Morningstar 529 Ratings: The Top Plans and What They Offer

Michigan Education Savings and Utah’s my529 remain at the top; Vanguard age-based plans get a Process downgrade.

Morningstar’s team of manager research analysts annually assigns forward-looking, qualitative ratings to a subset of the 529 college savings plan universe based on our assessment of each plan’s investment merits relative to its peers.

Just as 529 education savings assets hit $386 billion in August 2022, our analysts began reviewing 54 plans that represented 93% of those assets.

Using a 529 college savings plan when saving for future education expenses can be an attractive option, as investments in the plan grow tax-free. You can learn more about 529 college savings plans and how to start saving in our 529 guide.

Movers and Shakers in Our 529 Ratings

At the overall plan level, 529 ratings moves were modest—two downgrades and six upgrades—with a few notable themes across the underlying pillars. Vanguard-managed plans that employ an age-based structure experienced Process rating downgrades to Average, as these offerings now feature less attractive traits, such as an aggressive track that has above average duration risk in and near enrollment, and conservative and moderate tracks that derisk relatively early, meaning investors are less likely to keep pace with the rising costs of higher education. Stewardship standards for each state, as reflected in the Parent rating, continue to rise, with elements such as evidence of robust interaction between the state and its investment entity set as a baseline; two states were upgraded and two downgraded within this context. And in good news for 529 investors, fees continue to inch downward. The average fee as of our 2022 review fell to 0.45% from 0.48% in 2021 (prior to 2022, the average fee was calculated across only plans under coverage, but the average fee calculation now includes all 529 plans, regardless of coverage, and provides a more representative context for industry trends). Many plans continue to employ index funds and exchange-traded funds, when possible, improving cost efficiency for investors.

In 2022, 34 plans received a recommended rating in the form of Gold, Silver, or Bronze. Morningstar Medalist plans offer investment options that should outperform and exhibit some combination of the following attractive features:

- A well-researched asset-allocation approach

- A robust process for selecting underlying investments

- A well-resourced and experienced investment team

- Strong, stable, and engaged oversight from the state

- Low fees

Investors in these medalist 529 plans should be well-positioned for the future.

The remaining 20 plans with Morningstar Analyst Ratings are Neutral or Negative and are dominated by advisor-sold plans, whose high fees detract from their overall ratings. Of the 16 Neutral-rated plans, 11 are advisor-sold, six of which carry Above Average Process ratings, indicating these plans offer well-designed investment options. The compounding impact of high fees, however, can hinder performance and the total amount saved over the long term. Negative-rated plans may exhibit a subpar asset-allocation approach, an unattractive lineup of underlying funds, and/or high fees that reduce the odds of investor success.

Many states offer income tax benefits to 529 participants who invest in their home state’s plan, but these benefits vary widely. Some are generous, offering tax credits on low contributions. For other states, the tax benefit is dependent on the contributors’ marginal state income tax rate and state deduction limits. Morningstar does not factor state tax benefits into its ratings, but 529 plan participants can consider the potential tax benefits of investing in their state’s plan, along with our ratings, as part of their decision-making process.

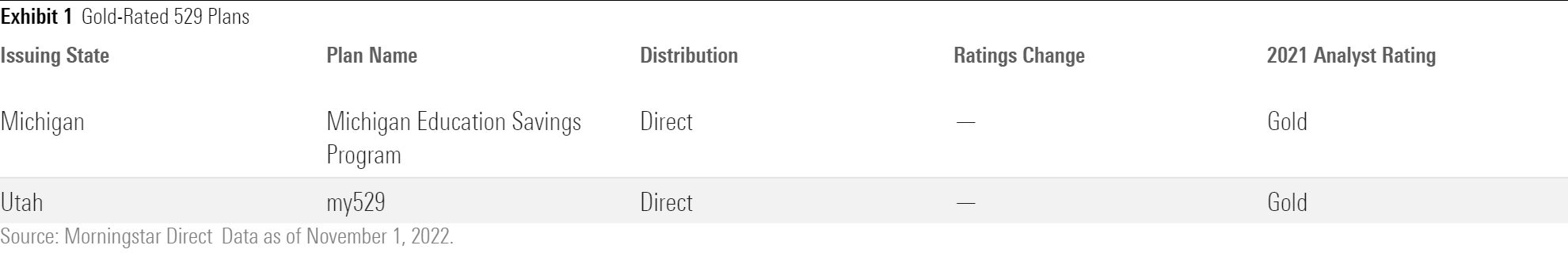

Gold 529 Ratings: Industry Standard Setters

In 2022, two plans merit Analyst Ratings of Gold. The excellent stewardship of the state Parents of the Michigan Education Savings Program and Utah’s my529 result in well-designed, low-cost offerings.

In 2020, the Michigan plan moved to a target enrollment structure, in which participants see a gradual shift to bonds from stocks; this mitigates the risk that comes with equity step-downs during volatile markets (age-based series make larger, more infrequent step-downs). To plan this transition, the treasurer’s office worked closely with its investment manager TIAA-CREF to design the glide path to benefit the average beneficiary in this plan, who typically starts saving at around 5 years old. At the same time, the state pushed for improvements in the underlying lineup and now the plan features highly rated Vanguard, iShares, Schwab, and TIAA-CREF funds. This move also resulted in lower fees for the series, and the plan continues to be among the cheapest in the industry.

Utah’s my529 plan is the only plan that has received a Gold medal every year since we debuted our ratings in 2012. Utah moved from an age-based to a target enrollment structure in 2021, and it incorporated insights from participant data and asset-allocation research into this new glide-path design, benefiting set-it-and-forget-it savers. The plan also continues to offer its unique, custom age-based portfolios that allow investors to build their own glide paths using Vanguard and DFA funds. State oversight continues to be topnotch. Instead of hiring an investment manager for the plan, the state employs its own well-resourced and experienced investment team and draws upon a network of experts, including its board, an investment advisory committee comprising institutional investors and advisors, and consultants.

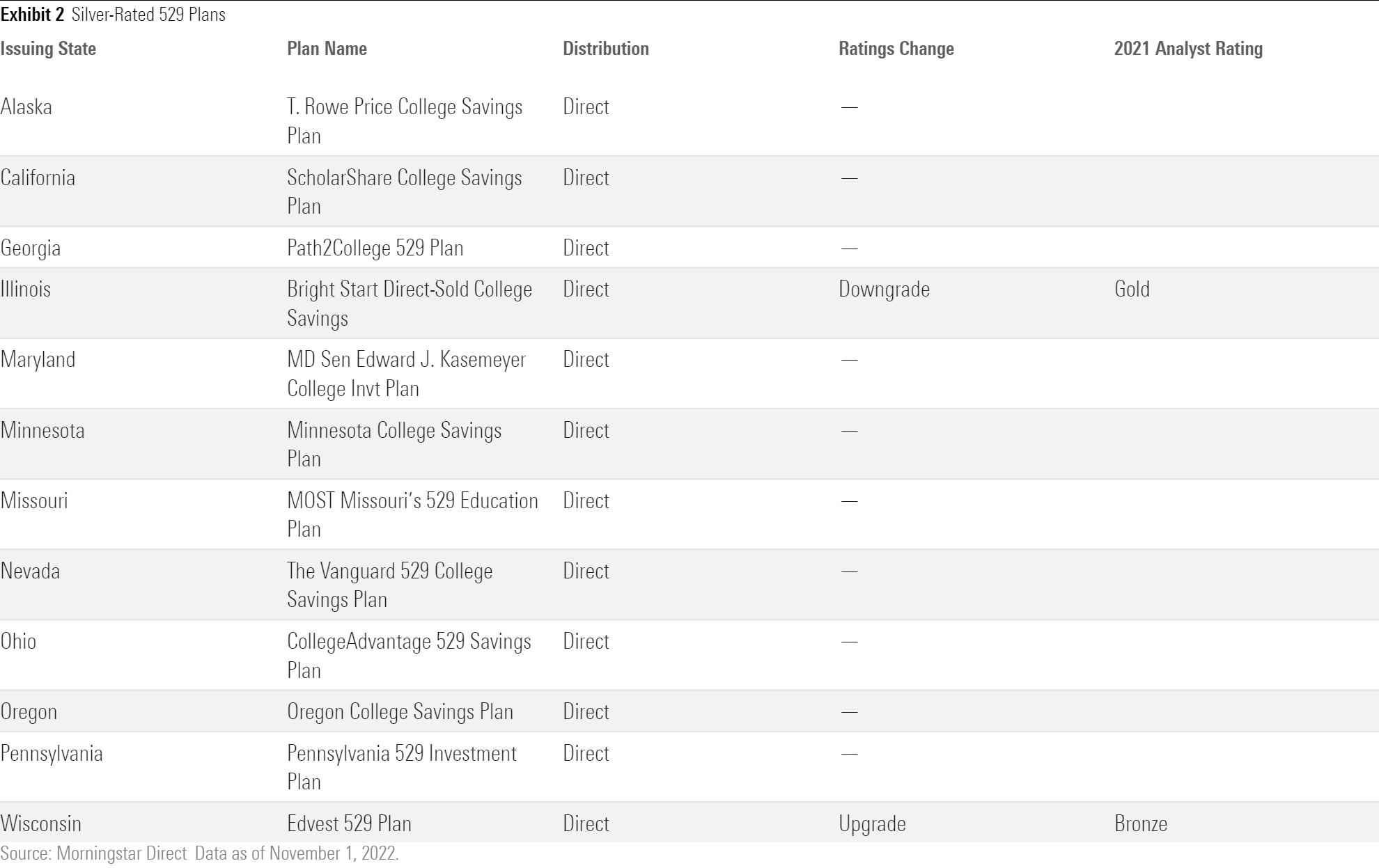

Silver 529 Ratings: Standard Carriers

Almost all of the Silver-rated plans have an Above Average or High rating for both People and Process. This indicates that a highly regarded investment team employs a rigorous process regarding glide-path design, asset allocation, manager selection, and risk management to create an offering that is suitable for 529 beneficiaries.

There are two new Silver-rated plans this year. Illinois’ Bright Start Direct-Sold College Savings was downgraded to Silver from Gold because of recent turnover in the state treasurer’s office, and the Wisconsin Edvest 529 Plan was upgraded to Silver from Bronze following improvements to the target enrollment lineup and fee cuts.

Bright Start’s partnership between the Illinois treasurer office’s investment professionals and investment advisor Wilshire has long been a source of strength. The state actively manages its age-based series with regular small adjustments to the underlying fund lineup. One ongoing trend is the effort to gradually shift to passive from active funds in more efficient asset classes. In 2021, the state’s director of investment analysis and due diligence was promoted to chief investment officer, and later that year, his sole team member—and replacement—departed. The CIO now works with an interim director (as of August 2022) and a new analyst hired in late 2021 who is new to the industry. These changes lowered the plan’s People rating to Above Average from High and caused an overall downgrade to Silver. Overall, this plan is still a strong option, offering three risk-based tracks, available with either very low-cost index funds or a strong mix of active and passive strategies composed of many Morningstar Medalists.

In May 2022, Wisconsin improved its target enrollment series’ underlying fund lineup, swapping in three highly rated Vanguard funds and removing three actively managed TIAA-CREF funds. This change, along with newly negotiated program manager fee cuts, resulted in a large 30% average fee reduction and a Price Pillar upgrade. Wisconsin’s open-architecture approach has become more like those of the Silver-rated direct-sold plans that TIAA-CREF manages for California, Georgia, and Minnesota. As such, we have upgraded this Wisconsin plan to Silver.

The Vanguard 529 College Savings Plan, Pennsylvania 529 Investment Plan, and Ohio’s CollegeAdvantage 529 Savings Plan also earn Silvers. Vanguard is the investment manager for these plans, all of which have adopted Vanguard’s new target enrollment structure. MOST Missouri’s 529 Education Plan has not adopted the target enrollment structure but retains its Silver rating because of strong state Parent stewardship and recent fee reductions.

Other Silver ratings include plans (offered by Alaska and Maryland) run by a topnotch team at T. Rowe Price. These are favorites among all-active target enrollment series. Silver-rated Oregon College Savings Plan distinguishes itself with a target enrollment series that features a portfolio for every year (most plans offer portfolios every two or three years).

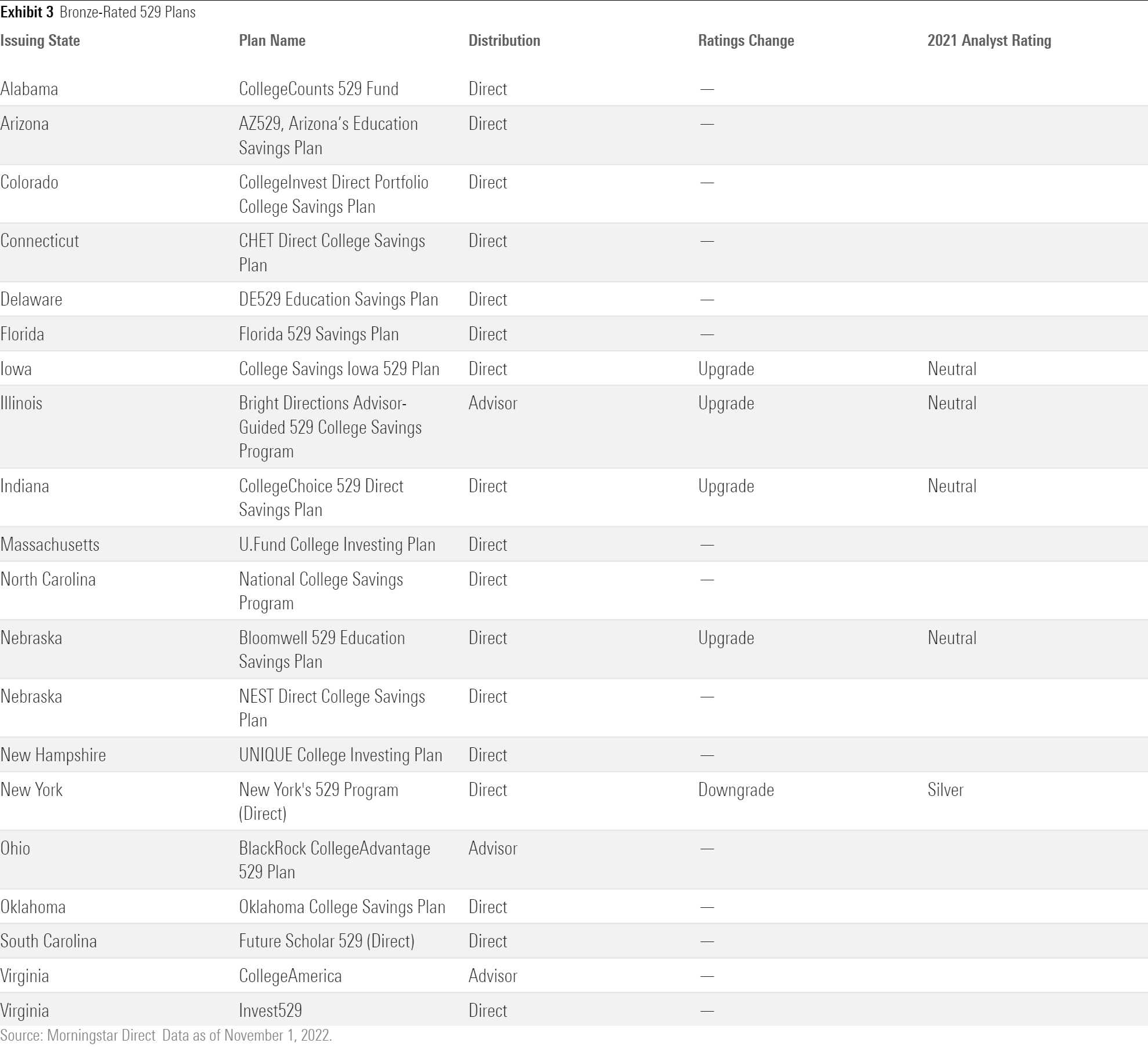

Bronze 529 Ratings: Meeting and Sometimes Exceeding Standards

Bronze-rated plans tend to have a mix of Average to Above Average ratings across the People, Process, Parent, and Price Pillars. They can still help investors meet their goals, but the range of outcomes is wider than those of Silver- or Gold-rated rivals.

Four plans were upgraded to Bronze from Neutral in 2022. Indiana’s CollegeChoice 529 Direct Savings Plan earned a Process upgrade by improving the diversification of its target enrollment series’ by increasing its exposure to non-U.S. stocks to 35% within the equity sleeve (from 25%) and adding a real estate fund. Other improvements included removing a credit-sensitive bond strategy and dropping average fees by 25%.

Fee cuts also elevated College Savings Iowa 529 Plan and Illinois’ Bright Directions Advisor-Guided 529 College Savings Program to Bronze from Neutral. Iowa trimmed its program management fee this year, making it among the industry’s cheapest. Illinois’ Bright Directions’ average fees for its age-based series are the lowest among advisor-sold plans. In November 2022, the plan will launch a lower-cost index-based series, which will further reduce average fees.

Nebraska’s Bloomwell 529 Education Savings Plan earned an upgrade because of increased confidence in its offering, which features two options: a core low-cost index fund track and a socially aware track whose underlying holdings include Morningstar Medalist iShares ESG equity funds and a high-quality bond sleeve.

Vanguard plans that continue to use the age-based structure instead of the newer target enrollment structure all saw Process rating downgrades to Average from Above Average. These include North Carolina’s National College Savings Program, MOST Missouri’s 529 Education Plan, Colorado’s CollegeInvest Direct Portfolio College Savings Plan, and New York’s 529 Program (Direct). North Carolina’s and Colorado’s overall ratings remained Bronze, but New York’s fell to Bronze from Silver and Missouri retained its Silver. Vanguard’s age-based offerings have outdated traits such as above-average duration risk in the aggressive track and overly conservative moderate and conservative tracks that remove equity exposure by 17 and 13 years old, respectively.

Neutral 529 Ratings: Industry Standard

The list of Neutrals remained consistent. It includes many advisor-sold plans whose layers of fees offset their Above Average Process ratings. New Mexico’s Scholar’s Edge has made adjustments that bring it more in line with evolving industry standards, prompting an upgrade of its rating to Neutral from Negative.

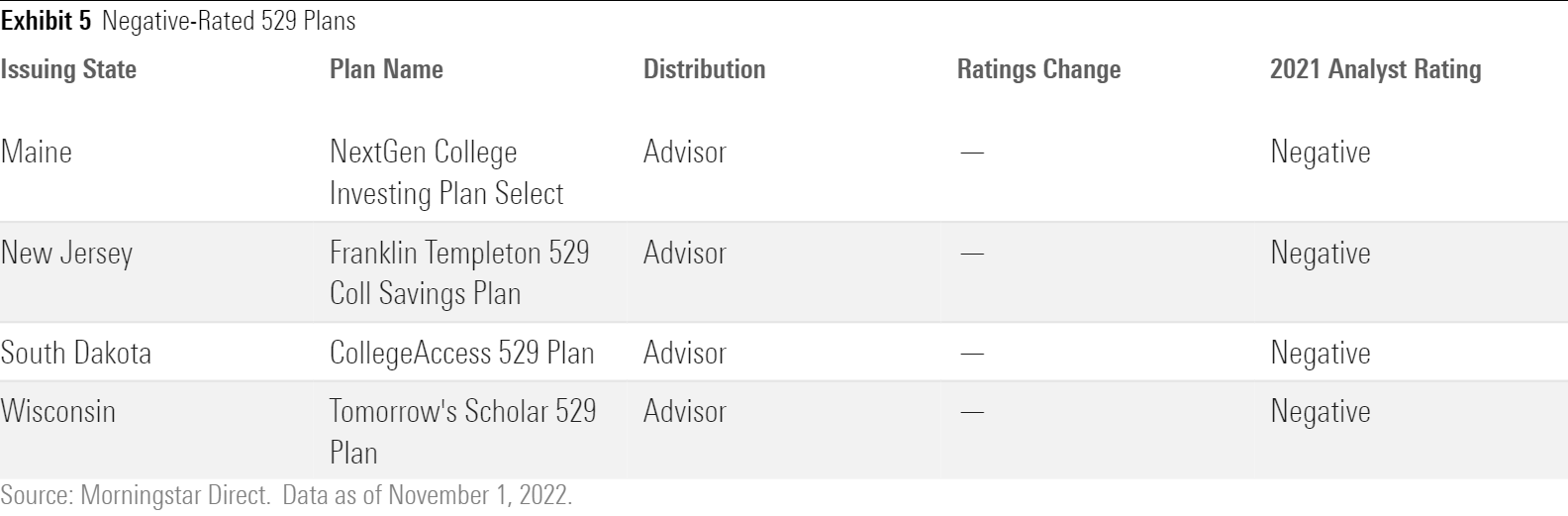

Negative 529 Ratings: Below Standard

Seven plans earned Negative ratings in 2021. Four of them stayed Negative in 2022, New Mexico’s Scholar’s Edge moved to Neutral, and two plans were dropped from coverage: Nevada’s SSgA UPromise 529 Plan and USAA 529 Education Savings Plan.

There were some pillar changes among the Negatives. College Access 529 Plan saw a People downgrade to Below Average, as a new firm with fewer resources took over. Virtus provided a home for three members of the team after the SEC disqualified their previous employer Allianz Global Investors from providing advisory services to U.S.-registered funds effective July 2022. This transition hollowed out the plan’s investment team, as it lost access to Allianz’s 80-person global multi-asset outfit.

For New Jersey, recent improvements to its direct and advisor-sold age-based series’ underlying fund lineups drove a Parent rating upgrade to Below Average from Low. The new fund lineup also features lower cost strategies, improving New Jersey’s Franklin Templeton 529 College Savings Plan’s Price rating to Above Average from High.

Morningstar Analyst Rating Inputs

We began rating 529 education savings plans in 2012. Over that period, these tax-advantaged investment options have gained popularity, as assets climbed from $167 billion to over $386 billion as of August 2022. The 529 industry continues to evolve, and in July 2020, we rolled out an enhanced rating methodology, reflecting our updated views on what an industry-standard plan looks like and what aspects of a plan warrant our highest conviction. We evaluate plans based on four key pillars: Process, People, Parent, and Price. Pillar-level research informs our holistic view of plans and results in the Morningstar Analyst Rating for 529 plans.

The 2022 ratings (54 plans covered) featured a total of eight upgrades or downgrades, compared with 11 in 2021 (62 plans covered) and 27 in 2020 (61 plans covered). The implementation of our enhanced ratings methodology in 2020 sparked an increased number of upgrades and downgrades compared with prior years, but with this rubric well-exercised for a third year running, our forward-looking ratings were within expectations.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/de44b91c-c918-4e53-81c3-ce84542f3d36.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KD4XZLC72BDERAS3VXD6QM5MUY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/BZ4OD6RTORCJHCWPWXAQWZ7RQE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/JNGGL2QVKFA43PRVR44O6RYGEM.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/de44b91c-c918-4e53-81c3-ce84542f3d36.jpg)