Annuities Are Not Alchemy

But they can be good medicine for some investors.

Retirement plans across the country may finally be getting serious about adding more annuity options. The goal of this push is to help the pool of near-retirees allocate to products that will help generate income in retirement—but our research suggests that this may not be the right tactic for everyone.

Along with my colleague at Morningstar’s Center for Retirement and Policy Studies, Aron Szapiro, I examined some common strategies to generate lifetime guaranteed income in retirement plans and compared the projected performance against that of a portfolio-only strategy in a new study.

Overall, we found that annuities do not add much value when an investor is already well-prepared for retirement. They also do not help much when Social Security or other guaranteed income sources already cover the majority of anticipated retirement expenses.

Still, many near-retirees would likely benefit from annuities. For these investors, we found that a partial allocation to a simple immediate or deferred income annuity tended to lead to better outcomes. However, none of the annuity-based strategies could compete with delaying Social Security claiming, especially when there is high inflation.

We expand on these findings below.

How We Define Lifetime Income Strategies

Before we dive in, it is important to quickly define the strategies and products we consider in this article.

- Portfolio only. Use Social Security benefits, claimed at retirement (which we assume is at 65), and systematic withdrawals to fund expenses in retirement.

- Social Security bridge. Delay claiming Social Security until age 70, taking larger withdrawals to fund retirement expenses before Social Security benefits start.

- Fixed single premium immediate annuity, or SPIA, at retirement. Purchase a fixed SPIA with a portion of wealth at retirement and use Social Security benefits and portfolio withdrawals for remaining expenses.

- Qualified longevity annuity contract, or QLAC, at retirement. Purchase a QLAC with income starting at age 80. Use Social Security and portfolio withdrawals to fund remaining expenses.

- Deferred variable annuity with guaranteed living withdrawal, or GLWB, rider. Contribute to a deferred variable annuity before retirement and start guaranteed living withdrawals at retirement. Use Social Security and the investment portfolio to cover remaining expenses.

Read more: Morningstar’s Guide to Annuities

What’s the Biggest Determinant of the Right Lifetime Income Strategy?

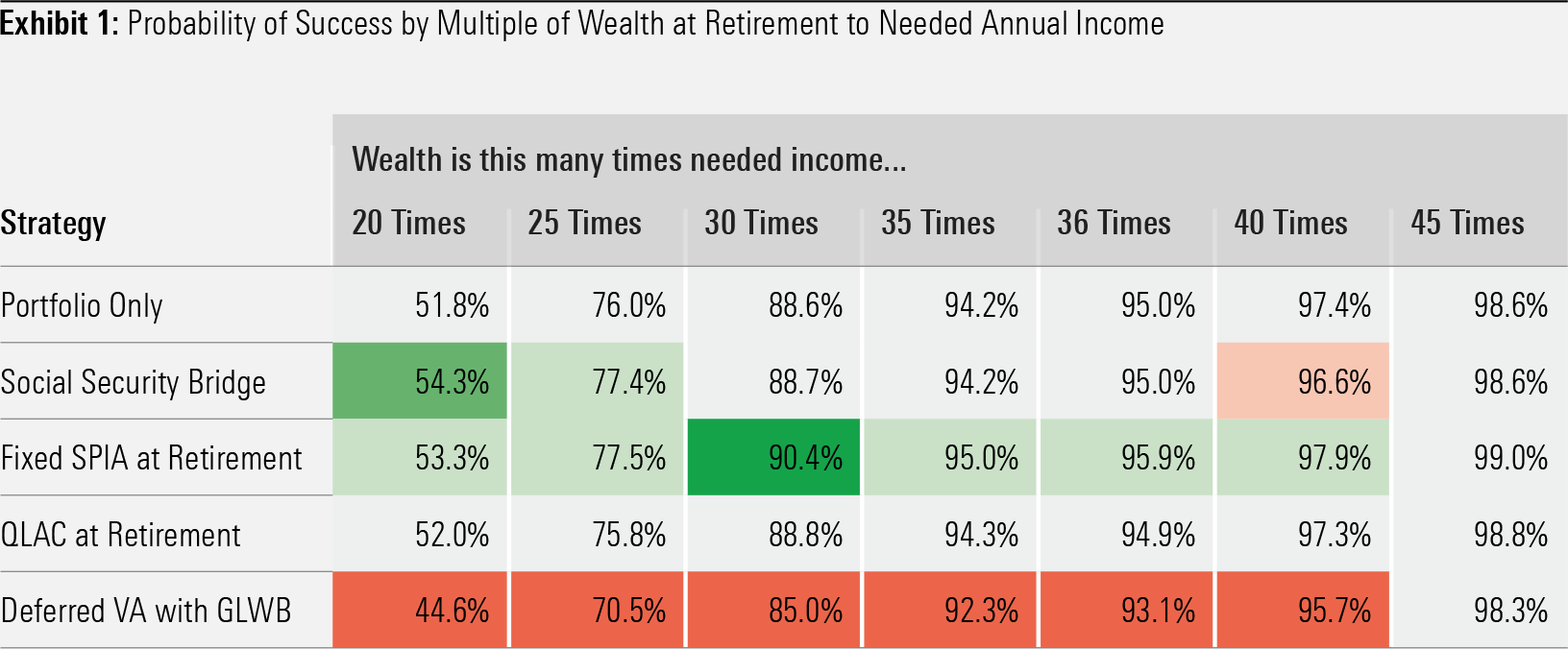

We found that annuities are not appropriate for all investors. In fact, we found that if an investor’s wealth at the start of retirement is more than 36 times their needed annual retirement income (defined as annual expenses less Social Security income), they would succeed at least 95% of the time with a portfolio-only strategy, as shown in Exhibit 1.

This amount of wealth leaves little room for an annuity to have a meaningful impact on the investor’s retirement, as the retiree can more or less self-insure against market risk and longevity risk. Note that the coloring in Exhibit 1 highlights the strategies that perform relatively better (green), near the middle (gray), and relatively poorly (red). We applied the coloring to each column separately.

This rule of thumb is a good starting point to determine whether an annuity-based strategy is worth considering. However, it is sensitive to our assumptions and framework, so we recommend reading our report for a deeper discussion.

Next, we investigated whether annuities provide value when existing guaranteed income streams cover the vast majority of anticipated retirement expenses. We found that they do not. This is because the existing guaranteed income streams already provide protection against market risk and longevity risk.

However, some investors in these categories can still benefit from additional guaranteed income. Annuities can enable well-funded participants to spend more every year or make a large purchase early in retirement. They can also psychologically benefit participants who have a strong preference for income stability.

Investors Should Consider Social Security Bridging Before Other Lifetime Income Strategies

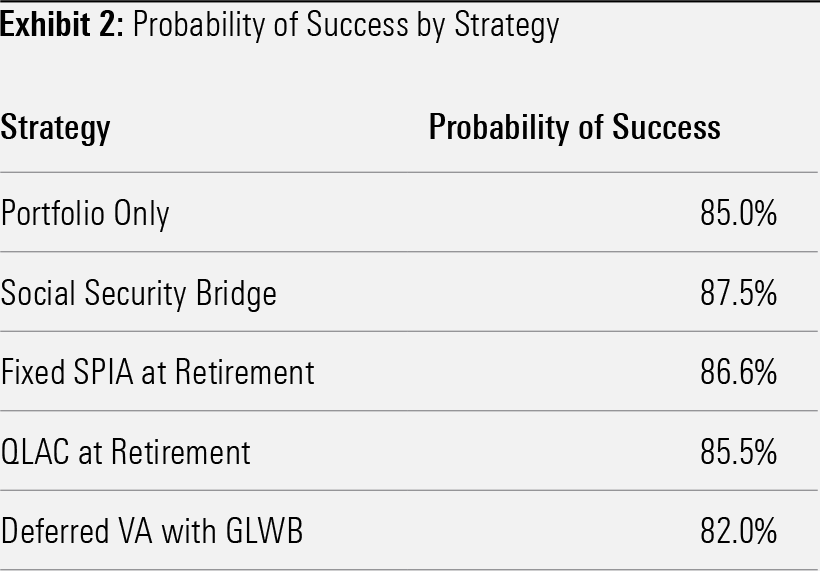

Next, we studied investors who have the right profile to benefit from annuities. We found that the Social Security bridge strategy performed the best, as shown in Exhibit 2.

Simply put, Social Security bridging offers more generous payments than private annuities, for the following reasons:

- Social Security has no profit margin requirement.

- The benefits are based on life expectancies of the United States population, instead of the above-average life expectancies used by insurance companies.

- The benefits are indexed to the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W).

Outside of Social Security bridging, we found that the fixed SPIA and QLAC strategies provided the biggest boost to the probability of success because they mitigate against market risk and longevity risk. These annuities also tend to outperform bonds over longer time horizons on account of mortality credits.

The deferred variable annuity with GLWB was the only strategy to underperform the portfolio-only strategy. This is because the guarantee is not generous enough to provide much help in cases where the portfolio-only strategy falls short. We discuss this in much greater detail in the main report.

The deferred variable annuity aside, the results indicated that there is still a place for annuities as investors that want or need more guaranteed income can benefit from combining a private annuity with the bridging strategy.

Social Security Bridging Provides Better Protection Against High Inflation Than Other Lifetime Income Strategies

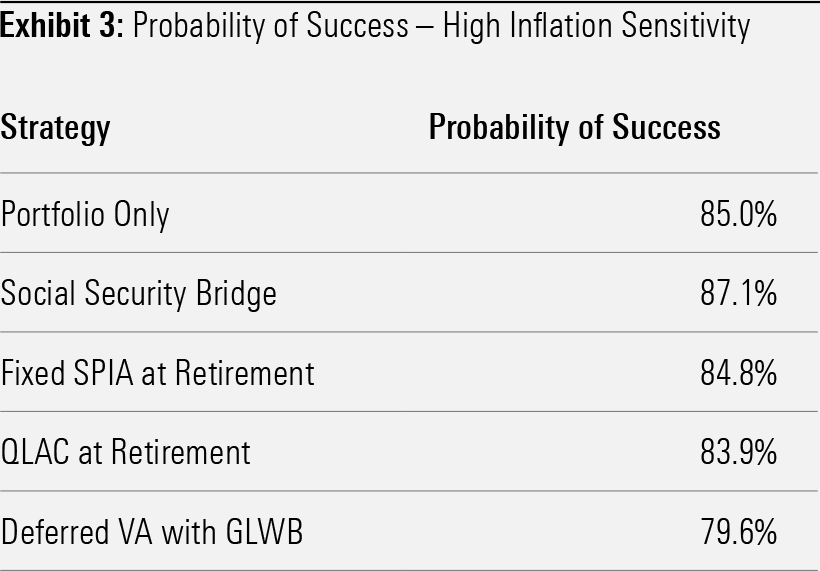

Next, we ran a high inflation sensitivity analysis. We generated scenarios in which normal inflation is around 4%, instead of the 2% target used for our base analysis, but real portfolio returns were kept the same (we did increase the portfolio returns by the difference between the high inflation and base inflation values). Results are presented in Exhibit 3.

The Social Security bridge is the only strategy that outperforms the portfolio-only strategy. This is because it is linked to CPI-W. Though fixed SPIAs and QLACs tend to be high performers when inflation is typically around 2% a year, they underperformed the portfolio-only strategy in this sensitivity.

Conclusion

In sum, this research showed that partial allocations to annuities can help some investors but not others. And for those who can benefit from annuities, we found that they should consider Social Security bridging before private annuities.

However, we did not address how an investor’s portfolio should be adjusted to account for additional guaranteed income. This is important because not doing so can result in the investor being overly exposed to the bondlike investments throughout retirement, which we’ll further explore in our next column.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/478a471a-aa07-4241-afd4-40cf325f3951.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WNDFS2S4FNA6LEJDB2Y6E4XHYQ.png)

/d10o6nnig0wrdw.cloudfront.net/05-01-2024/t_17b16ff580be466186dfca2760195b1f_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/BZ4OD6RTORCJHCWPWXAQWZ7RQE.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/478a471a-aa07-4241-afd4-40cf325f3951.jpg)