First Job? How to Create (and Stick With) a Budget

We show you how to set up a budget that aligns your spending with your goals and values.

Editor’s note: A version of this piece originally ran in July 2017.

Many people think of budgeting as a way to keep themselves out of trouble. And it's true--setting your own guardrails can help you resist the temptation to overspend and take on debt. But a budget is also a way to align your spending with your goals and values.

A budget could help you carve out a meaningful contribution to your retirement account, for example. It could also help you allocate money toward an impactful charitable donation.

The first step in creating a budget is knowing exactly how much of your paycheck is left over after taxes and retirement plan contributions, as well as necessary monthly expenditures--groceries, rent, loan payments, etc. But obvious though it may sound, few people actually sit down and map it all out.

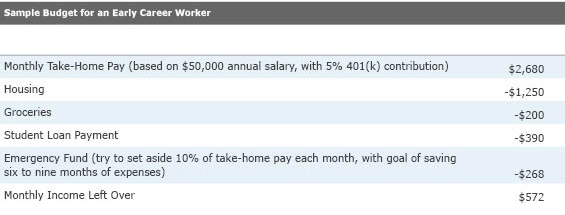

Take a look at this example.

What's Your Take-Home Pay? According to a study by staffing firm Korn Ferry, the average starting salary for a college graduate in 2019 was about $50,000, so we'll create a sample budget based on that.

I used this take-home pay calculator from ADP to compute semimonthly take-home pay after accounting for FICA, Social Security, and Medicare taxes. The calculator also asks for state of residence to factor in state income taxes. I used Illinois in the example, partially because that's where I live but also because the state has a 3.75% flat rate, making it easy to compute.

In the example, the semimonthly take-home pay is $1,526 ($3,052 in months with two pay periods), assuming no contributions to a 401(k) or health savings account, and no other payroll deductions for healthcare or other employee benefits.

Contribute to a 401(k) But of course you'll want to contribute to your 401(k). In these early years, it may seem like there's not enough paycheck to go around, especially if you also have student debt or if you're saving for short-term goals like a car or a down payment on a home.

But it may help to think of it in these terms: You'll get the money back years from now, when you may no longer have the ability (or desire) to work. Retirement accounts are great incubators for growing wealth over many decades because they allow for tax-deferred compounding. If you don't know what to invest in, a target-date fund with a date coinciding with your 65th birthday (or planned retirement age) can be a good option.

How much should you contribute? Determine whether your company provides a 401(k) match, and try to contribute at least that much. For example, say the company will match up to 5% of your contribution at a rate of $0.50 for every dollar you contribute. Contributing less than 5% means you're turning down some free money.

Going back to the take-home pay calculator, I factored in 5% of gross pay as a 401(k) election. Remember that 401(k) contributions are funded with pretax dollars, and you pay taxes upon withdrawal. I think this helps with budgeting; if you direct pretax money to your 401(k) before it hits your bank account, it simplifies and automates the process of saving.

That leaves us with approximately $1,340 per paycheck, and $2,680 most months.

Food and Housing The traditional recommendation is not to spend more than 30% of your pretax income on housing (which includes rent and utilities). Although rent is expensive and you want to find a safe, nice place to live, I wouldn't go much higher than this, especially if you're basing this number on your pretax income.

That's $1,250 per month based on a $50,000 per year salary. If you can't find a safe, reasonably priced apartment within that limit (it could be tough if you live in a less affordable city such as New York or San Francisco), there are ways to bring costs down. Consider getting a roommate or living at home if your family is amenable and you work near enough.

A squishier line item in the budget is food. Some people are perfectly satisfied spending less than others on groceries. Cooking meals at home rather than dining out could help stretch pay.

Student Loan Debt Many college grads start their careers with student loans to pay off.

The average student loan balance in the United States is $37,000, according to data from Student Loan Hero. Let's assume the interest rate is 5% and the term of the loan is 10 years. The monthly payment would be around $390 per month. Be sure to factor that into your monthly budget.

Set Aside Money for an Emergency Fund An oft-cited rule of thumb in financial planning holds that three to six months of household living expenses should be tucked away in an emergency fund, because if you lose your job it could take you that long to find a new one. But director of personal finance Christine Benz recommends an even larger cushion--preferably nine months to one year of living expenses, particularly if you are highly paid or work in a highly specialized field, because such jobs can be more difficult to replace.

Try to set aside 10% of take-home pay each month, or as much as you can to fund this safety net.

As you can see, this monthly budget is very tight. And certainly, there will be other important expenses such as commuting, health and wellness, clothing, entertainment, and your phone bill. Here are a few tips for staying on track.

Keep Credit Card Usage in Check Seeing how little cash you actually have to work with every month makes it easier to understand the temptation to rack up credit card balances. Resist the urge! Credit cards offer great convenience--not only do they save you from lugging around a big wad of cash, they offer a grace period where you don't accrue interest on purchases so you can defer payment until the next billing cycle.

But aim to pay your credit card off every month--don't carry a balance if you can avoid it. The average credit card charges an annual percentage rate upward of 16%, according to Bankrate.com. With an interest rate this high, paying off only the minimum balance is not a smart strategy. This calculator from Bankrate.com computes how long it will take to pay off credit card balances at different interest rates and payment amounts. Let's assume you have a $5,000 balance, and you pay a minimum payment every month--say, 4% of your balance. At a 16% interest rate, it's going to take 10 years and six months to pay that off--and when all is said and done, you will have paid nearly $7,400--a nearly 50% premium.

Paying for things with a debit card or using cash might help with overspending; find a method that works for you.

Keep a Spending Journal Write down everything you spend money on for three months. Make sure you include unplanned expenditures like going out for drinks with friends, Uber and Lyft rides, and so on.

Also take stock of monthly recurring charges, and decide which ones are absolutely necessary and which are simply nice to have. Most people consider their mobile phone and data plan an essential item but that doesn't mean you can't shop around to find the best value. Cable television can be very costly, and cheaper alternatives abound. Likewise, many of us have amassed quite the collection of paid streaming services and apps--perhaps it would be cheaper to bundle a few or eliminate the ones you use the least.

Likewise, going to the gym can be great for your health, but not so much for your wallet. If you really prefer the gym to jogging or doing push-ups at home, though, shop smart. Check for a discount through your employer, or comparison shop to see which offers the best value. (Some gyms offer discounts for paying for six months to a year upfront, and others will sell a discounted pass that limits use of the facility to nonpeak times.)

Takeaways Although it may not be all that much fun, creating a budget is incredibly important. Bringing what you earn and what you owe into sharper focus not only helps keep you out of debt, it helps you prioritize how you spend your money.

Additional Resources Budget planning worksheet (PDF)

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IFAOVZCBUJCJHLXW37DPSNOCHM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/JNGGL2QVKFA43PRVR44O6RYGEM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/GQNJPRNPINBIJGIQBSKECS3VNQ.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)