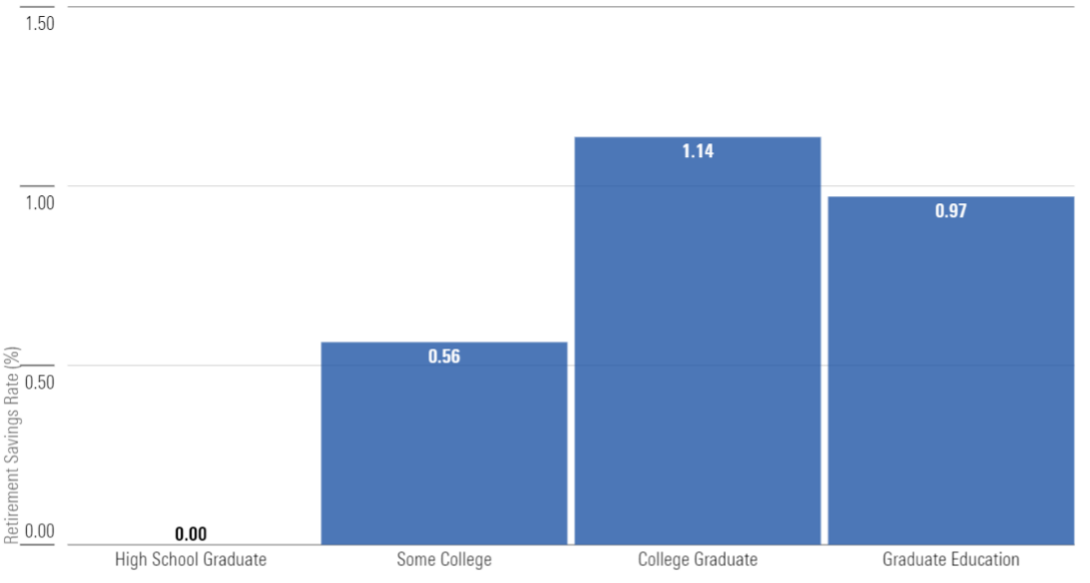

Even though many households do not have retirement accounts, we compared those that do to understand what influences their rates of saving. Again, we see that Hispanic households’ retirement savings rate is lower than white households--this time by 0.21 percentage points--and income remains a key factor affecting retirement savings rates.

However, education emerged as a factor that particularly affects retirement savings rates among Hispanic households, with those led by a college graduate having a 1.1-percentage-point higher retirement savings rate than those led by an adult who completed less than a high school education (see below).

- source: Morningstar Analysts

Solutions for Maintaining Current Savings and Boosting Future Savings

We propose a few solutions for addressing the volatile account balances and persistent low savings rates among Hispanic Households. Hispanic households are more likely to borrow from retirement accounts compared with white households, and such withdrawals can have a drastic negative impact on a household's overall savings balance. A key strategy to avoid this problem is having a separate emergency savings account, which companies can help with by offering such accounts along with traditional retirement savings accounts.

Boosting the access, adoption, and ease of usage for retirement savings accounts is critical for boosting future savings. Hispanic households will benefit from employers who do more to simplify the savings process and set up automatic enrollment in workplace retirement plans. For the many workers who do not currently have access to plans, there are promising innovations--such as pooled-employer plans--which may allow smaller employers to offer this benefit as well as state-run IRAs.

Structurally, pay-parity and anti-discrimination policies meant to address the racial income gap could also address the savings gap and, in turn, the wealth gap, given income’s central importance to differences in savings and wealth accumulation regardless of race and ethnicity. Also, because of the broad diversity of Hispanic American households, educational initiatives to promote saving activity and trust in public and private wealth accumulation vehicles could benefit from targeted communications and multilanguage outreach that fits the cultural contexts of Hispanic households.

/s3.amazonaws.com/arc-authors/morningstar/e03cab4a-e7c3-42c6-b111-b1fc0cafc84d.jpg)

/s3.amazonaws.com/arc-authors/morningstar/ff370d56-5946-45e8-a1ea-5e50301bc997.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-24-2024/t_a8760b3ac02f4548998bbc4870d54393_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/O26WRUD25T72CBHU6ONJ676P24.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/U772OYJK4ZEKTPVEYHRTV4WRVM.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/e03cab4a-e7c3-42c6-b111-b1fc0cafc84d.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ff370d56-5946-45e8-a1ea-5e50301bc997.jpg)