What Are Workers Paying to Save For Retirement?

It depends on the size of your employer, according to our new research.

In our second annual Retirement Plan Landscape report, we look at a range of trends in the private-sector workplace plan market, spanning both defined-benefit and defined-contribution plans. As a preview, here are our findings when it comes to what workers are paying to save for retirement and the ESG risk their portfolios may be exposed to.

Costs Are Coming Down, but Employer Size Dictates by How Much

Saving for retirement through a workplace plan is cheaper than ever—as all U.S. investing is—but there is still a wide range of variation and your exposure to that variability largely depends on the size of your employer. People who work for smaller employers and participate in small plans pay, on average, around double the cost to invest as participants at larger plans—around 84 basis points (0.84%) in total compared with 40 basis points (0.40%), respectively.

The total cost is composed of the asset-weighted expenses associated with the plan and overall plan administration expenses, and, in both regards, scale is an enormous advantage. While the median costs have dropped across all plan sizes from our previous report, small plans have not meaningfully closed the gap on their larger counterparts. The median small plan ($25 million or less in plan assets) moved the needle slightly faster, dropping 4 basis points in 2020 compared with 2019, to 0.84% in 2020 from 0.88% in 2019, while for the largest plans (more than $500 million in plan assets) total costs fell just 1 basis point, to 0.40% from 0.41%.

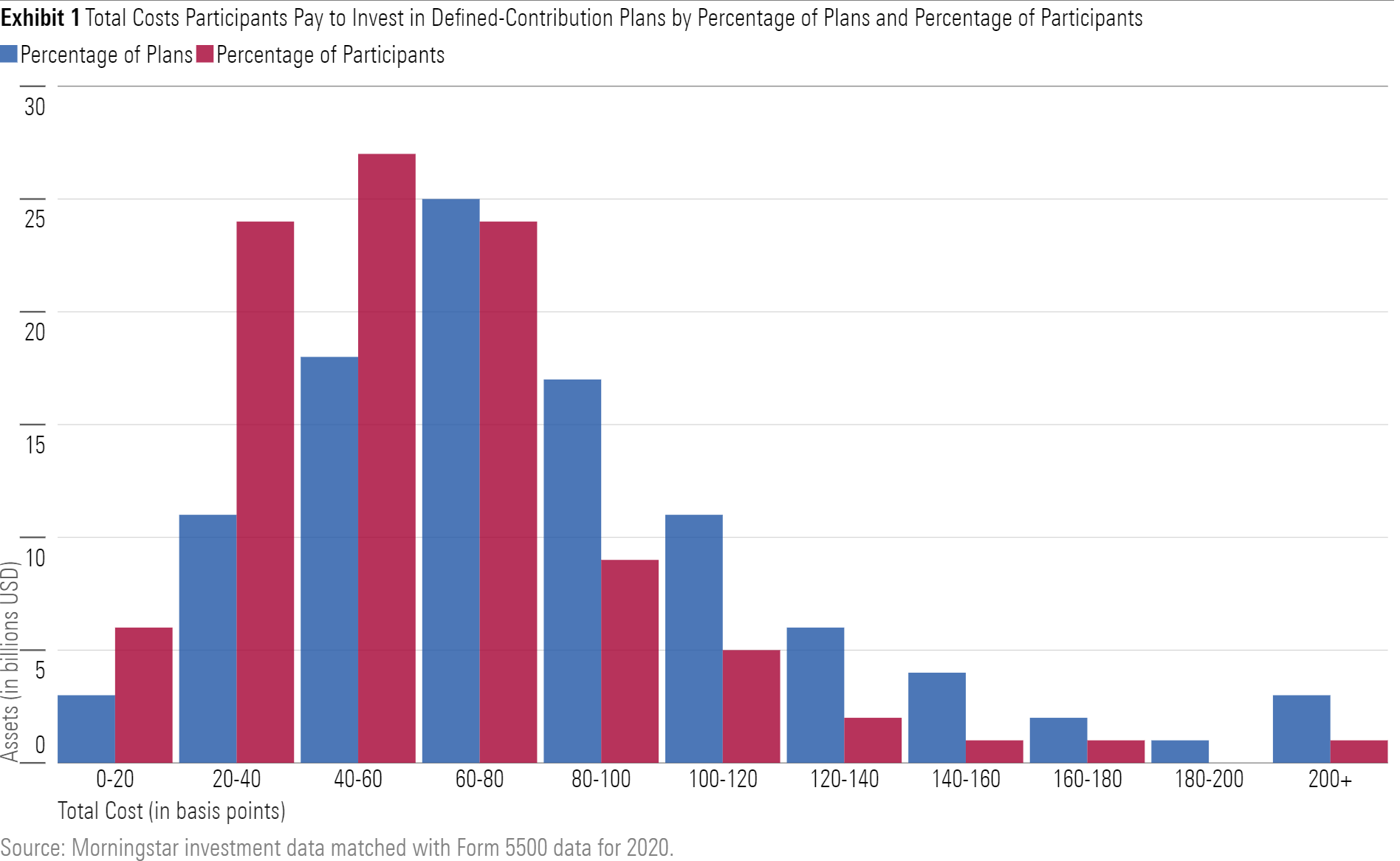

There is a wide range of total fees that participants pay to save for retirement through a workplace plan, spanning from less than 20 basis points (0.20%) to more than 200 (2.00%). Fortunately, the majority of defined-contribution plan participants are in larger plans and benefit from the lower costs of these plans, with 80% of participants in plans charging less than 80 basis points (or 0.80%), despite these plans making up just 57% of the market.

Retirement Plans Miss Out on Low ESG Risk Investments

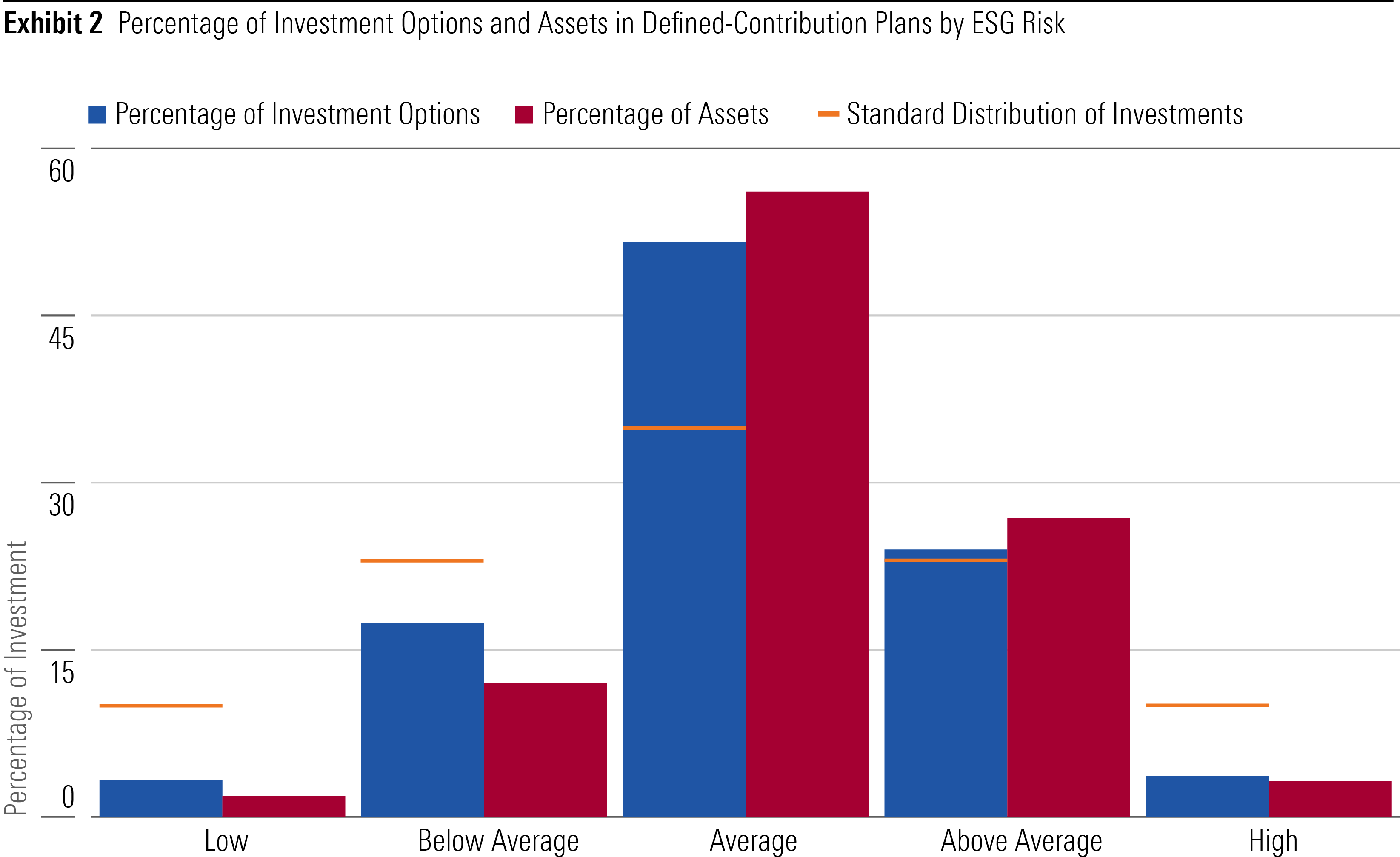

Turning from cost to risk, U.S. retirement plans are often not helping their participants avoid environmental, social, and governance risks. Plans offer investment options that are more likely to have higher ESG risk compared with the overall distribution of ESG risk in investments we rate, as shown in Exhibit 2. Put another way, the companies that participants’ assets are invested in are less likely to be addressing ESG issues, based on Sustainalytics’ ESG Risk Rating, leaving them more exposed to ESG risks.

Additionally, on an asset-weighted basis, workers are not generally investing in strategies with low levels of ESG risk. For example, just 3.3% of investment options and 1.9% of assets are in strategies with the lowest levels of ESG risk, but 10% of all strategies rated by Morningstar are in this category.

Distinct from the question of managing ESG risk, plans are beginning to offer investments that incorporate sustainability into their investment strategy, either through having a general sustainability mandate or by employing exclusionary screens on specific industries or products. As of 2020, 16% of all plans offered at least one investment employing one, or both, of these approaches.

As with other trends in the retirement system, the largest plans are leading the way, with nearly 20% offering investments with sustainable considerations. These investments have the potential to increase participation if they can engage employees who would otherwise not save in their workplace plan by allowing them to invest in line with their values. A recent survey found that a growing number of investors, particularly millennials, expressed interest in sustainable investing. Sustainable strategies are more likely to be offered as a single-asset investment than an all-in-one target-date fund, meaning that assets in these investments will likely increase more slowly than overall retirement plan assets, but increasing engagement and participation in the system can create long-term impact.

Regulatory uncertainty has kept growth of sustainable assets in plans small, but these strategies may be key to engaging additional participants. We estimate just over $50 billion within defined-contribution plans with 100 or more participants is invested in strategies with a sustainable mandate or employing exclusions. This is not an insignificant amount but still less than 0.8% of the total assets in these plans. This is in large part because plans have been hesitant to even make these investments available in the ever-changing regulatory environment.

Younger investors will one day be the bulk of defined-contribution plan participants. Our research shows that they have a strong interest in sustainable investing, which could be an avenue for these plans to explore to encourage greater participation.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/f3c31470-cc00-45ac-b20f-d2928ec12660.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/YBH7V3XCWJ3PA4VSXNZPYW2BTY.png)

/d10o6nnig0wrdw.cloudfront.net/04-24-2024/t_a8760b3ac02f4548998bbc4870d54393_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/O26WRUD25T72CBHU6ONJ676P24.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/f3c31470-cc00-45ac-b20f-d2928ec12660.jpg)