Forget Value vs. Growth--Size Drove Returns in 2021

Six charts showing how market cap drove returns.

When it comes to stock market performance in 2021, for the first time in years, it wasn’t value versus growth that shaped returns--it was big-company stocks versus small.

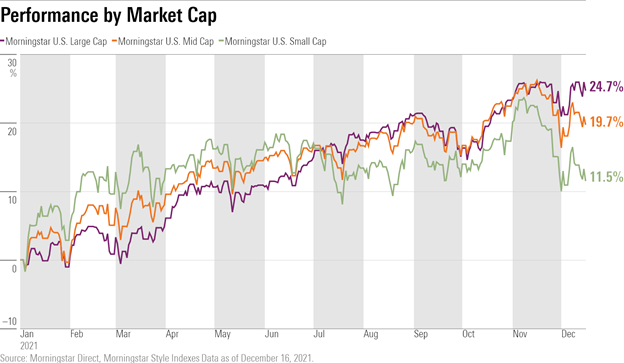

The largest U.S. companies are outperforming their small-cap counterparts in 2021 by 13 percentage points, the widest gap since 2010. Mid-cap stocks are closing out the year in between. But it may be that from an investment opportunity standpoint, small-company stocks now have the advantage.

Notably, that lead among the largest companies comes after small-company stocks had far outperformed during the first five months of the year.

“This was a year of two modes” says Hari Ramanan, chief investment officer of research funds at Neuberger Berman.

Small-cap companies started the year strong amid optimism about the economy, the reopening of businesses and institutions throughout the world, and the wide availability of coronavirus vaccines.

At the same time, major central banks were committed to keeping interest rates low to support the recovery.

This backdrop encouraged investors to gravitate toward stocks with riskier profiles, such as small-company stocks that are more exposed to the U.S. economy, often called a “risk-on” stance in Wall Street lingo. As of June 1, the Morningstar U.S. Small Cap index was up 17%, beating the mid-cap index’s returns of 15%, and large-cap index’s 11%.

During the second half of the year, however, the dynamic flipped. Supply chain troubles created disruptions in the economy and inflation pressures began to build. Then came the delta variant, and in recent weeks the omicron variant spread worries. At the same time, the Federal Reserve signaled it would be pulling back on its support for the economy to focus on battling inflation.

That led investors toward a more “risk-off” stance, favoring larger and less volatile stocks such as tech giants Microsoft MSFT, Apple AAPL, and NVIDIA NVDA. Since June 1, the Morningstar U.S. Large Cap index is up 12.4%, mid-cap stocks are up 4.6%, but small-caps are down 3.9%. Overall, the Morningstar U.S. Market index is up 23% in 2021.

“In the first half of the year, where small-caps outperformed, the market saw ‘risk-on’ behavior,” says Ramanan. “And in the second half of the year, investor sentiment broadly switched to ‘risk-off’ behavior.”

“Mega-sized tech stocks behave as bond proxies,” explains Ramanan. “Investors concentrate in the largest companies, seeking safe haven.”

The Morningstar U.S. Large Cap index is currently up 25.9%, the highest it has reached since 2019.

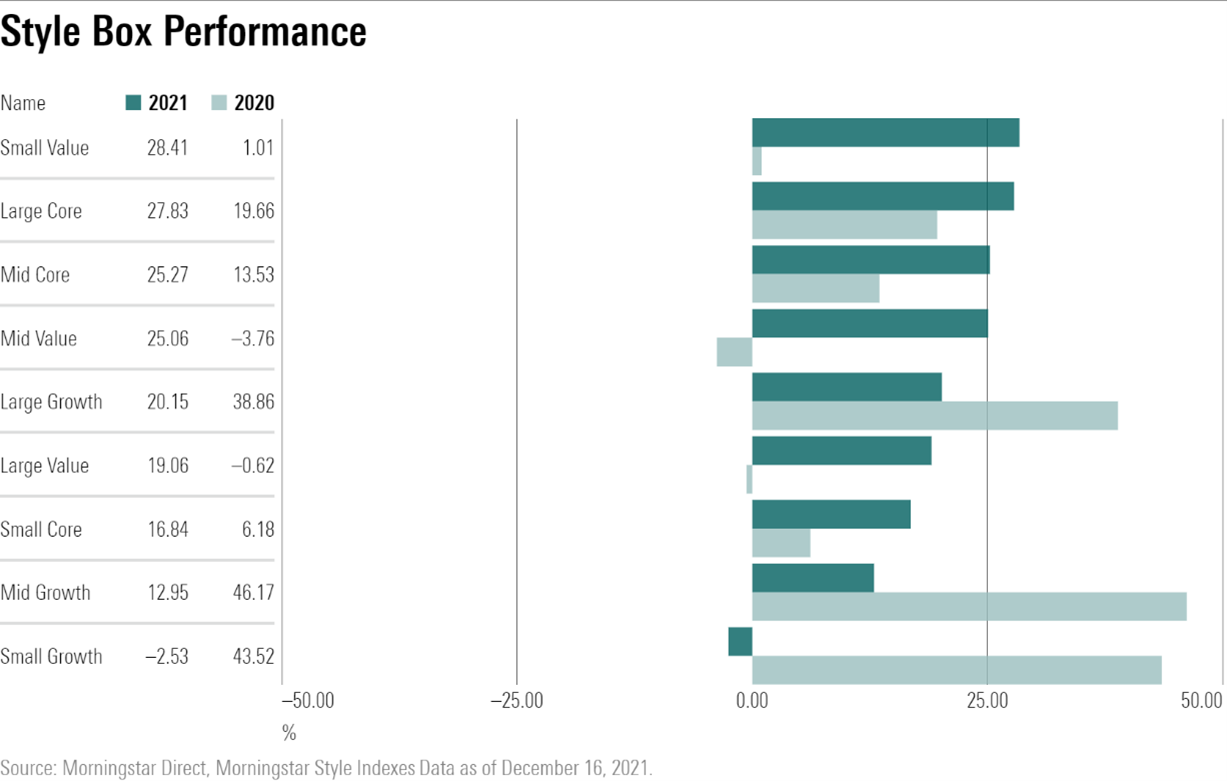

This marks a change from last year, when the value-growth performance differential drove the market narrative. In 2020, all the biggest gains in the market came from high-growth companies. The Morningstar Small- and Mid-Growth indexes came in neck and neck, each reaching returns of over 40%. And the Morningstar U.S. Large Growth index wasn’t far behind, ending the year up 39%.

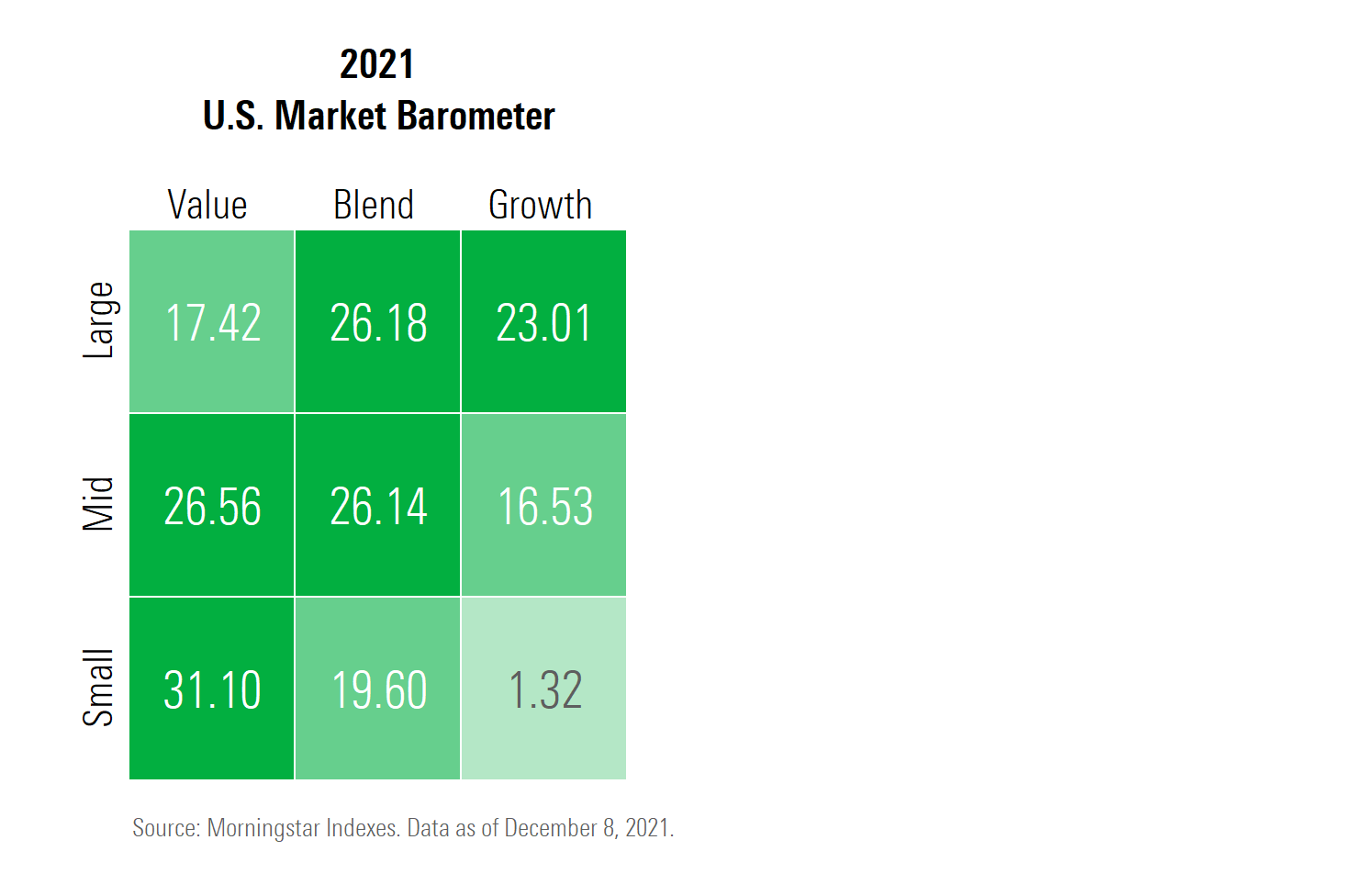

This year, it’s much more about size. Large growth and large blend were the leaders for the Morningstar U.S. Market index as of December 15, each contributing 8.5 percentage points to the total 24% market return.

“We are seeing two main reasons that large-caps are outperforming this year,” explains David Sekera, chief U.S. markets strategist at Morningstar.

One reason is that the large-cap portion of the market has a higher percentage of stocks in the technology and communications sectors than mid-cap and small-cap categories, “two sectors that have benefited from the work-from-home or hybrid arrangements,” Sekera says. In addition, “The large-cap category has a high percentage of stocks that benefited from the shift in consumer spending to goods from services.” Other notable large-caps had their own storylines, such as Tesla TSLA, with the growing interest in electric vehicles, and Pfizer PFE and Moderna MRNA, which benefited from the need to continue battling COVID-19.

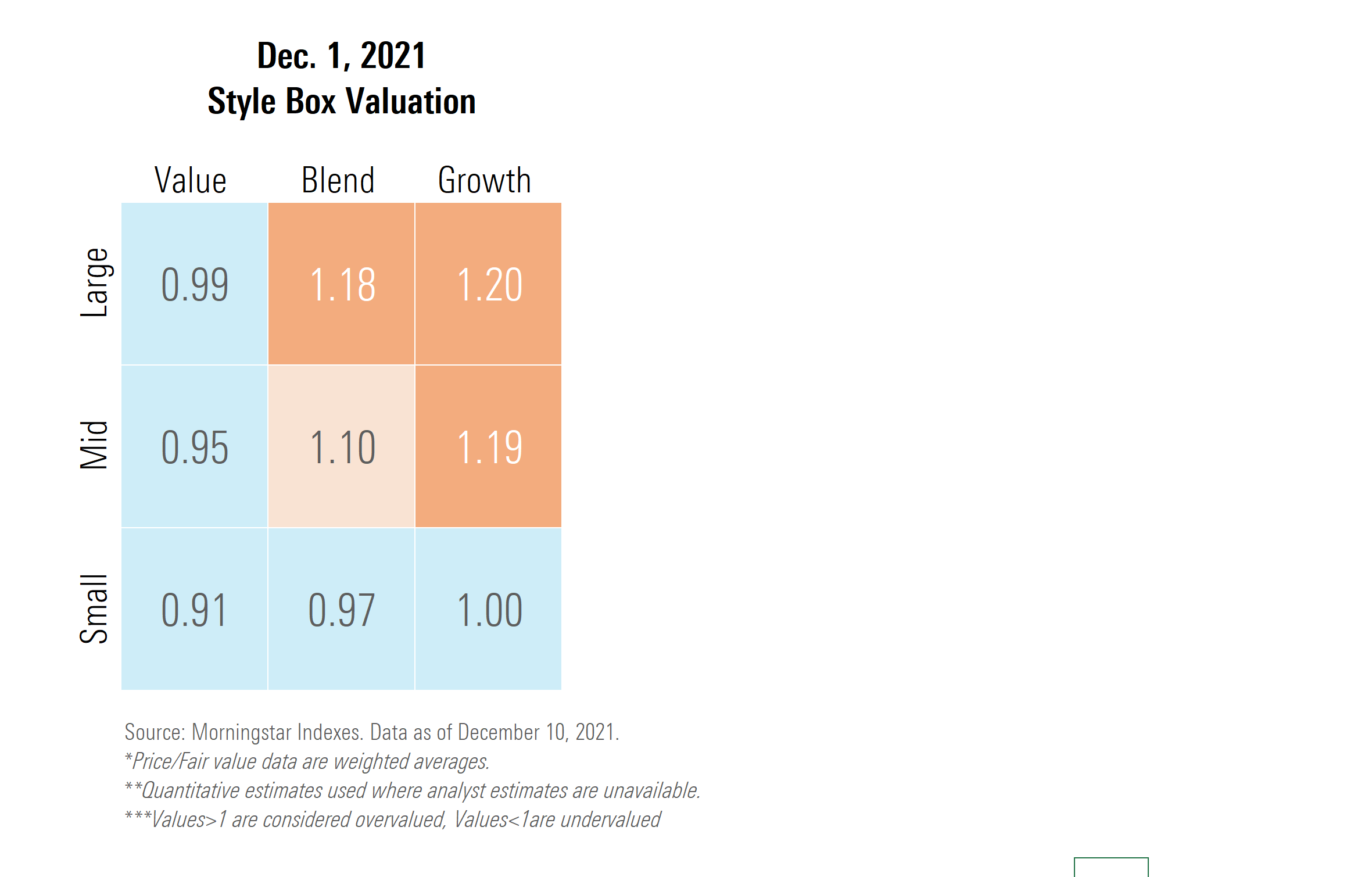

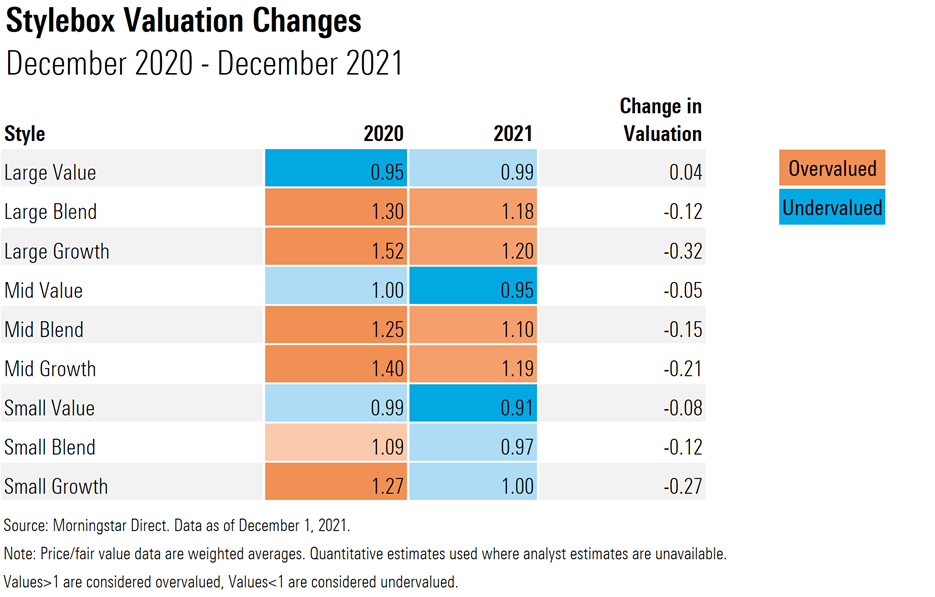

From a valuation perspective, the small-cap portion of the market and the value side are trading at or slightly under their fair value estimates. Small value is the least expensive segment as a group, currently trading at 91% of its Morningstar fair value estimate.

Large-growth and large-blend companies look the most overvalued as a group, trading at approximately 20% above their average fair values.

“The opportunity today is actually back on the ‘risk on’ side,” says Ramanan. “There’s a reasonable opportunity in both growth and value names below the mega-cap companies.”

This year’s market is more fairly valued overall than 2020’s market, however. Every section of the Morningstar Style Box, save for large value, has shifted closer into fairly valued or undervalued territory. Only the Morningstar Large Value index has inched upward 4 basis points, to 99%--almost exactly equal to its portfolio-level fair value estimate.

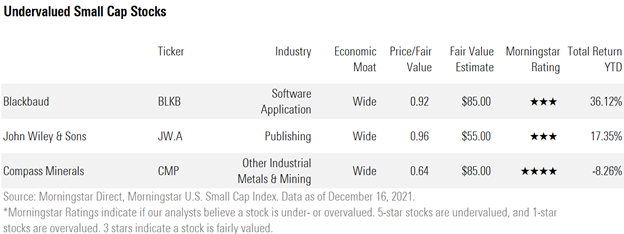

Here are three undervalued holdings from the Morningstar U.S. Small Cap index that fall under our analysts' coverage. All three earned wide Morningstar Economic Moat designations from our analysts, which means they are likely to sustain competitive advantages for at least the next 20 years.

Blackbaud BLKB

“We believe Blackbaud is deeply entrenched in the social-good community and expect its leadership to continue to drive the space forward over the long term as it transitions to a subscription model. Such transitions tend to pressure near-term results, but we think the worst is behind the company and that results should naturally improve over the next couple of years. We also see the company as among the most negatively affected from the pandemic within our software coverage, so as the world returns to normal, Blackbaud is benefiting.”

--Dan Romanoff, senior equity analyst

John Wiley & Sons JW.A

“While Wiley has been affected by a softer U.S. student enrollment environment and normalizing demand for online content and courseware, we believe the company remains well positioned for the continued rise of digital education. We continue to see opportunity in its online program management business, which should expand as university clients increasingly look to optimize the student experience while controlling costs as virtual and hybrid degree programs proliferate. We also believe Wiley has considerable opportunity on the corporate front, particularly as clients attempt to close skill gaps in a difficult hiring environment.

Although investment in the business’ growth will impede segment margins, we are encouraged by the 67% constant currency revenue growth Wiley saw in its talent development services unit, as the business allows it to leverage its content and client relationships.”

--Zain Akbari, equity analyst

Compass Minerals CMP

“Compass Minerals holds an enviable portfolio of cost-advantaged assets. Its Goderich rock salt mine in Ontario benefits from unique geology, and with access to a deep-water port, it can deliver deicing salt to customers at a lower cost than competitors. Additionally, the company controls one of only three naturally occurring brine sources that produces the specialty fertilizer sulfate of potash, or SOP. These operations at the Great Salt Lake in Utah can produce SOP at a significantly lower cost than producers that use a chemical process.

At current prices, we view Compass' shares as undervalued, with the stock trading nearly 35% below our fair value estimate. While the stock is no longer appropriate for dividend investors, we continue to see long-term profit growth for Compass. However, we reiterate our very high uncertainty rating as variable winter weather can cause profits to fluctuate widely from year to year. Further, with lower 2022 profits, we recommend Compass shares for long-term investors who can withstand some near-term volatility.”

--Seth Goldstein, senior equity analyst

/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/MFL6LHZXFVFYFOAVQBMECBG6RM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HCVXKY35QNVZ4AHAWI2N4JWONA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EGA35LGTJFBVTDK3OCMQCHW7XQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)