High TIPS Yields Are a Retiree’s Best Friend

A long-awaited investment opportunity has finally arrived.

At Long Last

After ignoring Treasury Inflation-Protected Securities ever since this column began, I am now paying them substantial attention. TIPS forced my hand. After many years of languishing at unacceptable levels, their yields have soared. At long last, the investment merits serious consideration.

TIPS Yields: 10 Years and 30 Years

The increase is deeply meaningful. High payouts on nominal bonds can be illusory. If inflation does not follow suit, those securities become bargains, but there is always the possibility of catching a falling knife, as the Wall Street adage goes. A conventional 10-year Treasury that pays 5% will be a good investment if inflation averages an annualized 3% over the next decade but a poor choice if inflation is twice that rate. In contrast, fat TIPS yields persist. They pay and pay and pay.

(It’s odd that TIPS yields fluctuate so sharply. Why would 2020′s TIPS investors have paid the United States to take their money, in real terms, while today’s buyers demand an annual gain exceeding 2%? Interest-rate researchers usually address long-term factors, but those cannot explain a three-year change. It seems, as Bill Bernstein claims, that although the Fed directly controls only short-term rates, its monetary policies affect the entire yield curve.)

A Fresh Opportunity

This development greatly benefits retirees who possess investment portfolios. True, higher nominal bond yields also help their case, as detailed in last week’s column. But only inflation-protected securities can safeguard with absolute certainty investors’ purchasing power. TIPS supply what other investments lack: payments that are fully inflation-adjusted.

Raw TIPS yields are difficult to interpret. How attractive, really, is a 2.38% real payout? We can, however, restate the deal by creating a TIPS ladder. A TIPS ladder holds TIPS of various maturity dates. By enhancing the securities’ yields with sales of the ladder’s capital, thereby liquidating the portfolio during the stated time horizon, investors can receive a return that is easier to evaluate.

TIPS Ladders

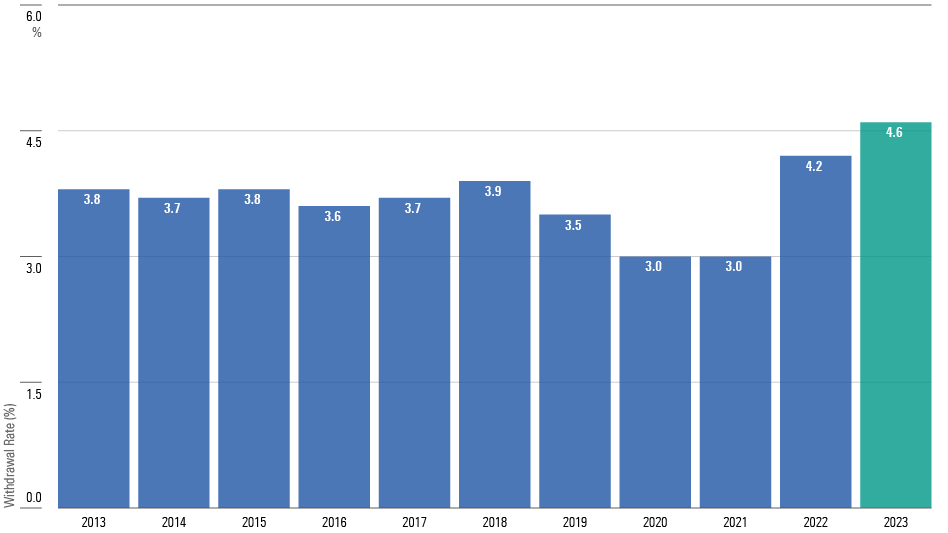

Happily, the U.S. Treasury Department provides historic TIPS yields, which can be translated into withdrawal rates. Armed with that data, we can compare the spending rate presented from today’s 30-year ladder against those available from previous TIPS yields.

TIPS Ladders: Withdrawal Rates

That information establishes the context. Over the past century, U.S. retirees holding portfolios with equal portions of domestic stocks and bonds have reliably been able to attain at least a 4% real withdrawal rate over the ensuing 30 years. Given that background, TIPS ladders were always guaranteed to fall short of the 4% mark while (on account of their construction) also being guaranteed to exhaust their original capital. That wasn’t much of a proposition.

Today’s 4.6% rate is another matter entirely. Even optimists must concede the possibility that the next three decades might prohibit such a generous withdrawal rate for those who invest either in equities and/or nominal bonds. Middling stock returns combined with bond market woes caused by persistent inflation would scotch that goal. For retirees willing to spend down their portfolios, guaranteed real income of 4.6% is hard to beat.

Adding Equities

Not all retirees will accept liquidating their portfolios, even over a period as long as 30 years. Some will worry about outliving that investment horizon, while others will hope to leave money for their heirs. But even such investors may find room for a TIPS ladder. If combined with an equity stake, ladders can potentially provide the investment equivalent of having one’s cake and eating it, too.

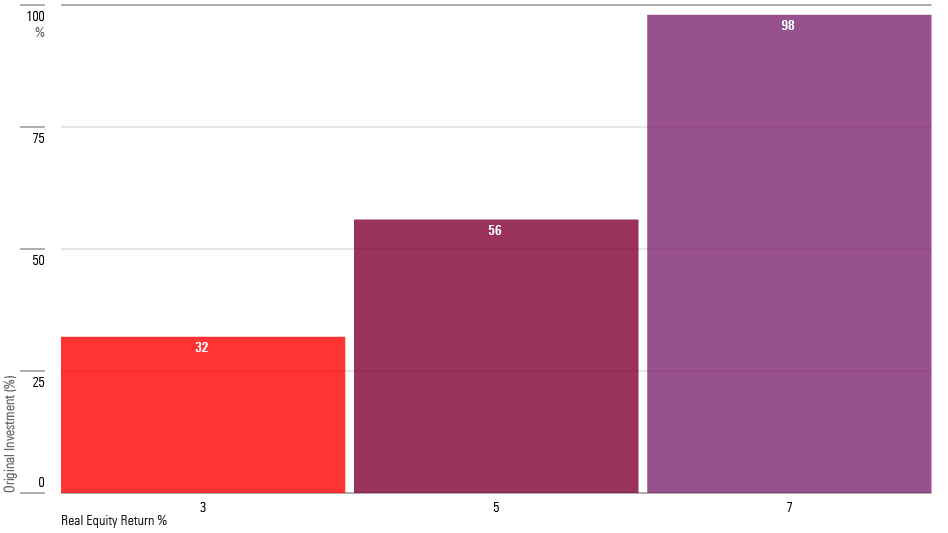

Consider, for example, a retiree seeking a 4% real withdrawal rate over the next three decades from a $500,000 portfolio, leading to an annual inflation-adjusted payout of $20,000. With a 30-year ladder rate of 4.6%, the retiree could generate the desired $20,000 by investing $435,000 in TIPS, placing the final $65,000 into stocks. The TIPS ladder would be spent, leaving the equity position untouched.

When the 30 years conclude, the retiree would no longer own any TIPS assets but would hold the equity stake. As demonstrated by the next chart, that position could be substantial. The illustration shows, once again in real terms, what percentage of the original $500,000 investment would be replaced by the $65,000 that was stashed into equities, assuming its stocks gain 1) the long-term U.S. equity average of 7%, 2) a cautious outlook of 5%, or 3) a truly humble 3%.

TIPS Ladders + Equities: 4% Withdrawal Rate

Admittedly, Morningstar regards the 7% forecast as overoptimistic. Stocks have become safer with time and therefore should earn lower future returns. But the 5% scenario seems reasonable. Should that occur, TIPS ladder buyers who used a 4% withdrawal rate and parked the remaining assets in stocks would retain 56 cents on their investment dollar—as always in this column, expressed in real terms—after the three decades had passed. With that amount, they could maintain another 15 years of spending. Only Methuselah would be unsatisfied.

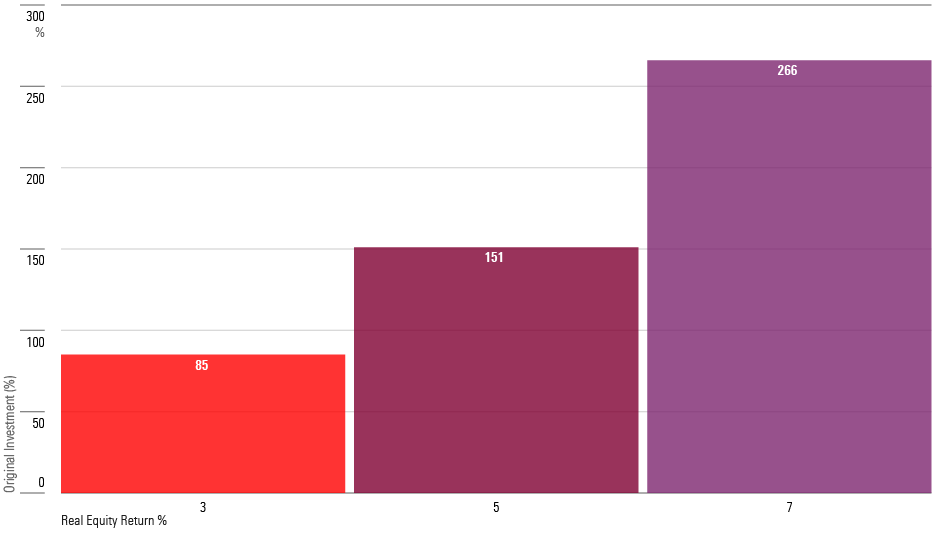

A related tactic, for those who can withstand a lower spending rate, is to cut the withdrawal rate to 3% from 4%, thereby permitting a 35% equity weighting. Doing so would likely create a perpetually increasing portfolio. Even assuming equity returns well below the historic average, investors following such a strategy would likely end their retirements with more assets than when they began.

TIPS Ladders + Equities: 3% Withdrawal Rate

Wrapping Up

Receiving real income from the U.S. government is an excellent proposition if yields are acceptably high. Today, they are.

The offer is particularly appealing for retirees who need not devote their entire portfolio to their spending needs, thereby permitting them to buy stocks. If their equity holdings are sufficiently large, and the financial markets reasonably kind, such investors could end up enjoying the best of both worlds: guaranteed real income plus capital appreciation. Such a combination is very difficult to beat.

The opinions expressed here are the author’s. Morningstar values diversity of thought and publishes a broad range of viewpoints.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/G3DCA6SF2FAR5PKHPEXOIB6CWQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)