The Best Allocation Model Portfolios for 2024

Eight multi-asset model portfolio series earn Morningstar Medalist Ratings of Gold.

Model portfolios continue to gain traction with financial advisors. Approximately $424 billion follows model portfolios as of June 2023, a 48% increase from $286 billion two years prior[1].

With this rise in popularity and no barriers to launching new paper models, asset managers have flooded the marketplace with options. Since Morningstar launched its model portfolio database in 2019, over 2,500 U.S. models have been reported.

Model portfolios are an investment blueprint delivered by asset managers or investment strategists. Most models are designed to serve as the core of an investor’s portfolio and hold exposures to both stocks and bonds. Of the U.S. models reported to Morningstar, 77% fall into an allocation category, with many coming as a series that includes multiple portfolios, each targeting a specific level of risk.

Our recently published 2023 U.S. Model Portfolio Landscape dives into the drivers behind the industry’s asset growth and makeup, product development trends, and areas of increased emphasis for the future, like customization. Morningstar Direct and Office clients can download the full report here.

The proliferation of similar target-risk models can make it hard for advisors to sort through the myriad choices available to them. Morningstar Medalist Ratings for model portfolios can provide a useful starting point for navigating the options advisors have available.

Ratings Roundup: Our Top Analyst Picks for Model Portfolios

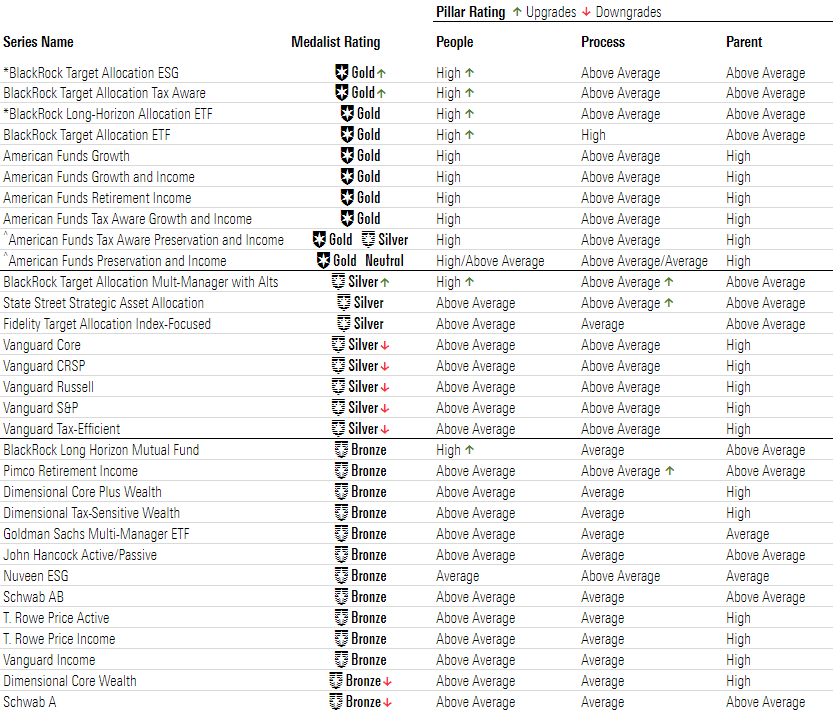

The table below highlights Morningstar Medalist Ratings for allocation model portfolio series with 100% analyst coverage, as of January 2024.

It also highlights how the Medalist Rating, People Pillar, Process Pillar, and Parent Pillar changed over 2023.

Morningstar's Top Rated Allocation Model Portfolio Series – 100% Analyst Covered

BlackRock and American Funds Top the Charts

Eight allocation model series earn the coveted Gold rating across all portfolios, four run by BlackRock and four by American Funds.

BlackRock’s high-caliber model portfolio investment team, led by Michael Gates, earned a People Pillar upgrade to High in 2023. The pillar change drove a Medalist Rating upgrade to Gold for the Target Allocation ESG and Target Allocation Tax Aware series, matching the ratings held by the Long-Horizon Allocation ETF and Target Allocation ETF series.

The team guides the firm’s model portfolio efforts and has demonstrated a commitment to challenging and enhancing its research-intensive process, resulting in prudent enhancements across its model series. It also benefits from the firm’s broader resources and the overlapping research agenda with BlackRock’s talented target-date team that covers strategic asset allocation and portfolio construction. Those additional resources allow the model portfolio team to more deeply research portfolio construction topics.

American Funds’ Growth, Growth and Income, Retirement Income, and Tax Aware Growth and Income series each earn a Gold Medalist Rating across all their portfolios. The firm’s experienced and well-resourced multi-asset team guides these offerings—a group that quickly strengthened following a revamp in 2020. The seven-person portfolio solutions committee, all portfolio managers with at least 25 years of industry experience, oversees the series, while the 12-person capital solutions group provides research and allocation support. American Funds’ model portfolios also feature a stellar lineup of underlying managers, and most earn Medalist Ratings of Bronze or better.

The American Funds’ models stand out for their objectives-based approach that’s grounded in investor research. Unlike many peers that allocate to a specific level of risk, the managers here allocate to the different roles equity and fixed income play in a portfolio, such as “growth” (growth stocks) and “income” (bonds). The group’s optimization model takes these portfolio objectives and produces a recommended allocation with exposures to American Funds strategies.

3 Model Series See Process Upgrades to Above Average

These three series’ thoughtful asset-allocation approaches and sound execution drove Process Pillar upgrades.

- State Street’s Strategic Asset Allocation series features a robust quantitative framework that’s been seamlessly integrated into thoughtful portfolio construction. The strategic asset-allocation process may appear standard with the typical four steps (risk and return forecasting, optimization, qualitative review, and implementation), but it is implemented efficiently and consistently, elevating it a cut above peers.

- BlackRock’s Target Allocation Multi-Manager with Alternatives portfolios earn a Silver rating. It includes an allocation to liquid alternatives as fixed-income substitutes, which sets this series apart from the firm’s other model offerings. A research-intensive approach guides the thoughtful portfolio construction and sensible mix of liquid alternatives, third-party actively managed strategies, and in-house funds and exchange-traded funds, driving the Process Pillar upgrade. The series’ use of liquid alternatives does drive up fees, however, resulting in its lower rating relative to the firm’s other offerings.

- Pimco Retirement Income series, which holds a Bronze rating, is designed to help investors in retirement navigate the difficult task of replacing their paycheck in retirement. The three versions of the series (conservative, balanced, and moderate growth) offer varying levels of income but do a good job of balancing that without taking on excess volatility, as many income-oriented models often fail to do. Sharp lead manager Erin Browne builds these models using Pimco’s fixed-income funds and low-cost passive ETFs from Vanguard. It’s a potent pairing.

Which Model Series Saw Ratings Downgrades?

Seven model portfolio series, including five Vanguard series, Schwab A, and Dimensional Core Wealth, saw a Medalist Rating downgrade without a pillar rating change. Higher conviction in other series pushed these down a notch.

However, each series remains appealing, earning a Silver or Bronze Medalist Rating.

Morningstar Expands Model Portfolio Coverage

The fast-paced growth of the model portfolio universe in recent years made assessing the expansive universe increasingly difficult. To help advisors, we expanded the Morningstar Medalist Rating for model portfolios to include quantitatively driven assessments in November 2022 (formerly known as the Morningstar Quantitative Rating).

The move more than tripled the number of model portfolios receiving a forward-looking Morningstar Medalist Rating at the time. Currently, over 1,700 U.S. model portfolios receive Medalist Ratings, or about 62% of those reported to Morningstar.

[1] Asset figures are based on both surveyed data and figures reported to Morningstar. These conservative estimates only account for assets where model providers maintain clear visibility.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/a3ffb7d7-3689-49a2-bfde-9235ef1e06ad.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/MNPB4CP64NCNLA3MTELE3ISLRY.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/SIEYCNPDTNDRTJFNF6DJZ32HOI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZHTKX3QAYCHPXKWRA6SEOUGCK4.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/a3ffb7d7-3689-49a2-bfde-9235ef1e06ad.jpg)