How Much Are 529 Plans' Tax Benefits Worth?

The tax benefits of 529 education savings plans, though complicated, are worth knowing.

Morningstar provides ratings on more than five dozen 529 savings plans, which are state-sponsored tax-advantaged vehicles that individuals can use to save and invest for future education expenses. Many states offer income tax incentives for those who use an in-state plan, but investors can also consider out-of-state options. Ultimately, tax benefits from 529 education savings plans depend on many factors, such as annual income and contribution levels, which can be quite different across investors. For this reason, tax benefits aren't an explicit input to Morningstar Analyst Rating for 529 Plans, but it behooves investors to consider their unique tax profiles before selecting an option. This article discusses how those tax benefits work and their potential impact.

Federal Simplicity

At the federal level, the tax benefits are straightforward, though still not uniform. Money invested in 529 plans grows tax-free, and investors do not pay capital gains taxes if they spend that money on qualified education expenses. Say a married couple regularly put money into an investment account over a number of years, and that amount appreciated by $10,000 by the time the beneficiary needed to take withdrawals. In a non-tax-advantaged account, this $10,000 would be reduced by the 15% long-term capital gains tax ($1,500 in this case) for married couples who earn between $83,351 to $517,200 and file jointly in 2022. Families who earned less than $83,351 would not have been liable for taxes on capital gains, and therefore would not have benefited from this federal tax break. Meanwhile, families who make over $517,200 pay long-term capital gains taxes at a rate of 20%.

State Complications

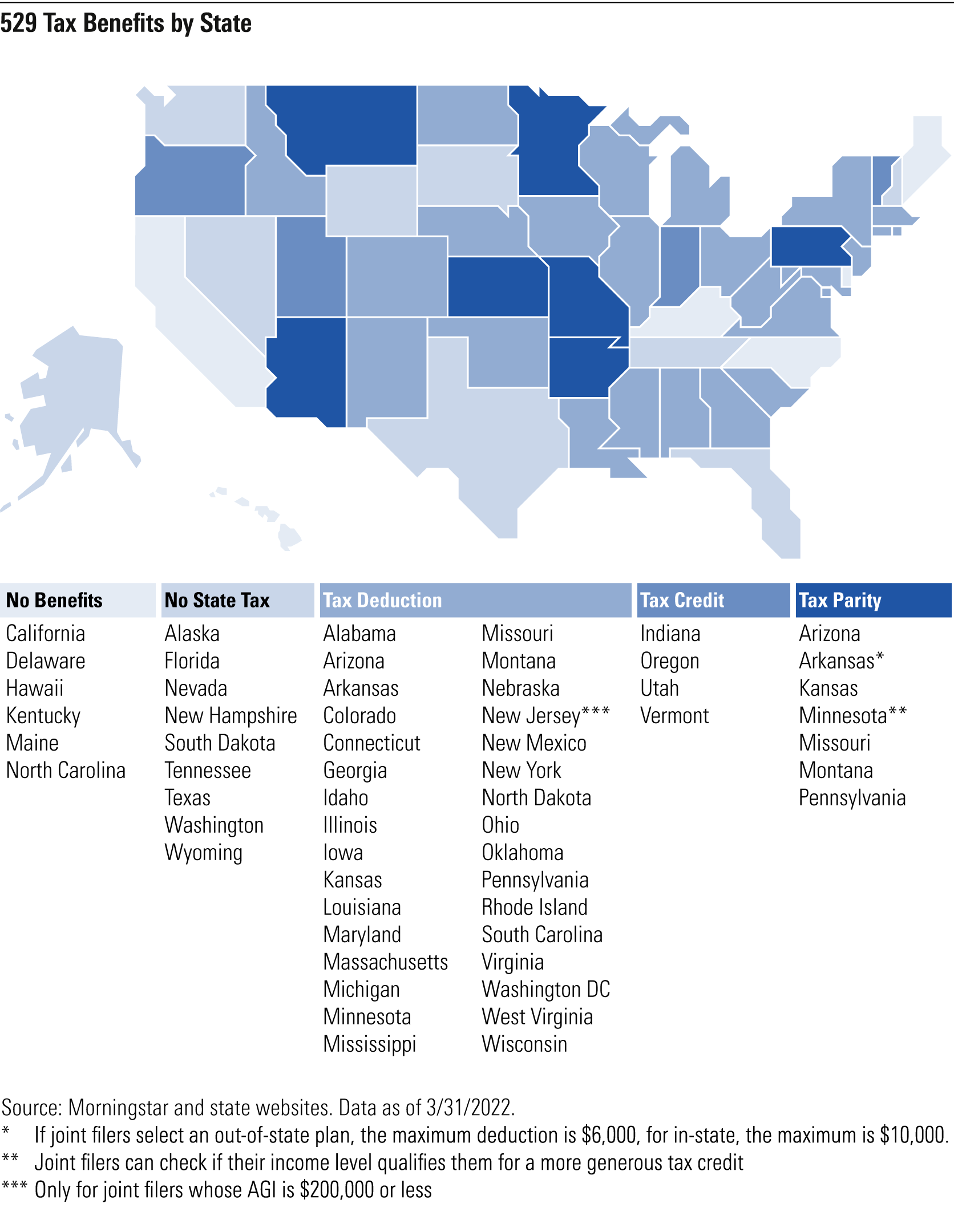

Tax benefits at the state level are more complicated still. The map below depicts states' differing tax benefits.

Where Are 529 Contributions Tax Deductible?

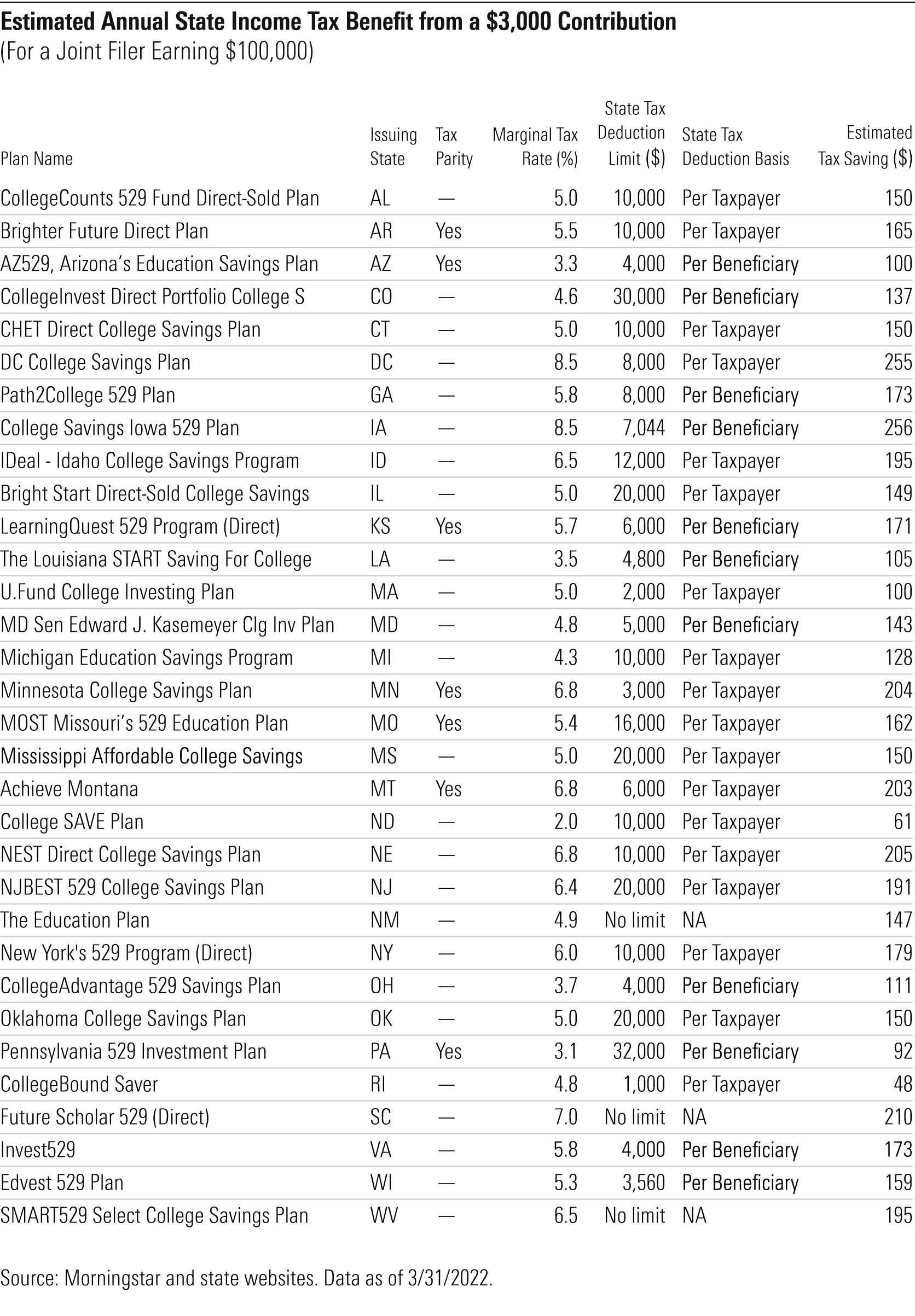

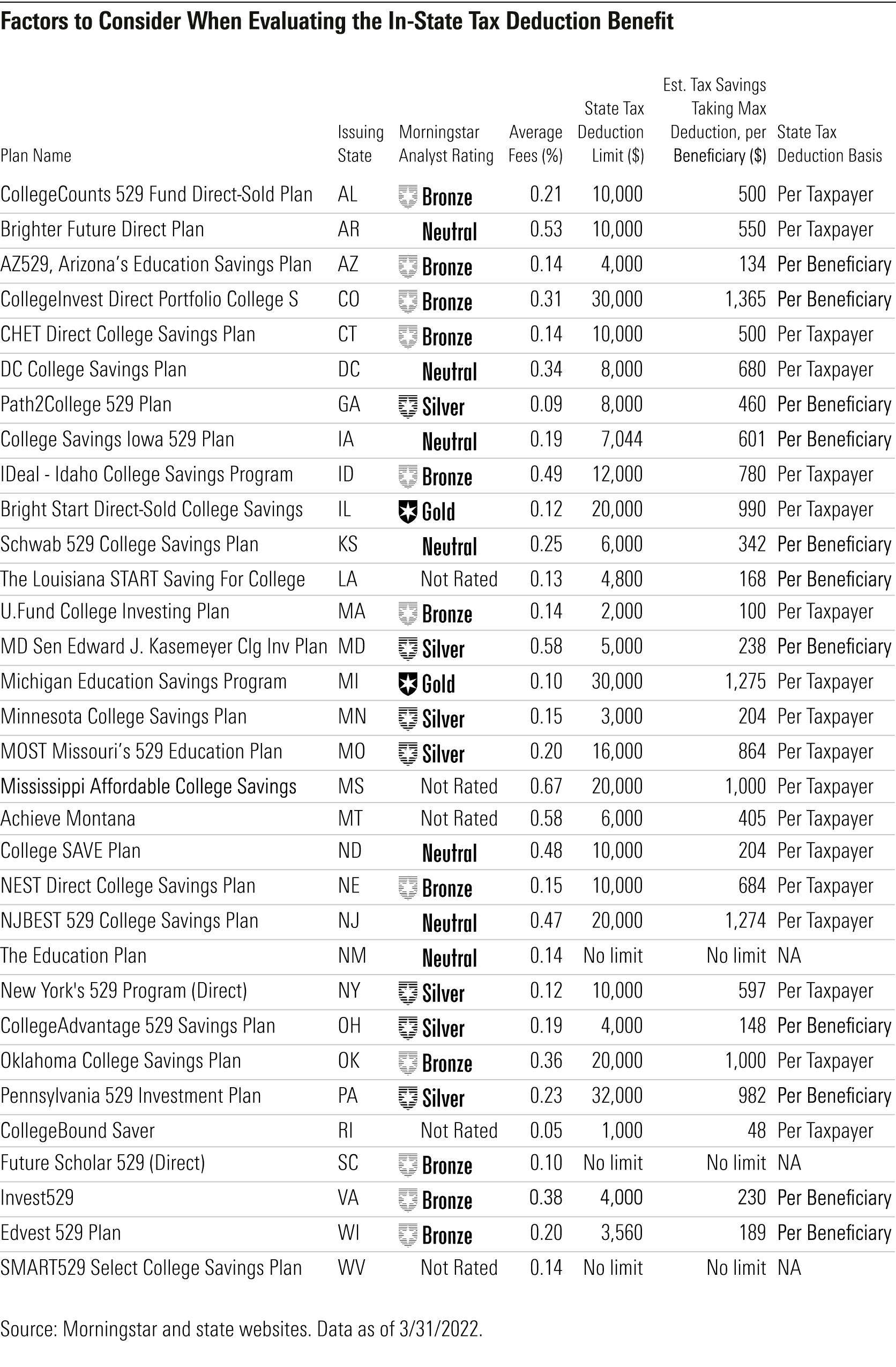

The District of Columbia and 31 states provide additional tax incentives by allowing families to deduct their 529 contributions from their taxable income calculation. There are several inputs to consider when estimating the tax benefits at the state level. For simplicity, let's consider a couple filing jointly with an annual income of $100,000 who deposits $3,000 a year (or $250 a month) into one beneficiary’s 529 account. Using each state's personal marginal income tax rate for this hypothetical couple, the annual estimated tax savings range from $48 to $269. At the low end, Rhode Island's maximum tax benefit is $48 a year, as the state tax deduction limit is low, at $1,000 per taxpayer (the marginal tax rate for a couple making $100,000 is 4.8%). Massachusetts' maximum tax benefit of $100 a year is also low, with a deduction limit of $2,000 per family and 5% flat income tax rate. The remaining states in this group have deduction limits that are higher than $3,000. The District of Columbia and Iowa offer the largest estimated annual tax savings, but that is because those states have among the highest marginal tax rates.

For those who can save a lot more, certain states provide very generous tax benefits. New Mexico, South Carolina, and West Virginia have no deduction limits. If the same family earning $100,000 saves $5,000 a year for each of their three kids, they can deduct $15,000 from their income, resulting in tax savings of $885, $1,050, and $975, respectively. Six states (Colorado, Illinois, Mississippi, New Jersey, Oklahoma, and Pennsylvania) have relatively high deduction limits of $20,000 to $32,000. Eight states (Arizona, Georgia, Iowa, Kansas, Louisiana, Maryland, Ohio, Virginia) have deduction limits of $4,000 to $8,000, but this is per beneficiary, so the maximum is applied per child, not per taxpayer. So a family with three beneficiaries can take maximum deductions of $12,000 to $24,000, depending on the state. Pennsylvania and Colorado are by far the most generous, as they offer the highest deduction limits of $32,000 and $30,000, respectively, per beneficiary.

Seven states--Arizona, Arkansas, Kansas, Minnesota, Missouri, Montana, and Pennsylvania--offer a much less restrictive benefit called tax parity, which means that investors are allowed to take a deduction on state income taxes on contributions made to any plan in the United States (most states only allow you to take a deduction if you invest in the state-sponsored plan). Arkansas offers a lower $6,000 state tax deduction limit if a family invests out of state (the max is $10,000 when investing in state), but the remaining six make no distinction between investing in or out of state.

Which States Offer Tax Credits?

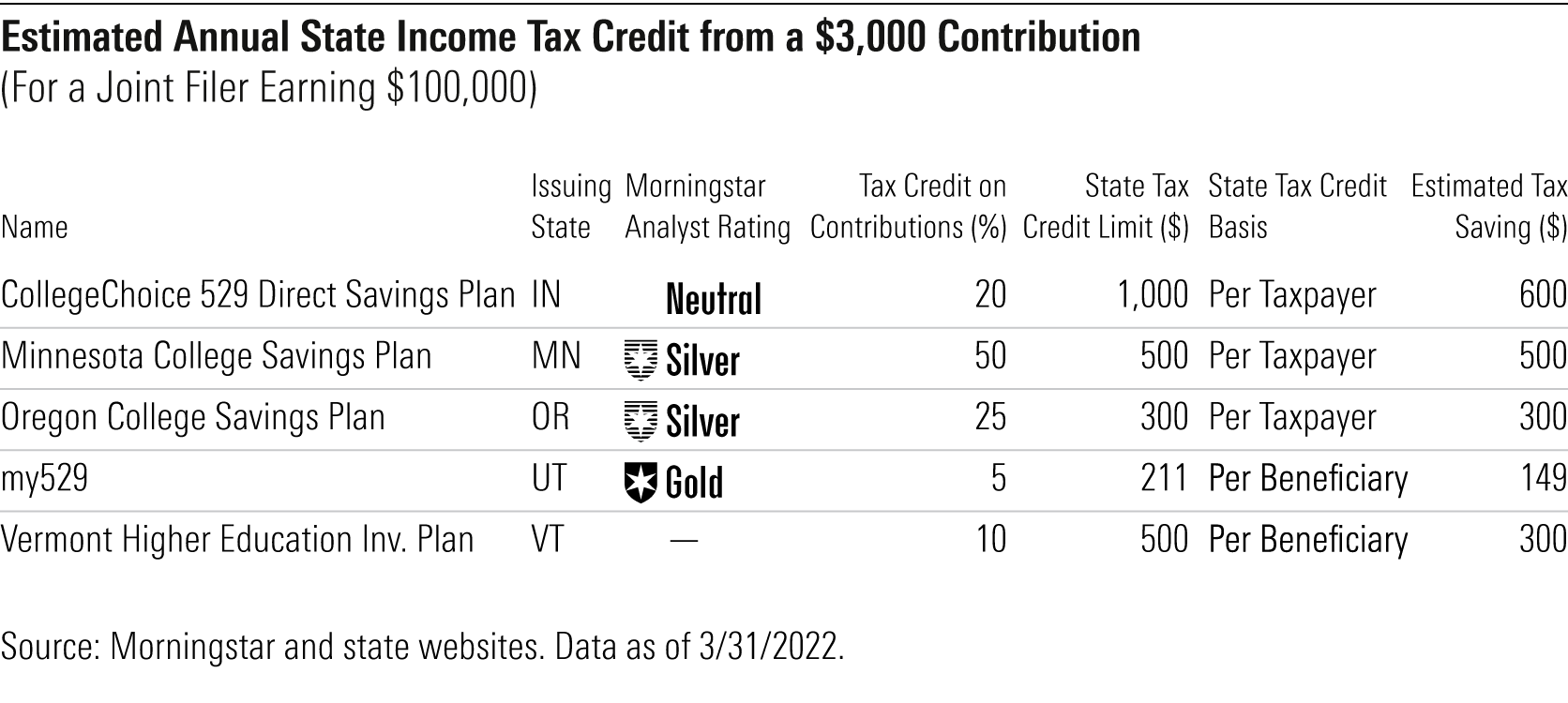

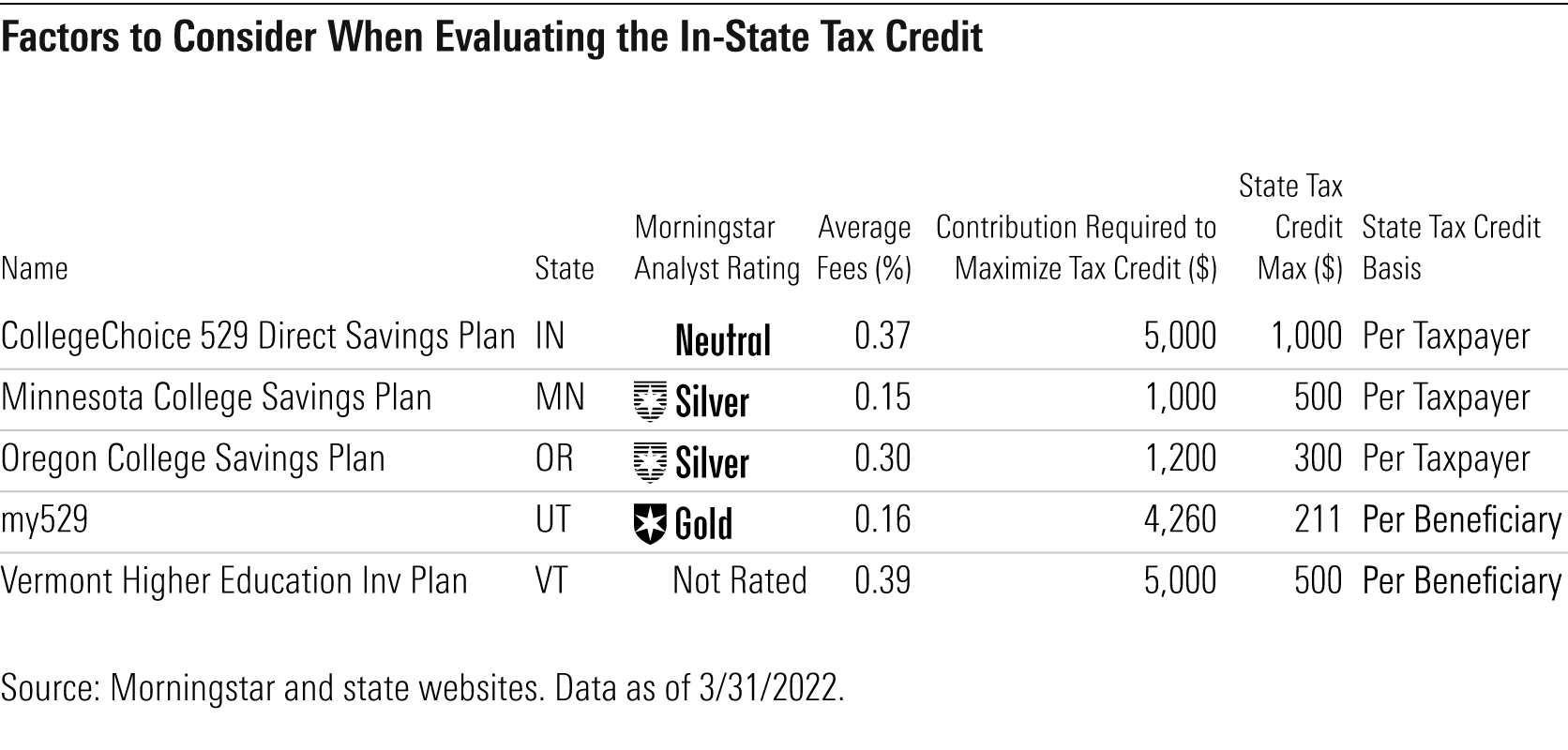

Indiana, Minnesota, Oregon, Utah, and Vermont provide tax credits, which families can use to offset their state income taxes. These credits, on average, offer greater tax savings to a broader range of families than deductions do. Oregon's maximum tax credit for joint filers is $300, which can be met with a relatively low contribution of $1,200. For those earning $100,000, the percentage of contribution eligible for tax credit is 25%, but this percentage is higher for families with lower incomes (and the percentage is lower for families with higher incomes). Minnesota also offers larger benefits to families earning less, as it offers the option of a deduction or a more generous credit. Like Oregon, the tax credit calculation is adjusted by income level. For those earning less than $80,430, the maximum credit of $500 can be earned with a relatively low contribution of $1,000 (where 50% of the contribution can be taken as a tax credit). The calculations for tax credits in Indiana and Vermont are a little less generous than Minnesota and Oregon, but the dollar amounts are significantly higher than the states with deductions. In Indiana and Vermont, a $3,000 contribution would result in tax credits of $600 and $300, respectively. Indiana has a high $1,000 state tax credit limit, per taxpayer. Vermont's state tax credit maximum is $500, but this is per beneficiary. Utah employs a relatively low 4.95% of contribution to calculate the tax credit, so a $3,000 contribution would result in a tax credit of $149.

How to Incorporate Potential Tax Benefits When Deciding Which Plan to Choose

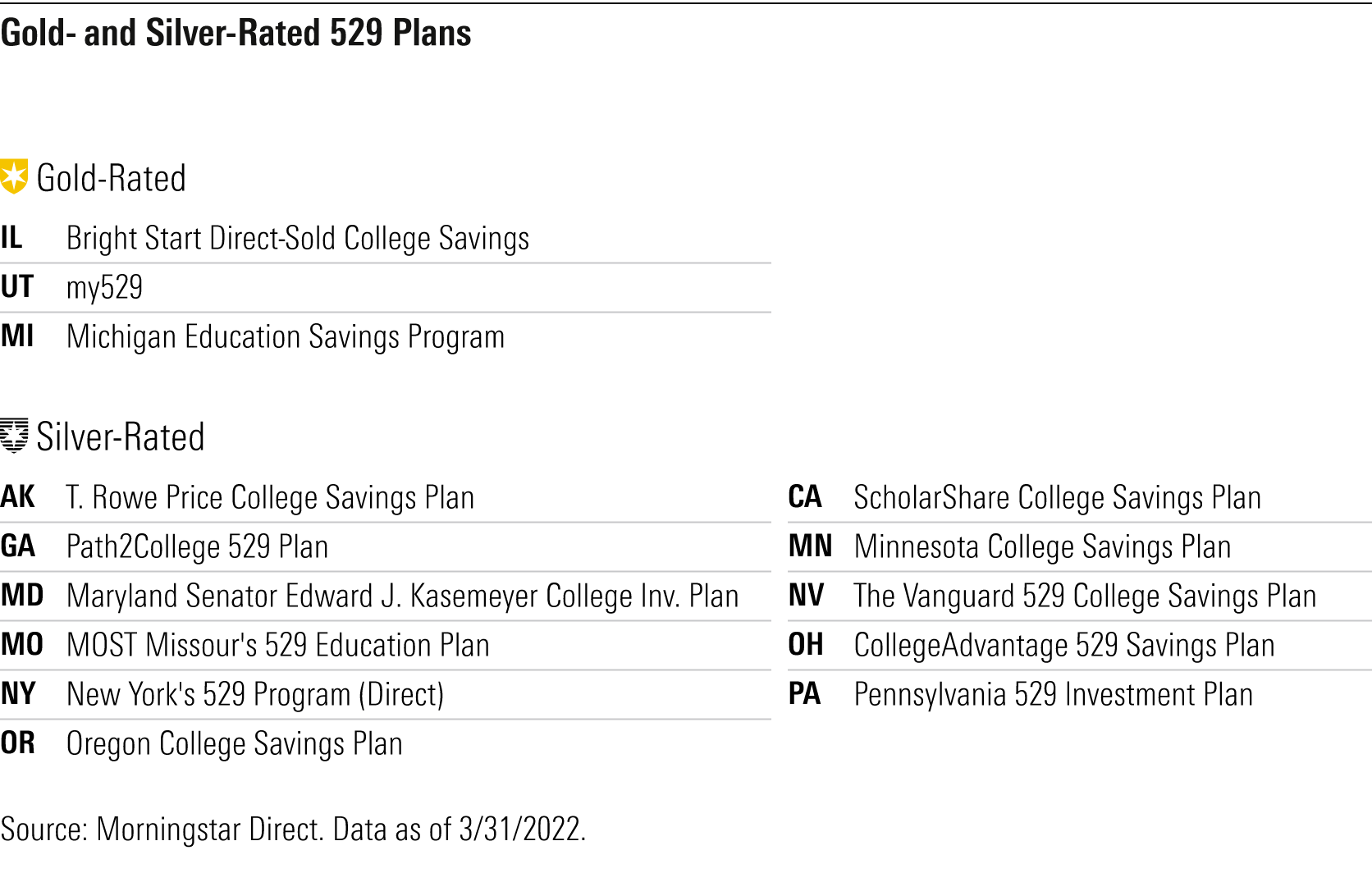

Fifteen states do not offer state-specific tax incentives, either because it's a state with no income tax or a state that doesn't offer any tax benefits on 529 contributions. These investors, along with those who reside in tax-parity states, have the flexibility to shop around, as they can invest in any plan without forfeiting tax benefits. Morningstar Analyst Ratings can point these investors to the best options. Currently, 14 plans receive an Analyst Rating of Gold or Silver, listed in Exhibit 4. Subscribers to Morningstar.com can access our 529 plan reports from the 529 Plan Center map. (After clicking on a state, please allow a few seconds for the plan options to download into your browser).

For those who reside in states with specific tax benefits, the exhibits below provide factors and data points to consider when selecting a plan. First, we list the Analyst Rating for the lowest-cost direct-sold plan and the average fees for the plan's cheapest age-based or target-date enrollment series, typically the default choice for most 529 plan users. We then return to our couple earning $100,000. The dollar value from a $3,000 contribution is listed in the second and third exhibits above. In the tables below, we calculate the maximum tax benefit by contributing at the state's limit, per year, per beneficiary. These calculations, along with the state's tax deduction or tax credit basis (per taxpayer or per beneficiary), can help families estimate the potential tax savings for their situation (such as how much do they plan to contribute and for how many beneficiaries).

For investors who live in states that provide a tax benefit, especially those who start saving when the beneficiary is very young, the compounding effect of the tax benefits (if the tax savings are deposited into the state's lowest-cost 529 account) may make it worthwhile to invest in-state. Those who save less than $2,000 a year may find the state tax savings less appealing, especially if the state's direct-sold plan carries a Neutral rating and relatively higher fees. These investors might want to consider picking a higher-quality plan outside their home state. But for most middle-class families saving for future education expenses, the federal tax benefits, combined with the state income tax savings (for those living in states that offer income tax benefits), make investing in a 529 plan very sensible choice.

This is the second in a five-article series on 529 education savings plans. You can find the first installment, which discusses our ratings methodology for these plans and our top picks, here.

Correction: The original article had incorrectly classified Utah's tax benefit as a deduction. It should be classified as a tax credit (June 9, 2022).

/s3.amazonaws.com/arc-authors/morningstar/de44b91c-c918-4e53-81c3-ce84542f3d36.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/JNGGL2QVKFA43PRVR44O6RYGEM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/BC7NL2STP5HBHOC7VRD3P64GTU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/de44b91c-c918-4e53-81c3-ce84542f3d36.jpg)