What to Watch for in the April Jobs Report

The key question for investors is, how much was the jobs market already cooling off?

With the weekend collapse of First Republic Bank and continued worries about the health of regional banks, the outlook for the U.S. economy is increasingly uncertain. The key question now for investors is, how much was the jobs market already cooling off in April 2023?

Economists are forecasting just a modest slowdown in jobs growth for April’s Employment Situation report due out Friday.

“The next few jobs reports are likely to show continued softening of the labor market—but not outright weakness,” says Eric Winograd, chief economist and strategist at AllianceBernstein.

For now, “the labor market is still very strong,” he says. “We expect growth to slow, but the evidence is that currently, the labor market is a source of strength for the economy.”

Winograd says he will be keeping a close eye on wage growth and the labor force participation rate (in addition to the headline payroll numbers) for insight on the state of the job market.

April Jobs Report Forecast Consensus

- Nonfarm payroll employment to rise 180,000 versus a 236,000 increase for March.

- Unemployment rate to come in at 3.6%, which would be a slight increase from 3.5% in March.

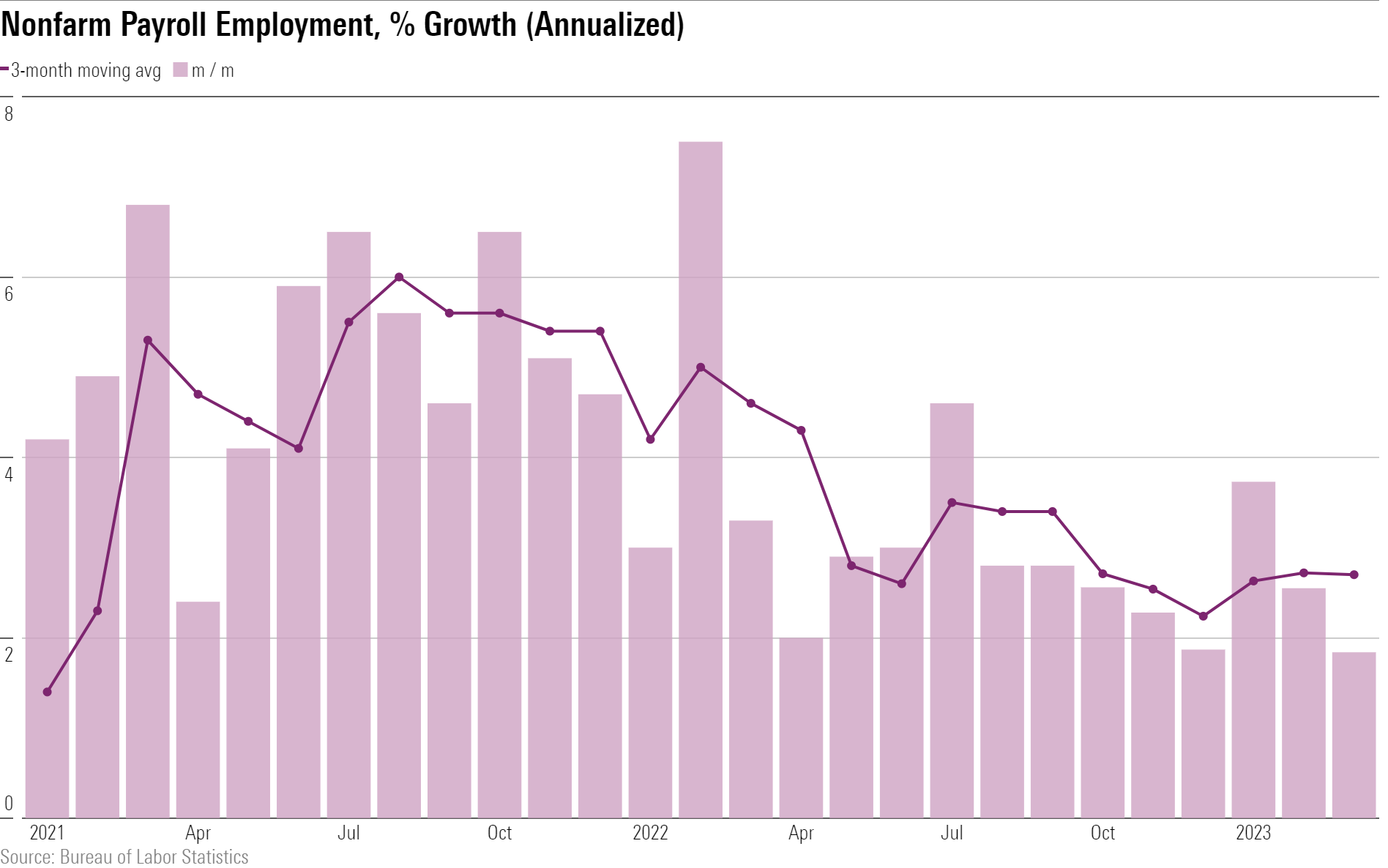

After the strong March jobs report showed a solid pace of hiring and left room for the Federal Reserve to continue hiking interest rates, economists are expecting a slight slowdown in the rate of jobs growth for April. Nonfarm payroll employment is expected to post an increase of 180,000 for April, according to FactSet’s consensus estimates. That would follow an increase of 236,000 for March and 311,000 in February.

Forecasts call for the unemployment rate to tick upward to 3.6% in the April jobs report, which would still be near historically low levels.

“Though jobs growth has already started to slow, we haven’t seen job losses yet,” Winograd says. “As we move into the second half of the year, we will see some negative months, but the data suggests we’re still a long way from that.

“The Fed won’t look at cutting interest rates until the employment rate really starts to weaken. Weaker reports would reduce the likelihood of continued interest-rate hikes from the Fed.”

Winograd adds that jobs growth below 100,000 would be considered “weakening,” but only until jobs growth falls below zero would the Fed feel more urgency.

Here are some key data points to watch for in the April jobs report:

Wage Growth

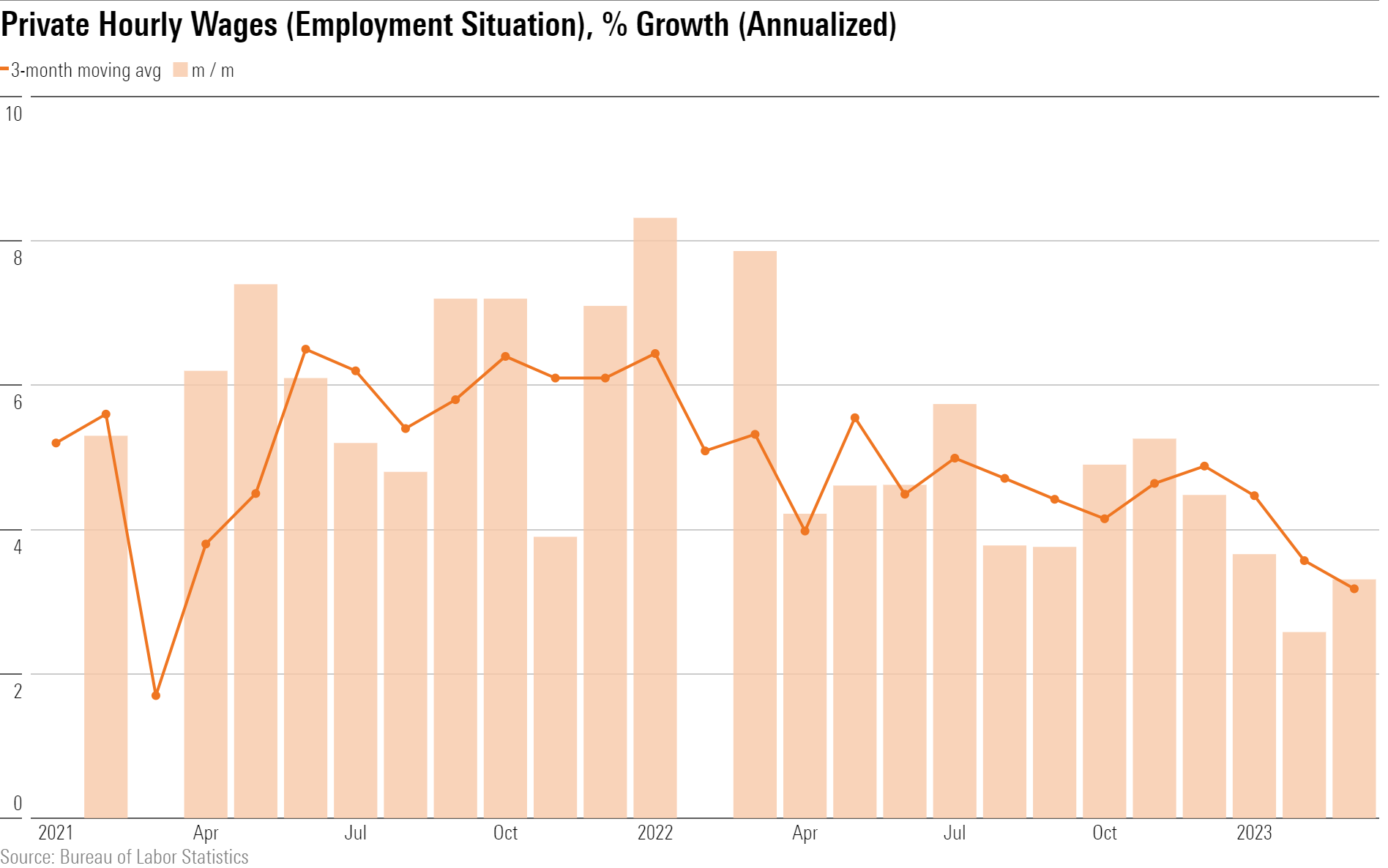

Winograd remains focused on wage growth as a measure of tightness in the labor market. “There is a feedback loop between wages and inflation,” he says, adding that with wages still growing 5.5% year over year, the Fed is going to be watchful for inflationary pressures.

“Wages are still going up, just not as fast as they had been” Winograd says. “We expect that trend to continue for a couple of months.”

An expansion in labor supply in conjunction with moderating labor demand helped to moderate wage growth in March, according to Morningstar’s chief economist Preston Caldwell.

“Wage growth has gone completely back to normal prepandemic levels,” Caldwell says. “We’ll have to wait for confirmation from other data to proclaim the excessive wage growth problem fixed, but for now, this [March] data is very comforting.”

Labor Force Participation Rate

The labor force participation rate is a key measure of the number of people working relative to those looking for work.

“Encouragingly, we’ve seen the participation rate for prime-age workers return to peak levels,” says AllianceBernstein’s Winograd. “This means that some workers are still available.”

The labor force participation rate reached 62.6% in March, with a 0.3-percentage-point increase over the past three months.

“Labor demand does appear to be moderating [as of March],” Caldwell wrote. “With the job openings rate in February dipping to 6.0% compared with a peak of 7.4% in March 2022.”

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/AGAGH4NDF5FCRKXQANXPYS6TBQ.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/5N6PBZJLMJEIXBH6EHTKPDK6NE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOFK3IUSBRF5XHSFKBZHOG4J5A.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)