Annuities Unveiled: A Guide to the Different Types of Annuities

Breaking down income annuities and savings annuities.

Annuities are complicated. And the jargon that professionals use to discuss them does not help.

That’s because the word “annuity” actually refers to a broad range of financial products. To help ordinary investors, we recently published a guide that goes through the different types of annuities and their common features.

I like to categorize annuities—which are really just contracts between insurers and purchasers—as either an income annuity or a savings annuity.

- Income annuities provide the owner a steady stream of cash flows for a set period or for the rest of their life.

- Savings annuities are an accumulation-focused product with an account balance. While all savings annuities allow the owner to convert the account balance into a stream of cash flows, this is rarely done. These vehicles are often referred to as “deferred annuities,” but I prefer the term “savings annuity” because it better describes how these types of annuities are used in practice.

Before we go into more detail, I want to clarify upfront that all annuities have explicit costs, implicit costs, or both. The overarching principle is that an insurer will take a portion of the interest or investment gains of the assets underlying a contract before passing along the rest to the owner.

What Are Income Annuities?

Income annuities vary in their design, but they all provide a guaranteed stream of cash flows in exchange for an insurance premium.

Income annuities can include single premium immediate annuities, or SPIAs, and deferred income annuities, or DIAs. The key difference between the two is when the owner will start receiving cash flows. With SPIAs, the owner will start receiving payments right away, hence the word “immediate” in their name. With DIAs, the payments start at a future date. In either case, buying an income annuity is more or less equivalent to converting a lump sum of money into a pension.

Most income annuities provide fixed, or level, payments. This means that the payments to the owner are set when the annuity is purchased and are not impacted by fluctuations in the market. There are some ways to customize the payments, which I discuss in the full guide.

Researchers typically think of income annuities as an efficient vehicle for retirement income. In fact, we have found in our prior research that a partial allocation to an income annuity can improve retirement outcomes when it is used as a bond substitute. This is because they mitigate against market risk (the risk that a retiree’s investments lose money) and longevity risk (the risk that a retiree outlives his or her savings).

That said, the key trade-off with an income annuity is that they require the purchaser to “annuitize,” or give up access to their insurance premium, in exchange for the guaranteed payments. And because the income annuity payments are set, their value erodes over time due to inflation.

Thus, it is important to keep the majority of the portfolio in more-traditional investments that 1) can potentially mitigate against inflation risk and 2) can be tapped when needed.

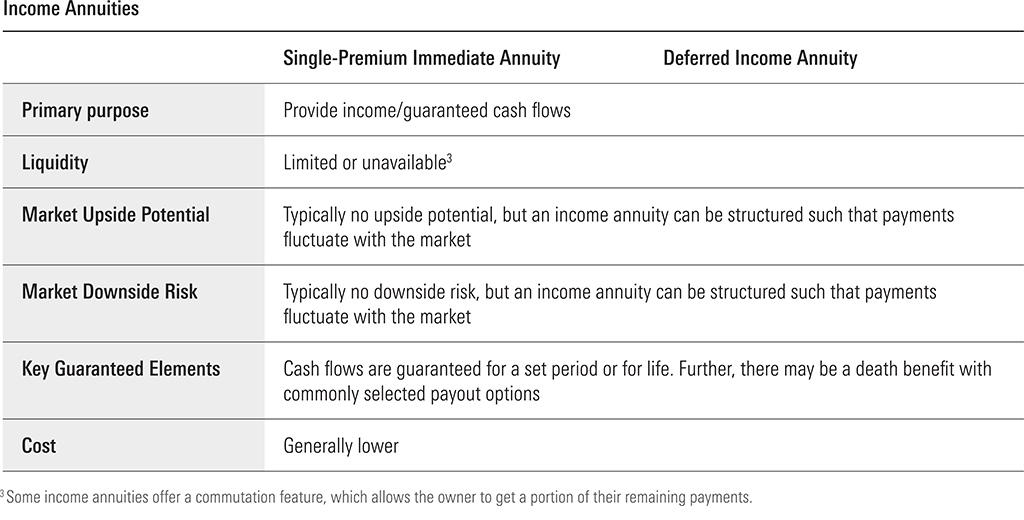

The table below summarizes income annuities.

Income Annuity Features

What Are Savings Annuities?

At their core, savings annuities are an accumulation-focused vehicle with an account balance that provides tax-deferred growth. The owner can convert their account balance into a stream of cash flows in the future, which is tantamount to using the account balance to buy a SPIA. But in practice, very few people do this.

Unlike with income annuities, the owner can access their account balance within a savings annuity. However, owners should be aware of surrender charges, which is a fee that is assessed if the owner withdraws more than the “free partial withdrawal” amount (typically 10% of the balance). Surrender charges typically decrease (as a percentage) over time. There can also be a market value adjustment, which can increase or decrease the amount that the owner gets upon a withdrawal.

Savings annuities also pay out the account balance (net of surrender charges and market value adjustments) to any beneficiaries upon death.

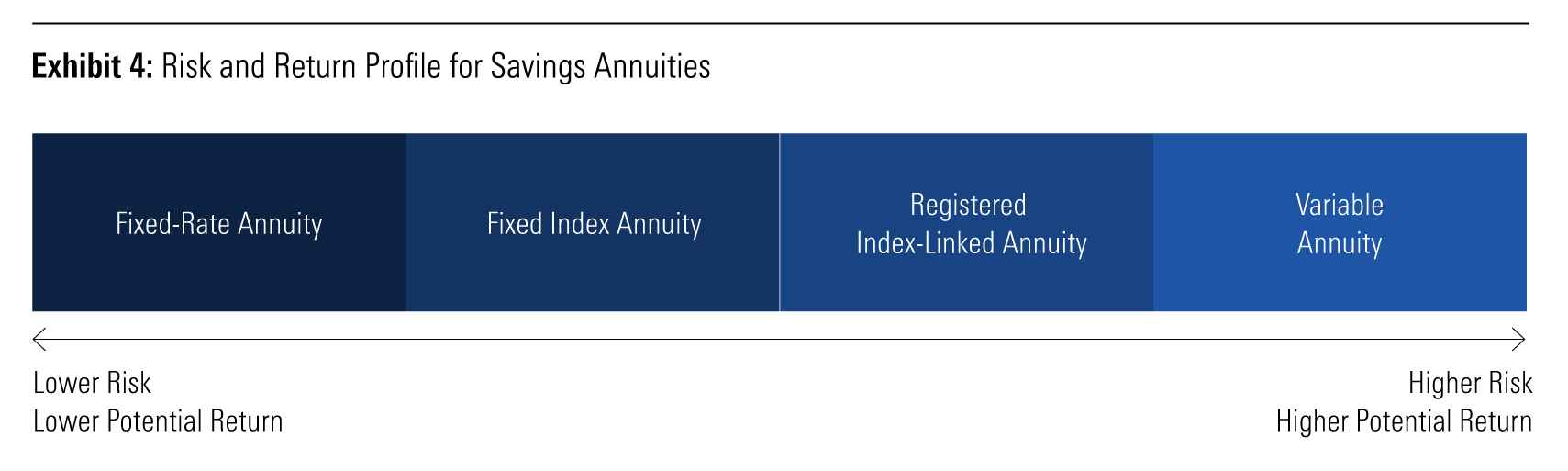

There are four types of savings annuities: 1) fixed-rate annuities, 2) fixed index annuities, 3) variable annuities, and 4) registered index-linked annuities. I like to differentiate among them by comparing their risk and return profiles, which are illustrated below.

Risk and Return Profiles for Savings Annuities

- With fixed-rate annuities, the insurer declares a rate of return on the account balance upfront. Typically, the rate of return is guaranteed for multiple years. This type of annuity has lower risk, as the principal value does not fluctuate with the market. The closest comparison to a fixed-rate annuity is a certificate of deposit, but fixed-rate annuities can also serve as a substitute for bonds in an investor’s portfolio.

- Fixed index annuities are a type of annuity where the rate of return is based on the movement in a market index. (Most insurers offer standard stock indexes, such as the S&P 500, but exotic indexes are increasingly common.) There are a variety of methods that insurers offer to credit interest. One common approach is to cap the returns on the underlying index. Another common approach is to provide a “participation rate,” which represents the percentage of the index return that the annuity owner actually gets. Fixed index annuities have more risk (and upside potential) than fixed-rate annuities, but risk is still limited as the balance will not decrease due to index performance.

- Variable annuities are a registered security where the account balance fluctuates with the underlying investments. Unlike fixed-rate and fixed index annuities, there is no principal guarantee. But variable annuities offer more upside potential. Owners of a variable annuity can choose how their money is invested, with many insurers offering a variety of stock, bond, and money market funds (called subaccounts). Unlike the other products discussed so far, variable annuities have explicit fees. There are fees for both the annuity itself and for the underlying subaccounts.

- Registered indexed-linked annuities are a cross between a fixed index annuity and a variable annuity. They are, as the name implies, a registered security, and just like with a variable annuity, there is no principal guarantee. However, unlike a variable annuity, the owner does not allocate the premium to specific subaccounts. Rather, the owner selects an index, and the rate of return is based on the movement in said index, like with a fixed-index annuity. Intuitively, registered-indexed linked annuities fall in between fixed index annuities and variable annuities in the risk/return spectrum.

Savings annuities are sometimes sold with a rider, which is a feature that provides some type of additional guarantee. Riders typically have an explicit fee that is assessed on an annual basis. The most common rider is a guaranteed lifetime withdrawal benefit, which provides the owner with cash flows for life while allowing them to maintain access to the balance in the product. I will expand upon this type of rider in a future article, but interested readers can find details in the guide.

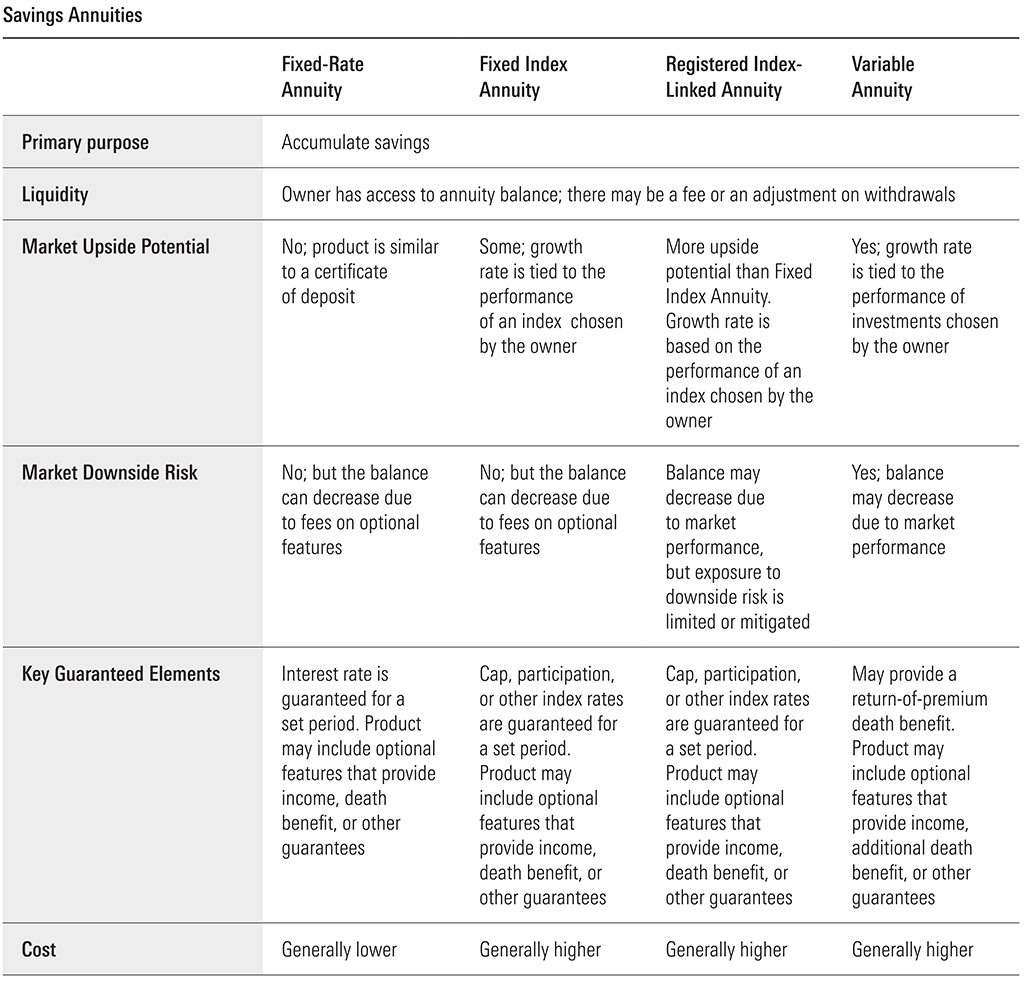

The below table compares the different types of savings annuities.

Savings Annuities

Due Diligence With Annuities

Our guide can serve as a starting point for those interested in annuities. Still, with the variety of products in the market, prospective buyers should get unbiased, individualized advice and carefully review the contract details before making the purchase.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/478a471a-aa07-4241-afd4-40cf325f3951.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/YBH7V3XCWJ3PA4VSXNZPYW2BTY.png)

/d10o6nnig0wrdw.cloudfront.net/04-24-2024/t_a8760b3ac02f4548998bbc4870d54393_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/O26WRUD25T72CBHU6ONJ676P24.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/478a471a-aa07-4241-afd4-40cf325f3951.jpg)