The Good News on Safe Withdrawal Rates

Our annual study suggests that new retirees can spend more from their portfolios.

Recent retirees haven’t had an easy time of it lately. When stock and bond prices both plummeted in 2022, many retirees saw big dents in their portfolio values; a typical portfolio made up of 50% stocks and 50% bonds would have lost about 16% for the year. While market conditions have improved a bit in 2023, balanced portfolios have yet to win back all of their 2022 losses as of Oct. 31, 2023. Making matters worse, higher inflation has forced many retirees to take bigger withdrawals as their portfolio values have shrunk.

But for people who are about to retire, the prospects for retirement income look a bit brighter. In our newly released research paper, “The State of Retirement Income 2023,” my co-authors Christine Benz, John Rekenthaler, and I estimate that retirees drawing down income from an investment portfolio can now afford to withdraw as much as 4.0% as an initial spending rate, assuming a 90% probability of still having funds remaining after a 30-year time horizon. That figure is the highest safe withdrawal percentage since Morningstar began creating this research in 2021. (The highest starting safe withdrawal rate based on similar assumptions was 3.3% in 2021 and 3.8% in 2022.)

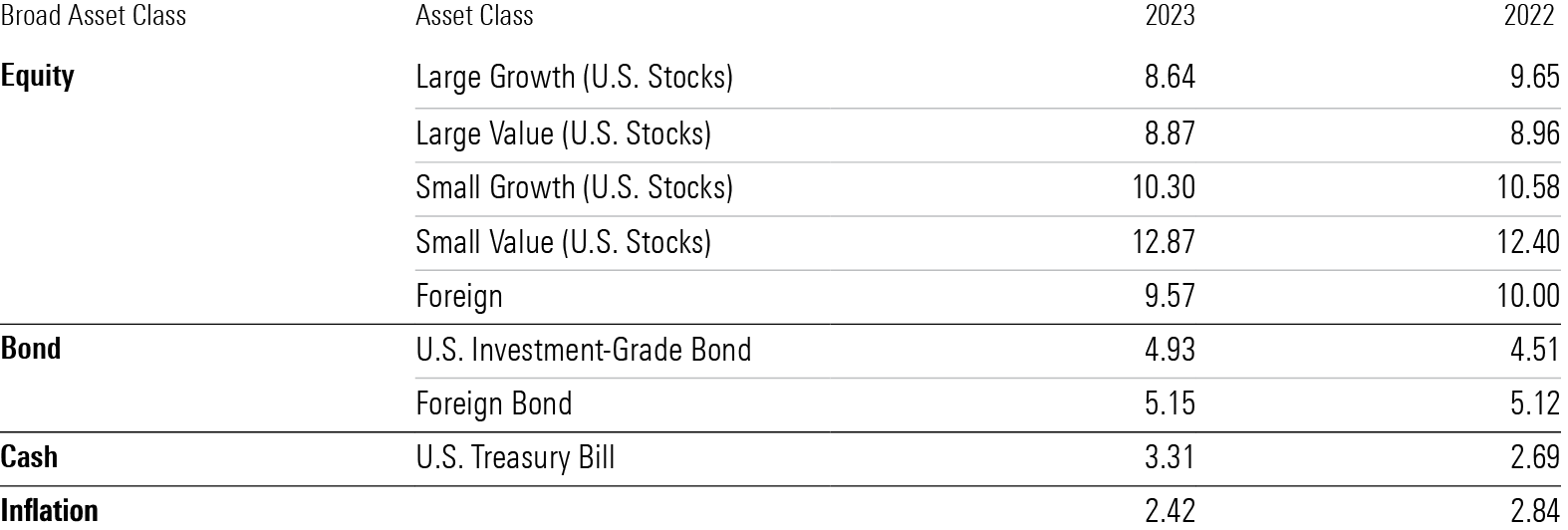

The reason? As yields on bonds and cash have increased, the forward-looking prospects for portfolio returns—and in turn the amounts that new retirees can safely withdraw from those portfolios over a 30-year horizon—have continued to edge up since we covered the topic last year. A more moderate inflation outlook has also helped: We used a 2.42% long-term inflation forecast this year, versus 2.84% in 2022.

Retirees who are willing to employ more-flexible strategies or make other modifications to a basic approach of using 4% as a starting point for withdrawals and then adjusting that dollar amount each year for inflation can enjoy even higher starting withdrawals, assuming they’re willing to accept other trade-offs, such as fluctuating year-to-year real cash flows and the possibility of fewer leftover assets at the end of a 30-year period.

Digging Into the Research: An Analysis of Safe Withdrawal Rates

As in last year’s study, we employed a “base case” to test safe starting withdrawal rates. Specifically, we assumed a new retiree with a 30-year anticipated time horizon who would like to secure a 90% probability of not outliving their money. We assumed the retiree was using a fixed real withdrawal system, which involves setting the starting withdrawal amount and then taking inflation adjustments to that dollar amount each year thereafter.

We held these key inputs steady from last year, but the overall assumptions for portfolio returns rose based on the capital markets assumptions put together by our colleagues in Morningstar Investment Management. The anticipated 30-year returns for stocks were slightly lower in this year’s research compared with the previous year, with projected returns for an all-equity portfolio edging down to 9.41% from 9.88% in 2022. At the same time, though, expected fixed-income returns (including cash) moved up to 4.81% from 4.44% in 2022. As mentioned above, more temperate inflation assumptions were another positive. Our 30-year inflation forecast eased down to 2.42% from 2.84% in 2022.

Projected 30-Year Asset Class Return % and Inflation % Assumptions, 2023 vs. 2022

With two out of the three main assumptions trending in a positive direction, our research suggests that people heading into retirement today can reasonably use a higher starting withdrawal rate than indicated last year. As shown in the table below, we estimate that a new retiree planning for a 30-year time horizon can safely withdraw as much as 4% of the portfolio’s value as a starting safe withdrawal rate for a portfolio with a 40% equity weighting. Because of the more attractive yields available on fixed-income securities, we found the same figure applies to portfolios with equity weightings as low as 20%.

30-Year Starting Safe Withdrawal Rate %, by Asset Allocation, 90% Success Rate

Investors might expect that safe withdrawal rates would increase with higher equity weightings, but that’s not necessarily the case. Our return assumptions still assume that stocks will deliver significantly better long-term returns than bonds and cash. As a result, equity-heavy portfolios typically ended up with more money left over at the end of the 30-year period. But stocks also court significantly higher levels of volatility, which makes the outcomes for all of the withdrawal rates tested inherently less certain. In addition, we targeted a success rate of 90%, which is relatively high. This also tended to tilt the scales in favor of the less volatile assets of bonds and cash.

For retirees with time horizons both shorter and longer than 30 years, portfolios with equity weightings of 20% to 40% also generally supported higher withdrawal rates than more equity-heavy portfolios. As shown in the table above, retirees with shorter time horizons can safely withdraw significantly more than the 30-year baseline assumption, but safe withdrawal rates ratcheted down at a more modest pace for retirees with longer time horizons.

How Dynamic Withdrawal Strategies Can Help

As in last year’s paper, we tested a variety of additional flexible withdrawal systems. These ranged from straightforward adjustments—such as forgoing inflation adjustments after the portfolio lost value in the preceding year—to more complex systems such as the “guardrails” approach originally developed by financial planner Jonathan Guyton and computer scientist William Klinger. This year, we also tested a strategy that incorporates the average decline in spending that occurs over the retirement lifecycle based on empirical data. All of these systems allowed for starting safe withdrawal rates relative to the fixed real spending rate we used as our base case.

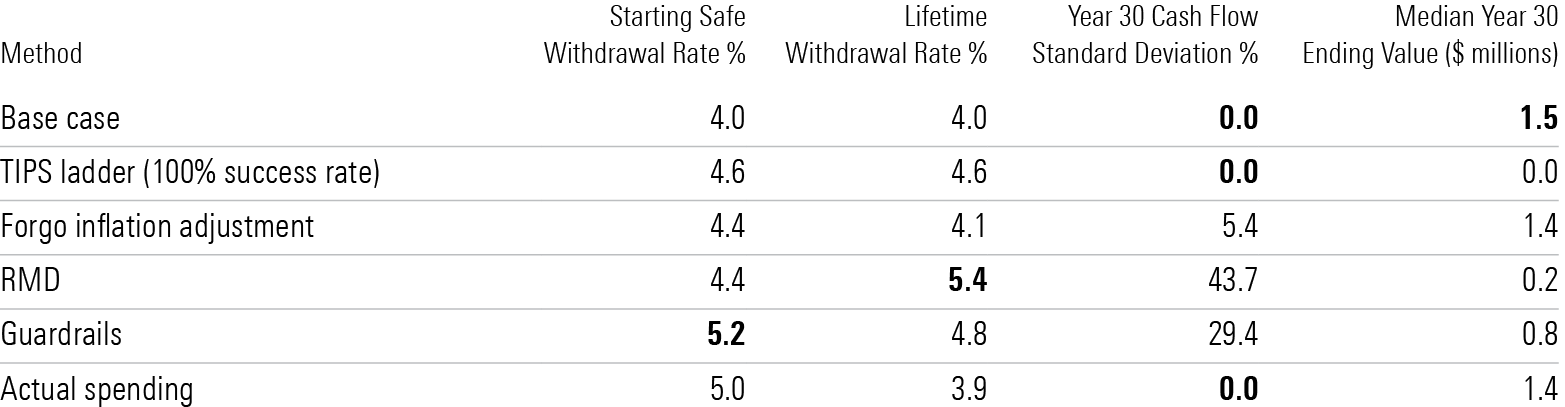

Spending Methods Summary, 40% Equity/60% Bond Portfolio, 30 Years, and 90% Success Rates

As shown in the table above, though, these strategies all entail trade-offs. For example, the guardrails method and taking withdrawals in line with required minimum distributions both allowed for higher starting safe withdrawal rates, but at the expense of much greater variability in cash flows from year to year. Making gradual reductions in actual spending over time allowed for a higher initial withdrawal rate, but led to a lower lifetime withdrawal rate.

Another trade-off involves how much money is left at the end of the spending period. At one extreme, the base case and actual spending methods typically led to the highest remaining balances at the end of the 30-year period. This metric is relevant for retirees who want to maintain (or even grow) their assets to leave something behind for heirs or charity. On the other hand, the guardrails and RMD methods typically end up with lower remaining balances because both of them result in higher withdrawals in good markets. These methods—as well as the TIPS ladder method described below—are best for retirees who want to maximize consumption (including gifting to loved ones and charity) during their own lifetimes rather than leaving something behind.

The Role of Guaranteed Income

In addition to the dynamic withdrawal strategies discussed above, retirees can also support their retirement spending by using guaranteed income sources, such as Social Security, annuities contracts sold by an insurance company, or Treasury Inflation-Protected Securities.

There are a few ways to maximize the value of Social Security: waiting to claim full benefits until the official full retirement age (currently 67 for people born in 1960 or after); delaying filing until age 70 to receive even higher monthly payments; or postponing Social Security while also waiting to tap into the retirement portfolio, which implies working longer and continuing to contribute to retirement savings.

Fixed annuities (either immediate or deferred) are another way of generating a guaranteed income stream (which mainly consists of a return of the initial capital amount purchased over time). Because they spread out mortality risk across a wide pool of policyholders, fixed annuities continue to deliver monthly payments throughout a retiree’s life span.

A TIPS ladder, which is a self-liquidating portfolio created to support spending over a specific time horizon, can also be an attractive way to generate guaranteed income. Because both principal values and yields of TIPS are adjusted for changes in inflation, they not only provide a steady income stream, but also provide a built-in hedge against unexpected inflation. Creating a TIPS ladder involves buying TIPS with a range of maturities over the entire spending period (30 years, in this case), and then using the proceeds of the bonds as they mature (as well as their ongoing coupon payments) to cover spending needs over time.

Current yields on TIPS are more attractive than they’ve been in the past, making the TIPS ladder strategy particularly compelling for this year’s study. We estimate that as of Sept. 30, 2023, a 30-year TIPS ladder would support a 4.6% withdrawal rate. That’s not only higher than most of the other strategies we tested, but also 100% guaranteed. On the downside, if the retiree uses the TIPS proceeds for spending, there’s no potential for residual balances, in contrast with the portfolio-spending strategies that we discussed in the preceding section.

Conclusion

Retirement drawdown strategies remain one of the most challenging areas in all of finance. But fortunately, retirees have numerous options. The right level of flexibility in a retiree’s spending system ultimately depends on several different factors, including whether the individual wants to prioritize steady income over time, maximizing withdrawal rates, having money left over for bequest purposes, and the extent to which fixed expenses are covered by nonportfolio income sources.

Christine Benz and John Rekenthaler contributed to this article.

How to Balance Your Lifestyle and a Safe Withdrawal Rate in Retirement

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/360a595b-3706-41f3-862d-b9d4d069160e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/YBH7V3XCWJ3PA4VSXNZPYW2BTY.png)

/d10o6nnig0wrdw.cloudfront.net/04-24-2024/t_a8760b3ac02f4548998bbc4870d54393_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/O26WRUD25T72CBHU6ONJ676P24.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/360a595b-3706-41f3-862d-b9d4d069160e.jpg)